I was supposed to open a calmly written thread for Taseko Mines during June when I had time to write more about the company. However, yesterday came a really interesting piece of news that might unlock a lot of value for the company, while the stock is almost on the verge of a breakout. Therefore, a text I wrote a year ago, which I quote shamelessly, will serve as a primer for the case.

Company Introduction

Taseko Mines is a Canadian copper miner with the producing Gibraltar open-pit mine, the Florence Copper project in the early stages of construction, and several growth projects awaiting their turn.

1/4 of Taseko’s enterprise value is debt, 900 mcap, 1300 EV, so there is also a nice leverage here as the company pays off its debt and the stock gains the value held by the debt. The debt burden seems heavy and off-putting for the company, but a change is coming.

Florence Copper

Florence Copper is an ambitious growth project that, if successful, will turn Taseko into a cash cow.

Instead of an underground or open-pit mine, Florence will use in-situ technology for copper extraction. In practice, this means that wells are drilled into the ore, into which a solvent is sprayed, bringing the copper to the surface more economically. Most uranium is mined with this technology, but for copper, the technology is more experimental, as I’ve found only a few mentions of its use at the scale Taseko is attempting.

The production costs mentioned in Florence’s technical report, 1.1 USD per pound, versus Gibraltar’s already industry-low production costs of 2.5 USD per pound, put things into perspective.

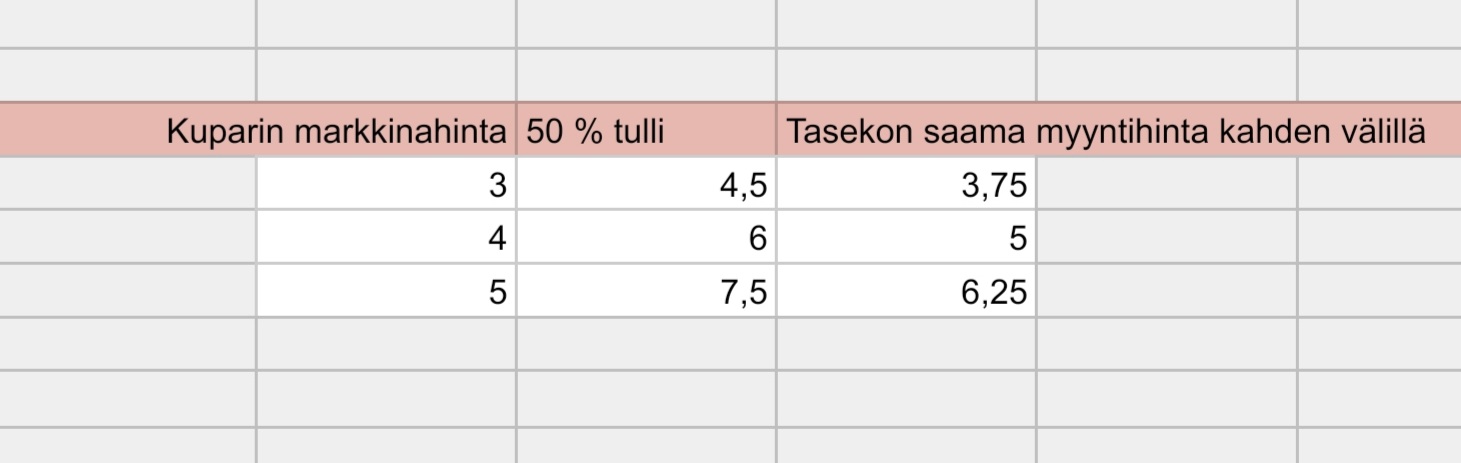

When estimating the company’s cash flow generation capability at different copper prices, I arrived at this estimate:

In the model, I have used Gibraltar’s C1 production costs of 2.5 USD for -26, Florence’s at 1.6 USD, financing costs of 60 million, and a somewhat inflated 60 million capex.

Present Moment

There’s only about half a year left until Florence’s startup. If Florence operates, the company, by my estimate, trades at these prices below P/FCF 3. That is an absurdly low price for one of the industry’s lowest-cost companies. The market clearly doubts the functionality of in-situ mining and the company’s high debt burden, whose ability to be managed depends on Florence’s operation.

In the previous quarter, the risk level also rose as the company lowered its guidance due to the declining ore quality at their only mine, Gibraltar. The company guides that quality should improve again from Q3 onwards, but this is the mining industry, surprises are possible.

However, the company released a very interesting piece of news yesterday, which will provide the company with liquidity and immediately improve its fundamentals.

New Prosperity Rises from the Dead

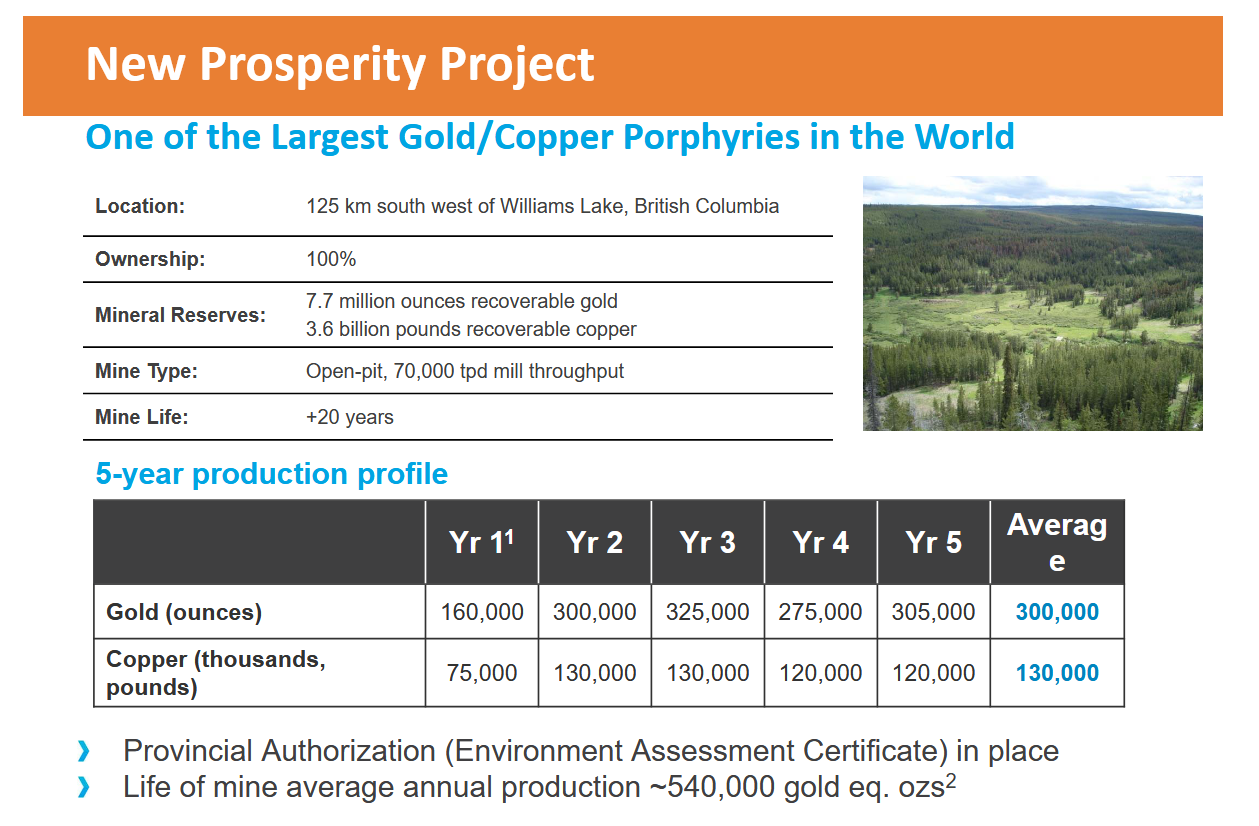

Taseko has fought for years with local Indigenous people over the construction of the New Prosperity copper-gold mine. At one point, Prosperity was supposed to be Taseko’s next mine, but as disputes continued, the company threw in the towel and began building Florence.

Here is an old 43-101 report from 2007 on New Prosperity. https://minedocs.com/20/Prosperity_102007.pdf

Due to inflation, the cost figures cannot really be trusted, but it gives a good idea of the scale of the mine in question.

Now, back to the agreement released on Friday;

-The Province pays Taseko 75 million in compensation.

-Mine ownership is divided, with Taseko owning approximately 3/4 and the Indigenous people - Tsilhqotʼin - holding 1/4.

-In the future, mining operations can only be developed with the consent of the Tsilhqotʼin.

-Taseko cannot be the mine operator.

What does this practically mean?

Taseko can only extract value from the mine by selling its share. This possibility is indeed referred to in the text; “can divest some or all of its interest at any time, including to other mining companies that could advance a project with the consent of the Tŝilhqot’in Nation.”

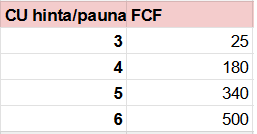

Okay, what is the value of this marketable mine? I approached the modeling with the idea that;

-all costs have doubled since the 2007 43-101 report

-production is crippled to 200 ounces in terms of gold because the Indigenous people prevent mining in some areas.

-for copper, to 80 pounds. Same reason as above.

-the mine has a lifespan of only 20 years

I discounted the cash flows by 10% to the present.

I got a present value of 1000 million for the gold portion and -250 million for the copper portion, meaning a net of 750 million.

A very simple and indicative calculation. No one will pay anywhere near that much for that share, because the Indigenous people have a veto in all decisions. However, 100-200 million seems like a quite realistic idea.

How will all this be reflected in Taseko’s stock in the short term?

The stock rose by about 18% on Friday, as a result of which the market value increased by about 150 million, half of which would be from compensation and half from the pricing of Prosperity’s value. From a pure SOTP (Sum-of-the-Parts) valuation perspective, one could speculate that the news has not yet been fully priced in. However, in my opinion, the picture is more nuanced.

The stock is now at a new ten-year high. The question is whether a decline back to where the stock has consolidated for the past year is ahead? I don’t think so.

Justifications

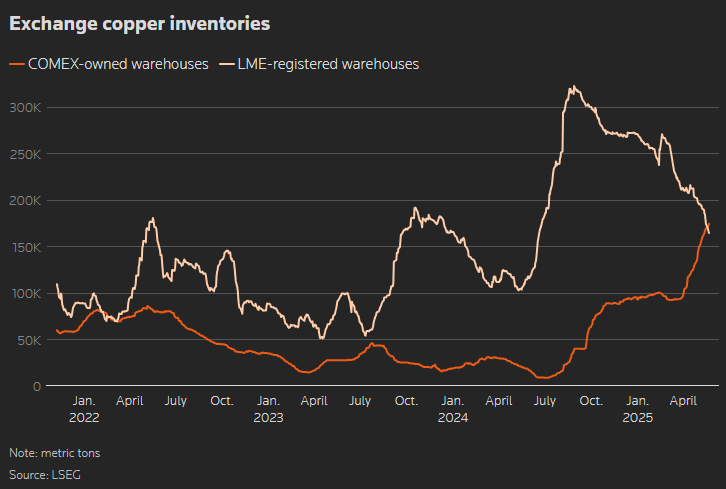

-Copper company stocks have been a good barometer of the global economy. For example, Ero Copper’s stock has practically gone hand in hand with recession fears in recent years, and it left its lows behind long ago, while the global economy seems to be continuing at a good pace despite the trade war.

-Taseko’s stock also began to recover surprisingly well after a poor quarter. Even after previous quarters, the stock has risen as if market participants were afraid of missing the boat, only to sell the next day because they fear the large debt burden. This could be a sign that the market is ready to price in Florence.

However, I believe the Prosperity agreement has the greatest symbolic significance. The company now has more liquidity and an asset for sale on its balance sheet. This immediately lowers the stock’s risk level. Therefore, I see many reasons why the stock should push through its current peak - a situation that is explosive, especially when the stock’s value is much higher.

End game

Florence’s successful startup will serve as a guiding light for Taseko. The company would then be able to build its next mines solely with cash flow, thus being one of the biggest beneficiaries of the upcoming rise in copper prices, creating immense value in a sector known for destroying it.