Scout Gaming Group operates in Europe’s growing DFS (Daily fantasy sport) market. Scout offers DFS solutions to gaming and betting companies, as well as B2C through its own website fanteam.com. The product is similar to Liigapörssi (Finnish fantasy sports game) or what Draftkings offers in the USA, with the difference that Scout seems to be one of the few that also offers a B2B solution.

With Scout’s solution, client companies can offer their customers DFS services through Scout’s platform, which connect to the same “pool,” allowing all customers to benefit from increased prize money.

The market in Europe and America is currently inverted: in America, DFS has long been permitted and very large, and now casino and gambling games are growing from the grassroots level, whereas in Europe, casino and gambling games have been large, but DFS is growing rapidly.

The popularity of FPL (Fantasy Premier League) or simply the domestic Liigapörssi (Finnish fantasy sports game) well illustrates the market potential; in neither is money used, but rather it’s done for fun and sport.

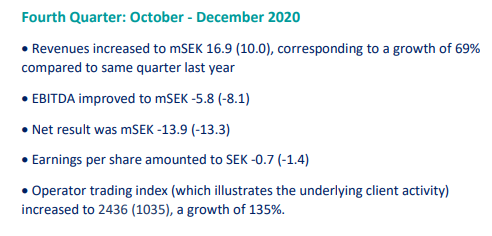

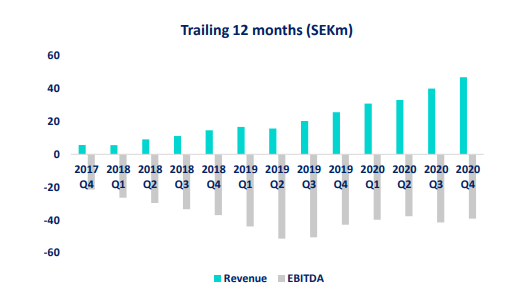

Growth has been rapid, and new major clients have been announced at a good pace, last week Sweden’s largest gambling company ATG. Today’s published Q4 report.

The valuation is not cheap by traditional metrics, but growth is strong, and it is not slowing down simply due to already agreed-upon clients, and the market potential is large. Let’s see what the market’s response to today’s earnings report will be.

“The start of the year has been strong and we are expecting continuous heavy growth!”

“Scout Gaming continues to meet strong demand at the same time as we have so far only touched the long-term potential. We have updated our internal assessment of the potential size of the European fantasy sports market and currently estimate it to amount to between SEK 5.5-7.0 billion at Gross Gaming Revenue level, which means approximately 2-3% of the entire total online gaming market in Europe. It is an attractive market and we do everything we can to consolidate and expand our position to competitors.”

“During the quarter, we launched a number of customers, including Parimatch, which also launched odds-based products from Scout Gaming. However, we are not yet live with real money gambling on Norsk Tipping. Launch with real money is expected to take place as soon as the Norwegian Ministry of Culture has given final approval. During the first quarter, we are expected to launch a beta with Betsson in selected markets. Global rollout is expected to continue during the year and in the coming years. After the end of the quarter, we also entered into an agreement with the largest Swedish gaming operator ATG. Launch is expected later this year. We have also continued dialogues with several major potential customers.”

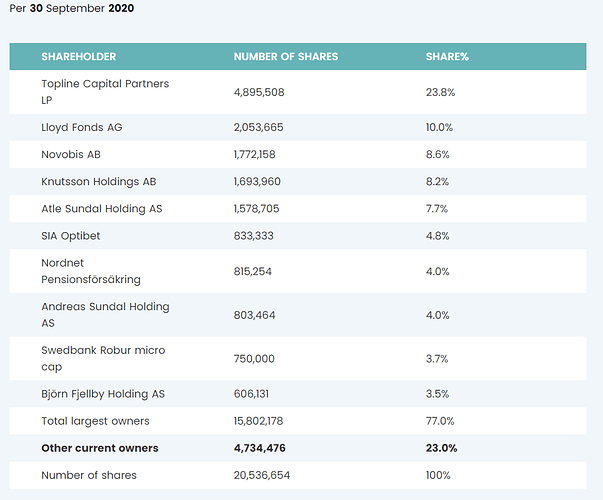

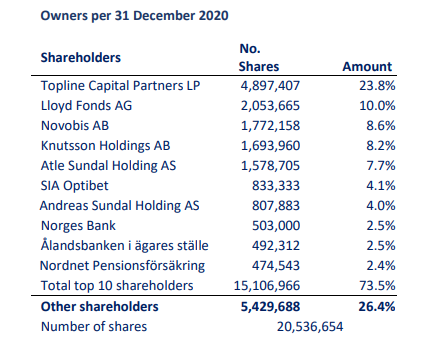

Finally, an analysis of the company by the main owner, Topline Capital Partners LP (23.8%), which estimates the price to be approximately SEK 1000 by 2027.

https://www.docdroid.net/r1i4tpY/scout-gaming-scout-ss-writeup226527-1-pdf