Mielenkiintoinen ja tarpeellinen ketju!

I myself work a bit too close to the telecom operator industry, but here are some key trends that could be significant, at least in the near future, in Finland and the Nordics. The order is random, based on what comes to mind.

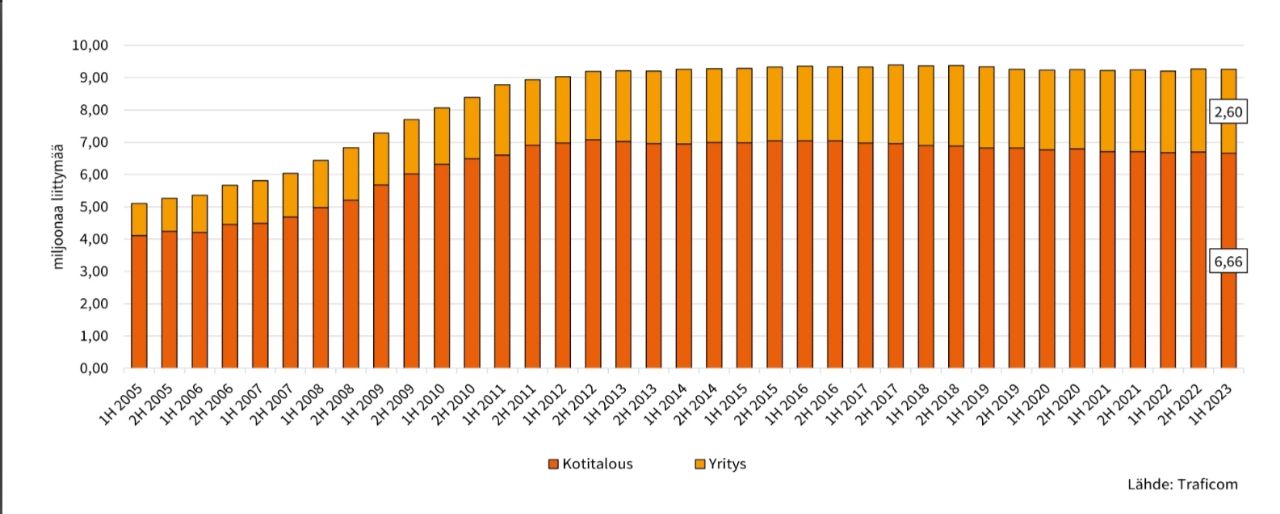

1. Mobile Markets are Saturated

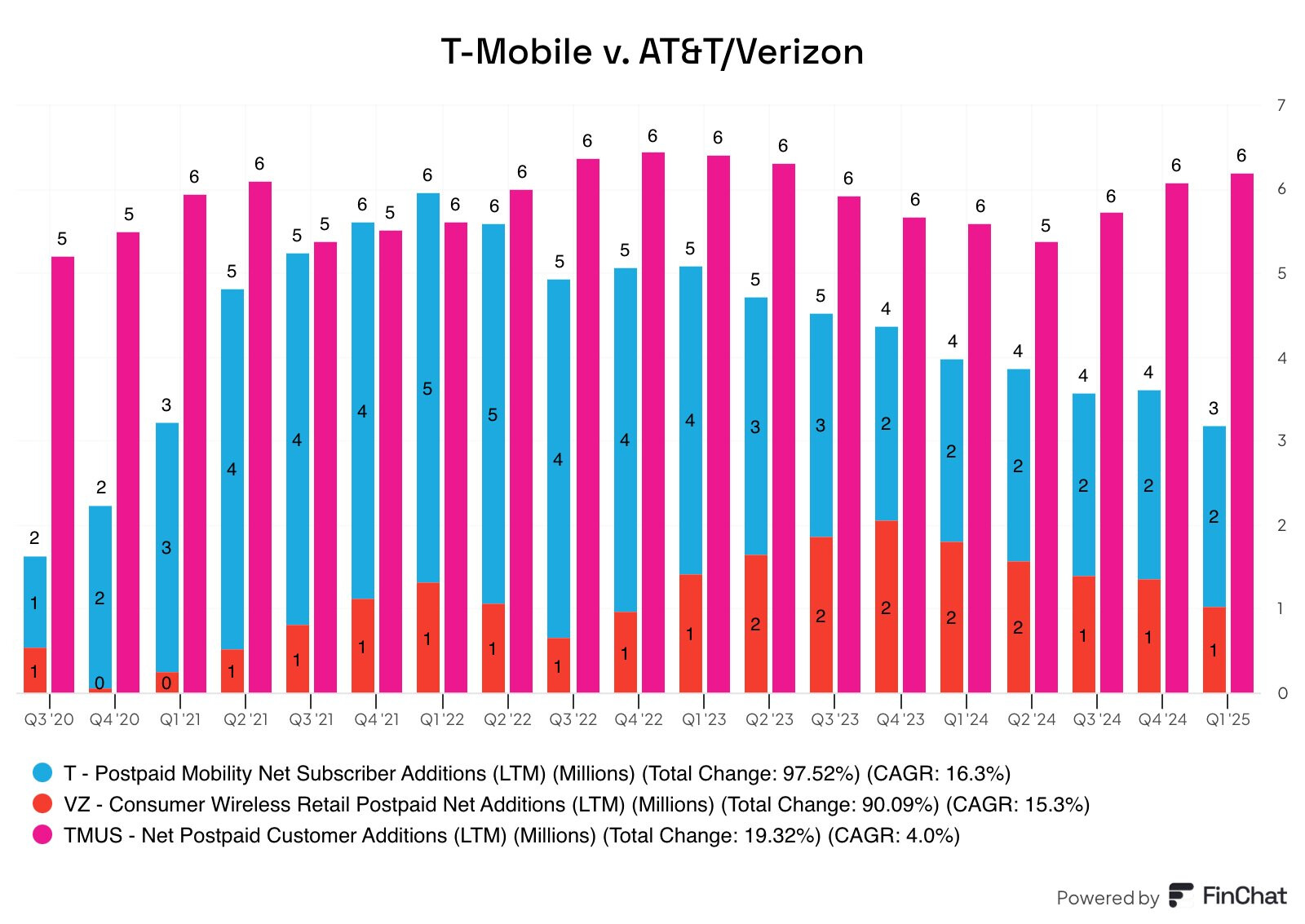

The number of operators’ main products, i.e., mobile subscriptions, is no longer growing significantly. Small growth may arise, for example, due to immigration, but in Finland, this seems to be mainly directed at prepaid subscriptions. In practice, this means that revenue growth comes mainly from price increases and 5G upgrades. In recent years, consumer markets have indeed seen price increases.

This year, however, the situation may change, and significant price increases may no longer be expected. Mobile revenue growth is thus increasingly dependent on customers switching from competitors.

2. Growth from Fiber and IoT Markets

However, volume growth is particularly evident in fiber connections for detached houses in Finland. Currently, there is a construction boom underway, financed with high debt leverage and private equity funds.

What is peculiar about this development is that operators have not been the most active players, as the scale of investments is large and returns take a long time to materialize. Selling mobile subscriptions is more scalable and yields results faster. The problem, however, is that customers seem to prefer fiber over 5G connections.

Another challenge for the fiber boom is that operators still have old copper and especially cable broadband networks in areas where fiber is being built. These old networks are cash cows for operators, built long ago, so replacing them with fiber – especially fiber built by a competitor – can be expensive for operators.

It will be interesting to see if any mergers and acquisitions occur in this sector. In Sweden, the broadband market is more developed than in Finland, and its size relative to the population is almost double that of the Finnish market – meaning there is potential for value creation.

The IoT market is currently growing rapidly, as more and more devices require mobile network connections. Operators are indeed able to increase the number of IoT subscriptions by tens of percent annually. The challenge, however, is that the average revenue per subscription (ARPU) is low. For IoT to become a significant part of operator business, either ARPU must rise, or volume growth must continue to be equally strong.

3. Where to Invest When Mobile Networks Are Ready?

The coverage of operators’ 5G networks is already almost 100% of the population in Finland, even though the share of 5G subscriptions out of total subscriptions is still far from 50%. This means that operators have to consider new profitable investment targets.

Investment opportunities can be found, for example, in fiber infrastructure, but another option is to increase dividends. For example, Elisa is raising its dividend more this year than in previous years.

4. Monetization of Towers and Other Infrastructure

Operators often own significant amounts of valuable infrastructure that may not yet be fully utilized financially.

In Sweden, many operators have already separated their radio masts into their own companies and brought in external investors. In Finland, Telia has done this, and Telenor (DNA) appears to be in the process of separating its mast business.

The value of masts should not be underestimated – for example, Telia’s mast business in Finland and Norway was recently estimated to be worth approximately 1.5 billion euros, which corresponds to about 12% of Telia’s current market capitalization.

Masts are not the only valuable infrastructure asset. For example, rooftop sites and many fixed network components can also offer new monetization opportunities or are at least partially underutilized.

5. Moats Are Still Deep

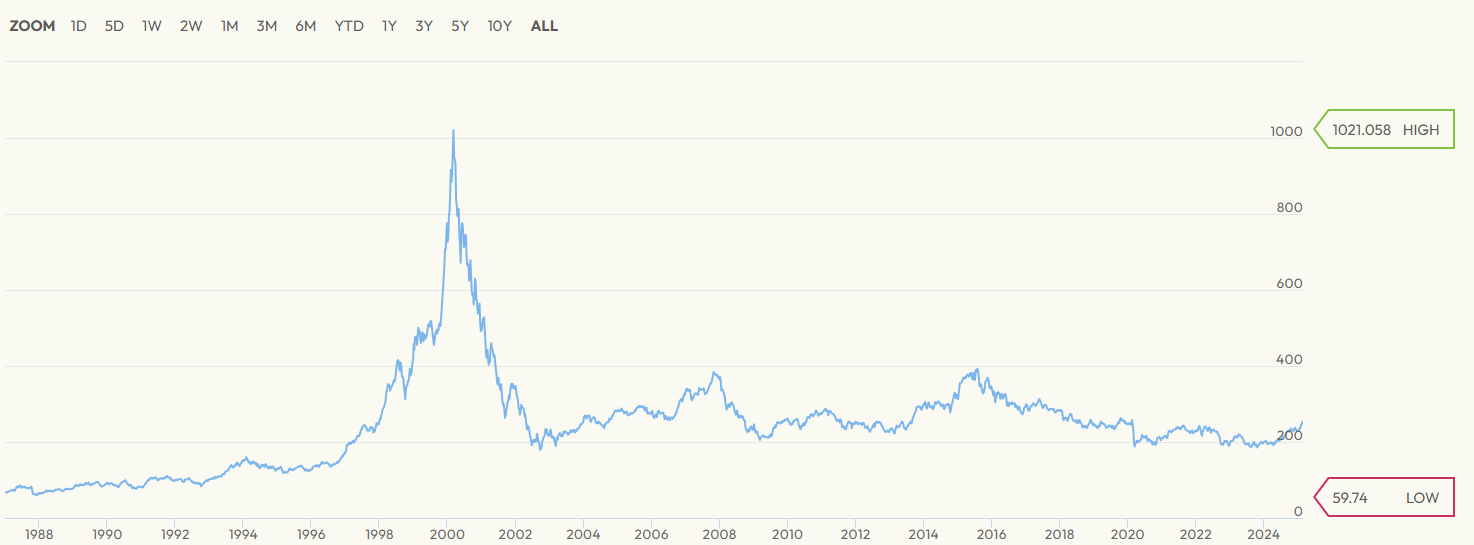

The operator business is attractive in the sense that it does not currently appear to be exposed to significant disruptive threats. Companies have invested up to 15% of their revenue annually for decades to build networks that are difficult for competitors to challenge. Furthermore, products are subscription-based, which makes the business predictable – even a 5% annual revenue decrease would be rare even in a poor market situation. Conversely, peak growth is rarely expected, as operators typically grow by only a few percent per year.

Of course, technological trends occasionally emerge that could challenge the position of operators. One such could be satellite internet. It remains to be seen whether, for example, Elon Musk’s Starlink could take market share from traditional operators.

![]()

![]()

![]()

![]()