What does Raketech do?

Raketech is a Swedish company listed on First North, focusing on digital marketing and performance-based business, particularly in the gambling industry. Its core business involves driving traffic to its partners’ gambling sites and acquiring new customers for these sites. Raketech creates and manages gambling content in various forms, such as review sites, recommendation portals, and comparison sites. Its business model is based on Raketech receiving a commission when a user they have referred starts playing on the sites (e.g., opens a gaming account, makes a deposit, and starts playing).

Why is it an interesting investment?

Raketech is an interesting investment for several reasons. It operates in a highly profitable industry where digital marketing for gambling is continuously growing. The company has a strong position in its key markets and benefits from the ongoing global expansion of the gaming industry. Additionally, its revenue model, based on performance-based commissions, makes it a generator of relatively stable cash flow, as it can scale its business with relatively low additional costs. Raketech’s business generates strong cash flow and has the potential for significant growth in the future.

What are the risks?

There are significant risks associated with Raketech’s operations. The gambling industry is a strictly regulated sector, and legislative changes, such as licensing requirements and marketing restrictions, can weaken its earning potential in certain markets. Reputational and responsibility risks are also substantial, as ethical issues related to gambling and responsible gaming requirements may negatively impact industry players. Furthermore, competition is fierce, and new competitors could displace Raketech’s market position, which could reduce the company’s market share and thus its cash flow.

What is the risk/reward?

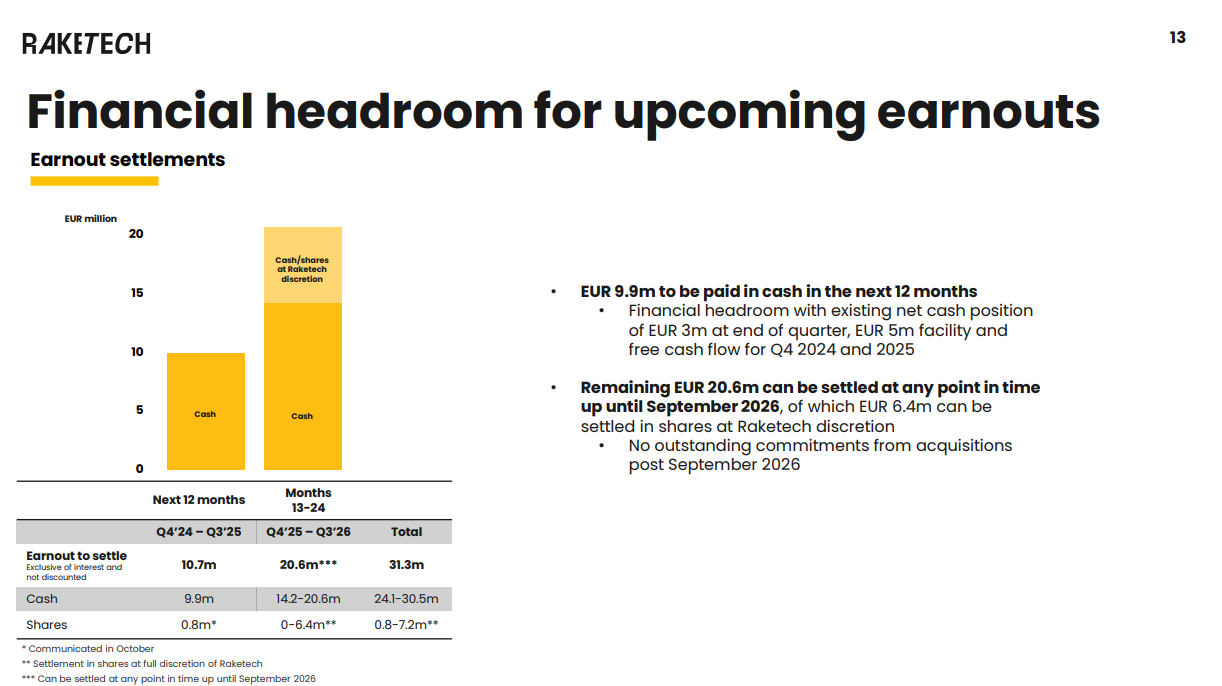

Raketech’s risk/reward ratio is attractive because a free cash flow (FCF) of approximately EUR 18 million is forecast for this year before earnout payments. At the same time, Raketech’s EV (Enterprise Value) is approximately EUR 60.6 million, making the EV/FCF approximately 3.34. Redeye’s bear, base, and bull cases are 11, 32, and 66 SEK, while the share price is currently around 7.3 SEK. Raketech therefore has the potential for strong growth and stable cash flow, making it an interesting investment. However, the nature of the regulated industry and potential legislative changes bring significant risks that could weaken the company’s ability to generate results. It is necessary to assess how much weight is given to the growth potential relative to risks such as tightening regulation and increasing competition.

Why is the share price low?

Mainly because Raketech acquired Casumba Media in 2019, an acquisition in which earnout payments played a significant role. Initially after the purchase, Casumba performed like a dream, which caused the earnout payments to rise very high (approximately EUR 34 million of the amount still remains). However, once the earnouts were locked in, problems began in Casumba’s business. Recently, its growth and profitability have been much weaker than before.