I recently researched the popularity of the stocks I own among Nordnet users. Fairfax had only 312 shareholders. That’s incredibly low for a service with over 630,000 Finnish users alone and millions across all Nordic countries. At the same time, Berkshire has nearly 20,000 owners and Investor over 60,000. To improve the company’s recognition, I decided to write a discussion opener about the company on the forum. I believe the company deserves its own thread.

Fairfax Financial Holdings (FFH)

Fairfax Financial Holdings (FFH) is a Canadian insurance and investment company. The company’s headquarters are located in Toronto. Fairfax operates through several subsidiaries. Prem Watsa leads Fairfax. The company’s website can be found here: https://www.fairfax.ca/

Originally, the company was founded as Markel Service of Canada in 1951. The name was changed in the 70s to Markel Financial Holding Ltd. In 1985, Prem Watsa, who serves as the company’s CEO and Chairman, took the helm. In 1987, Watsa reorganized the company and renamed it Fairfax Financial Holdings Ltd. Watsa owns approximately 9% of the company’s shares. Fairfax’s current market capitalization is ~55 billion CAD.

FFH’s Business Model

Fairfax combines insurance and investment operations. The company invests the capital (‘float’) accumulated from the insurance premiums it collects. This business model allows the company to have both stable cash flows and to capitalize on market investment opportunities.

Fairfax aims to achieve a 15% growth in book value per share over the long term, which it has historically achieved. The company’s toolkit includes share buybacks, which it has used quite aggressively. The company distributes a small dividend, currently around one percent.

FFH’s Goals and Culture

- Our objective is to achieve a 15% annual increase in book value per share over the long term by managing Fairfax and its subsidiaries for the long-term benefit of customers, employees, shareholders, and communities – at the expense of short-term profits if necessary.

- We focus on long-term growth in book value per share, not quarterly earnings. We grow both organically and inorganically.

- We ensure that our financing is always on a sound footing.

- We keep our shareholders well informed.

The company’s stated values include:

- Honesty and integrity are essential in all our relationships and are never compromised.

- We adhere to the Golden Rule: treat others as we would like to be treated ourselves.

- We work hard, but not at the expense of our families. (

)

) - We are always looking for opportunities, but we emphasize risk management and seek ways to minimize capital loss.

- We believe in having fun – at work! (

)

)

Other aspects related to the company’s culture can be found here: https://www.fairfax.ca/about-fairfax/#values

FFH as a Driver of Shareholder Value

Since its inception, Fairfax’s book value per share has grown by over 18% annually. The S&P500 index has yielded approximately 9% annually during the same period. However, Fairfax’s journey has not been smooth sailing. Far from it. The journey includes bumpy periods in addition to success.

Between 1985 and 1998, the company’s book value per share grew at an annual rate of up to 43%. Watsa was lauded as the “Canadian Warren Buffett,” and the stock was valued at nearly 4x book value in 1998.

The first difficult period for the company came at the turn of the millennium. Fairfax acquired two insurance companies whose balance sheets were in poor shape. Fairfax had to raise new capital in the following years, even fighting for survival. Another period of weaker performance came after the financial crisis. Watsa and Fairfax’s investment team took a pessimistic view of the market and hedged away potential returns for several years, as the market developed against their view.

Since 1986, the stock’s book value, underwriting profit, investment income, and share price have developed as follows:

Last 15 Years

After the financial crisis, from 2010-2017, the company experienced the weaker phase mentioned above. After that, the company corrected its mistakes. In the 2020s, Fairfax’s results have developed excellently, which has also been reflected in the share price.

Operating profit, last 10 years:

- 2016 - 2020 ~1 billion CAD,

- 2021 ~1.8 billion CAD,

- 2022 ~3.3 billion CAD,

- 2023 ~4.4 billion CAD,

- 2024 ~5.3 billion CAD.

Why has the company performed so well now? The short answer is that both the company’s insurance and investment operations have been of very high quality during this period. Lessons have been learned from past mistakes.

Fairfax expert on the forum, @Hades, has already elaborated on this in the Investment Companies thread. I will quote his excellent points below:

https://keskustelut.inderes.fi/t/sijoitusyhtiot-salkun-ytimena/34448/163

Fairfax’s sources of income and brief comparisons to 10 years ago:

1. Underwriting profit - efficiency has significantly increased (CR ~93%) and scale has more than doubled over the decade through both acquisitions and organic growth.

2. Interest and dividends - zero interest rates curbed returns from the 2010s until 2023. Fairfax managed this situation well and multiplied its interest income from debt securities in a couple of years.

3. Results from associates - Fairfax’s investment portfolio is significantly better in quality than 10 years ago, and this has become a relevant segment for the firm.

4. Operating profit from non-insurance sector companies - this segment is practically still under construction, but this revenue stream will also grow strongly.

5. Investment returns - growth has been seen, but these are also by far the most volatile and therefore the weakest source of return. The hedge positions held in the 2010s and shorting of the bull market were also discontinued, which removed a nine-figure drag from operating profit annually since the aftermath of the pandemic.

Returns have grown across a broad front, but very safe and high-quality interest income, income from good associates and subsidiaries, and a growing and improving insurance business have replaced the previous reliance on successful investments and their returns, which are harder to predict and replicate. In addition, diversification away from the insurance cycle will smooth out fluctuations when the market turns sooner or later. Of course, profitability may weaken and interest rates may fluctuate, but Fairfax’s operating profit is of significantly better quality than before.

Then there’s also:

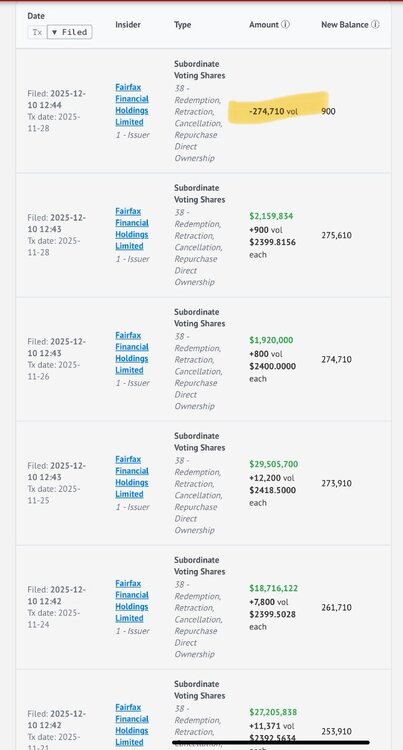

6. Number of shares - almost stable compared to ten years ago, but has decreased very significantly in the shorter term (for example, over 20% since 2017). Share issues financed the growth of the insurance segment, e.g., the acquisition of Allied World - now shares are being bought back again.

7. Valuation level - Fairfax’s valuation bottomed out at approximately P/B 0.5 during the COVID dip, from which it has now risen to around P/B 1.5.

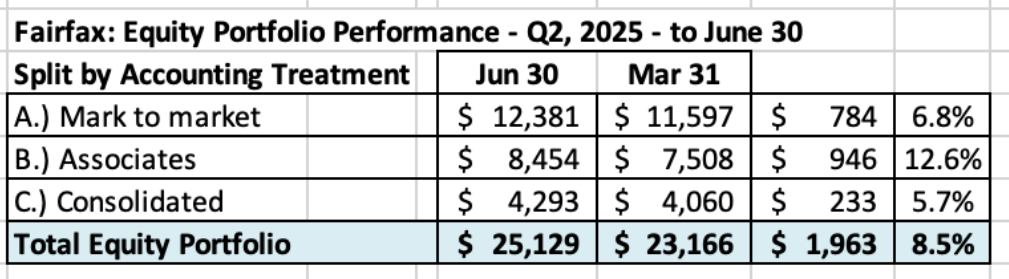

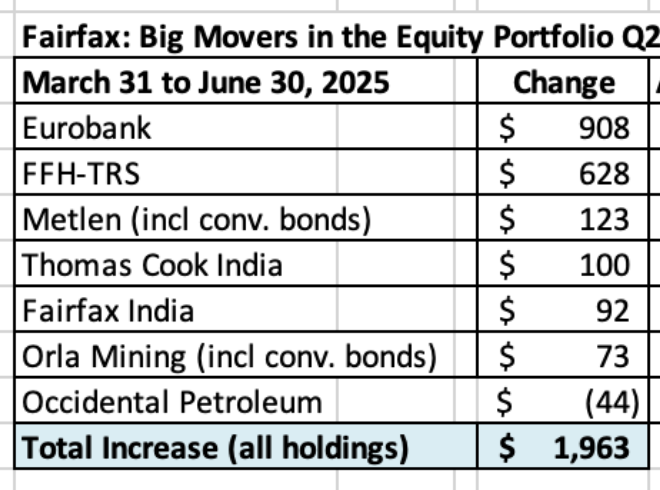

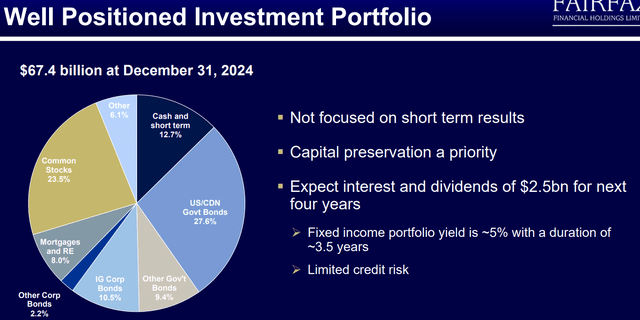

FFH’s Investment Portfolio

- most of the capital in bonds, a smaller part in stocks

- interest and dividends expected to be approximately 2.5 billion USD (or 3.4 billion CAD) annually for the next ~4 years

- focuses on capital preservation

- focuses on long-term growth, not short-term profits

- the composition of the equity portfolio can be found in the annual report, p.16 - > https://www.fairfax.ca/wp-content/uploads/2025/03/FFH_Fairfax-Financials-Shareholders-Letter-2024-with-attachments.pdf

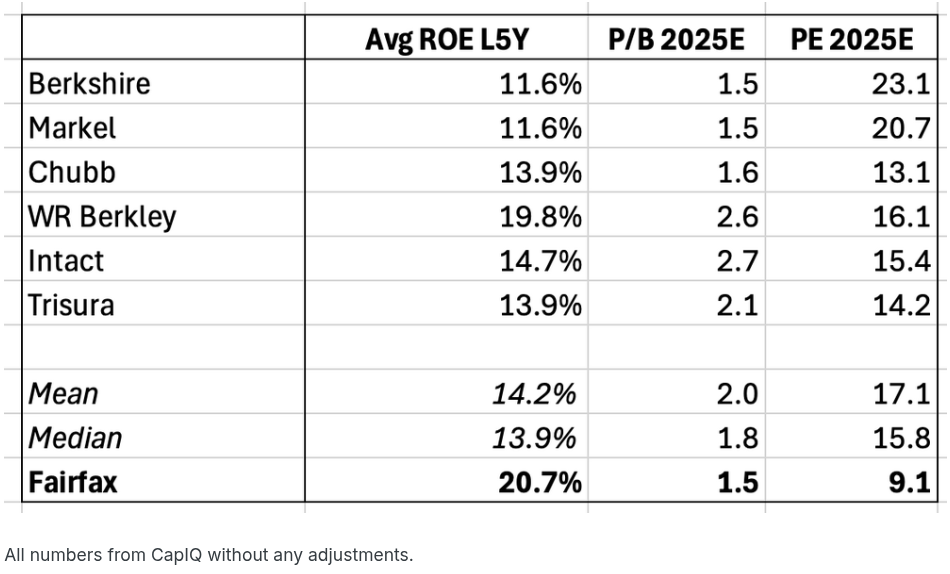

About Valuation

It must be said that the stock’s valuation is no longer “junk” level, having risen to its current P/B 1.5 (2025e) and P/E 10.5 (2025e). The company is predicted to generate a return on equity of +15% for the third consecutive year. So, the valuation is no longer as cheap as it was a while ago. But the stock still doesn’t look particularly expensive when you can buy it at ~10x earnings.#### Top-10 Largest Owners (February 2025)

number of shares / percentage of all shares

Why Own FFH?

A few reasons (why I personally own the stock):

- Business Model: Fairfax’s business is based on combining insurance operations and investment activities. Both Berkshire and Fairfax have shown how good a combination this can be at its best.

- Long-term Track Record: FFH’s value creation is unparalleled over approximately 40 years (although returns have not been consistent).

- Performance: The insurance business and capital allocation have been refined to excellent condition, which has created enormous value for shareholders in the 2020s.

- Growth Potential: Fairfax is still a relatively small ‘large-cap’ company on a global scale, with room to grow.

- Boring is Good: FFH is a suitable investment for long-term ownership, where the power of compounding can do the work (and the investor only needs to wait patiently).

More Discussion on Fairfax (in addition to this thread)

https://thecobf.com/forum/5-fairfax-financial/

Now, let’s discuss. ![]()