One more thing to add regarding Evolution: I found this company through Swedish bloggers, it might have been Professor Kalkyl. His site has quite a collection of global growth companies, some of which are very close to quality company status (if they aren’t there already). Google Translate should handle it well, so I’ll share the Swedish link, and of course, he also has a Twitter account.

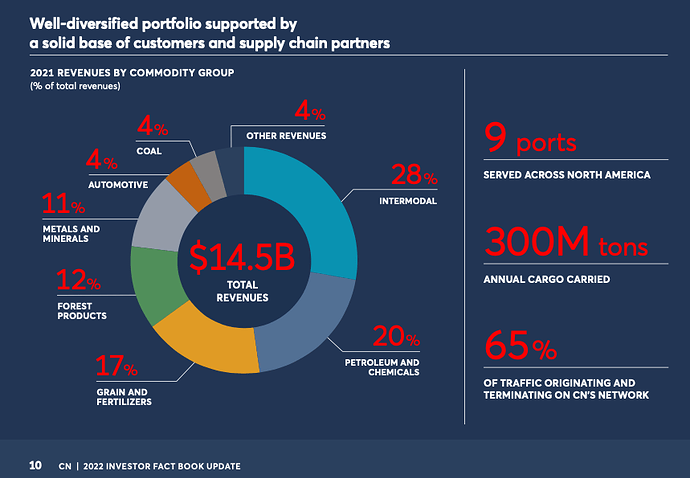

I too have considered the logistics business as low-margin bulk, with low barriers to entry and where it’s difficult to achieve sustainable competitive advantages.

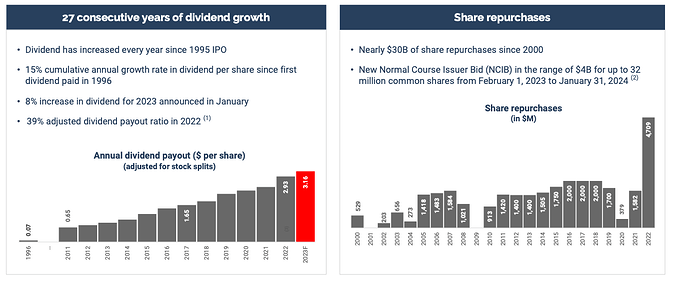

- The number of Canadian National Railway’s shares outstanding has decreased from 722.6 million at the end of 2019 to 688 million

- The dividend has increased every year since 2005

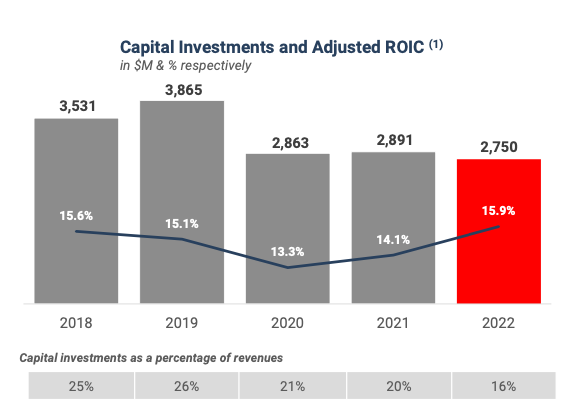

- Return on invested capital (ROIC) was 15.8% in 2022 (target 15-17%)

- Targeting 10-15% earnings growth for the years 2024-2026.

https://www.cn.ca/-/media/Files/Investors/Investor-Day/20230503-Shareholder-value-creation-EN.pdf?la=en&hash=50FC0AEC2C48F667EDD79ABF419440A668478C43 - investor presentation

https://sifterfund.com/wp-content/uploads/Sifter-Fund-Canadian-National-Railway-Investment-Case-Study-2018.pdf - Sifter’s old analysis from 2018. The financial figures are old, but you can still draw information about the business itself from it.

Railway company has pricing power – Case Canadian National - Sifter Fund - summary of the previous report

https://www.cn.ca/-/media/Files/Investors/Investor-Annual-Report/2022-CN-Annual-Report.pdf?la=en&hash=A3EE1D329D2D9104167E582B53215E6C9C4A7C8D - annual report

It seems those freely available ROIC figures differ slightly from the company’s own. It should be checked where the difference originates. Unfortunately, I cannot say, @JNivala, whether CNR benefits from Biden’s infrastructure package.

@Santeri_Korpinen, are you still sharing the company analyses you produce? It’s been a while since the last share. If you do, could an updated analysis of CNR be shared here?

On the other hand, I’ve been wondering if the content of the freight transported by CNR matters? Do we need to consider the demand outlook for different metals, oil, and other products, etc.? ![]()

edit:

I dug up historical growth figures (CAGR) for the last 5 and 10 years:

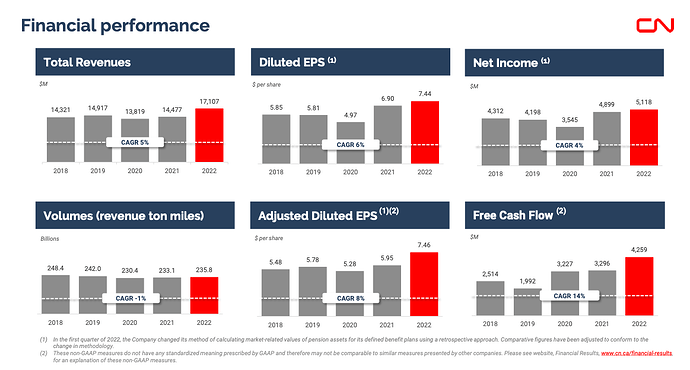

- Revenue growth 7.0% (10y) and 5.6% (5y)

- EBIT growth: 7.4% and 5.7%

- EBITDA growth 8.20% and 6.70%

- Free cash flow growth: 12.40% and 13.00%

- Dividend growth: 14.40% and 11.60%

- The business is quite capital-intensive, which also limits the emergence of competition. Secondly, it is no longer sensible to build a competing rail network on a large scale. CapEx has varied between 16-26% of revenue in recent years. Most of it is maintenance investment and the rest is growth investment.

A few highlights from the investor materials in image format:

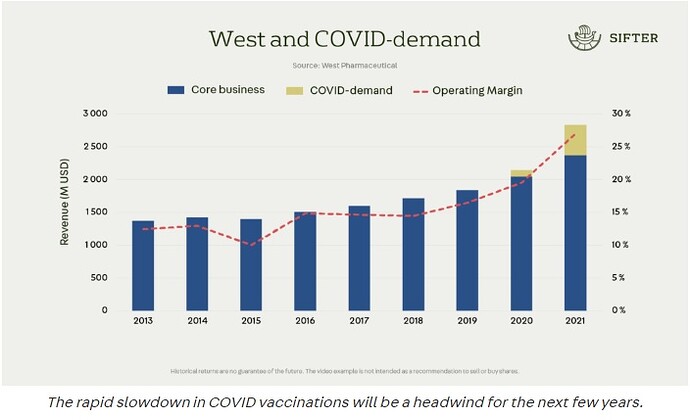

I have to comment a bit on this great info about West, as I’ve been following this pharma company (among others) for quite some time. It’s true that medicines always sell, but not quite steadily. In West’s case, it’s worth remembering at least the huge additional sales that came thanks to Covid. And the company did take quite a downturn from Christmas '21 to Christmas '22.

So if you think longer-term (and assume that a new corona isn’t coming anytime soon), it’s good to strip out that Covid effect from the figures when evaluating the company’s future.

At West, COVID-related sales have practically zeroed out, and this is reflected in this year’s growth figures. In fact, both 2022 and 2023 are close to zero growth. This is indeed due to COVID, the additional sales it generated, and the subsequent disappearance of those sales. The core business has been performing steadily once the disruption caused by COVID is stripped away.

West’s estimate for COVID-related sales this year is 60 million dollars, and the analyst forecast for this year’s revenue is 2.98 billion, meaning the share of COVID-related sales is only about two percent of revenue.

Regarding West Pharma, I would focus more on the biologics market, which has grown strongly in recent years, and this trend is unlikely to change in the coming years.

I personally managed to buy West at the end of last year around the 240 USD mark.

Philip Morris International (PMI)

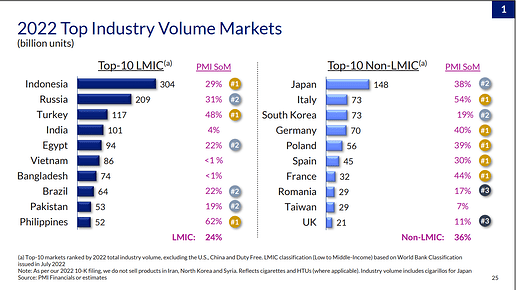

What is one of the most important skills of a quality company? The ability to reinvent itself if the need arises. Most people know PMI as a tobacco giant, but the company is moving at full speed away from tobacco toward a smoke-free future (or at least, that’s how ESG consultants believe they should communicate to Wall Street). Like other large nicotine giants, this is happening for Philip Morris through two avenues: smoking is declining organically, and significant investments are being made in tobacco-free/smoke-free nicotine products. According to Devin LaSarre’s materials, PMI’s tobacco sales volume has declined by approximately 4 percent per year from 2013-2023, so we are not talking about a trivial drop.

How then is PMI a quality company when its core business is melting away? This is a good question. Between 2016 and 2022, revenue grew at a CAGR of approximately 3%, and EPS accordingly at an annual rate of over 4%. This is by no means convincingly quality-company-like performance, even if the period was hit by a pandemic-sized headwind slowing the sales of a product that erodes the respiratory system. Still, it can be stated that few weak companies manage to achieve top- and bottom-line growth while the core market is slowly eroding. Compared to the previous year, PMI took market share from its competitors in both traditional tobacco and heated tobacco. Pricing power is indeed solid, as volume declines are offset without much thought by raising the price of an addictive product. If you’re thinking now that this must show in the margins, you’re right; it does. Gross margins of around 60-65 percent and EBIT margins of 35-40 percent are everyday business in this industry. I won’t even bother looking at the ROIC, just so I don’t feel bad about everything else in my portfolio instead of this.

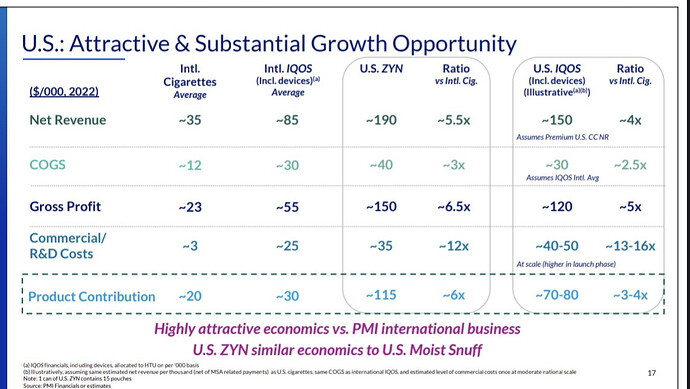

If price increases aren’t enough, there is also growth expected in the coming years. Many could argue that PMI has the two best nicotine products in its portfolio: IQOS (heated tobacco, yet a smoke-free product) and Zyn (nicotine pouches). Both products represent what PMI signals about the future: nicotine products without the health hazards brought by tobacco. Individually, both of these are already billion-dollar revenue businesses today, and growth is only just beginning. Both product categories are growing at a staggering pace in terms of both sales volume and revenue: growth in IQOS tobacco stick sales has been over 20 percent, and Zyn’s sales curves are in a total hockey-stick phase. Everyone has surely noticed at the store checkout that nicotine pouches are being asked for constantly, and Zyn is the gorilla in the US market with a market share of over 60 percent.

Growth will also be supported by the fact that PMI will be able to commercialize IQOS in the US starting next May, and given its success in the European markets, one would expect that to accelerate growth even further. Zyn is a true diamond with its nearly 50 percent EBIT margins, and it is being introduced to new markets more aggressively (I believe Finland is on the list for this year!). I still can’t claim to understand how the hell the takeover bid for its parent company, Swedish Match, ever went through. These two product categories already represent over 35 percent of PMI’s revenue—and best of all, their margins are suspected to be even better than those of traditional tobacco products. Below are the company’s own calculations, albeit mainly in a US context:

Tobac… nicotine companies have incredibly strong competitive advantages that are also easy to understand. Distribution networks are definitely worth mentioning: the growth of Zyn and IQOS is significantly eased by the fact that they already distribute their other products to every continent. People are, on average, very loyal to brands in addictive products (who the hell would have believed that either?), so there is pricing power. An additional advantage is a factor that will likely shake up other consumer goods companies: the marketing power of social media stars is unfairly strong and cost-effective compared to traditional marketing methods. Whether it’s Prime, Feastables, or about a thousand different cosmetic products, the ability of influencers representing these to market their products practically for free is frighteningly strong for any corporation. In contrast, this reach is much weaker for nicotine products, which are subject to legally mandated marketing bans.

On the other hand, politics in this industry is a double-edged sword: it protects against competition and new entrants, but legislation and taxation regularly throw a wrench in the works. Recently, we’ve seen news about, for example, nicotine pouch bans in the Netherlands, where the idea was likely conceived while taking a smoke break. You just have to live with this—Big Tobacco is an easy target, even if for once there might be a reason not to shoot first.

The company held a CMD this week, where they announced targets for the coming years. For the 2024-26 period, they are aiming for 6-8 percent growth in revenue and volumes, and 9-11 percent EPS growth. The volume growth target for smoke-free products is approx. 33% CAGR (Zyn) and approx. 15% CAGR (IQOS), so the company certainly has an admirably clear direction and vision for where future growth will come from. At the same time, the plan is to pay down debt to a more tolerable level, as the acquisition of Swedish Match last year was entirely debt-funded (purchase price over 15 BUSD). If the targets are met, the result will start to look much more like a quality company—especially considering how much of the tobacco market there is in the world to be disrupted with new products.

Valuation on this year’s forecasts is approx. 15x P/E, and quickly calculated, approx. 16x P/FCF. The valuation doesn’t look particularly cheap considering the somewhat slow growth, but if smoke-free products are significantly more profitable than traditional ones as the company forecasts, the multiples will start to melt quite effectively. I think it’s good to compare these multiples to traditional alcohol brands as well, which are sometimes traded at significantly higher multiples—smoking truly is a hated topic in investing too. PMI churns out free cash flow well, as capex has typically been in the range of 10-15 percent of cash flows and major acquisitions are likely behind them for now. Generous dividends are therefore likely to continue, as they have until now.

Quality company or not? In my opinion, definitely a quality company—especially if you focus on the longer history, every tobacco company likely earns that label. The company meets many quality criteria excellently and the competitive advantages are crystal clear to anyone willing to accept them, but somehow they need to be converted into factors that generate cash. CEO Jacek Olczak and his associates will have their work cut out for them to bring one of the best business models into the modern era.

(disc: not in portfolio)

Hi,

Great opening for the thread @JNivala, I’ll be following this thread as well and will try to contribute to the content in the future. A few points regarding content creation and the issues already raised in the thread;

-

The thread has already mentioned the exceptionally high demand growth for pharmaceutical companies during the COVID-19 period, which is partly reflected in weakening key figures as demand returns to normal levels or to a normal growth path from 2019 onwards, in areas where inventory accumulation cannot be utilized before the so-called expiration date passes.

-

Related to the previous point, both the COVID-19 period and the state of war in Europe also work in the opposite direction; they may have directly lowered the key figures of a good quality company so that they no longer pass quality criteria (quality criteria exist, of course, to identify companies that can perform despite changes in external factors).

-

In qualitative factors, that first point—looking into the future—and a reasoned presentation of why a previous earnings growth trend would continue for 5-10 years is excellent, and I hope to see more thoughts on this in the thread in the future. Looking at the past is always easier than trying to predict the future; on the other hand, tracking the actual results is the only thing that can be stated as fact.

-

Stagnators (“mörnijät”), Microsoft stagnated badly after the turn of the millennium; note, it wasn’t a flash in the pan at that point but continued to perform. I’m still a bit bitter that I didn’t realize I should have trusted it more, as it was one of my first investments, although towards the end of its stagnation phase. Because of this, I might interpret the current situation as a clear overvaluation. I believe growth will slow down and in the future, it will take a position again as a more boring investment, causing the market value to drop, but valuation multiples might be in good shape following a price drop.

Before looking further, I would put a card on the table that is familiar to Finnish investors from both the stock market and home: Olvi. Olvi has taken a bad hit recently, especially due to the uncertainty of its Belarusian operations.

Before the COVID-19 period, 3-year figures from the financial statements:

- Return on invested capital (ROIC) is around 20%: 2017 (19.7%), 2018 (21.2%), 2019 (20.8%)

- Revenue growth over 5%: 2017 (7.6%), 2018 (11.3%), 2019 (6.4%)

- Net profit growth around 10%: 2017 (10.5%), 2018 (10.7%), 2019 (10.3%)

- Net profit margin over 12%: 2017 (15.1%), 2018 (25%), 2019 (26.1%)

Olvi’s market value has become more reasonable due to the exceptionally strong realization of the Belarus risk. However, the company’s business development has been on a good track in recent years, and value creation for shareholders has been solid. The company has also tried to keep its debt in good order so that there is cash on hand. I believe that after overcoming the Belarus problem, Olvi will be able to continue with a high return on invested capital. Olvi has an existing distribution network and can make a good profit even though the prices of its own products are fully competitive. So, Olvi has a good moat based on cost-efficiency. It also works with global soft drink giants; the Belarusian part of Olvi has done this too. The business is not very cyclical.

I don’t currently have Olvi in my portfolio, but it’s on my watchlist and I’m considering buying even at these prices. The biggest fear is divestment of Belarusian operations at a low price and the remaining potential risk where Lidskoe Pivo underprices products in the market in the coming years, thereby taking remaining market share from Olvi as well.

- Is this fear unfounded?

- How do you see it: is it possible for Olvi to move into the so-called “quality stock basket” in the future?

A lot of my own reflection, which might have been unnecessary, but at least I managed to bring one Finnish company to the table. Even one that doesn’t fully meet the criteria from recent years, but in my view, the situation has been very exceptional. I hope this message brings some added value to the discussion. ![]()

This list surely includes many companies that fall under the name of this thread:

https://x.com/returnoncap/status/1708566383540240604?s=20

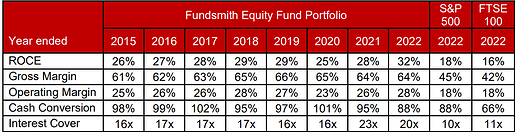

I recently read Terry Smith’s Investing for Growth, which is largely compiled from his Fundsmith fund’s investor letters and other writings. A strong recommendation for both the book and Fundsmith’s investor letters. The fund’s investment strategy is entirely based on holding global quality companies ![]()

It is indeed easy to argue for Philip Morris for the first time in a long while that the business is also growing on a volume basis due to the growth of smoke-free products. In my opinion, however, the risk in smoke-free products lies in the fact that brand durability has not yet been proven, although IQOS’s market position is gradually starting to be protected by the device base, as those HEETS can, as far as I know, only be used with an IQOS device. Significant market funding (regulation, ESG, etc.) would unlikely be found for a new tobacco company, but it could be found for competitors of ZYN, for example. In a market economy, doesn’t it generally go so that excess returns are eaten away by competition? Profitability levels for IQOS and ZYN are top-notch, but there is still a long way to go to reach a brand like Marlboro (the most popular cigarette brand for 50 years straight). The markets are not pricing in success of that scale either, but I think it is a valid point to raise in this thread, where competitive advantages are evaluated on a scale of decades.

Additionally, for those who are just now hearing about Philip Morris as an investment, the “International” part of the company’s name is because the license for Philip Morris’s traditional tobacco products in the USA is held by Altria (also in the list linked by Atte). Below are the market shares of the traditional side in the largest markets (before Swedish Match).

Fundsmith also owns Philip Morris and is very similar to Sifter in its investment criteria.

Fundsmith also publishes a so-called look-through table similar to Sifter’s, which describes the quality of their holdings:

Fundsmith differs from Sifter in that it focuses more clearly on only a few sectors (consumer staples, technology, medical devices, and luxury). Quality companies that come to my mind outside of those sector constraints include Moody’s and serial acquirers like Danaher. On the other hand, for example, this study by Michael Mauboussin (link) argues in favor of industry constraints.

Below is a tweet featuring all the companies Fundsmith has owned throughout its history.

https://twitter.com/long_equity/status/1589573858646163456/photo/1

I can write similar introductions for lesser-known names (e.g., IDEXX, Mettler-Toledo, Waters, Coloplast, and Amadeus) that have appeared in the thread once I find the time. For those interested in Fundsmith, I’ll also add Terry Smith’s speech from 2019 (https://www.youtube.com/watch?v=YZM9dhiDbzI). I base my own understanding of company quality very much on the same points discussed in the speech between 8:52-51:56.

Out of boredom, I opened that Mauboussin list; a short industry description, average returns on capital, and home country. There are some rather strange concentrations; in the author’s opinion, waste management and telecom networks are good moat businesses even if no money is made there (good news for Telia and L&T?). I’m also slightly amused by the complete absence of German-speaking companies while there are some airports on the list.

- Adobe; media software, ROIC 23.2%

- AENA SME, airports, ROIC 4.7%

- Air Products and Chemicals; industrial gases, ROIC 10.5%

- Alphabet, cloud services and online advertising, ROIC 25.1%

- Altria, tobacco products, ROIC 17.5%

- Amazon, e-commerce and services, ROIC 9.3%

- Amerco, van and trailer rental, ROIC 9.3%

- American Tower, telecom network REIT, ROE 34.3%

- Analog Devices, signal processing equipment, ROIC 7.9%

- AON, corporate insurance services, ROE 34.7%

- Arthur. J. Gallagher, reinsurance, ROE 12.9%

- ASML, semiconductor process technology, ROIC 23.1%

- Autodesk, CAD software, ROIC 18.8%

- AutoZone, auto parts, ROIC 45.3%

- Bausch + Lomb, contact lenses, ROIC 9.6%

- Black Knight, banking software, ROIC 6.0%

- Blackstone, asset management and real estate, ROE 27.1%

- Bolsa Mexicana de Valores, exchange services and related, ROIC 20.4%

- British American Tobacco, smokes, ROIC 6.2%

- Brown & Brown, property and casualty insurance, ROE 13.4%

- Cadence Design Systems, circuit board design, ROIC 23.4%

- Canadian Pacific Railway, rail freight, ROIC 12.7%

- CBRE Group, commercial real estate leasing, ROE 19.4%

- China Tower Corp, telecom networks, EBITm 15.4% (ROIC 3.5%)

- Christian Dior, luxury products, ROIC 11.4%

- Cooper Companies, contact lenses, ROIC 11.3%

- CME GROUP, derivatives exchange, ROIC 8.9%

- Copart, online car auctions, ROIC 25.6%

- CoStar, real estate information services, ROIC 6.0%

- Crown Castle, telecom network REIT, ROE 9.3%

- Danaher, diagnostics and biotechnology services, ROIC 7.3%

- DexCom, diabetes care, ROIC 5.3%

- Diageo, spirits, ROIC 12.6%,

- Douzune Bizon, financial software, ROIC 6.4%

- Essilorluxotica, eyewear, ROIC 3.6%

- Estee Lauder, skincare and makeup, ROIC 16.0%

- Evolution, online casinos, ROIC 23.8%

- Fair Isaac, software (credit scoring), ROIC 37.3%

- FirstService, property maintenance, ROIC 4.2%

- General Dynamics, defense industry, ROIC 15.1%

- Grupo Aeroportuario del Pacifico, airports, ROIC 13.6%

- Grupo Aeroportuario del Sureste, airports, ROIC 13.0%

- Hermes International, luxury consumer goods, ROIC 23.8%

- IDEXX, veterinary equipment and services, ROIC 50.1%

- Illumina, DNA and RNA sequencing, ROIC -20.9% (nothing but losses)

- Intercontinental Exchange, exchanges and related services, ROIC 7.3%

- Intuit, financial management software, ROIC 26.9%

- Intuitive Surgical, surgical automation and services, ROIC 15.1%

- Johnson & Johnson, pharmaceuticals, ROIC 15.5%

- Jumbo Interactive, gambling (lottery), ROIC 31.5%

- Kering, Gucci, ROIC 15.2%

- Linde, industrial gases, ROIC 7.0%

- Live Nation Entertainment, entertainment concerts, ROIC -6.9% (more losses)

- Lockheed Martin, aircraft and missile systems, ROIC 30.1%

- L’Oreal, hygiene products, ROIC 15.6%

- LVMH, luxury products, ROIC 15.2%

- Marsh & McLennan, insurance and management consulting, ROIC 14.2%

- Martin Marietta Materials, selling gravel, ROIC 7.8%

- Mettler-Toledo, scales, ROIC 35.5%

- Microsoft, apparently they make some software, ROIC 23.1%

- Moody’s, financial analysis, ROIC 20.0%

- MSCI, tinkering with some indices to the annoyance of investors, ROIC 17.9%

- Northrop Grumman, aircraft gadgets and satellites, ROIC 19.7%

- NVIDIA, graphics processing unit chipsets, ROIC 22.4%

- O’Reilly Automotive, auto parts, ROIC 33.5%

- Pernod Ricard, alcoholic beverages, ROIC 5.9%

- Philip Morris, tobacco products, ROIC 47.6%

- Pool Corporation, swimming pools, ROIC 29.4%

- PPG Industries, paints, ROIC 10.8%

- RTX, aircraft and missiles, ROIC 5.2%

- RELX, scientific publishing and analytical services, ROIC 19.6%

- Republic Service, waste management, ROIC 7.3%

- Rightmove, real estate brokerage, ROIC 213.8%

- S&P Global, market informatics, ROIC 41.7%,

- SBA Communications, data network REIT, ROIC 5.5%

- Sherwin-Williams, paints and coatings, ROIC 15.4%

- Sony Group, consumer electronics and entertainment, ROIC 14.3%

- Synopsys, circuit board design software, ROIC 11.8%

- Taiwan Semiconductor, circuit board manufacturing, ROIC 24.0%

- Tencent Holding, computer games, fintech and online advertising, ROIC 17.9%

- Tesla, electric cars, ROIC 24.7%

- Texas Instruments, microchips, ROIC 35.5%

- Thermo Fischer Scientific, laboratory equipment, ROIC 8.4%

- TransDigm Group, aircraft component manufacturing, ROIC 5.2% (but EBITm 40%, balance sheet is fat)

- Transurban Group, toll roads, ROIC 0.2%, EBITm approx. 10% (don’t know how this ended up on the list)

- Union Pacific railroad freight, ROIC 15.6%

- Universal Music Group, music production, ROIC 24.6%

- VeriSign, web domains, ROIC 214.8%,

- Veririsk Analytics, insurance analytics, ROIC 13.8%

- Visa, payment services, ROIC 25.6%

- Vulcan Materials, cement dammit… ROIC 6.6%

- Warner Music Group, music production, ROIC 10.6%

- Waste Connections, waste management, ROIC 4.9%

- Waste Management, waste management, ROIC 10.2%

- Zoetis, vaccine and drug development, ROIC 16.9%

That isn’t really a list of perfect businesses, but rather a list of companies whose shield is high barriers to entry. You don’t have to look any further than the Elisa vs. Telia battle on our local exchange to see this in practice. It’s hard to enter the industry, but of the giants, one is doing well while the other is struggling.

You can certainly tell from that list that critical (and especially physical) assets are highly valued, which is why there are plenty of tower companies and airports. The problem is finding companies that are able, on the one hand, to monetize their critical assets better and better, and on the other hand, don’t suffer too much from an increasing need for investment. The highest returns are eventually competed away, but certain companies with ultra-strong moats are somewhat immune even to that. From Mauboussin’s list, Copart and Waste Management immediately come to mind; they own land in good locations where the business operates (salvage yards, landfills) and which would be impossible for new competitors to replicate—suitable land simply isn’t available anymore in places where it would make sense to transport car wrecks to await final disposal. It’s easy to raise prices when there are no alternatives. In the same category are those gravel/crushed stone/material companies that, as I understand it, can operate as local monopolies—transporting gravel from one city to another costs so much that it’s rarely profitable to look for better quality further away.

From outside the list, RCI Hospitality Holdings comes to mind as a different kind of example. The restaurant industry is a daily struggle for life and death, but in the strip club industry, new competitors don’t get permission from decision-makers to enter the market. Who would want more titty bars in their neighborhood anyway? Hopefully, the assets aren’t critical to anyone, but if there is demand, RCI’s clubs can be in a near-permanent monopoly position in many cities. Personally, I consider that a business with a very strong competitive advantage, but I understand, of course, why it doesn’t appear on every list. ![]()

Of course, Telenor is also competing for Finnish telecom networks through DNA, which has at least captured market share from those two. For those outside the top three, the barrier to entry is certainly massive, but how much of a burden is mutual competition on returns on capital? Perhaps it would be better to think of the moat as being around the industry rather than the individual companies?

Every list of high-moat companies always reflects its creator, and that list by Mauboussin is not at all a bad selection of companies that are likely almost impossible for newcomers to challenge. Competitive advantages based on such unique physical assets do provide a quite strong foundation to build upon, but in addition to gravel pits and cell tower leasing, similar trump cards can also be found in power grids, seaports, ore deposits, and oil fields. However, it is difficult for me to perceive many companies operating in these sectors as quality companies, despite even very deep moats, in the sense they have been discussed in this thread.

Then again, a moat arising from regulation is the most pleasant thing for its holder to own; unfortunately, all kinds of politicians then cause trouble, and monopoly companies tend to decline into epitomes of inefficiency. On top of that, the markets jack up prices to the sky when they hear (or think) there are even slightly more permanent competitive advantages somewhere; try buying quality firms at a decent price then ![]()

It’s just worth noting with these that, for instance, Nordea charges a 25% withholding tax instead of 15% on Canadian dividend machines.

This is unfortunately true; investing in Canada through Nordea for dividend purposes will therefore be a disappointment in terms of taxation.

For the United States, 15% is currently withheld at Nordea.

Banks don’t seem to (at least not many of them) offer help with tax reclamation, meaning the process is left to the shareholder to perform themselves.

(On Nordnet’s side, it seems to be Canada (25%), USA (30%) → Edit: this only applies to those who are not tax residents in Finland.)

So, it’s worth checking the current situation with your broker beforehand to avoid disappointment when dividends are paid.

Removed a question from the message so the discussion doesn’t go off track. Also added a clarification to the Nordnet part that was provided in a comment. ![]()

No, they don’t; that part you quoted applies to those other than tax residents in Finland.

Nordea does take 25% of Canadian dividends, but it is an issue caused by the broker’s sub-custodian. At least previously, the same was true for OP, so this isn’t related to the tax treaty as such, but rather to the fact that information about nationality is not passed on to the sub-custodian. In practice, the solution to the problem is to choose a broker where the process works correctly.

Exactly, so from the US it’s normally a 15% withholding tax, but in that sense I’m still standing my ground regarding CNR, meaning Nordea takes 25% on it contrary to the tax treaty ![]()

Among wide moat companies, I have 7 in my own portfolio: Air Products and Chemicals, BAT, JNJ, Lockheed Martin, Mastercard, Raytheon, and Visa. Only Mastercard and Visa seem to meet the criteria for a quality company, but even they are not worth buying on that basis alone, as the current price sets an unnecessarily tight required rate of return for a purchase.

My own purchases were around 2014-15, so I am waiting for a reduction in some positions that would allow for the use of the deemed acquisition cost (hankintaolettama). On my watchlist are Estee Lauder and Ulta Beauty from the same sector; I like the latter’s brisk share buybacks.

Edit: additionally, I am following Texas Roadhouse and Domino’s Pizza for their interesting cash flow yield, but these are not global, just like Ulta Beauty isn’t.

Thanks @JNivala for starting this excellent thread. My colleagues told me about this, but I just haven’t had the time to reply here yet. It’s nice to see that Sifter’s website has been actively visited and the ideas utilized.

We can occasionally comment here when discussing companies in the Sifter portfolio, but I thought we could perhaps hold a Teams call toward the end of the year and go through your questions all at once. If this gets support, @Riku_Pennanen will organize a Teams call or a physical meeting for those interested.

Here is a list of “ROIC aristocrats” encountered on X https://x.com/long_equity/status/1712116216876196215?s=20

Hi @Santeri_Korpinen! This idea would be great, I’d certainly love to participate in this. I think many others here are interested in this idea too! I at least would have some questions about different companies that are also in your portfolio ![]() I’ll tag you guys here, but of course, answers can be given during that Teams call if you don’t have time to write here

I’ll tag you guys here, but of course, answers can be given during that Teams call if you don’t have time to write here ![]() Or even better if a face-to-face meeting is possible

Or even better if a face-to-face meeting is possible ![]()

A few short answers: Over the past 7 years, the element of profitable growth has become somewhat more emphasized in Sifter’s analyses of quality companies. Ultimately, a sustainable rise in share prices is only possible through profitable earnings growth, and in that, predictable revenue growth is even more important than margin expansion. For many quality companies, margins are already high enough that we often do not base the investment on margin improvements (Margin of Safety). Similarly, for revenue and earnings growth, we use forecasts 10-20% lower than the market consensus, depending on the case. So, all in all, one difference between quality companies and value companies is precisely that growth gradient for revenue and earnings.