Novo has long deserved its own thread, but no one has had time to create a starter post.

In the Global Quality Companies thread, @JNivala wrote concisely about Novo

NOVO NORDISK

Novo is Denmark’s Nokia, but with the difference that Novo has better prerequisites to continue its excellent performance and thus avoid Nokia’s dismal fate. I’ll keep the message relatively short so everyone has the patience to read it.

Novo is a pharmaceutical company founded in 1923, specializing particularly in diabetes. As a doctor, this field is very close to my area of expertise. From a pharmaceutical company’s perspective, diabetes is very attractive, because even though the etiology of diabetes varies significantly, it can generally be said that it is primarily a lifestyle disease. And specifically, as people globally live “more abundant” lives, diabetes as a disease becomes more prevalent. Thus, the TAM (Total Addressable Market) is growing, and thanks to its long history and scale, Novo has clear competitive advantages specifically in the treatment portfolio for this disease. The pharmaceutical industry is a business with high barriers to entry, as it requires significant capital for product development and is also very heavily regulated in all market areas.

Novo’s focus has been quite purely on diabetes treatment, but now also on the treatment of obesity, which is on everyone’s lips. In fact, these topics are essentially related, as the effective “weight loss drugs” discussed today were primarily developed as diabetes medications. It is logical that a solution for weight management was found this way, because as I described at the beginning, the relationship between diabetes and overweight is close.

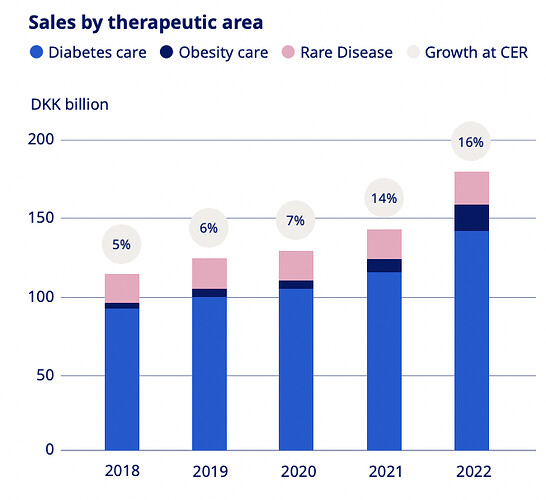

Novo’s sales distribution clearly illustrates where the money comes from:

This emphasis is clearly visible in Novo’s pipeline:

From this, it is clear that the strongest growth is now driven by obesity drugs, either for this indication or through “off-label” use.

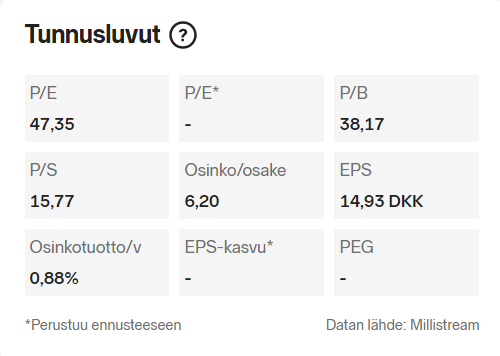

Novo meets all criteria for a top-quality company with its historical key figures:

- ROIC has varied greatly, but the > 15% criterion has been met effortlessly.

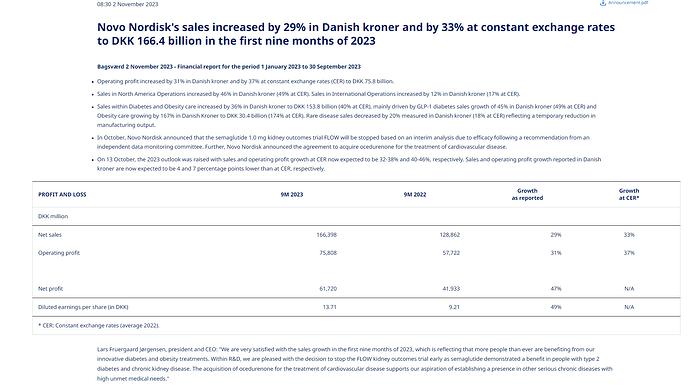

- Revenue growth from 2010 - H1/2023 is approximately 8.5% p.a.

- Net income growth from 2010 - H1/2023 is approximately 13% p.a.

- Net profit margin is > 30%

And we have every reason to believe that things will continue, briefly here are some points:

- High barriers to entry (regulation, capital requirements, requires specific expertise in drug development, etc.)

- TAM continues to grow for diabetes

- Medical treatment for obesity is only in its early stages in terms of sales volumes

The most significant threat is related to this medical treatment for obesity. As seen from the valuation multiples, the market is pricing in significant profitable growth through obesity treatments. And it is undeniably quite clear that in the coming years (e.g., 2024-2028), the company will almost certainly grow at pleasant rates in terms of both revenue and profit.

However, there is also a risk here. Although this thread is not intended to discuss valuation in more detail, it is good to understand that Novo’s market value relies heavily on the narrative of the triumph of obesity drugs. However, in the long run, there is a valid and significant threat that a clearly more effective medical treatment will be invented that displaces the current GLP1 analogues. This could, for example, be completely outside Novo’s area of expertise, or a competitor’s products could simply be better. This change in narrative would be devastating for valuation multiples, as mere excellence in diabetes treatment would not nearly justify current multiples.

Link directly to the message: Globaalit laatuyhtiöt - #43 käyttäjältä JNivala - Osakkeet - Inderes forum

The Global Quality Companies thread is worth following regarding Novo: Globaalit laatuyhtiöt - #43 käyttäjältä JNivala - Osakkeet - Inderes forum

And there has been previous discussion about Novo in the Pharmaceutical Industry thread: Lääketeollisuuden teknologisia huipputuotteita etsimässä: tasaista tylsää vai vuoristorataa? - Osakkeet - Inderes forum