What a pleasant surprise. The changes in key personnel caused some uncertainty for me, but fortunately, it was for nothing. It’s also good that no dividend is being paid; now it’s time to strengthen the balance sheet and execute the strategy. The core concept of this company is solid. The most pleasant surprise of the earnings season so far.

In my opinion, Olli has actually been quite well on top of things. Predicting exact numbers is naturally difficult, but after watching all the content/interviews Olli produced during the winter, the insight/content has been correct. Sometimes the numbers just surprise you one way or another. The stock price decline has mostly been due to uncertainty regarding management turnover, and the same uncertainty naturally applies to the analysis, which is why it was probably difficult to take a stronger stance as the share price fell.

Usually, when management changes as completely as this, the figures don’t tend to surprise on the upside, but this is certainly a good position for the new management to build from. You can post questions here for Kari’s final interview or go ask them yourself in the webcast starting at 11:00! Boreo, Webcast, Q4'25 - Inderes

@Olli_Vilppo, could you ask what is behind Kahri taking responsibility for Technical Trade and what Karlsson’s role will be going forward?

Edit: Kari actually just clarified this in the webcast – responsibility is now being shared more, and Kahri will share the Technical Trade segment together with Karlsson.

That operational EBIT was indeed at a surprisingly strong level, especially considering that SSN’s result was exceptionally robust in the comparison period. Furthermore, knowing that the metal industry and other industries are just starting to gain growth momentum while construction is still at rock bottom, the potential for earnings growth is significant this year. On top of this, the major restructuring of Delfiini has been completed, and we can expect the profit level there to improve towards the end of the year, creating a quite favorable outlook for this year. All of this translates to the bottom line with good leverage, given the strong debt leverage.

Financing costs were also more moderate than Olli’s expectations, which resulted in a significant beat in earnings per share.

Here’s Kari’s interview!

I asked AI a bit about what kind of reception Fronius’s Velocity has received:

The user reception of the Fronius Velocity Assistant (Velo), introduced in late 2025, has been highly positive, with early reports from testers and industry experts highlighting it as a significant innovation in manual MIG/MAG welding. It is described as a “game changer” that bridges the gap between manual welding and automation, particularly for long seams and consistent, high-quality results.

Pronius has a good video at the link:

https://www.linkedin.com/company/pronius-oy/posts/?feedView=all

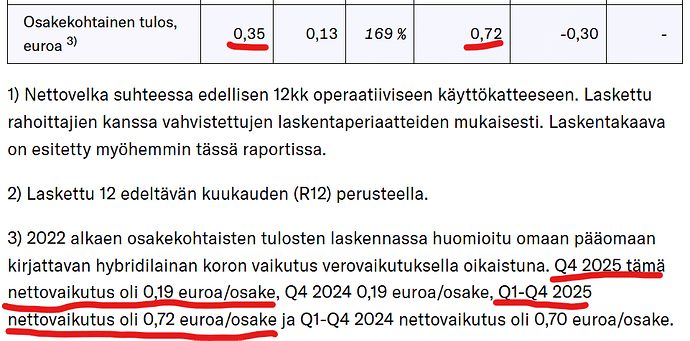

A question regarding that hybrid: Above is a picture from the financial statements. Am I understanding correctly that the interest on the hybrid is eating up a massive amount of the earnings per share at the moment? If we imagine a situation where the hybrid didn’t exist and the earnings level was the same as now, would the total earnings per share for 2025 be twice as large (i.e., the net effect of the hybrid interest would be added to the realized earnings per share)?

Can an analyst or a forum member answer this?

AI or Artificial Intelligence assessment:

If this hybrid loan were converted (refinanced) at a typical bank loan interest rate:

-

Annual interest expense for the hybrid: €20m x 10.75% = €2.15m

-

-

If the bank loan interest rate were, e.g., 5%: The financing cost would be approx. €1.0m, resulting in savings of approx. €1.15 million per year.

-

The EPS impact of that €1.15m is (1.15/2.7m shares) approximately 42 cents per share.

-

and my own comment: there are opportunities here to lower financing costs as the general interest rate level has fallen: Boreo has the chance to either obtain a new hybrid at a lower interest rate or increase the share of bank loans in the loan portfolio (by renegotiating covenant terms). In other words, the drop in interest rates works in favor of the Boreo investor now, as the company has returned to a growth path after the challenges of 2023-2024. So, falling interest rates will certainly benefit investors in one way or another when the hybrid is renewed.

-

I hadn’t noticed this myself either. 2025 result 3.9 and 2.7 million shares = EPS €1.44. Apparently, the adjustment for the impact of hybrid bond interest on the reported EPS is made after this, resulting in the reported 0.72. Good this way; I had thought that hybrid interest was ‘profit distribution’, i.e., separate from these key figures.

Or are there other interpretations?

Updated Boreo report here: Boreo Q4'25: Tuloskasvu valuu vivulla alariville - Inderes

As summarized in the headline, if Boreo continues on the same earnings growth trajectory, the improvement in operating profit will flow through nicely to the bottom line.

The interest on hybrids and convertible bonds (approx. EUR 2 million after taxes per year) has indeed been deducted from the company’s reported EPS, but one-off items, which are adjusted in operative EBIT, have not been deducted from it. Our adjusted EPS forecasts take the hybrids into account but also adjust for one-off items.

Thanks for the report!

I would certainly find it strange if development followed the estimates closely and the share price on February 16, 2027, was only €19. By then, the previous year’s EPS would have been nearly €1.5, and we’d be well into a financial year where EPS would be approaching €2.2, meaning the current year’s P/E ratio would be around nine. At the same time, earnings growth would still be projected for the following year as the market continues to recover. Of course, they are just forecasts, albeit quite realistic ones.

Let’s hope that this turnaround that began in 2025 lasts and even accelerates! ![]()

This is correct, because if those forecasts are met, uncertainty regarding performance will fade, and at some point, the market will also start considering acquisition potential as leverage decreases.

From the perspective of the DCF calculation (EUR 19.3), the long-term profitability levels—which we currently have at 6%—have a significant impact on the company’s value. We haven’t started raising this yet based on just one excellent report. In principle, our target price cannot exceed the DCF (unless we start pricing in future acquisitions, which was done some time ago with Boreo).

Inderes’s modeling/forecasting, based on its two current core assumptions, leads to an undervaluation of Boreo’s share price development in the medium term:

- In the latest Inderes analysis from yesterday, the headline reads: “Our valuation is based on current holdings”

- It is clear that a serial acquirer does not operate solely with its current holdings and structures; instead, holdings increase over time, and structural arrangements are possible/likely.

- In the latest Inderes analysis: “Boreo is valued at a clear 40-50% discount compared to the peer group of serial acquirers, which we consider partially justified given the weaker returns on capital in recent years.”

- This assumption is based on the past: the different general economic situations between Sweden and Finland. Sweden avoided/absorbed the effects of the war in Ukraine much more mildly. In itself, Boreo’s/Preato’s serial acquisition capability is quite comparable to Swedish peers, as shown by Boreo’s 2020-2022 performance, or the 2022-2025 performance of Consivo, a serial acquirer owned by Preato in Sweden.

In itself, Inderes’s undervaluation of Boreo is not that harmful to a Boreo investor (one can buy the stock at a discount), but it is certainly harmful to Boreo as a company (financing opportunities are more difficult through prolonged undervaluation).

That said, Inderes’s latest comprehensive report on Boreo is well-written and a high-quality piece of work for those looking for basic information on the serial acquirer model. This is where Inderes’s strengths lie, as well as in the video interviews. The video interviews provide added value for everyone.

For the reason stated above, it is very good that RedEye is also currently analyzing Boreo.

Hi!

It’s great that you’re such a fan of the company, and I remember reading your glowing comments about it as far back as four years ago, so your enthusiasm hasn’t waned despite the drop in the share price!

What I don’t understand is your criticism that the analysis is harmful to the company’s financing opportunities. Especially since we maintain a positive outlook. A good analysis also takes risks into account. We are actually very confident in this case at the moment and find the risk-reward ratio very attractive!

The reason why acquisitions aren’t factored into the valuation is explained in the analysis; it’s because leverage is still high, and as Kari mentioned in the interview, the focus is on current holdings and paying down debt!

The historical track record for return on capital has also suffered from bad luck (e.g., the divestment of YE’s Russian operations), but that is why the report highlights that the valuation could return to peer levels if the return on capital also rises to their level.

Regarding Boreo’s report. What a great quarter. And not just one good quarter, but the whole year 2025 can well be called a turnaround year for Boreo.

The thoughts raised by Justus are quite relevant and worth discussing. Karhu_hylkeen’s reflection as well. The relationship between Inderes’ target price and the forecasts for coming years has been discussed on the forum before. Sometimes the target price can be a bit modest compared to the forecast. This has been justified by the fact that there is significant risk associated with the forecast materializing, which weighs down the target price. However, it is understandable that some might find this confusing or puzzling.

Some analysis houses (Nordea, Redeye, SEB, ABG, etc.) use a valuation range instead of a single TP (target price). Then there is probably more agreement that the future valuation could fall somewhere within that range. Perhaps this discussion happens less frequently then. We go with whatever system is in use. All probably have their pros and cons.

Is the intention perhaps to include inorganic growth as part of the valuation if leverage decreases? As far as I know, acquisitions are not forecasted for other serial acquirers like Relais and Aallon either. I’ve understood that it is Inderes’ more general policy.

For a serial acquirer, inorganic growth is obviously a significant part of value creation. But when you know that this is not fully considered in Inderes’ valuation, you can take it into account fairly well and read the analysis “correctly.”

Of course, it leads to a lower estimate if (specifically value-creating) serial acquisition is missing from the calculation. For example, the (somewhat high) valuation of several Swedish serial acquirers would not be easy to justify without an inorganic growth component in the company’s valuation.

I think it’s good to also present a critical view of Inderes’ stock evaluation and its foundations.

-

As I mentioned above, I do not agree with your two central views/assumptions regarding Boreo at the moment.

-

Personally, I also use sources other than Inderes. Its financial data comes from S&P Global Market Intelligence, which allows for comparable analysis. It includes 72,000 listed companies, and the five main pillars of its analysis are below:

-

Value: Assesses whether the stock is undervalued relative to its current price. The analysis primarily uses discounted cash flow (DCF) calculations as well as comparative multiples, such as P/E and P/S ratios.

-

Future Growth: Based on analyst forecasts for the company’s revenue and earnings growth over the next 1–3 years.

-

Past Performance: Examines the company’s earnings development, margins, and return on equity (ROE) over the past five years.

-

Financial Health: Analyzes the company’s balance sheet, particularly indebtedness and the ability to meet short- and long-term obligations.

-

Dividend: Evaluates the dividend amount, its continuity, and sustainability (payout ratio) relative to earnings and cash flow.

The results of that analysis can be found, for example, on Yahoo Finance’s pages and are accessible to everyone. They show completely different target prices. I won’t post them here since advertising is apparently forbidden, but anyone can find them with a little searching. - I can send it to you, Olli, for your information via private message on this site. The same DCF model is used there, but with different assumptions than Inderes. It’s worth checking out too!

And of course, a low share value limits the company’s financing opportunities, as an undervalued stock cannot/should not be used to finance acquisitions.

This is a good question! So far, the reasoning has mainly focused on why they aren’t considered in the valuation, but the point at which one starts to front-run future acquisitions is difficult to define precisely. At the very least, it requires a strong track record, trust in the company’s capital allocation skills, and the capital to be allocated.

I remember that in the summer of 2021, Joonas’s target price was above the value given by the DCF model precisely based on this thesis—that future acquisitions create value—and this sparked a lively discussion at the time.

In the comprehensive report, this question was considered as follows:

“Despite the clarity of the factors affecting valuation, determining a precise and static multiple range is challenging for an acquisition-driven value creator like Boreo, as an overly narrow approach would lead to viewing the company from too short a perspective and solely based on the earnings power of its current operations. In the medium and long term, Boreo will very likely have more businesses under its umbrella than it does now, so a valuation based on a strict multiple range and only the current businesses would, in our view, also be irrational over time. We believe the value of the current businesses reflects the lower end of Boreo’s justified value well, while any value above this reflects the value creation from future transactions already priced in by the market. In our opinion, the pricing of value creation from future corporate transactions should be weighed against the company’s current M&A capacity and historical evidence of value creation. Currently, this capacity is limited due to high leverage.”

Hi

Of course, your analysis is also welcome on the forum. And well-reasoned analyses, comments, and questions always help everyone understand the case better.

Boreo (Q4 interview): Redeye speaks with CEO Kari Nerg