Target vs. Guidance

As I understand it, this thread is mainly addressed to company representatives, but I decided to deviate from the pattern and address this post to investors as well, since I couldn’t think of a better place for these thoughts.

In these times of falling share prices and earnings, many investors get excited about criticizing companies for the guidance they provide and the targets they set. There is a seed of development in criticism, I admit, but it often feels like investors forget the difference between a target and guidance.

Searching Google, a target is defined as follows:

“A target describes the state of affairs or change that one wants to achieve through action, rather than the action itself.”

I personally latch onto the phrase “wants to achieve.” I’ll approach this with an anecdote:

Here in Luxembourg, an American coach—who later made an impact in Finland as well—joined the national hockey team. He wrote as the title for the plan presented to the federation: “Olympics 2026 and how we’re gonna get there.” As the team manager at the time, I recommended he wipe a certain part of his body with said paper, but being a jovial person, I reminded him that it might be wise to first take his head out of that same place. Regardless, I think his point about creating a ridiculous target and starting to build a strategy for it also had merit. Even if Luxembourg hockey achieved only 1% of that target, it would be progress. In the end, I think it was already great to be part of the Olympic movement and organize the qualifiers in our home village, where Kyrgyzstan bitterly took the advancement spot from us. However, the house was full for every game, the TV cameras were there, and the guys on the team were damn committed.

Anyway, enough about that.

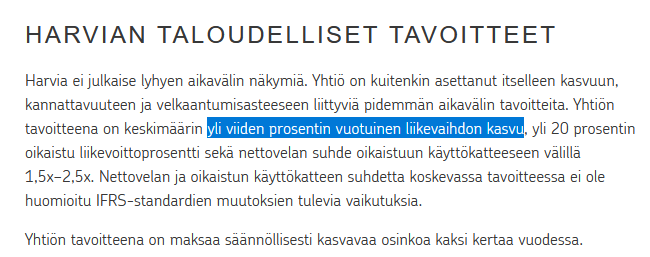

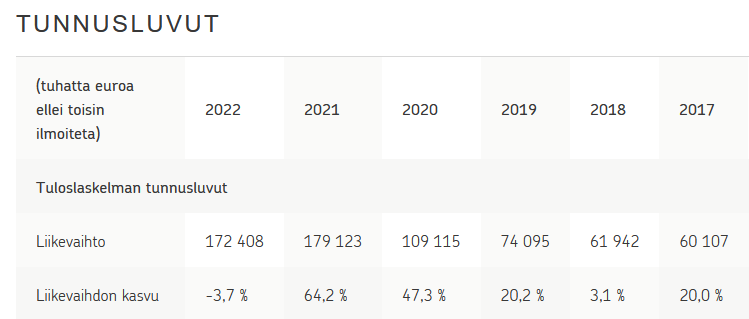

How this relates to investing: a target is a target. As @Harri_Sieppi mentioned, as a company, they want to set high targets instead of playing it safe. Now, as a public company, one has to consider what is a good public target and what is an internal one. I’ll return to ice hockey. I would argue that in the Hockey World Championships, there are about 4–6 teams that set a target of winning the gold every year. To me, it’s absurd to claim that 3–5 of them fail every year. It wouldn’t make sense for the Finnish national team to set a target of “places 2–3,” even though they are more likely. Also, if the Finnish national team wins the championship, say, twice in four years, I don’t think it can be said they failed in their targets.

I drifted into hockey again. I’ll try to get back to investing.

Let’s pull a name out of a hat, “Norppa,” for a growth-oriented company. Norppa sets a target of 20–30% revenue growth for the coming years. Does that mean the company will achieve this target every year? In my opinion, no. Does it mean the company will have achieved 20–30% growth after n years? In my opinion, no. The company has set a target, a sort of dream scenario. The same dream scenario would happen if the Finnish hockey team won the championship every year.

It is therefore important to remember that a target is not guidance, and an investment decision should not be built based on a target.

Guidance: “The Finnish national hockey team’s guidance for 2024: The team will achieve places 1–4 in the World Championships played in Czechia. The guidance may be revised depending on the number and quality of players available from the NHL. The group stage matches and success in them may also affect the accuracy of the guidance.”

Target: “The Finnish national hockey team targets the world championship in the Ice Hockey World Championships to be played between 2024 and 2027.”

As a final note, it should be mentioned that for limited companies, exceeding a target is not always desirable. As an example, a comment from CEO @Mikael_Rautanen. I remember him mentioning that too much growth would no longer be manageable and could degrade quality when the organization can’t keep up.