I promised to make a thread about this company. Apologies, I’m quite a bad investor, and a beginner-level investor like me might not be able to pick out the most important things about an investment target, and I might also have stated some things a bit incorrectly. ![]() I don’t speak English very well, so I might have made some funny mistakes when translating.

I don’t speak English very well, so I might have made some funny mistakes when translating.

Netflix is a subscription video service and also a production company that offers movies and TV series. The company was founded in 1997 in the United States and operates worldwide except in China, the Crimean Peninsula, North Korea, Russia, and Syria.

About the company’s operations through history

The company was indeed founded in 1997 in California and began its operations with DVD mail-order sales. Netflix was listed on NASDAQ in 2002.

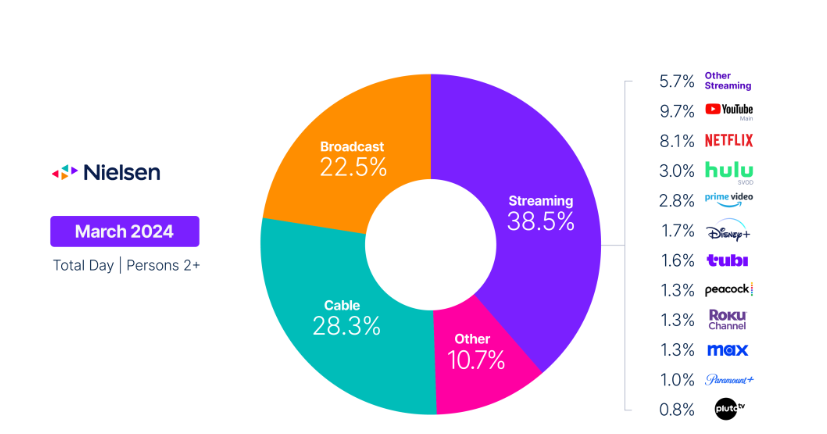

In the 2010s, Netflix began producing its own TV series, which it showed only to its own customers. According to Sandvine, in 2014, Netflix used 35 percent of all USA’s internet traffic, while YouTube, in second place, consumed 15 percentage points. The years 2013-2017 were a time of software development and distribution expansion.

Netflix expanded into international productions and acquired entirely new productions between 2017 and 2020. The company, for example, produced its first Colombian original series and signed a four-year deal with Stranger Things director-producer Shawn Levy. Generally, the company made significant investments in productions and literary deals, which were central to its strategy during these years. In addition, Netflix expanded its operations into areas such as cinema and book sales.

From 2021, Netflix expanded into the gaming world, in addition to winning awards at the Oscar Gala and also receiving Emmy Awards. In 2021, the company decided to expand into the gaming industry and hired former Electronic Arts and Facebook executive Mike Verdun to lead game development. In the same year, the company also officially launched its own mobile games. Sony Pictures Entertainment “granted” Netflix the rights to its releases starting in 2022. The company continued to form several partnerships during these years and expanded its original content into various fields, such as books, theatrical performances, and live sports. DVD rentals were eventually discontinued, and the corporate structure was reorganized.

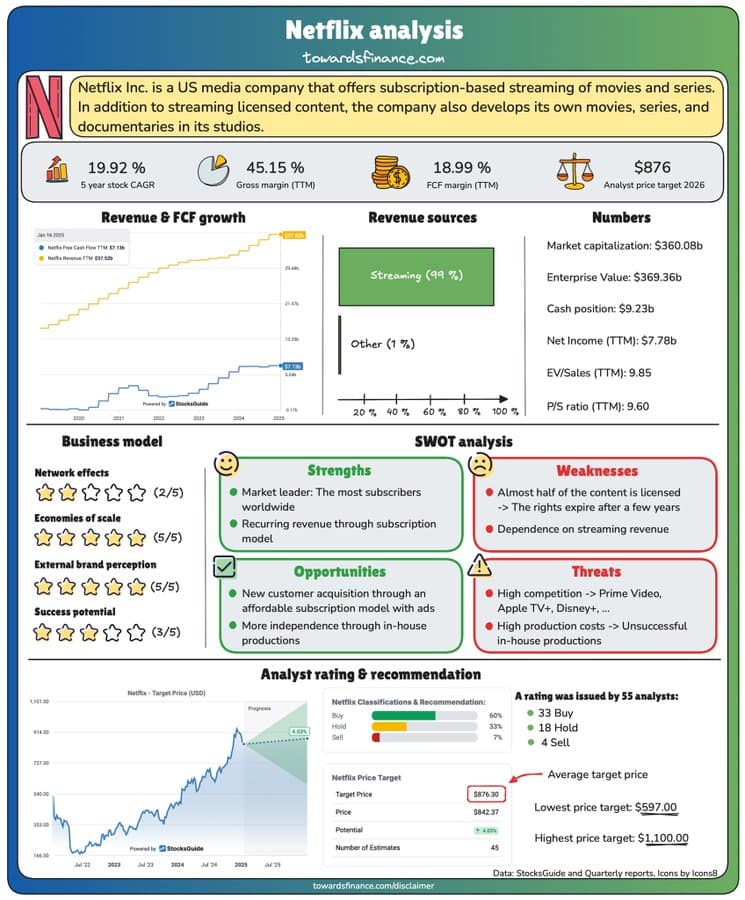

The company as an investment target

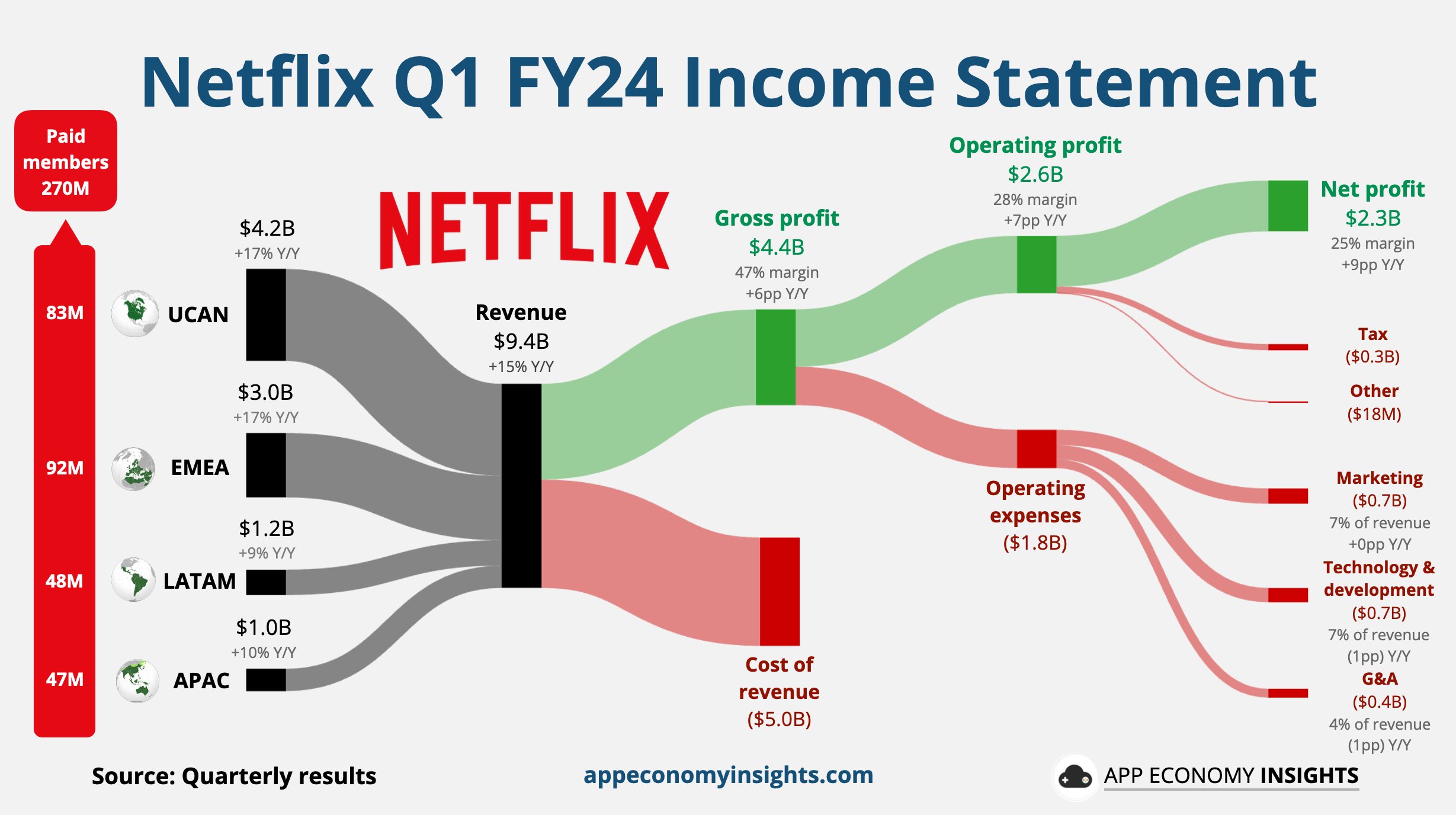

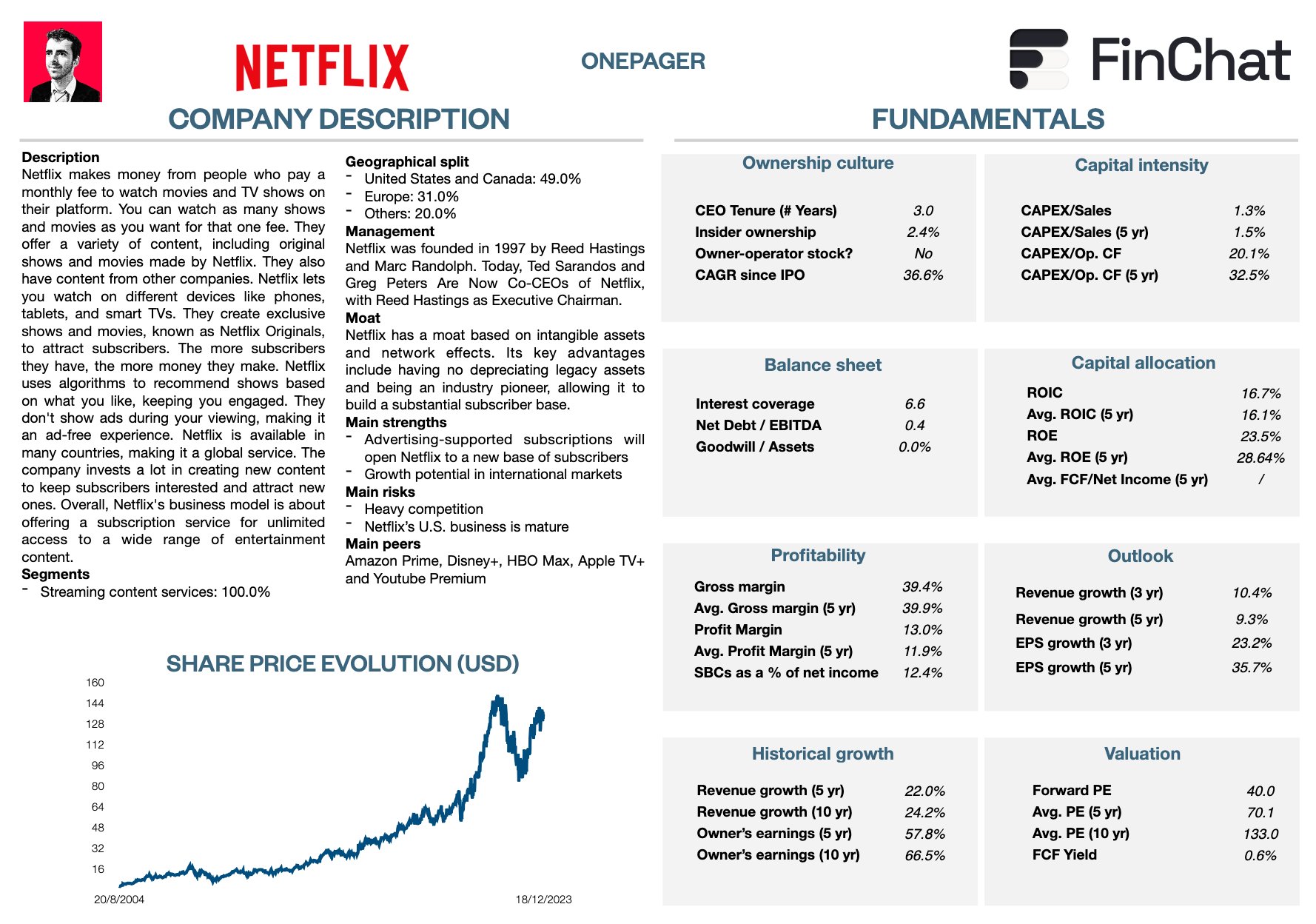

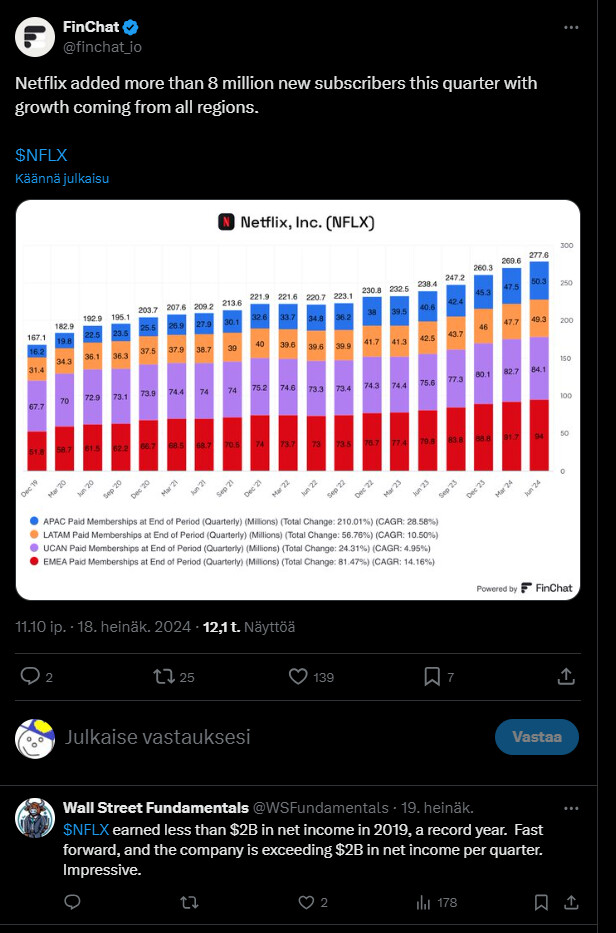

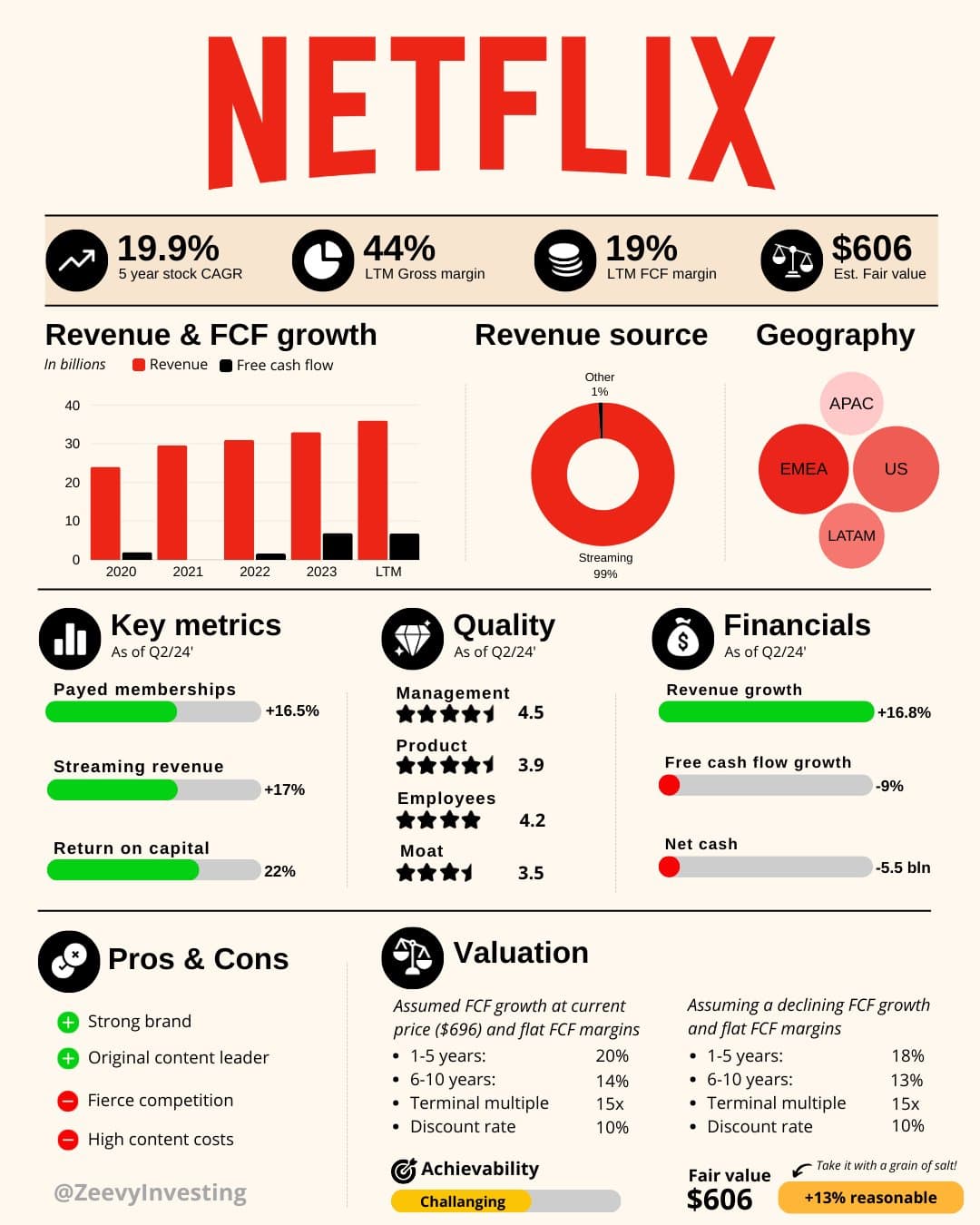

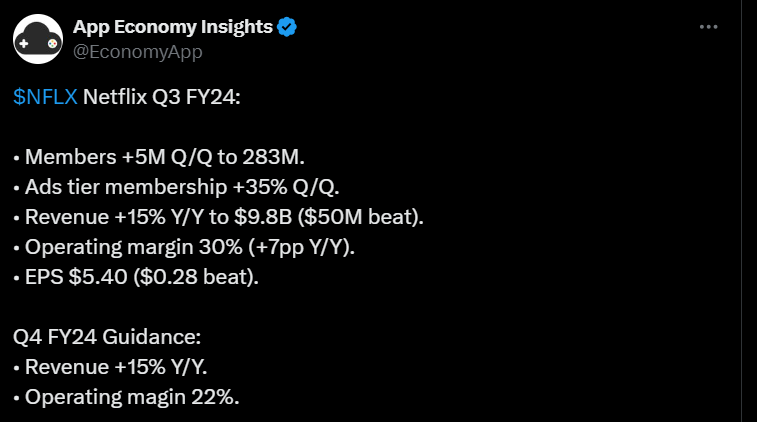

This gives a general idea, for example, of where the company’s money comes from:

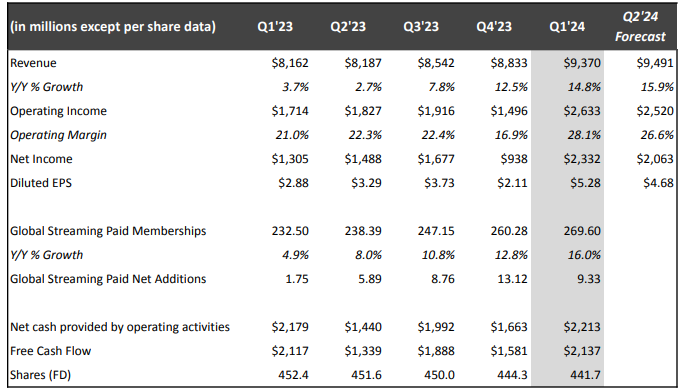

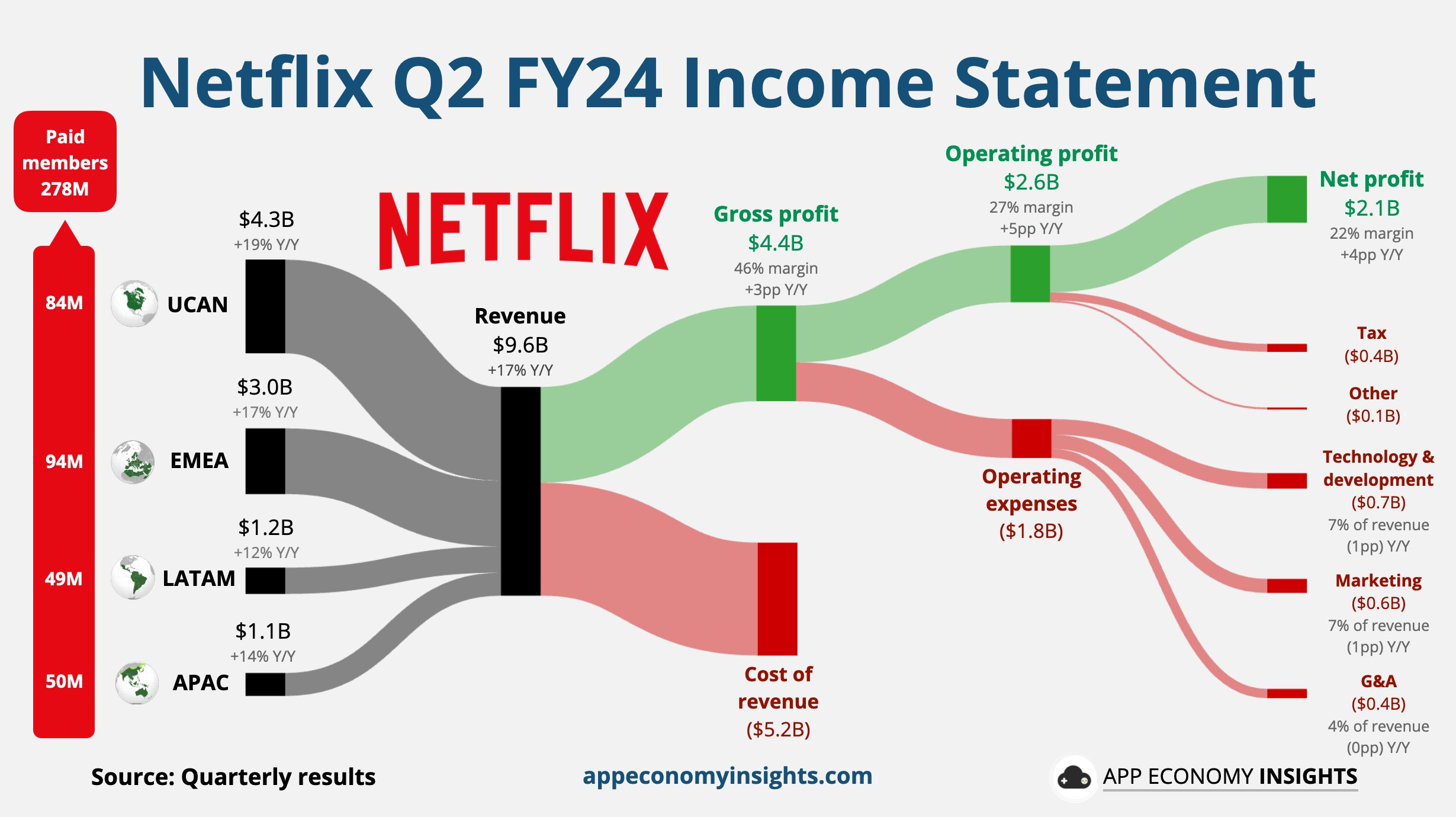

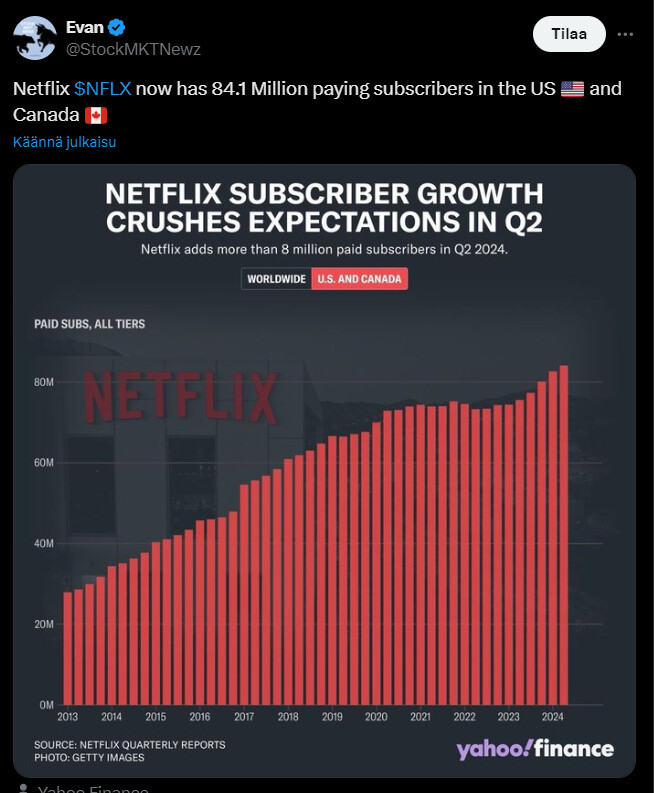

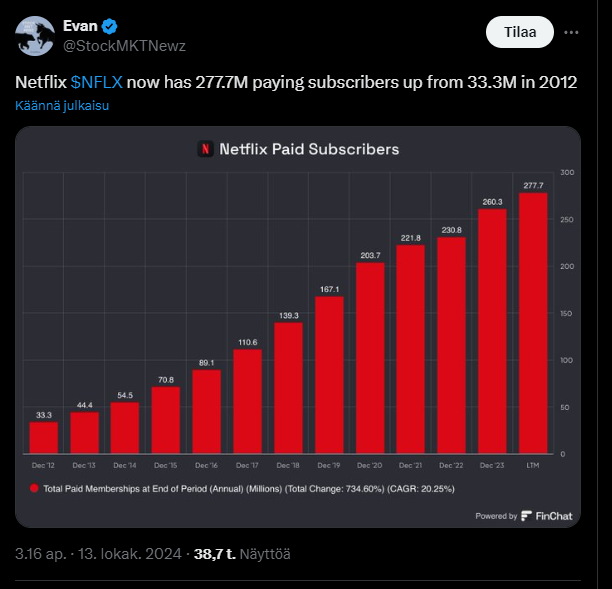

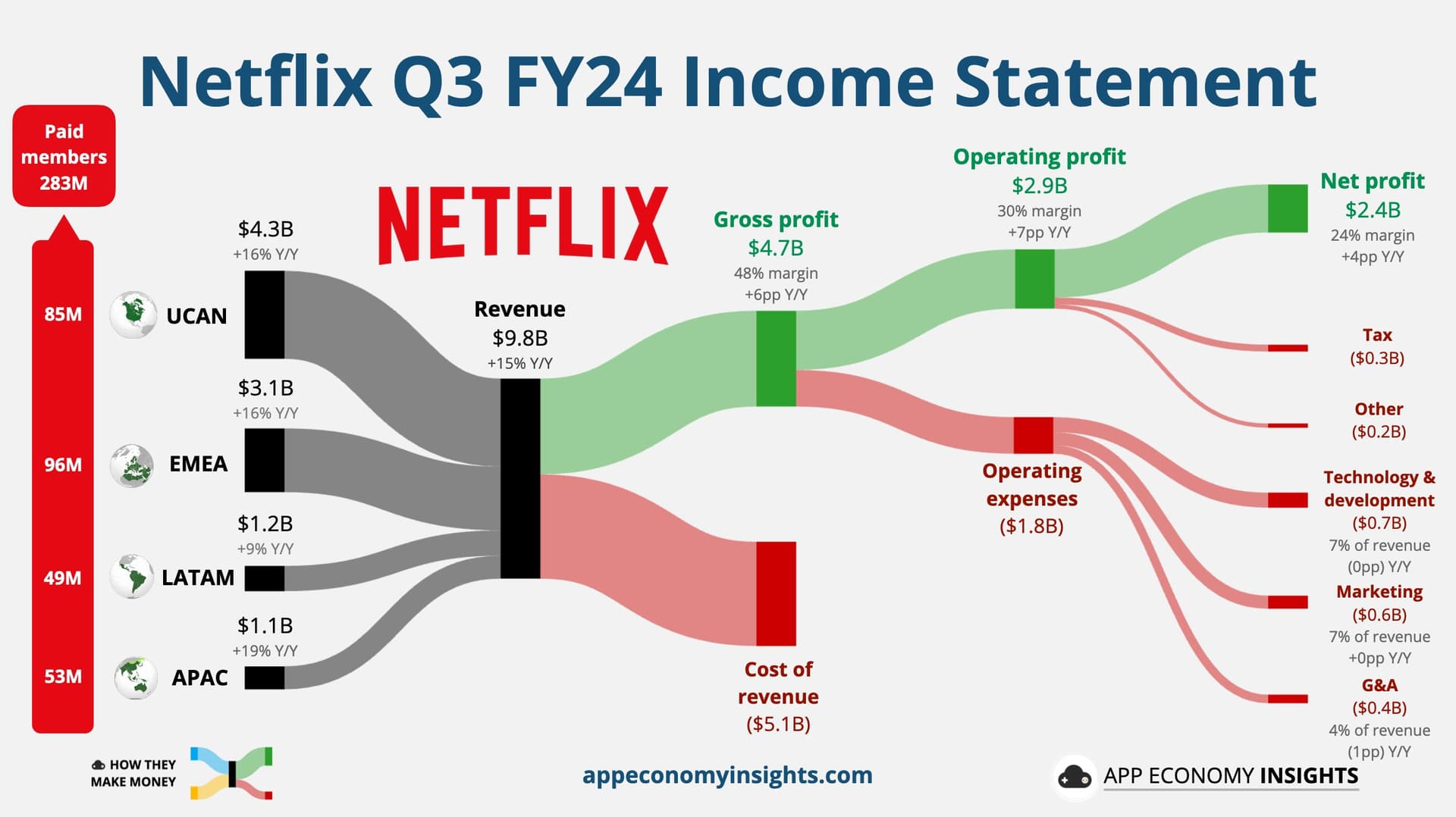

This shows a bit how the number of members has grown by region:

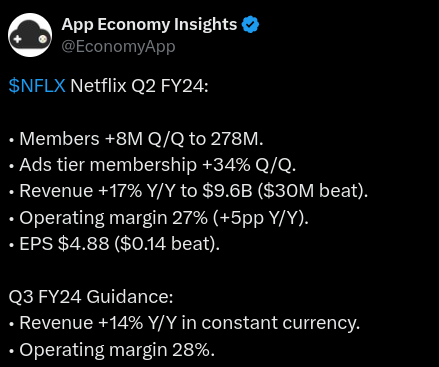

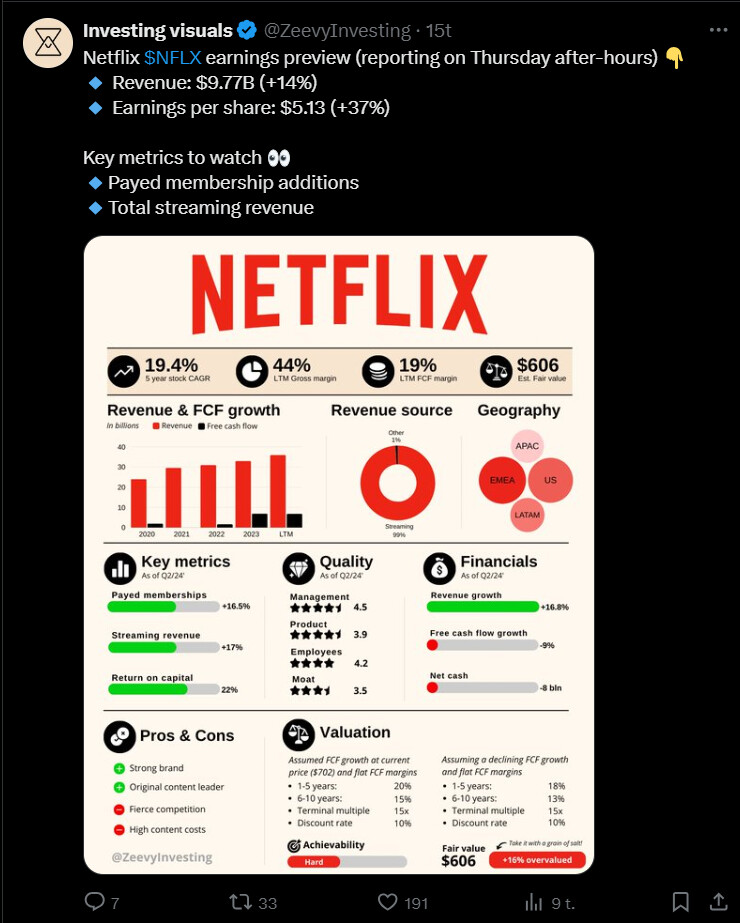

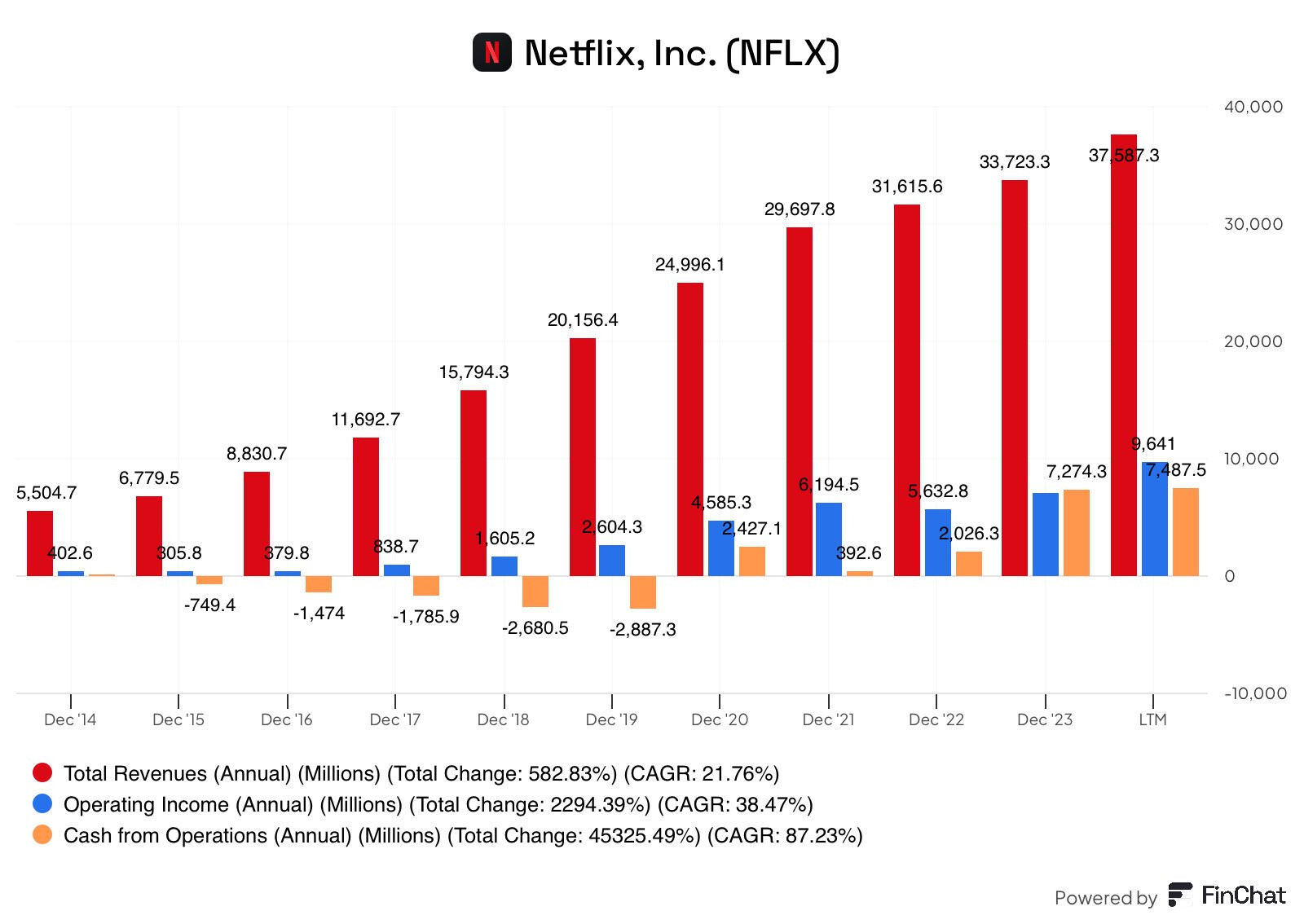

Latest financial figures:

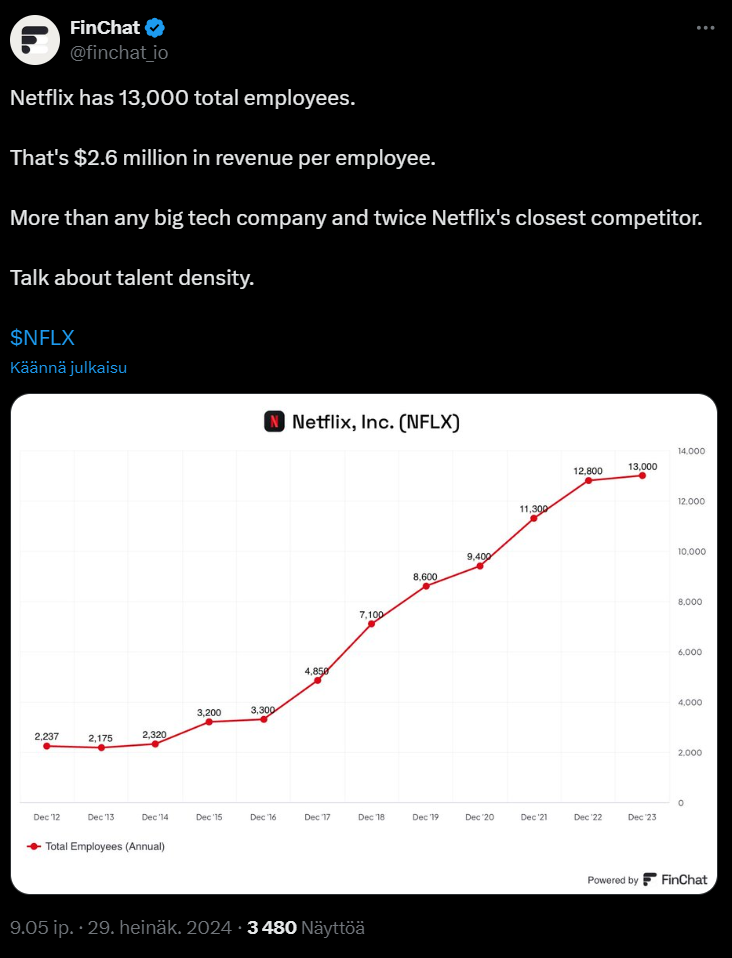

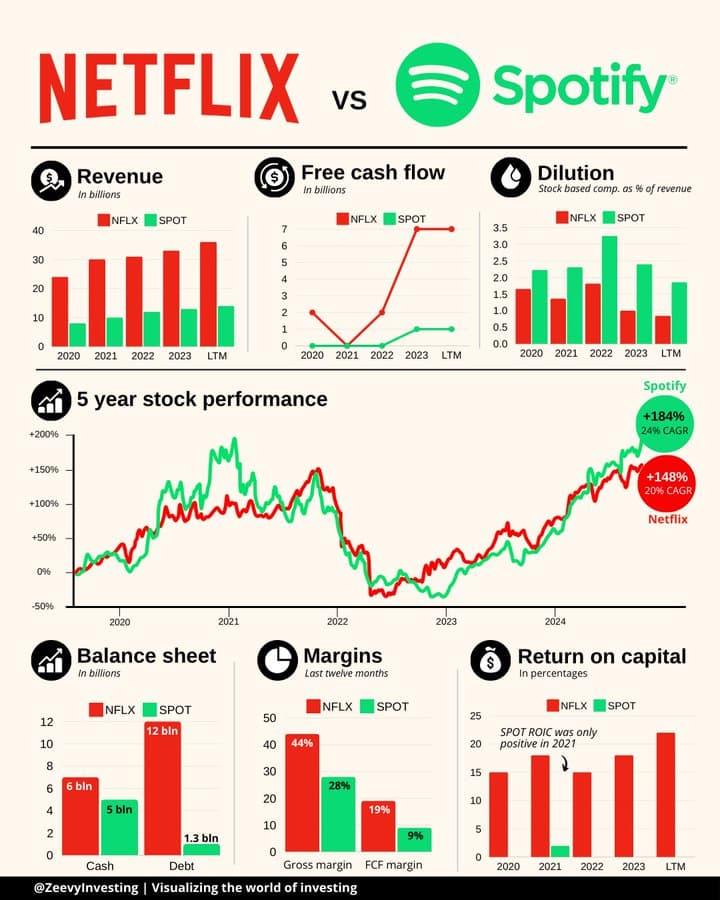

The company’s revenue has grown, and subscriber numbers have increased. In addition, Netflix has raised its prices and restricted password sharing, which increases subscriber numbers and improves profitability. The company is constantly developing and undergoing major changes, for example, by merging into the gaming world and offering live sports.

Some of the previous points are, on the other hand, threats in the long run, such as price increases or entering new fields. It may also raise doubts that the company no longer reports quarterly member growth, and while user numbers have grown, growth has slowed, and the latest guidance was not to everyone’s liking.

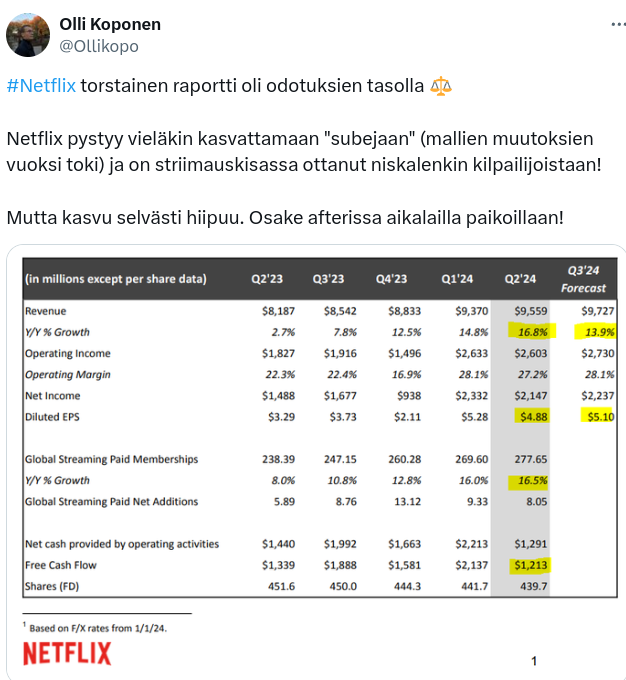

Netflix stock historical trend: