To follow up on @IsoValas’s excellent summary, here are a couple more slides from the presentation.

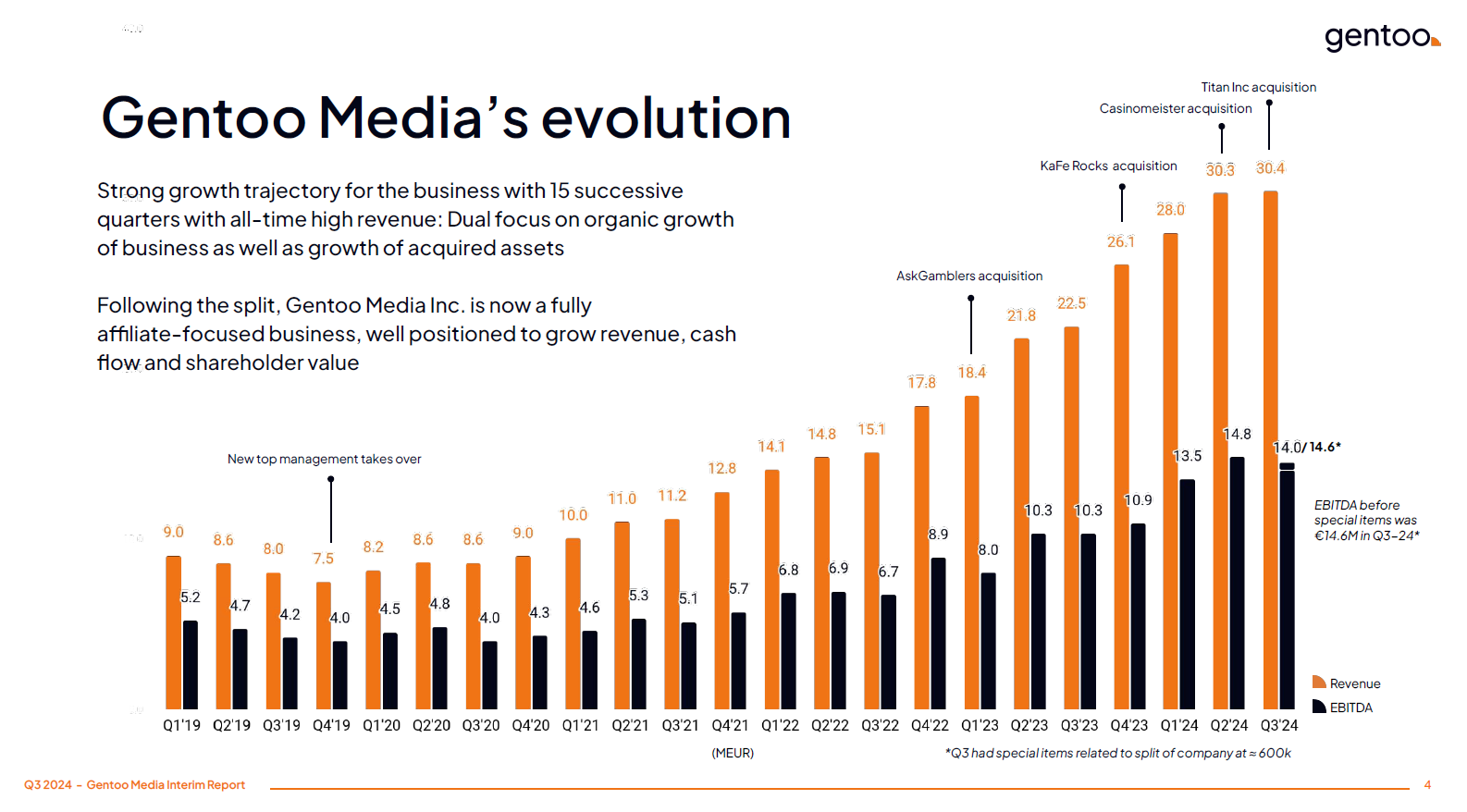

Revenue and EBITDA are ticking steadily upwards, driven by acquisitions. Regarding the Q3 results, it is also worth noting the seasonality: QoQ growth has been practically flat every year. According to the company’s expectations, Q4 is set to be strong again.

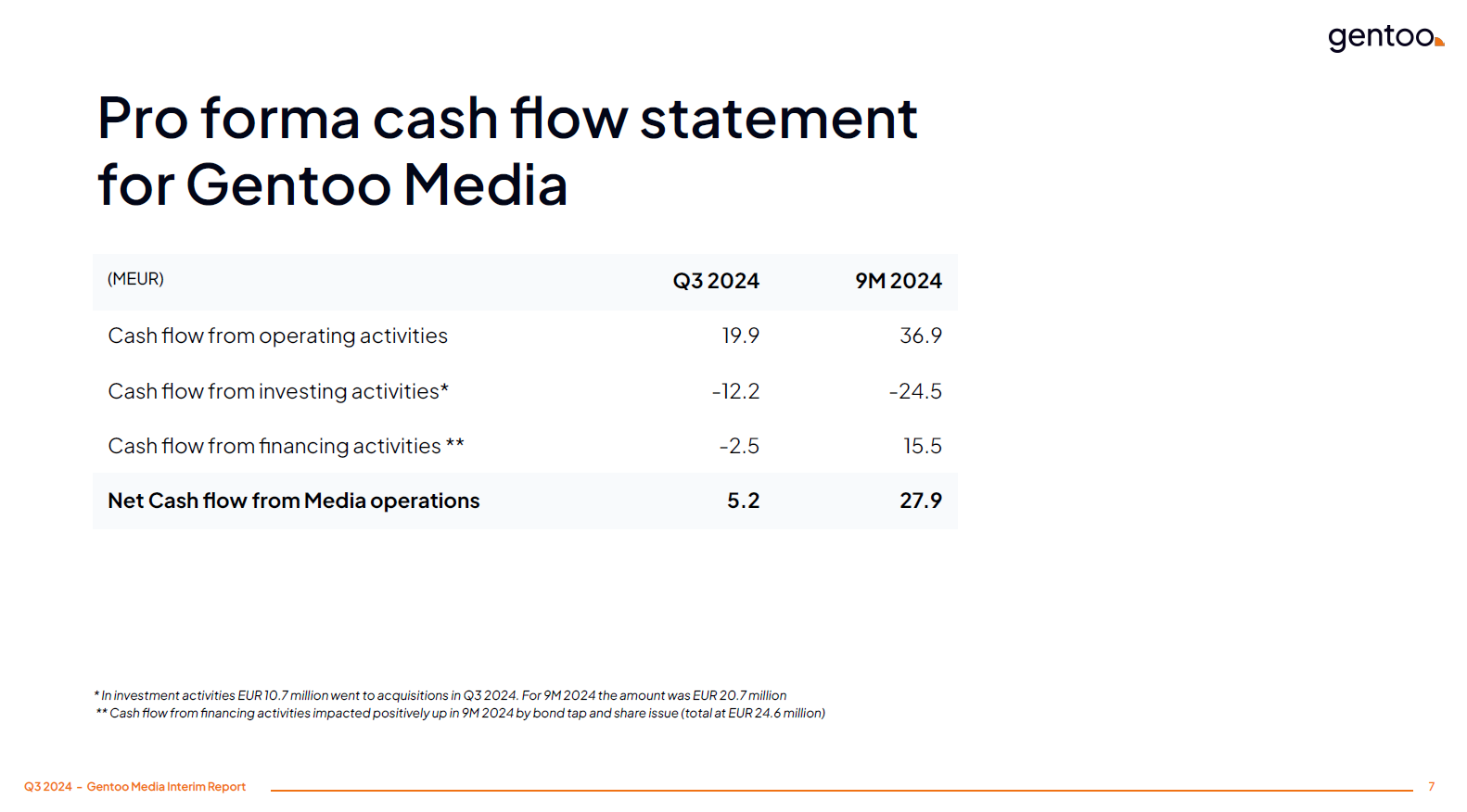

Cash flow looks great. The CEO mentioned in the webcast that if they generate 15 MEUR in EBITDA, he expects a cash flow of 10-11 MEUR from that (bond interest expenses already deducted). The company is finally able to use its generated cash flow freely now that there is no software side to finance. According to my back-of-the-envelope calculations, Gentoo’s FCF yield is now around 10%, which is quite reasonable for a company growing organically at a rate of about 15%. (note: the “investing” section in the image includes significant acquisitions)

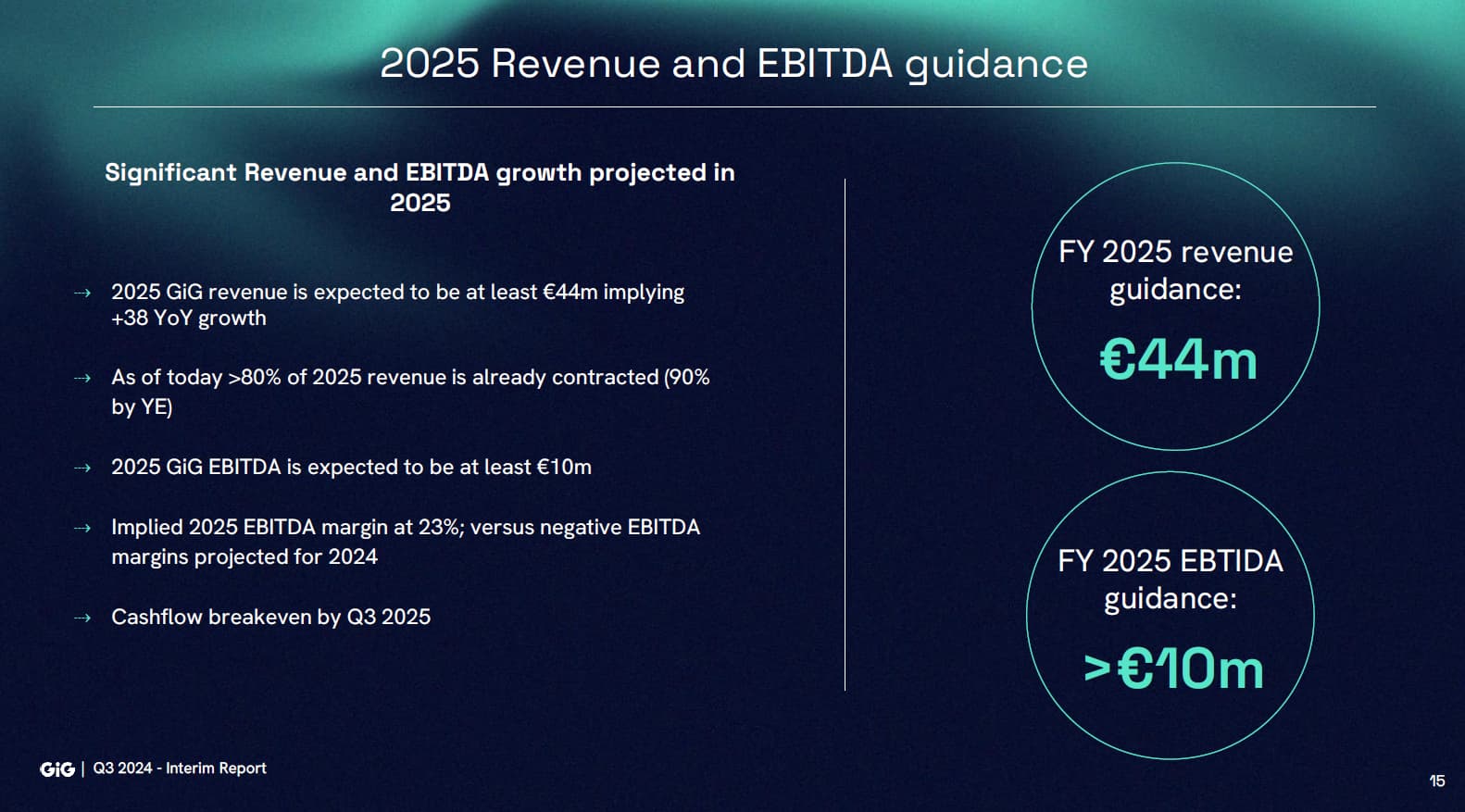

GIG Software has indeed been split into its own company. There are likely not enough enthusiastic owners here to warrant a separate thread for the software side, so below is a short snapshot of their reported Q3 results. Tldr: the business is progressing as expected, and for next year, revenue is still expected to exceed 44 MEUR with an EBITDA of 10M. 10 MEUR in cash, and cash flow breakeven is expected in Q3/25.