I’ll also add that the importance of numerical metrics in the analysis accounts for a fairly minimal portion of the time spent (approx. 20%), while qualitative factors such as barriers to entry, the business model, competitive advantages, products, services, and reviewing customer segments take up the majority of the time. Assessing corporate culture is extremely difficult. One can evaluate management stability and tenure, as well as insider holdings, and these do provide some insights. We have divested from companies like Starbucks and several others due to CEO changes, as these have created uncertainty regarding the continuity of the company’s strategy.

I agree with that high R&D/Revenue ratio (i.e., it’s good to be high), but on the condition that the company’s business model and the maintenance of its competitive advantage require it. Often pharmaceutical companies or semiconductor companies have that exact competitive advantage of cumulative learning on their side, which creates a moat against competition as well as strong pricing power. The flip side, of course, can be that R&D is not an investment but an expense, and thus shareholders’ money is wasted.

NOVO NORDISK

Novo is Denmark’s Nokia, but with the difference that Novo has better prerequisites to continue its brilliant performance and thus avoid Nokia’s miserable fate. I’ll keep the message fairly short so that everyone can manage to read it.

Novo is a pharmaceutical company founded in 1923, specializing especially in diabetes. As a doctor, this field is very close to my own area of expertise. From a pharmaceutical company’s perspective, diabetes is very attractive because, although the etiology of diabetes varies significantly, we can generalize that it is primarily a lifestyle disease. Specifically, as people globally live more “affluent” lives, diabetes becomes more common as a disease. TAM (Total Addressable Market) is therefore growing, and thanks to its long history and scale, Novo has clear competitive advantages specifically in the treatment portfolio for this disease. The pharmaceutical industry is a high-barrier business, as it requires significant capital for R&D and is also heavily regulated in all market regions.

Novo’s focus has been quite purely on diabetes treatment, but now also on the treatment of obesity, which is on everyone’s lips. In fact, these topics are essentially linked, as the effective “weight loss drugs” spoken of today were primarily developed as diabetes medications. It’s logical that the solution for weight management was found this way because, as I described at the beginning, the relationship between diabetes and obesity is close.

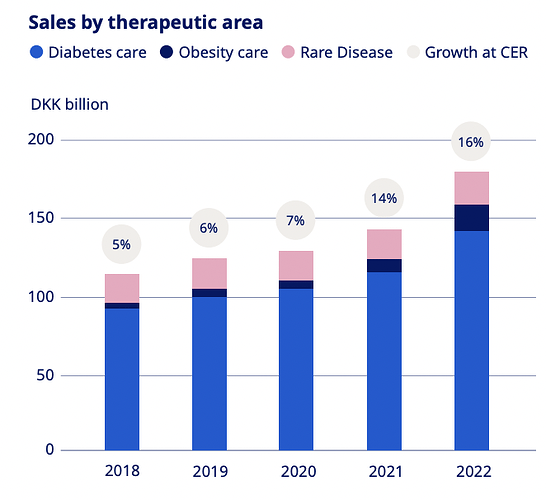

Novo’s sales breakdown shows quite clearly where the money comes from:

You can clearly see this focus in Novo’s pipeline:

From this, we can clearly see that the strongest growth is now driven by obesity drugs, either with this indication or through “off-label” use.

Novo meets all the criteria of a high-quality company based on historical key figures:

- ROIC has varied greatly, but the > 15% criterion has been easily met.

- Revenue growth 2010 - H1/2023 is around 8.5% p.a.

- Net profit growth 2010 - H1/2023 is around 13% p.a.

- Net profit margin is > 30%

And we have every reason to believe that this will continue, briefly some points:

- High barriers to entry (regulation, capital needs, requires specific expertise in drug development, etc.)

- TAM keeps growing regarding diabetes

- Medical treatment of obesity is only in its infancy in terms of sales volumes

The most significant threat relates to this medical treatment of obesity. As seen from the valuation multiples, the market is pricing in significant profitable growth through obesity treatments. And it is arguably quite clear that in the coming years (e.g., 2024-2028), the company will almost certainly grow nicely in terms of both revenue and earnings.

However, there is also a risk here. While this thread is not meant for a detailed valuation discussion, it is good to understand that Novo’s market value relies heavily on the narrative of the triumph of obesity drugs. However, in the long run, there is a valid and significant threat that a clearly more effective medical treatment will be invented, displacing the current GLP-1 analogs. It could be, for example, completely outside Novo’s area of expertise, or a competitor’s products might simply be better. This change in narrative would be devastating for valuation multiples, as expertise in diabetes treatment alone would not justify anywhere near the current multiples.

@Santeri_Korpinen, I’m very interested in Sifter’s view on the following: Novo’s product for obesity treatment is semaglutide, which is purely a GLP-1 analog. Unfortunately, there is no significant improvement in sight in the pipeline (see image above). But if we look at the pipeline of the main competitor, Eli Lilly, it looks completely different. Tirzepatide has just entered the market, which is a dual agonist and, based on good evidence, is a MORE EFFECTIVE weight loss drug than semaglutide alone (at least among those with diabetes). Furthermore, Lilly has retatrutide in its development pipeline, which is a triple agonist, and its preliminary evidence is much better, even close to the efficacy of bariatric surgery. Of course, it will take years for this to reach the marketing stage, but Eli Lilly is certainly much better positioned specifically in the medical treatment of obesity.

How have you at Sifter approached this dilemma? Novo’s growth path even in the medium term is likely on track because the demand for medical treatment of obesity is so amazingly high that Novo’s products will still sell like hotcakes even though tirzepatide has already entered the market. But as an investor, you surely consider this current valuation and its sensitivity to a change in narrative. In the short and medium term, I don’t see very large threats to Novo’s business performance, but in the long term, they exist, specifically in this obesity segment. And unfortunately, at these valuation levels, that pretty much defines the success of a long-term investment.

I created a dedicated thread for Novo, as the company is being discussed in a few different threads. I shamelessly borrowed @JNivala’s message ![]() Novo Nordisk - Euroopan arvokkain yhtiö? - Osakkeet - Inderes forum

Novo Nordisk - Euroopan arvokkain yhtiö? - Osakkeet - Inderes forum

Bad late summer weather ruined Olvi’s Q3/2023 results. The report also includes the payment of a fine by the Belarusian subsidiary, which makes the adjusted operating profit better than the reported one.

Right at the beginning of the interim report, the statement “Unfavorable late summer weather decreased sales volume by 5.4%” is an all-too-easy justification for the decline in sales volume. Similar statements have certainly appeared in Olvi’s reports before; that phrase is elaborated on slightly after the figures in the section where the CEO discusses business development.

It will take at least a while for Olvi to catch the same kind of tailwind they were capable of before the COVID-19 era. Rising costs, along with the unstable situation regarding Belarus, will probably provide an opportunity to pick up shares even cheaper. At least that’s what I believe if those issues don’t start to resolve themselves, or else revenue and operating profit growth would need to come from other operations to compensate for the rising costs and the unstable situation in Belarus. Sales volume growth/status is currently best in the Belarusian operations, although in terms of net sales, the region has not performed as well relative to sales volume as other market areas.

Regarding the beginning of the year, the revenue growth criterion is still met. I previously posted those pre-COVID figures:

Before the COVID era, 3-year figures from the financial statements:

- return on invested capital is around 20%, 2017 (19.7%), 2018 (21.2%), 2019 (20.8%) - net sales growth over 5%, 2017 (7.6%), 2018 (11.3%), 2019 (6.4%) - growth of profit for the financial year around 10%, 2017 (10.5%), 2018 (10.7%), 2019 (10.3%) - net profit margin over 12%, 2017 (15.1%), 2018 (25%), 2019 (26.1%)

Olvi still has potential in my view, but when it can be properly harnessed again is another matter. I don’t have Olvi in my portfolio, and the fact that I was previously considering buying at these prices became less likely with this interim report. Unless I talk myself into believing that the overall situation and the hiccups in development are only temporary.

Excellent article. Few businesses—even high-quality ones with a competitive advantage—are able to incrementally (re)invest for long periods with a high return on capital and thus sustain high earnings and cash flow growth. And the fact remains that “stocks follow earnings” in the long run.

There are many such so-called ”Legacy moat” companies. They are good businesses and possess better-than-average financial metrics, but they are no longer able to significantly accelerate value creation because the return curve for new investments in their own core industry hits a wall.

With these companies, one must also be particularly careful about what one pays for them, as a high valuation combined with slow or non-existent earnings growth is usually a surefire way to underperform the index.

Several such companies from the Helsinki Stock Exchange come to mind, and some have already been mentioned in this thread.

Several hard-core industry professionals have already written in this excellent thread - based on the analysis, clearly including @Hades as well - so I may have only a little to add myself.

I’m still forced to comment that, in my opinion, some kind of ESG dimension should be attached to the concept of a ”quality company”. Based on that, PMI or its competitors (despite what consultants say) cannot be quality companies, no matter what shows up on the EBIT lines.

The industry’s longer history is truly unparalleled. It’s wild to imagine how much money and top-tier expertise has been spent in the industry, instead of on genuine added value, on misleading consumers, political decision-makers, and authorities alike about the risks of their own products for decades [x]. Something comparable can surely be found in the history of last century’s capitalism, but it is still a case of historic proportions. One can admire it or not.

In my opinion, all global quality companies leave a mark on the world, or at least on their own time, in addition to the fat wallets of happy shareholders. Whether it’s timeless design, the economic crown jewel of a small nation, energy production, the smartphone revolution, or, say, the mass production of diesel (or nowadays electric) cars for consumers. PMI has also undeniably left its mark - indications of the main product’s footprint can easily be found on, for example, the WHO website. If you have enough imagination, you can relate the figures to PMI’s market share (15-25%) and, for instance, try to calculate the scale of costs that societies and relatives have had to bear from diseases directly related to tobacco products (hint: a single lung cancer patient and their treatment can cost the public sector in Western countries up to 150,000 euros). One would love to see these detailed in an ESG report, but I guess not.

One would think that by getting involved with the stock, even remotely in a retail investor’s role, you’d get a good return. But looking closer, during PMI’s existence (2008 spin-off), the stock has returned—taking into account dividends (dividend yield average 5.68%) and their taxes—less than an investment in the OMXHGI index, despite Helsinki’s recent sluggishness. It’s not even worth comparing the stock to the key US indices, let alone the real quality companies mentioned here. In those, returns can be 10-20 times higher, even more in tech. From the Helsinki Stock Exchange, for example, Kone has been a far more profitable investment than PMI during that period, and best of all, when riding up a skyscraper once again in a reliable modern elevator, you notice that the company’s carefully manufactured products have a fundamentally positive impact on society.

Believe the “healthiness” and “responsibility” of the industry’s new products if you wish, but often an old dog doesn’t learn new tricks. This message is intentionally a bit provocative, so apologies for that. ![]()

I only just got around to reading this great article myself; thanks @Zorcap for bringing this up again so I noticed it once more. This was exactly what I was looking for when defining a quality company for this thread. Growth is exactly why it is an important component, and it must be achievable with a high return on invested capital. For example, KONE is definitely a top-tier firm, but it can no longer reinvest its capital efficiently. Although ROE and ROIC look high, it cannot grow at that pace but rather generates steady results with little capital. However, for owners, it doesn’t necessarily mean good returns due to the lack of profitable growth. And in fact, in KONE’s case as well, we can see that those returns on invested capital have slowly declined along with slow growth → recent growth has not been as profitable as the earlier core business.

I’ll edit my opening post a bit more and add the link to this article at the end. These are exactly the kinds of companies I want to see shared in this thread! ![]()

One doesn’t have to disagree with you at all regarding the sleight-of-hand tricks or societal impact of tobacco companies, and hopefully others share that view as well. I, however, strongly disagree with the role of ESG in investing, whether it’s a quality investing style or not. Quality is verifiable in many cases through numbers, but responsibility, on the other hand, is largely a matter of opinion.

The responsibility label has suffered such inflation that there is no longer a path back to credibility: an ESG report can surely be cobbled together for every global business to justify being On the Side of the Good ![]() . This has unfortunately been swallowed whole in the financial industry, and now “responsible” funds include pharmaceutical companies whose products have ruined the lives of small children as early as two years old, food companies that have “silenced” unionized workers with hitmen, and high-quality tech firms where worker suicides are prevented as an ESG measure when working conditions drive laborers to jump off the factory roof. Let everyone choose for themselves the lens through which they view these firms—the outcome depends essentially on that very choice. There simply doesn’t seem to be a company that would recount the darkest moments of its corporate history in a visually pleasing slide deck.

. This has unfortunately been swallowed whole in the financial industry, and now “responsible” funds include pharmaceutical companies whose products have ruined the lives of small children as early as two years old, food companies that have “silenced” unionized workers with hitmen, and high-quality tech firms where worker suicides are prevented as an ESG measure when working conditions drive laborers to jump off the factory roof. Let everyone choose for themselves the lens through which they view these firms—the outcome depends essentially on that very choice. There simply doesn’t seem to be a company that would recount the darkest moments of its corporate history in a visually pleasing slide deck.

The above were just a few examples of why ESG 1.0 shouldn’t interest any investor. You are quite right that some companies create a better world than others, but when push comes to shove, absolutely every one is ready to disregard the common good—and that is where the significance of responsibility crumbles in my book. You can’t polish a turd, and irresponsibility cannot be patched up by drafting an ESG report or any other greenwashing hype. Fortunately, everyone is free to act according to their own morals in their investment decisions, but this should have almost nothing to do with quality investing.

Thanks, and I agree with the posts. And also about the ESG hype, although I secretly hope we’ll get something useful out of it one day.

I used the term ESG inadvertently, but I didn’t actually intend to go into the world of reporting, certificates, and assessments. I admit the whole message was more of a vent anyway, as professionally I’ve unfortunately seen too much of this tobacco industry “quality business.” Admittedly childish, but “quality company” has a (mostly) positive ring to my ears, and I perhaps wrote a bit hastily.

But if we are looking for some absolute truth, then the concept of responsibility is indeed an impossibility because it’s inevitably subjective (though it’s worth remembering that you can do all sorts of things with those US GAAP/IFRS figures too). Despite this challenge, I thought I’d suggest at least this kind of simple intuition-based exclusionary strategy (let’s call it negative screening) and drop the tobacco industry out of the investable universe, which many would likely accept based on general knowledge, because although there are skeletons in every closet, not all sins are created equal and for some sectors it’s just not easy to find a peer. Many large investors have surely made similar reflections even before the big ESG circus. If I recall correctly, for example, the Oracle of Omaha reached the same conclusion specifically regarding tobacco, and I think Sifter’s funds do the same, not touching stocks in the industry as part of their investment principles. Whether the companies in the sector could still be quality companies from their perspective, well, so be it.

But I noticed while considering the angle of the response that the difficulty of the “quality company” concept was known and the thread starter had reserved the right to define it in this thread. My choice of topics doesn’t seem to fit the scope, so I’ll cautiously move back to just following along.

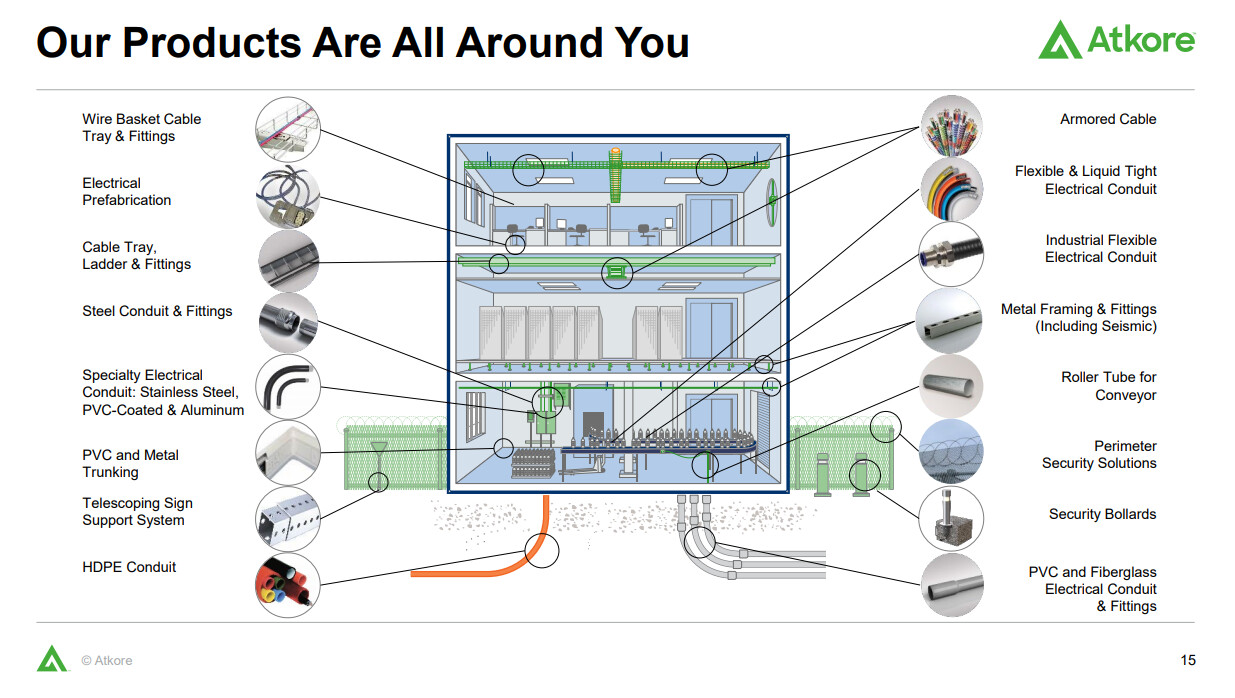

My recommendation for a quality company is the US mid-cap industrial Atkore (NYSE:ATKR). Today, the company primarily manufactures miscellaneous electrical infrastructure products such as electrical conduit/cabling/enclosure solutions as well as other electrical-related and non-related infrastructure products (metal framing, mechanical pipe, perimeter security, and cable management; see image).

The company has undergone an impressive transformation from a loss-making, sluggish industrial conglomerate into an extremely profitable cash flow machine since 2010, when a private equity firm acquired it from the Tyco conglomerate, restructured the company thoroughly, and later IPO’d it back to the stock exchange in 2016.

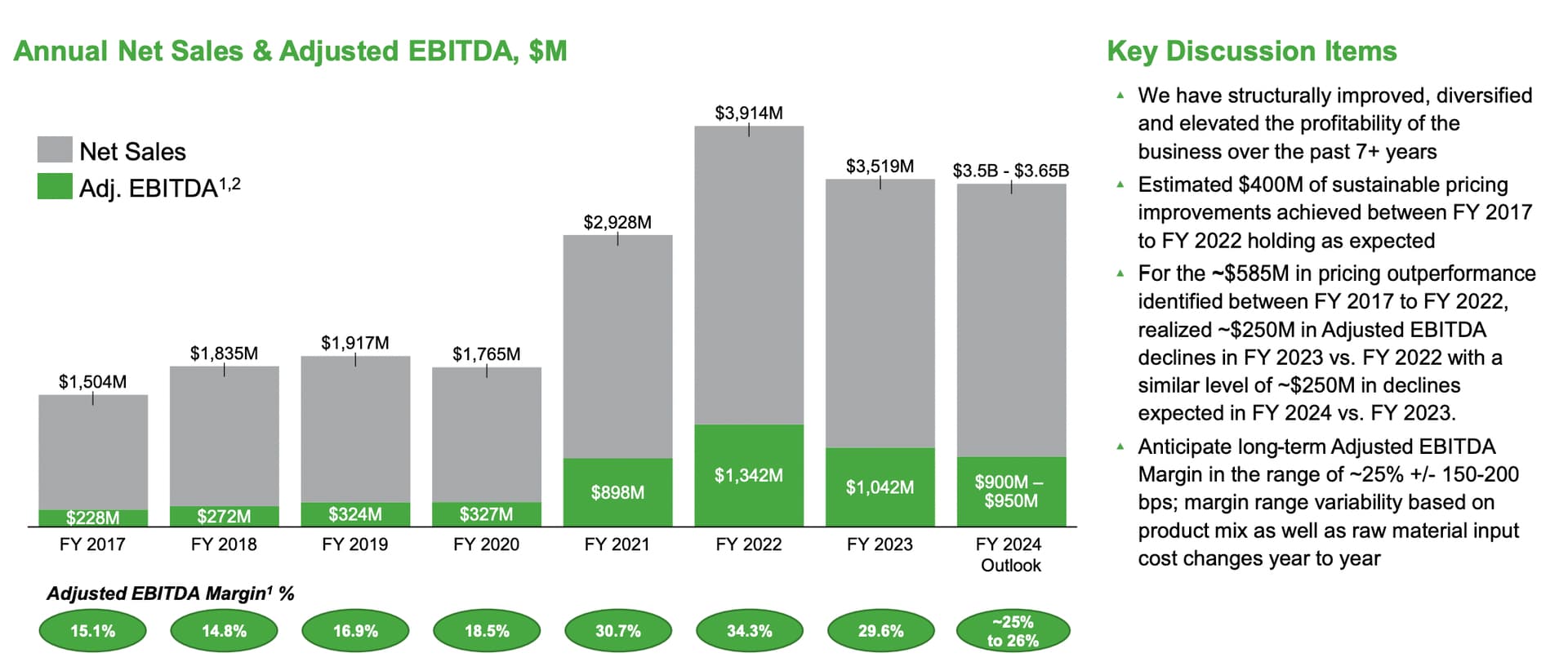

- Revenue growth over the last 10y CAGR 9.46%

- EPS growth over the last 5y CAGR 54.97%

- 5y average ROIC 30.9%

- Net profit margin 4–19% (2016–2023)

The company’s development has certainly been quite non-linear, and in recent years, profitability growth in particular has been very rapid. In any case, in the listing year 2016, the company generated an EPS of $0.94 per share, and now the company has guidance for 2025 of $18+, meaning the capital belonging to investors has increased 18-fold in about a decade, which can be considered a strong performance.

Several factors have made this possible.

- This is the best-managed company I have personally come across.

- It’s a turnaround company, and the roots of the turnaround were established when the company was taken private; at that time, 90% of senior managers were fired and replaced with better leaders (shareholder value maximization purists), particularly from the successful Danaher Corporation (including ex-CEO John Patrick Williamson).

- The company has quite effectively cornered the markets for its main product segments in the United States, and competition is limited.

- The company manufactures products that are not profitable to freight over long distances or store in large quantities (e.g., plastic pipes), so locally the market share can be even higher (local monopoly).

- The company’s pricing, ordering, manufacturing, invoicing, and delivery processes have been honed to be significantly more efficient than its competitors’. For example, the company aims for a 24-hour delivery time from the factory manufacturing process to the end-user at the job site, which naturally keeps the working capital and invoicing cycle very short and raises ROIC.

- Capex has been optimized to a minimum (3–4% of revenue vs. 15% industry average), and the entire cash flow is directed toward share buybacks or acquisitions, and the company has successfully operated as a serial acquirer.

One factor has also been that the company has been quite lowly valued since its listing (P/E 6–12; FCF yield 6–20%), and thus the company has found an extremely productive investment target for its capital in its own stock. Since the IPO, the company has bought back and canceled about 40% of its shares, and the buyback program naturally continues every day.

The future looks bright as well. There are many positive processes underway in the United States that Atkore supplies products to, including the general electrification of society, the infrastructure required by EVs and renewable energy, data centers, the factory reshoring phenomenon, broadband, storm protection for power lines, etc. The federal government is distributing money quite generously to support these projects in the coming years, and Atkore naturally benefits from these directly and indirectly. For example, Atkore receives about 100 million in tax credits from the Inflation Reduction Act related to solar panel infrastructure manufacturing, etc. (thanks Biden ![]() ), and Atkore guided that the revenue of this Solar segment will double now in the 2024 fiscal year. In 2025, BEAD (Broadband Equity Access and Deployment Program) will follow, and the company is opportunistically the second-largest HDPE pipe manufacturer for the US Telecom segment.

), and Atkore guided that the revenue of this Solar segment will double now in the 2024 fiscal year. In 2025, BEAD (Broadband Equity Access and Deployment Program) will follow, and the company is opportunistically the second-largest HDPE pipe manufacturer for the US Telecom segment.

The company reported its Q4 results yesterday. If you are interested in the company, it’s worth checking out the quite comprehensive and good presentation material. CEO Bill Waltz shared his thoughts on future market development in the earnings call: ”No matter where you are in the electrical industry, this is going to be the best decade ever.”

I would suggest one company here that is already quite a global quality company, namely Harvia.

Rationale below

Quantitative criteria are met.

Qualitative criteria:

The earnings growth trend will likely be steadier in the future, nice growth with good profitability (ROIC >20% Inderes forecast). Industry demand is growing relatively steadily and geographical expansion enables the company to continue growing faster than the market in the future as well.

There are several moats and they support the company’s profitable growth. Significant moats include:

- In-house design and vertical integration, keeping the reins in their own hands

- Economies of scale in production (Harvia is the market leader, competitors are smaller)

- Strong brand (or nowadays several)

- Long-term distribution relationships

- Strong financial position (okay, maybe a result of the previous ones)

The business has traditionally been steadily growing; now a couple of larger acquisitions, the demand boom caused by Covid, and losses caused by the war (Russian market) shook the figures for recent years. Even in the midst of a crisis, the company has been able to maintain excellent profitability, which speaks to quality (quality is more evident during bad times).

Harvia has been operating for over 70 years and Inderes’ history dates back to 2007, since when Harvia has achieved excellent profitability every single year—it is a great track record.

Has anyone found Atkore’s insider holdings and/or other ownership structure? It seems to be a bit hard to find.

I took a quick look on my phone to see if there’s anything in these?

Insiders

https://finance.yahoo.com/quote/ATKR/insider-roster?p=ATKR

Largest holders

https://finance.yahoo.com/quote/ATKR/holders?p=ATKR

Those are of some help. Even that is missing the Chairman of the Board’s potential holdings, and it only lists 4 out of the 9 board members.

For many companies, those holdings are listed on the board introduction pages, so you don’t have to search high and low for them.

12.26% of the free float has been sold short https://www.marketbeat.com/stocks/NYSE/ATKR/short-interest/. I wonder if there is any kind of short report circulating from anyone?

US companies often don’t report insider holdings directly on their websites for some reason. Openinsider.com is probably the best site for examining these. From there, you can deduce that Chairman Schrock owns 17,000 shares. Of course, sometimes you actually have to open those Form 4 filings to reveal the true nature of the transaction and ownership—for example, that the CEO owns most of the shares, 127,000 units, indirectly through their foundation.

I haven’t seen any short reports; the number of shares sold short has been relatively high for several years now. Also, the peer company Encore Wire has 28% of its shares sold short, so I’ve thought that it is more of a mechanistic sector bet and/or partly fund hedging, since the sector has performed so well that the next phase might be slightly worse.

Certainly, regarding Atkore, the company’s profitability has been significantly higher in recent years than it has been historically, and some of that profitability is now fading in 2023-2024, as the company has signaled for a long time. That is why the company gave that +$18 EPS guidance for 2025 (P/E 7.3 at current market value) to communicate what the normalized earnings level is. The company’s EBITDA margin was previously around the 13% level for a long time, and management guides that it will be ~25% in the future. Management’s message has been that the company has structurally transformed into a much more profitable one within the last couple of years, but the market doesn’t necessarily fully believe this yet, which may partly explain the low valuation and the short selling.

O’Reilly Automotive ja Autozone

O’Reilly ja Autozone harjoittavat autojen osien, työkalujen, tarvikkeiden ja muiden varusteiden vähittäiskauppaa pääosin Yhdysvalloissa. O’Reilly laajentui vuonna 2019 Meksikoon ja Autozone on toiminut pidempään Meksikossa ja Brasiliassa, mutta ulkomaisten liiketoiminnot muodostavat vain pienen osan kummankin yrityksen arvosta nykypäivänä. On poikkeuksellista, että samalta alalta löytyy kaksi näin tasavahvaa ja erinomaista yritystä. Omaan mieleen tulee lähinnä Visa/Mastercard/Amex -trio ja Coca-Cola sekä Pepsi. Mikä siis tekee autojen osien vähittäiskaupasta niin houkuttelevan markkinan?

Noin 40-50% myynnistä on loppuasiakkaille, joiden auto ei käynnisty tai siinä on muu akuutti vika. Tällöin on ymmärrettävää, että asiakkaat eivät katso tuotteiden/palveluiden hintaa vaan painottavat nopeutta, jolla auto saadaan kuntoon. Tämä mahdollistaa alan parhaille yli 50% bruttomarginaalin. Myös mielikuvat oikeanlaisten tuotteiden saatavuudesta vaikutta asiakkaisiin merkittävästi. Nopeus ja saatavuus ovat myös valttia Pro-segmentin mekaniikoille, jotka haluavat saada asiakkaan auton sisään ja ulos mahdollisimman nopeasti. Erityisesti alan isot toimijat ovat hyvin positioituneita hyötymään tästä dynamiikasta, sillä heillä on laajimmat tuotekatalogit ja myymäläverkostot sekä parhaat lisäpalvelut (esim. ilmainen työkalun vuokra sekä moottoridiagnostiikkapalvelu ja lähettipalvelut). Tämän lisäksi noin 40% prosenttia myynnistä tulee ylläpitotuotteista (pakkasneste, pissapoika yms.). Ylläpitotuotteiden ja akuutteihin vikoihin keskittyvien tuotteiden osuus on siis 80-90% liikevaihdosta, mikä tekee alasta houkuttelevan sen defensiivisyyden vuoksi.

O’Reillyn ja Autozonen ydinmarkkinaan kuuluu vanhempia pääosin yli 7-vuotiaita autoja, joiden takuut ovat päättyneet. Tämä mahdollistaa fantastisen näkyvyyden tulevaisuuden markkinan koon ja koostumuksen muutoksiin sekä rajaa liian suurten/pienten investointien riskiä. Se mikä myytiin 7 vuotta sitten uutena, on relevanttia O’Reillylle ja Autozonelle tänään. O’Reillyn ja Autozonen kohdemarkkinat kasvat kohtuullisen tasaisesti ja ennustettavasti autokannan ja ajettujen kilometrien kasvaessa. Kun uusien autojen myynti sakkaa taantumassa, sen vaikutukset eivät heijastu O’Reillyn ja Autozoneen yhtä vahvasti koska ne, jotka eivät ostaneetkaan uutta autoa taantuman vuoksi joutuvat ajamaan yhä vanhemmilla autoilla, jotka vaativat yhä enemmän korjauksia ja ylläpitokustannuksia.

Kolmas loistavat ROICit mahdollistava tekijä on laaja tavarantoimittajien kenttä. O’Reilly ja Autozone voivat käyttää neuvotteluvoimaansa pienempiä toimittajia vastaan esim. vaatimalla pidempiä maksuaikoja tai alempia hintoja, sillä samanlaisia tuotteita valmistaa useampi yritys. Tämän lisäksi O’Reilly ja Autozone ovat jatkuvasti pyrkineet vähentämään riippuvuuttaan kalliimmista OEM-brändien tuotteista ja siirtämään myynnin painopistettä kohti omia private label -tuotteita. Autozone aloitti painopisteen siirron onnistuneesti jo vuonna 1986 Duralast-brändillään ja on nauttinut korkeammista marginaaleista pidempään kuin O’Reilly. Neuvotteluvoiman ja private label -tuotteiden seurauksena molempien yritysten käyttöpääomat ovat negatiivisia (toimittajat käytännössä rahoittavat yritysten toimintaa) ja marginaalit ovat alan huippua.

Numeropuoli on molemmilla yrityksillä näyttänyt hyvältä jo tovin (Data: Koyfin ja Stratosphere):

O’Reilly Automotive

- ROIC-% (5v keskiarvo): ~28%

- Liikevaihdon kasvu (10v): ~9% p.a.

- Liikevoiton kasvu (10v): ~10% p.a.

- Bruttomarginaali (5v range): 51-53%

- Liikevoittomarginaali (5v range): 19-22%

- Osakkeiden lukumäärä (2013 vs. 2023): -48%

- Myymälöiden lukumäärä (2013 vs. 2023): 3976→6111

- DIY vs. Pro liikevaihdon jakauma: 56%/44%

- Like-for-like myymälöiden liikevaihdon kasvu (2000-2022 range): 1-13% p.a.

L4L myynti kasvoi nopeasti koronan aikana (2020: 10,9% ja 2021: 13,3%), kun taas puolestaan hyytyi noin yhteen prosenttiin finanssikriisissä ja vuonna 2017. Oma arvaus L4L myynnin kasvusta normaalivuonna olisi ~4-5%.

- EPS kasvu (10v): ~21% p.a.

Autozone

- ROIC-% (5v keskiarvo): ~30%

- Liikevaihdon kasvu (10v): ~7% p.a.

- Liikevoiton kasvu (10v): ~7% p.a.

- Bruttomarginaali (5v range): 51-54%

- Liikevoittomarginaali (5v range): 19-21%

- Osakkeiden lukumäärä (2013 vs. 2023): -51%

- Myymälöiden lukumäärä (2013 vs. 2023): 5201→7140

- DIY vs. Pro liikevaihdon jakauma: ~75%/25%

- Like-for-like myymälöiden liikevaihdon kasvu Yhdysvalloissa (2000-2023 range): (2)-14% p.a.

Taas kerran nähdään, että korona on nopeuttanut kasvua (2020: 7,4% ja 2021: 13,6%). Autozonella kasvu on ollut huomattavasti tahmeampaa ja vuodet 2004-2008 mentiin nollakasvua. Pidemmän aikavälin normaalikasvu omasta mielestä noin 2-4%, koska Pro/Do-It-For-Me -markkinan kasvu on napsun nopeampaa (autojen monimutkaistuminen jne.) kuin DIY-markkinan, jossa Autozone on vahvempi.

- EPS kasvu (10v): ~17% p.a.

Mistä näinkin hyvät luvut johtuvat?

Luonnollisesti pelikenttä, jolla pelaat vaikuttaa paljon tekemiseesi mutta ovat Autozone ja O’Reilly myös omalla tekemiselläänkin ansainneet vahvat lukunsa. O’Reilly on erityisesti tunnettu pitkäjänteisestä tekemisestään ja yrityskulttuurista. O’Reilly on historiassaan palkannut johtoportaaseen lähes poikkeuksetta yrityksen sisältä. Kulttuuria ja strategian pysyvyyttä ovat tukeneet myös Larry ja David O’Reilly, jotka ovat toimineet eri rooleissa yrityksessä yli 50 vuotta. Autozone on puolestaan vaihtanut johtoaan useammin ja on palkannut talon ulkopuolelta usein. Toimitusjohtajana paikalla on kuitenkin istunut jo 18 vuotta Bill Rhodes, joka on vuodenvaihteessa siirtymässä täyspäiväisesti Autozonen hallitukseen. Uudeksi toimitusjohtajaksi on valittu talon sisältä Philip Daniele, joten ehkä naapurilta ollaan opittu jotain Autozonessa.

Erityisesti Autozonen EPS kasvua on ajanut yhtiön omien ostot, joilla se on saavuttanut legendaarisen kannibaalin statuksen. Yhtiö on viimeisen 25 vuoden aikana ostanut ja mitätöinyt lähes 90 prosenttia osakekannastaan. Nämä ostokset on tehty järkevillä kertoimilla (EV/EBIT 8-14) ja ovat luoneet pitkässä juoksussa huomattavasti arvoa. O’Reilly puolestaan keskittyi 2000-luvulla kasvuun yritysostojen kautta, joista suurin oli onnistunut CSK Auto -yrityskauppa, joka lähes tuplasi yrityksen koon. Myös O’Reilly on hakenut naapurista oppia ja saavutettuaan riittävän skaalan 2010-luvun alussa sekin on ostanut omia osakkeitaan jatkuvasti, joskin näiden ostojen kerroin on ollut vähemmän houkutteleva EV/EBIT 16.

Molemmat yhtiöt ovat viime vuosikymmeninä voittaneet markkinaosuutta laajalla myymäläverkostolla, tuotteiden saatavuudella ja lisäpalveluilla erityisesti alan pienemmiltä toimijoilta (joilla vielä noin 40% markkinasta), mutta myös viimeisen vuosikymmenen aikana Advance Auto Partsilta (josta lisää myöhemmin). Markkinaosuuksien voitto on mahdollistanut alaa nopeamman kasvun joka yhdistettynä järkevillä hinnoilla tehtyihin omien ostoihin, on tuottanut näyttävää EPS kasvua.

Pääosa tulevaisuuden kasvusta tullaan repimään myös samalla tavalla Yhdysvalloissa ja monet pienistä ketjuista ja ns. mom&pop shopeista on vaikeuksissa korkoympäristön kanssa. Konsolidoitava markkina tulee Yhdysvalloissa kuitenkin vastaan jollain aikataululla ja siksi molemmat yhtiöt katsovatkin etelään. Autozonen Meksikon liiketoiminta onkin kasvamassa vähitellen siihen kokoon, että se voi vähitellen alkaa antamaan tukea kasvuun. Molemmat yritykset ovat kuitenkin varsin kokemattomia Yhdysvaltojen ulkopuolella, joten kasvulla on riskinsä.

Uhkakuvia

Verkkokauppa ja Amazon

Akuuteissa tarpeissa verkkokauppa ei kykene vielä kilpailemaan O’Reillyn ja Autozonen laajan myymäläverkon kanssa, koska Autozonen/O’Reillyn lähetti ehtii ajamaan tarvittavat 10 mailia osien ja työkalujen kanssa nopeammin kuin verkkokaupan paketti ehtii ohelle. Tämän lisäksi myymälästä tuleva lähetti osaa neuvoa ja auttaa asiakasta osien asennuksessa toisin kuin UPS:n lähetti. Joidenkin tuotteiden lähettäminen paketissa on myös vaikeaa (esim. auton akut). Ylläpitotuotteissa kilpailu verkkokaupan kanssa voi olla verisempää, mutta kyllä ylläpitotuotteita ostettaessa myös arvostetaan palvelijan ammattitaitoa. Molemmilla yhtiöillä on omat verkkokaupat, mutta olisin skeptinen niiden kilpailukyvystä, jos verkkokauppa alkaisi ottamaan alalla merkittävää roolia.

Sähköautot

Sähköautojen kompleksisuus tulee siirtämään markkinaa DIY-puolelta kohti mekaanikkoja, koska yhä harvempi osaa huoltaa omaa autoaan. Tämä kehitys tulee kuitenkin vaikuttamaan alaan runsaan vuosikymmenen päästä, koska O’Reillyn ja Autozonen palvelema markkina koostuu pääosin yli 7-vuotiaista autoista. Pitää myös muistaa, että tällä hetkellä myytävistä autoista noin 8% on sähköautoja Yhdysvalloissa, joten pitkään saa odottaa ennen kuin sähköautot muodostavat merkittävän osan O’Reillyn ja Autozonen markkinasta. Ihmettelisin, jos yhtiöt eivät olisi valmiita sähköautojen lisääntymiseen heille relevanteilla markkinoilla vuosikymmenen päästä, koska kehityskulku on niin selkeä. Sähköautokentällä on toisaalta Teslan ja kiinalaisten muodossa uusia pelureita, jotka saattavat haluta tarjota myös omia huolto- ja varaosapalveluita toisin kuin perinteiset autonvalmistajat, mikä saattaa vaikuttaa markkinan kilpailudynamiikkaan.

Case: Advance Auto Parts

Advance Auto Parts on yksi alan kolmesta suuresta pelurista ja yhtiö oli vielä vuosina 2000-2013 Autozonen ja O’Reillyn kanssa samassa veneessä. Liikevoitto seitsenkertaistui vuodesta 2000 vuoteen 2013, ROE-% heilui erinomaisesti välillä 22-45% ja yritys osti vähän yli kolmanneksen omista osakkeistaan pois markkinoilta. Kannattavuus ei kuitenkaan koskaan noussut liikevoittomarginaalilla mitattuna yli 11%. Yhtiön johto näki, että sen piti laajentaa imperiumiaan noustakseen uudelle tasolle ja päätti vuonna 2013 ostaa General Parts Internationalin noin 2 miljardilla.

Yritysosto näytti aluksi onnistuneelta, mutta yrityksen marginaalit ja pääomantuotot alkoivat luhistua raskaan organisaatiorakenteen alla vuonna 2015, jolloin aktivistisijoittaja Starboard Value tuli yritykseen (Starboardin vuoden 2015 esitys). Yritys ei ole vieläkään selvinnyt täysin kriisistä ja liikevaihto on kasvanut vuodesta 2015 noin 10% liikevoiton laskiessa 25% ja ROE:n tippuessa 5-20% välille. Marginaalit ovat edelleen noin 6-8%. Viimeisimpänä käänteenä yhtiön osake on tippunut 60% viime vuodenvaihteen huipusta AAP:n laskiessa ohjeistustaan. Yritysarvo on samalla tasolla, kun ennen General Parts -yritysostoa.

Johtajavaihdokset ja yrityskulttuurin kestävyys

Vähittäiskaupan markkinat ovat yleisesti hyvin kilpailtuja, joten otteen herpaantuessa jälki voi olla rumaa. Uuden johdon ja yrityskulttuurin kyky luoda omistaja-arvoa pitkällä aikavälillä ei välttämättä ole yhtä hyvä kuin nykyisen johdon.

O’Reillylla ja Autozonella ei ole Westin tai Novon tasoisia regulaatiomuureja, mutta molemmat kuuluvat mielestäni tähän ketjuun. Mitä mieltä muut kyseistä firmoista, riittääkö laatu tähän ketjuun? En tiedä kuinka pitkiä avautumisia tänne ketjuun piti/sai laittaa, joten pahoittelen, jos ylitin jonkun rajan.

Jos kiinnostus yrityksiä kohtaan heräsi, niin suosittelen koluamaan läpi molempien firmojen IR-sivut, joilla on avattuna kohtuu selkeäsanaisesti yhtiön strategiat ja tulevaisuuden askeleet. Myös Business Breakdownsin podcastjakso on hyvä aloituspaikka yhtiöihin ensikertaa tutustuville (linkki).

(Disc: En omista kumpaakaan)

O’Reilly is definitely a quality company, as is likely AutoZone, though I barely know the latter as a company. My knowledge of O’Reilly is also quite superficial.

The primary reason I haven’t bought it is precisely electric vehicles and the electrification of transport. More specifically, the maintenance requirements for EVs are lower than for internal combustion engine (ICE) vehicles. Of course, they still need windshield washer fluid, brake service, etc., but less than ICE cars. Even brakes don’t need servicing as often due to regenerative braking, as the brakes experience less wear when the motor handles much of the deceleration. Tires, of course, wear out (perhaps even more so), while joints, bulbs, and other small components probably wear at roughly the same rate.

According to Anders Oldenburg’s blog posts at Seligson, the maintenance needs of EVs are about 15–25% lower than for ICE cars, but I personally find that estimate too conservative. Many new EVs have a service interval of 2 years with no mileage limit, or a regular service schedule isn’t even specified. Oldenburg’s blog (link below) uses examples like the Nissan Leaf and Hyundai Kona, where at least the older models have frequent service intervals. In newer and “better” EVs, the service intervals are even longer than in those older models.

Electrification of transport in the US is likely to be slower than the global average. Based on a gut feeling, it will be even slower in Mexico. According to Oldenburg’s excellent [blog post], in 20 years, “at worst,” 1/4 of the US car fleet could be EVs. Based on Oldenburg’s assumption of a 25% lower maintenance requirement, the market would be approximately 6–7% smaller than it would be without EVs.

The car fleet is unlikely to grow much faster than population and general economic growth, so I don’t see more than maybe 1% annual growth coming from that direction either. The aging of the car fleet certainly has an impact, but in the long run, I don’t really believe the average age of the fleet will rise much beyond the current ~12 years.

My own view is that the maintenance requirement for EVs is significantly lower than for ICE vehicles, and I would use 50% as a working figure. As EVs become more common and experience grows, “teething problems” will be resolved, which I believe will lead to lower maintenance costs as manufacturers gain more expertise.

Taking this into account, the total market may not grow at all and could even contract. High-quality operators will surely fare well and can take market share from smaller players with low pricing power. This concern over electrification is the primary reason why I haven’t jumped on the O’Reilly bandwagon yet.

Thanks again @Homeros for this pick. This is genuinely a very interesting case from an investor’s perspective, as the absolute valuation multiples are amazingly low. And there must be a reason for it, at least a reason to doubt the current earnings power. And as you mentioned in your other message, the reason must lie in those profitability levels.

If the company were to return to those previous profitability levels, the earnings would practically “collapse” and the P/E multiples would start to look quite reasonable (around 10-15x). But from an investor’s point of view, it looks very attractive that the market’s base scenario is that the company won’t reach those 25% levels. If the company reaches even roughly those levels, there is only upside pressure on the valuation in the coming years. At least competitors (Acuity Brands, Azz Inc, Belden Inc, etc.) are valued at clearly higher multiples across the board.

Do you have @Homeros any specific sources you use to follow the company (other than company reports, etc.)? What do you see as the biggest threats to the company if you approach it primarily through those competitive advantages? How reliable do you consider the company’s current revenue level and, for example, a 20% EBITDA margin level? Competitive advantages and their strength will ultimately be reflected numerically through these things. The firm at least has pricing power, as sales volume decreased -3.2% from 2021 → 2022 but revenue grew 33.7% (meaning gross margins only improved in that inflationary environment) ![]()

And if you’re up for it, Homeros, it would be interesting to discuss this more broadly and even slightly outside this thread in its own dedicated thread. You have a good understanding of the company, so start a thread if you find the time eventually ![]()