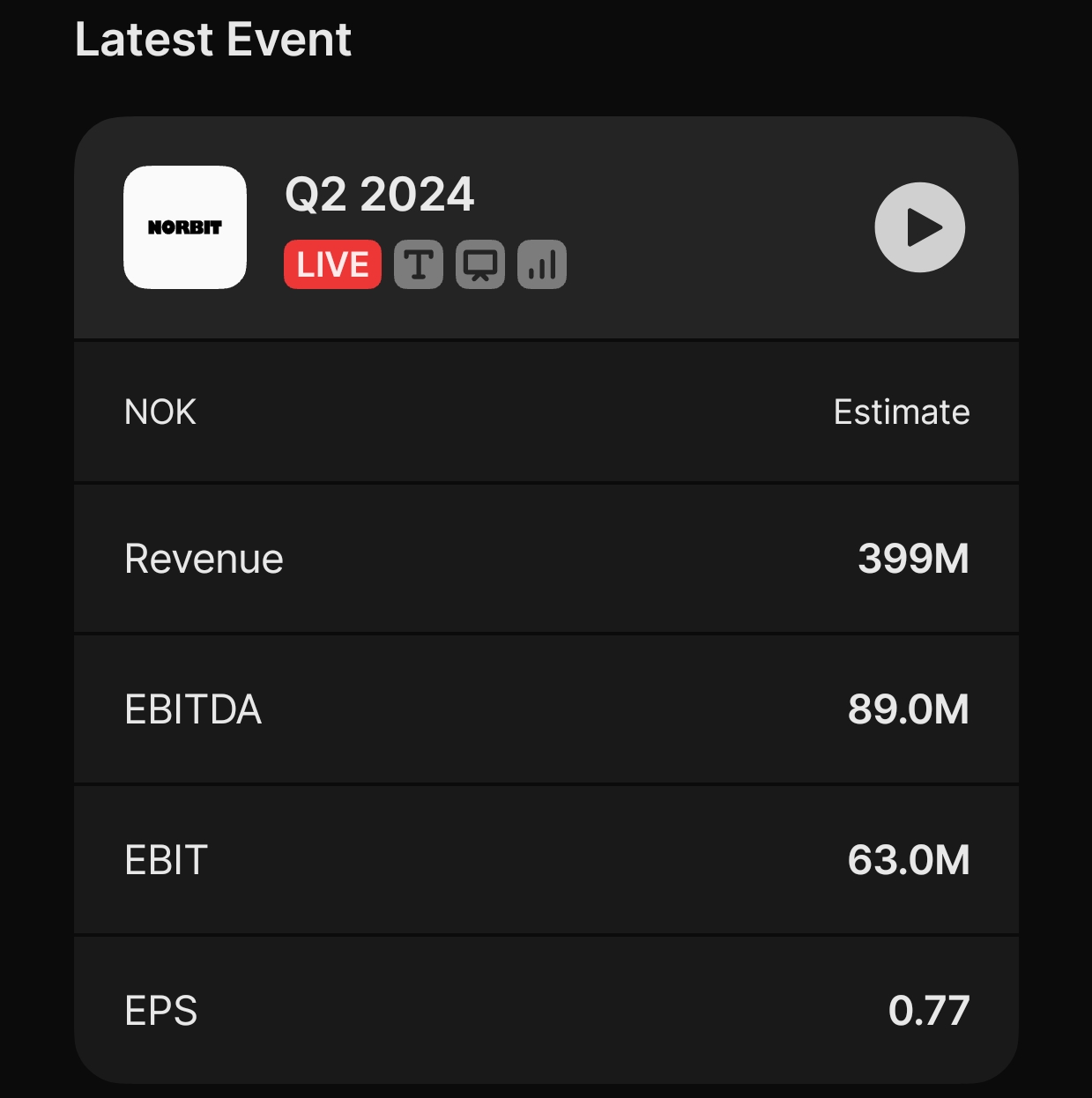

Was revenue predicted to decline? Or how did zero growth exceed forecasts ![]()

Was revenue predicted to decline? Or how did zero growth exceed forecasts ![]()

Yes! Just this quickly and back to work.

All right. The little one is in dreamland, so there’s time for hobbies ![]()

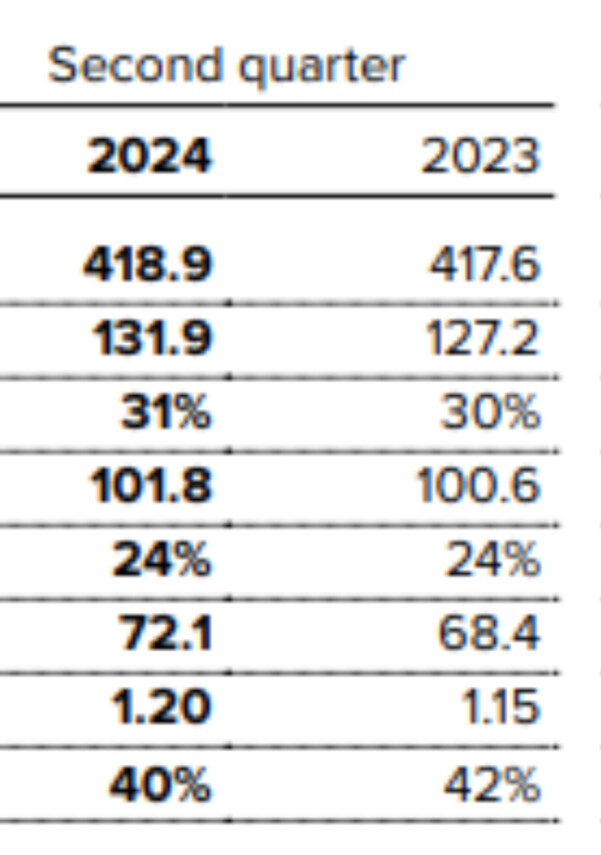

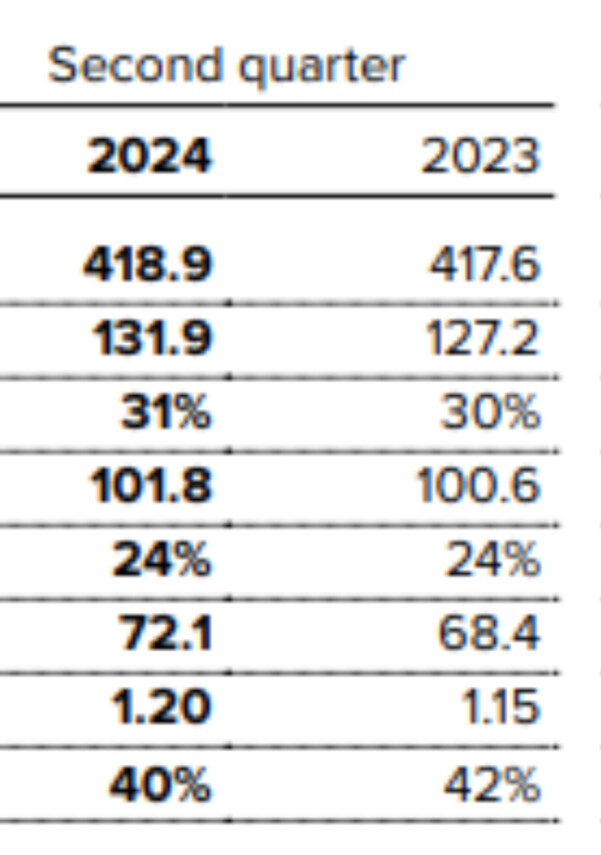

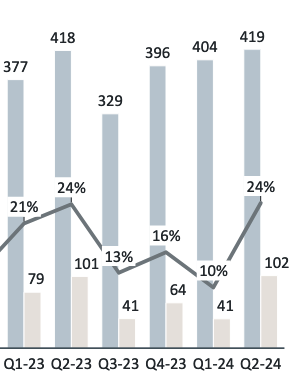

So, the interim report was good, and the market reaction is in my opinion a bit excessive (approx. +15% from the previous day’s highs). The report still leaves the possibility of a nasty profit warning, if my reasoning is correct:

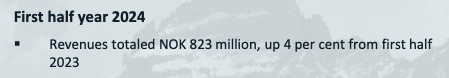

Realized H1’24 revenue 823MNOK, 17% EBIT.

This leaves 877MNOK missing from the lower end of the guidance.

The upcoming Q3 is usually the softest quarter of the year. In the newly published Q2 review, it is estimated that the revenues for both Connectivity and PIR will fall between 120-130MNOK. Let’s settle on the midpoint, resulting in a total revenue of 250MNOK from these segments.

That leaves Oceans, which had a revenue of 134MNOK in Q3’23. If we assume there would be 10% growth within the segment, Q3’24 revenue would be 145-150MNOK.

In total, Q3’24 for Norbit could be 395-400MNOK, which would be a very strong Q3. Despite a strong Q3, there would still be about 490MNOK in revenue left to achieve for the end of the year (i.e., Q4). This would mean 20-25% growth compared to Q4’23. If realized, it would also clearly be Norbit’s strongest quarter during its stock market history (measured in absolute currency). (Note! Consensus [Quartr] predicts a Q3 revenue of 450MNOK for Norbit; I assume this will be revised downward as the company specifies its guidance more towards the lower end).

All this growth would need to be achieved during the rest of the year, while simultaneously improving margins by 2 percentage points to reach last year’s EBIT % level (which the company is guiding for).

So, work needs to be done and robust growth is required. ![]()

These estimates are my own, and analysts are actually a bit more bullish in their forecasts. Let’s see how they get refined once they digest the Q2 results.

On Valuation

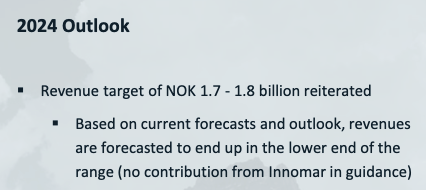

Guided 2024 revenue 1700MNOK and 19% EBIT = 323 MNOK EBIT.

To this, add Innomar’s annual EBIT of 70-80 MNOK to be recorded from July onwards, so maybe we could expect around 35 MNOK for the rest of the year?

If the 2024 guidance holds, and the lower end of the 1700-1800MNOK revenue range is reached with a 19% EBIT + Innomar 358MNOK. MCAP is currently 5.9 billion NOK. EV/EBIT 16.5. Whether this is expensive or cheap, everyone can decide for themselves. ![]()

On a lighter note, Norbit’s reports are a pleasure to read because the nature-themed photos embedded in them soothe an investor’s mind.

I’ll also boldly ping @Heikki_Keskivali for thoughts on the company if you’d like to share. Since you had written on X about the acquisition, I assume there’s some level of monitoring going on there. ![]()

Quite an interesting company. The company’s growth track looks quite nice, though this has certainly been supported by an M&A strategy. @Ituhippinen and others following the company could comment on the growth of the target market(s). It’s not quite clear to me why we should expect any exceptional organic growth here.

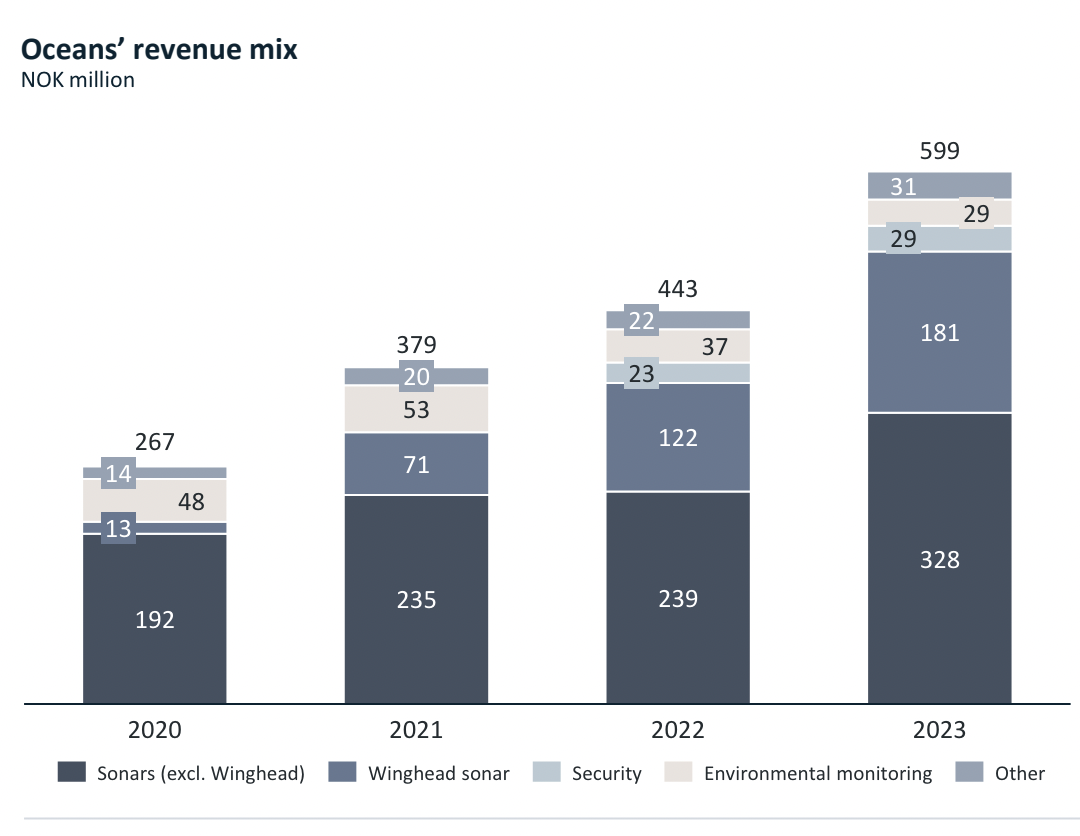

But when looking at the company’s growth, there’s been massive growth specifically in sonars:

Why have sonars been purchased at such an accelerating pace? How has the underlying market developed? Are there some one-off reasons (geopolitics??) why demand has exploded? And why can I trust that sonar demand will remain so strong in the future that this company continues to grow driven by them? ![]()

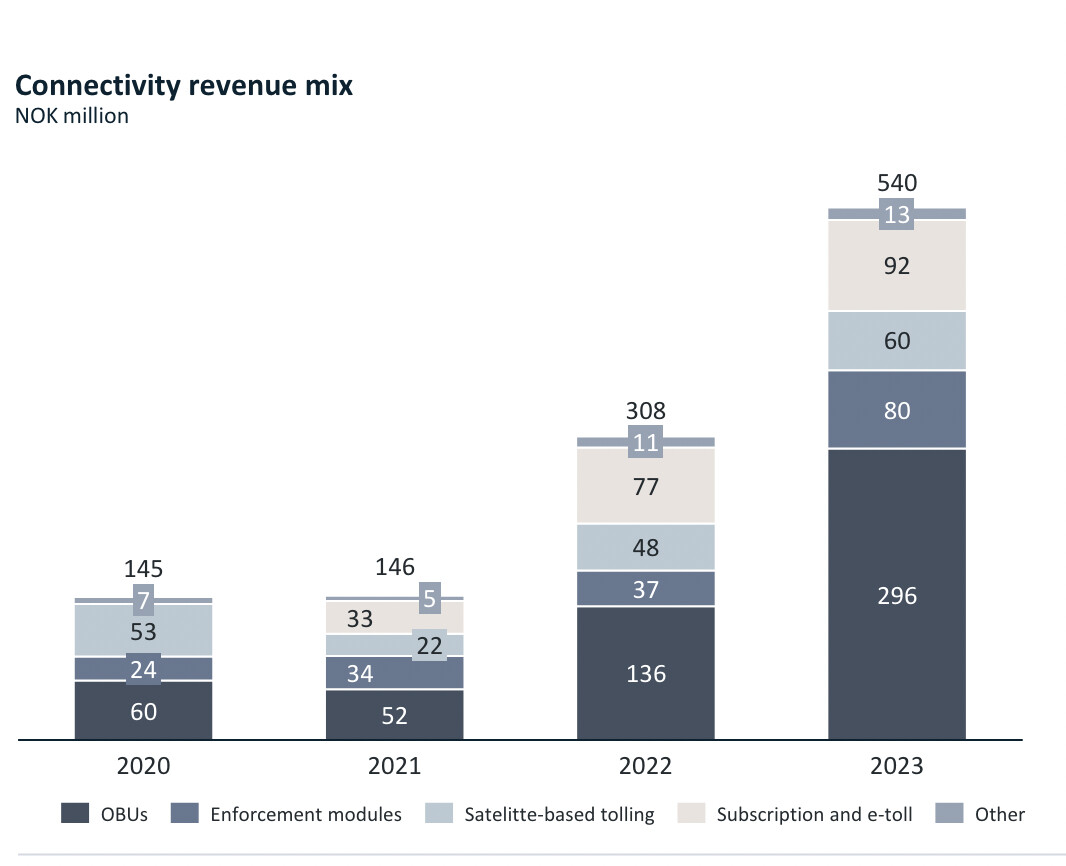

In the Connectivity segment, specifically the demand for OBU (On-Board Unit) products has grown exponentially in 2022-2023. It at least raises a question for me: is there demand here as well that could be interpreted as one-off related to the geopolitical situation? At least the chronological correlation matches the Russian invasion of Ukraine quite well.

Has the company commented in any way on the impact of the geopolitical situation on demand and sales? I quickly found at least a mention in the “growth drivers” section of the materials.

Here are some bits from my own notes; I don’t remember all the sources. Mostly from company documents, the “interwebs,” and Twitter. But take it with a grain of salt. ![]()

Market growth is estimated at approx. 5–9% annually according to various sources (sonars). This is expected to continue well into the mid-2030s. The total market for sonar alone is 3–4 billion USD (2023 estimate).

The sonar market grew by about 5–7% between 2019 and 2023, so it hasn’t been just a one-off spike. The same growth is predicted to continue for the next 10 years.

OBUs grew by about 10–15% annually from 2019 to 2023. Growth expectations for this sector remain at 10–15% going forward (5–10 years). Drivers include various Intelligent Transport Systems (ITS), regulation, and the increasing prevalence of vehicle-to-vehicle and vehicle-to-infrastructure communication. The total market for On-Board Units was about 2.6 billion in 2023. It is expected to grow to the 8–9 billion level by 2032.

In the big picture, the drivers (sonars) are defense, commercial activities (fishing, freight), and underwater research (mapping and imaging). Most of the world’s waters still remain unmapped.

The growth of maritime traffic and tightening safety regulations require constantly better mapping and surveillance, which increases the use of high-end sonars. One just has to trust that Norbit’s (Ocean) products are high-quality enough to eat into the market share. If I understand correctly, Norbit’s sonars were used for surveillance at the Olympics, which I think is a pretty good reference. They probably didn’t just pick any random product, but something from the higher-quality end of the market ![]() . As you wrote yourself, there is certainly market share to be gained outside the main market areas as well, despite the competition. I’ll add that Norbit has quite a comprehensive distribution network and an international customer base. Thus, market share can be captured in almost every corner.

. As you wrote yourself, there is certainly market share to be gained outside the main market areas as well, despite the competition. I’ll add that Norbit has quite a comprehensive distribution network and an international customer base. Thus, market share can be captured in almost every corner.

Slightly off-topic, it was mentioned in the Q2 presentation that both sonars and OBUs are replaced approximately every five years, at which point their lifespan has reached its end. Technology also advances significantly in that time.

I agree with you on this point: competitive advantage in the segment is hard to find. I do believe one exists, though, because they have secured strong partnerships (Toll4Europe). Of course, Norbit is known for its ability to create customized customer-specific solutions quite agilely. I would count this as one advantage. Additionally, in the latest Q2 presentation, someone asked what the difference is between these new OBUs and the old ones (the ones delivered to Toll4Europe), and the answer was something along the lines of “we can’t wait to tell you yet, but the other party in the deal will have the honor of announcing it soon.” They hinted that it relates to the product’s functional features and ease of use. (Not a literal translation!).

All in all, I would prefer to own just Oceans, but this comes as a bit of a bonus. But Connectivity isn’t a particularly weak unit either. ![]()

As far as I know, not in any more detail.

Here is an evening comment I tried to scribble down while playing video games with the boys… ![]()

edit: @JNivala and thanks for your opinions and the challenge. I really appreciate it. ![]()

Target prices have also been updated following the interim report.

Arctic 115 NOK, buy. (100 NOK)

Pareto 110 NOK, buy. (100 NOK)

Sparebank 100 NOK, buy. (75 NOK)

Better late than never. ![]()

The shortest answer is that Kongsberg’s equipment focuses more on deep-sea research, while Norbit focuses on shallow and medium-depth water. There are still products that overlap with the aforementioned assumption.

Norbit’s devices are generally more compact in design and more user-friendly. Their deployment is fast and doesn’t require an engineering degree. Norbit’s solutions are especially favored by small and medium-sized operators. The price range is difficult to estimate because (to my knowledge) exact figures are not published, but the impression I’ve gotten is that they are in the tens of thousands, but generally under 100k.

Kongsberg’s sonars, on the other hand, are consistently more complex than Norbit’s. Using them requires actual expertise and they are suitable for very demanding use. Generally, they are used in military applications as well as deep-sea research. Kongsberg’s price list starts where Norbit’s ends, i.e., roughly around the 100k mark.

All in all, the differences are not massive in product “quality,” but rather in application areas and budgets.

How likely do you think it is that the target will be met without having to issue a negative profit warning, given that Q3 has traditionally been quite a weak quarter and the company’s revenue has been stagnating for a year and a half now? Does the slow growth rate justify the current multiples for the stock?

You put me in a tough spot, Eka! And sorry for the number porn. Hopefully, this is correct.

What kind of profit warning would it be?

As I wrote above, the risk of a profit warning is acknowledged, and its probability is likely greater than 0 but less than 100%. I admit it’s looming slightly, but at this point, I’m going with the guidance and trusting management. If it were certain that they wouldn’t reach it, I believe management with such a good record would have already given an indication of a significant guidance miss. If, on the other hand, the guidance is missed by just a hair, does it change the big picture? In my opinion, no.

If Norbit’s own estimates for Q3 revenue come true regarding PIR and Connectivity, and Oceans’ revenue is the same as last year (0 growth), Q3 revenue would be 384 MNOK. If Q4’24 also sees zero growth and revenue is the same 396 [MNOK], Norbit would have H2’24 revenue of 780 MNOK. In H1’23, revenue was 823 MNOK. In that case, with zero growth for the rest of the year (except for the Q3 preview), Norbit’s revenue would be 1600 MNOK. That is, about a 6% miss. It would be unfortunate for the narrative, but not a catastrophe. I also don’t believe the rest of the year will be zero growth. ![]()

My own speculation

I calculated above that Norbit could reach about 400 MNOK in revenue for Q3. Analysts are predicting 450 MNOK, which seems really high. If we calculate that PIR and Connectivity bring about 240–260 MNOK to the table, that leaves the remaining 190–210 MNOK for Oceans. Of this, the Innomar acquisition will probably bring in 10–20 MNOK, which would leave Oceans with about 170–190 MNOK adjusted for Innomar (which is what they guide for). Now, Oceans had its record quarter with 195 MNOK revenue, which was a strong quarter. Reaching that 170 MNOK revenue is, however, quite possible in my opinion, even though it is usually the weakest quarter for Oceans.

However, a lot relies on Q4. They would need to grind out about 450–500 MNOK in revenue regardless, depending on how Q3 goes. So, to reach the guidance, they need to push through one really strong record quarter (Q4) and one very good quarter (Q3), which has seasonally been weaker. ![]()

I’m trying to look a bit further ahead, though, and follow the company’s progress toward the medium-term target.

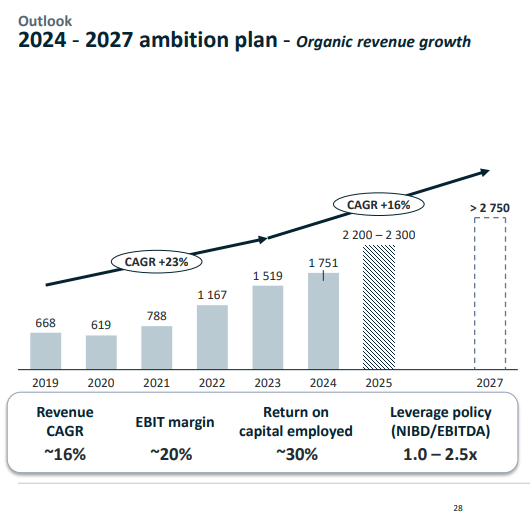

The board remains optimistic about NORBIT’s long-term outlook. The ambition for 2027 is to deliver organic revenues in excess of NOK 2.75 billion and an EBIT margin of around 20 per cent.

The company grew organically by 30% in 2023. In H1 2024, growth was recorded at 4%. I can acknowledge the H1 stagnation, but I wouldn’t quite call it 1.5 years of stagnation. The company itself has stated that there can be fluctuations from quarter to quarter in both directions. So, let’s give it more time. ![]()

If the growth for the full year is around 4%, then absolutely not. However, if Norbit reaches the lower end of the guidance, 1700 MNOK, organic growth for this year would be about 13%. I don’t think the valuation is cheap, but it’s tolerable.

So, I accept the risk of a profit warning with open arms, and if one comes, I’m already specialized in catching falling knives. ![]()

“In times of increasing geopolitical unrest, the need to protect what lies underwater has become more evident. At NORBIT, we are proud to see our solutions contribute to increased safety for people and critical infrastructure. This new order is, for us, a proof of the relevance of our offering”, says Per Jørgen Weisethaunet, CEO of NORBIT.

Part of my investment thesis is being reinforced as more focus is being placed on underwater security and surveillance.

The value of the order is approximately NOK 75 million, the majority of which is expected to be recorded in Q4 of this year in the Oceans segment. In Q4’23, revenue was NOK 177 million (Oceans), so this single order covers a pretty nice slice of expectations. More of these. ![]()

“Advanced negotiations” sounds interesting. Is it a deal now or isn’t it? ![]() Once this is closed (a humanist finally gets to use such a word, wonderful), it will be a nice big chunk for the PIR segment in Q1’25 to boost revenue (approx. 50MNOK). (Note: service delivery in Q1; there is no exact information on which quarter the potential payment will fall into, so the above is just my own speculation.)

Once this is closed (a humanist finally gets to use such a word, wonderful), it will be a nice big chunk for the PIR segment in Q1’25 to boost revenue (approx. 50MNOK). (Note: service delivery in Q1; there is no exact information on which quarter the potential payment will fall into, so the above is just my own speculation.)

Alright darlings, let’s continue the lively discussion! ![]()

The article is a spare time project I (Erik Stangeland) have been working on during the summer of 2024. The purpose of the article is for the reader to learn more about NORBIT, and NORBIT’s business segment Connectivity, in order to be able to make their own assessments of the business segment and the company as a whole.

So, below is a truly excellent deep dive into Norbit’s Connectivity segment, which often ends up a bit in the shadow of the sonar-manufacturing Oceans segment. Even though I think I know the company quite well, there is also plenty of new perspective in the link. ![]()

(Originally published on September 19, 2024, in Norwegian)

Oh, you were asking when Norbit’s results are coming?

We still have to wait a week for the Q3 results. This quarter has usually been the softest of the year.

After Q2, management guided that Q3 Connectivity and PIR would both have a turnover of approximately 120-130 MNOK.

This adds up to about 250 million, and currently, Quartr shows a consensus expectation of 450 MNOK for total revenue.

So Oceans would need to reach 200 million to hit analysts’ forecasts. Another option is that Connectivity and PIR exceed those figures, leaving Oceans with a bit less to do. Q3’23 Oceans revenue was 134 MNOK, so quite a bit of growth is needed in this segment. ![]()

Anyway, expectations are high. Norbit will soon get to show that the company is too.

As @Pohjolan_Eka noted above, the risk of a profit warning is elevated, and I personally expect a slight guidance miss for this year. Valuation is stretched, so there isn’t much room for negative news. On the other hand, the company knows how to surprise, so I’m looking forward to the interim report being released in a week with a positive mind. ![]()

e. Almost forgot to mention, it’s noteworthy that Q3 is the first quarter that also shows the impact brought by Innomar in the Oceans segment (from the end of July, i.e., August and September). Innomar’s revenue before Norbit was about 300 MNOK per year. Roughly divided into four quarters, that would be about 75 MNOK per quarter. So looking at this, meeting those Q3 expectations doesn’t exactly require magic tricks!

Roughly, I’m expecting the following:

125 MNOK (Con) + 125 MNOK (PIR) + 190 MNOK (Oceans, includes about 45 MNOK from Innomar). This would lead to 440 MNOK in turnover, which is pretty much in line with forecasts.

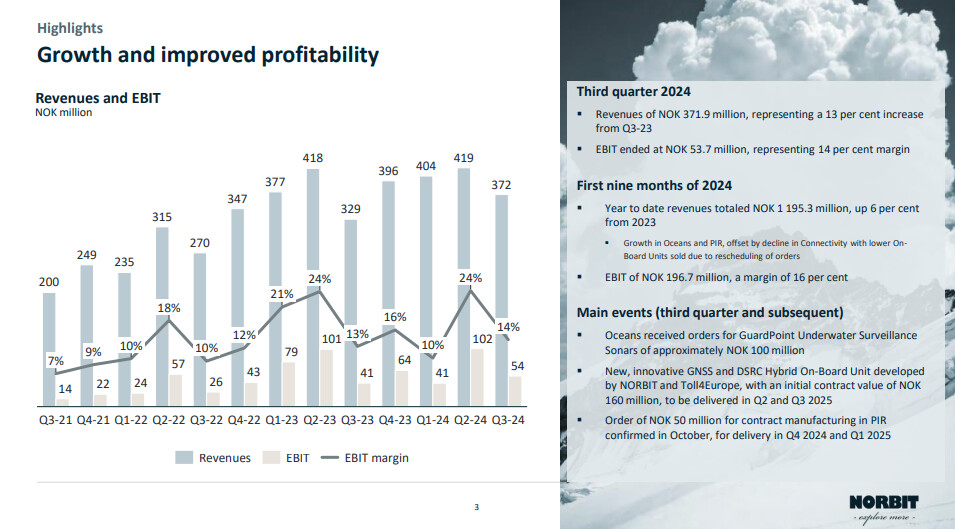

Trondheim, 14 November 2024: NORBIT delivered continued growth in the third quarter, reporting revenues of NOK 371.9 million. The reported EBIT result was NOK 53.7 million and NOK 60.1 million when adjusting for transaction costs relating to the Innomar acquisition.

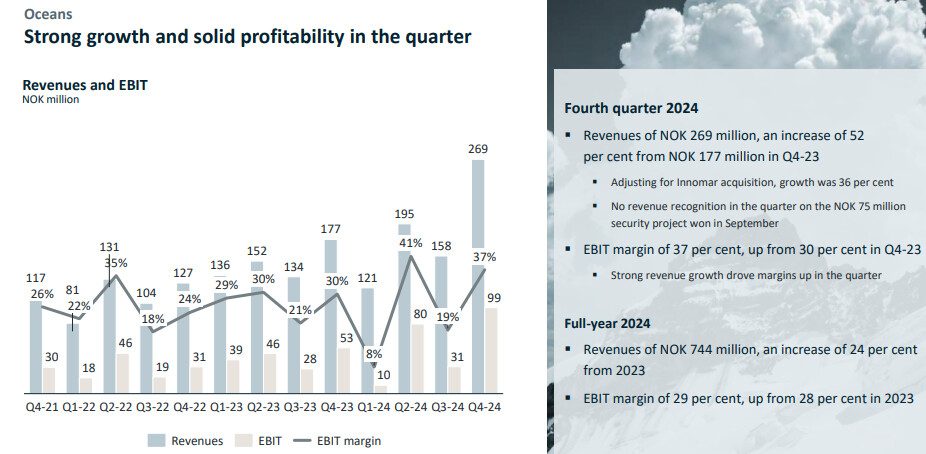

- The Oceans segment reported revenues of NOK 158.1 million, an 18 per cent increase from the third quarter of 2023, and an EBIT margin of 19 per cent.

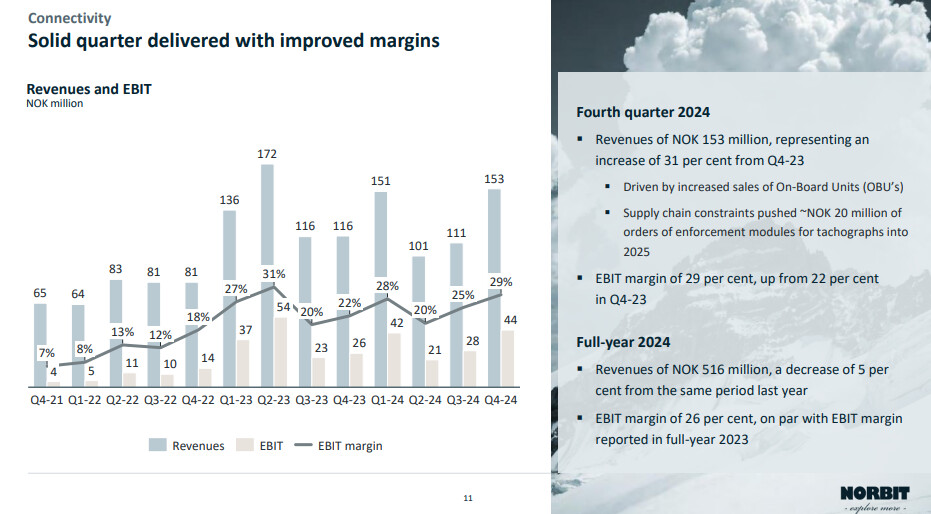

- The Connectivity segment reported revenues of NOK 111.0 million, a decrease of 4 per cent, and an EBIT margin of 25 per cent.

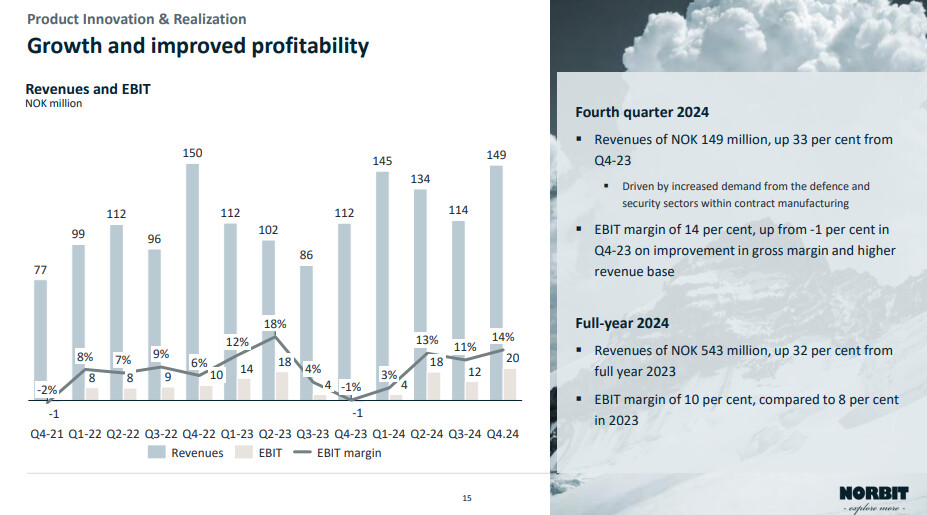

- The Product Innovation & Realization segment reported a 34 per cent growth in revenues to NOK 114.4 million, and an EBIT margin of 11 per cent.

“The third quarter was another eventful quarter for us at NORBIT. We saw growth across both Oceans and PIR, while Connectivity achieved increased profits despite rescheduled orders from a major European client,” says Per Jørgen Weisethaunet, CEO of NORBIT.

Just a quick comment, as work is once again interfering with my hobby. I’ll return to this later, but the main takeaway is the slight softness in the figures, but the full-year guidance is maintained.

“As we approach the last leg of 2024, it’s satisfying to see that we are on track to achieve our annual financial targets. It’s inspiring to witness how the organisation embraces the opportunities ahead, working tirelessly each day to ensure our clients experience our core value: We Deliver," says Weisethaunet.

Edit: Duties handled, now a few words about the report. Let’s remember that Q3 has always been the weakest quarter.

Miscellaneous from the initial impressions

Outlook

Consequently, EBIT should be 350MNOK this year, of which 197MNOK is currently accumulated from Q1-Q3. Revenue YTD is 1.2 billion NOK. To reach the Q4 guidance, 550MNOK in revenue and 153MNOK in EBIT are needed. If the lower end of the revenue guidance is realized, the EBIT % would have to be well over 25%! Now the company has a chance to show its scalability. ![]()

![]()

“Baltic Sentry” will involve a range of assets, including frigates and maritime patrol aircraft. The Secretary General also announced the deployment of new technologies, including a small fleet of naval drones, and highlighted that NATO will work with Allies to integrate national surveillance assets – all to improve the ability to protect critical undersea infrastructure and respond if required. NATO will work within the Critical Undersea Infrastructure Network, which includes industry, to explore further ways to protect infrastructure and improve resilience of underwater assets.

While waiting for Negaria, it’s good to focus on other news ![]()

NATO’s presence in the Baltic Sea is being strengthened, and the need for surveillance and monitoring is great. The news does not specifically highlight Norbit, but all this underwater surveillance strengthens my thesis that the sector will continue to have momentum in the future. Norbit’s security division’s products can be found here, if you need surveillance for your own lake cove due to poachers.

Dear audience, esteemed fellow investors.

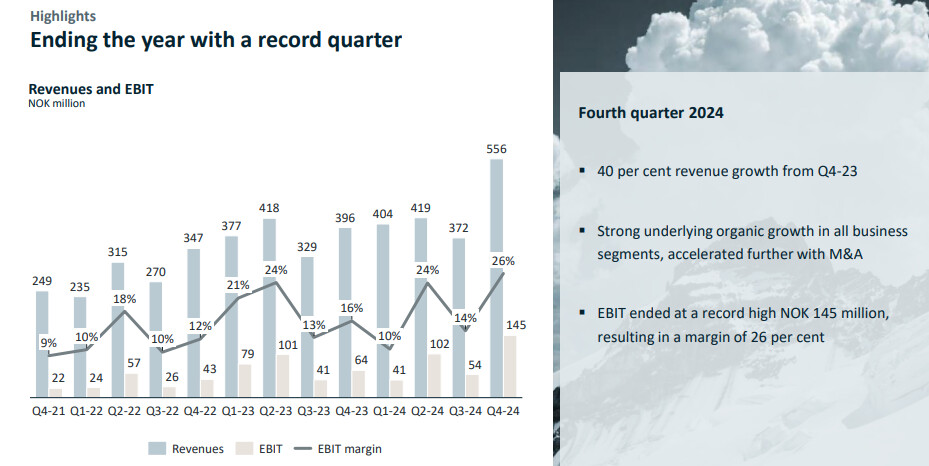

We still need to be patient for a moment. Q4 results will be published on February 13th. A rather strong Q4 is expected, as the negative news anticipated has not materialized. Investors around the world have breathed a sigh of relief and bought the stock into a significant upward trend as concerns have faded.

More on expectations later.

E. Key forecasts still highlighted (Tradingview):

Revenue 552MNOK (396MNOK)

EPS 1.63NOK (0.71NOK)

I’ll be back later, work is getting in the way of fun.

Revenue in line with forecasts, EPS slightly exceeded.

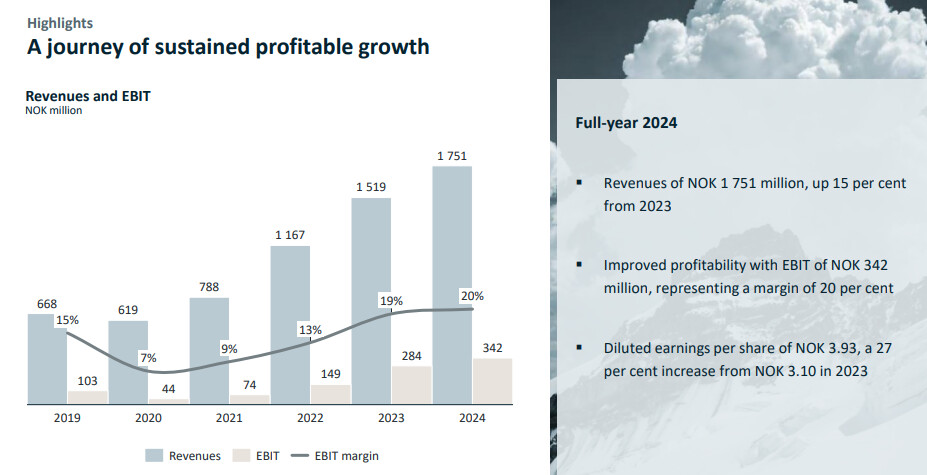

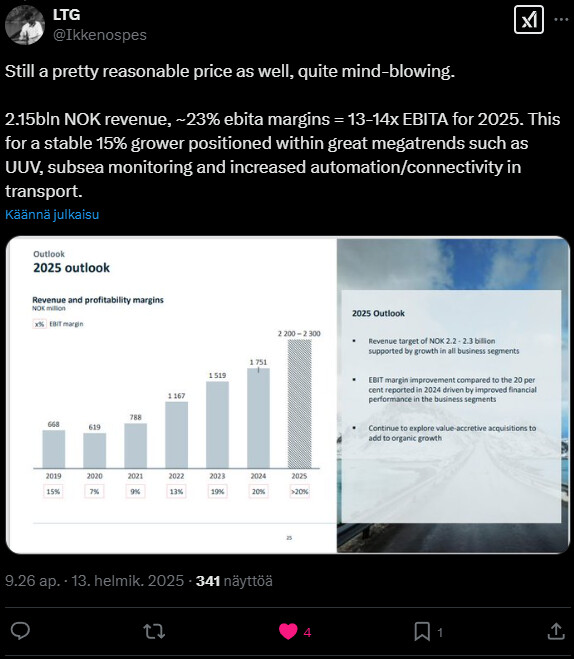

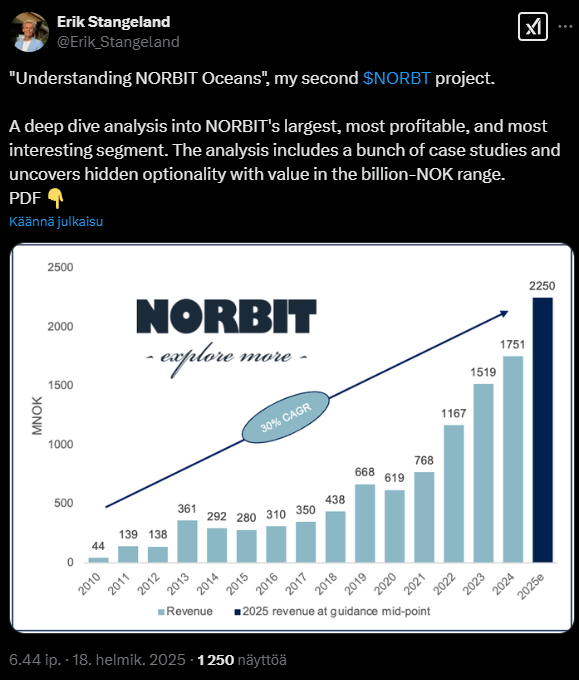

NORBIT delivered record-high revenues of NOK 1,751.4 million for the financial year 2024, with an operating profit (EBIT) for the full-year period at NOK 341.7 million, representing a margin of 20 per cent.

The fourth quarter also set a new record, with revenues reaching NOK 556.1 million - an increase of 40 per cent compared to the same period in 2023. The EBIT result for the quarter was NOK 145.0 million, representing a margin of 26 per cent.

Q4 by segment.

The Oceans segment achieved all-time high revenues of NOK 269.0 million, a 52 per cent increase from Q4 2023, with an EBIT margin of 37 per cent.

• The Connectivity segment reported revenues of NOK 152.7 million, an increase of 31 per cent, and an EBIT margin of 29 per cent.

• The Product Innovation & Realization segment saw revenues grow by 33 per cent to NOK 149.1 million, with an EBIT margin of 14 per cent.

2025 guidance fits nicely with forecasts.

Outlook for 2025 and beyond

2025 marks 30 years since the NORBIT journey began. The experience built over these decades enables NORBIT to deliver on its 2025 targets: revenues between NOK 2.2 and 2.3 billion and an EBIT margin above 20 per cent, supported by growth and positive margin development in all three business segments.

If the “nonnerot” (small investors/retail investors) aren’t excited after today, what else does the company need to prove:

Dividend proposal

Returning cash to the shareholders is part of NORBIT’s capital allocation framework. In line with the dividend policy, and considering the strong performance and NORBIT’s solid financial position, the board of directors proposes an ordinary dividend of NOK 2.00 per share. In addition, the board proposes an extraordinary dividend of NOK 1.00 to distribute excess capital, bringing the total dividend to NOK 3.00 per share for the fiscal year 2024 - corresponding to 76 per cent of the reported net profit.

Alright, let’s briefly and concisely go through the key points! All in all, very satisfied with the result, and what a monster quarter it turned out to be.

Revenue growth compared to Q4 last year was a massive 40%. This includes acquisitions and organic growth. EBIT-% a whopping 26%!

Indeed… This overall growth is truly admirable to behold. It’s not achieved at any cost, but by continuously increasing the EBIT-% towards the target level. There have been QoQ variations, and there will continue to be, but when we zoom out to the big picture, the company is delivering quite nicely.

Oceans

A top quarter, driven by successful sonar sales (steady growth within the segment across almost all products) and an acquisition (Innomar).

Connectivity

A good final quarter after somewhat soft Q2 and Q3. Overall, the segment did not grow at all in 2024; in fact, revenue decreased by a few percent. This needs to be monitored, and hopefully, the company will find a remedy for improvement. Profitability, however, has risen to an excellent level, which brings some balm to the wounds. An order of approximately 20MNOK has shifted to 2025 due to supply chain issues.

PIR

Impressive revenue growth combined with a rising EBIT margin. In the conference call, it was specifically mentioned that the defense and security sectors have been major drivers in contract manufacturing. I believe this is more of a permanent situation than a random one. Unfortunately (from a security perspective).

Future

Norbit once again reiterated its medium-term guidance. For 2025, the goal is still strong growth across all segments, with a guided range of 2.2 - 2.3 billion NOK in revenue with over 20% EBIT. The targets are, in my opinion, at least ambitious, but I still have no reason to doubt the targets set by management: the track record speaks for itself. In the conference call, it was also highlighted that continuous M&A search is underway. It now appears that the Innomar acquisition has been a real bullseye.

I also have to write some irresponsible speculation that I believe Norbit will reach its targets even before 2027. The last time, the medium-term target was broken a year ahead of schedule.

Q1 2025

Company’s own expectations:

Oceans >200MNOK revenue. This would be a rather robust improvement from Q1’24, when it was 121MNOK.

Connectivity 140-150MNOK revenue. Q1’24 was 151MNOK, which was a very strong quarter.

PIR 170-180MNOK revenue. Q1’24 was 145MNOK.

Closing words (my own rambling).

I am comfortably sitting on my position, which is about 10% of my portfolio. If there were a small dip available, I could imagine adding more. The valuation is not outrageously cheap, but hey, when do you get quality cheap?

The link below provides a VERY comprehensive and extensive (75-slide PDF…) on the Oceans segment. A really great deep dive that I recommend going through if you’re interested in more detailed content within the segment.

https://x.com/Erik_Stangeland/status/1891891447982424469

Trondheim, 14 March 2025: NORBIT today announces that segment PIR has received orders worth approximately NOK 260 million from an undisclosed contract manufacturing client in the defence and security sector. Deliveries under the contracts will commence immediately, with the majority scheduled for second quarter of 2025.

“Given the current geopolitical landscape, we are convinced that there will be a long-term increase in demand for technology made in Europe. Our strategic investments in increased capacity enable scalability across all our business segments. These contract awards confirm that preparing for increased demand, including from clients in the defence and security sector, has been a sound strategic decision”, says Per Jørgen Weisethaunet, CEO of NORBIT.

The majority of the order will be delivered during Q2 2025, so it should be reflected in the interim report! For comparison, last year’s PIR revenue in Q2 was 135MNOK. This single order alone was about double that, although some will be recognized in Q1. In 2024, PIR had a turnover of approximately 550MNOK, now this one order is almost half of that. ![]()

It’s also noteworthy that this was a large order for the defense and security sector. My hunch is that the investment in this sector won’t stop here.

This once again looks good for Norbit. ![]()

e. At the same time, a shoutout from @Sijoittaja-alokas on X!