Yeah but these attractive assets should attract more than one buyer and then there will be an auction. In this one article I read from one analyst that if the sales are eg. 15% lower then book this would be decent deal for SBB. Who knows, depends on the asset I think.

Could very well be true. DI also reported that there are interest but they are in no hurry to act. They are playing a waiting game.

The real question what happens after some assets are sold? And to what price? If that price is way below reported in the book could eventually wipe out some SBBs own equity.

Also, some assets SBB has bought thru the years have been guaranteed by SBB to specific price since they got paid in SBB shares. I think one seller of assets to SBB has a guaranteed share price of 31 sek, if/when they are allowed so sell shares they got as payment for their assets.

All in all SBB is such a mess ![]()

I would not say a total mess - they did what was working widely - printing money and building empire - they and we all were caught off guard with the raising interest rates. Of course one could have maybe hedged more of these but easy to say now. Nobody expected this kind of instability and volatility in markets.

ps. currently I really enjoy short sellers losing money and panicking - they add nothing to this world. Smart brains wasted. I do own very small investment in this one.

Alright, and now Ilija is leaving the CEO position. Last day is next Monday, June 5th.

“My faith in SBB is intact and I remain a member of the Board of Directors,” Batljan said.

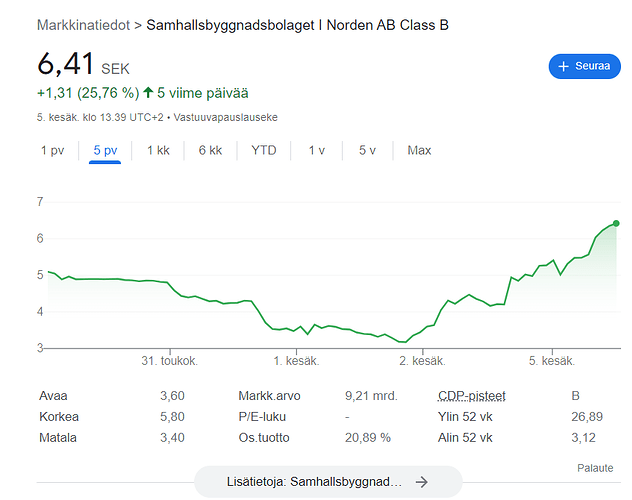

Highs of 5.8 SEK already. Now the shorts are burning. It is surely because of them that the share price is this low. Of course, the company’s former CEO has enabled these kinds of immoral attacks through his wrong actions.

Without a position, I would think very carefully about how much a change of CEO actually increases the value. Generally speaking, short sellers aren’t wrong; they typically know how to find a target where there is “air” (overvaluation). The real equation is likely the actual value of these properties vs. book value vs. rental yield.

I’ve been following the decline and I definitely won’t even enter a trade until the situation clears up. In this situation, a change of CEO could mean anything.

It’s not surprising at all that people here are blaming short sellers for exposing a festering mess like this. Maybe the finger should be pointed elsewhere.

Short sellers are a symptom. They aren’t the reason why a stock goes down the drain.

In this case too, the warning signs have been there for over a year. Now they’re blowing up in everyone’s faces, and the ones to blame are the company’s management.

Leiv Synnes is the CFO of Akelius, so the market is likely speculating that Akelius is buying SBB’s core business, if not the whole lot.

Akelius sold almost its entire portfolio right at the “peak” at the end of 2021 and has since been sitting on a massive pile of cash; they also recently took a 10% equity stake in Castellum. From the tenants’ perspective, Akelius would likely be a reputable owner for social infrastructure properties.

I could imagine that announcements might start dropping already over the weekend…

EDIT: I don’t have a position in the company myself either, just watching with popcorn in hand ![]() In my opinion, the fair value of the share is very close to zero.

In my opinion, the fair value of the share is very close to zero.

Good point - that Akelius deal was quite strange, at least to me. Whenever something smells fishy, it usually is - as they say - this can jump even 100% without it mattering. The next day, it can always open with a gap down. ![]()

Akelius informed DI this week that he has a war chest of 40 Billion Sek (“in cash”) plus any additional debt instruments he might have access to.

He said that he was not in hurry to buy anything ![]()

Yeah, SBB’s problem is that everybody knows they’re bleeding. Like a Dutch auction, price goes down until a buyer is found. Certainly, it ain’t Akelius’ interest to drive price upwards… ![]()

The tricky thing is that if SBB is forced to do a liquidation “whatever it takes”, the probable mark-to-market discount may drag other players down, too. Therefore it’s possible another troubled player sells inventory before the SBB deal is done. Which in turn rocks SBB’s boat again.

Swedish real estate market, what a giant spiderweb. SBB can’t be analyzed as a single entity.

Decision today. Hopefully, we can get a sale close to book value over the weekend and another proper squeeze towards 10 SEK. Shorts are the cancer of the market, but cancer often more likely affects companies operating with poor lifestyle habits. If you think realistically about what yield you’d buy a property from SBB as an investor, given a 10-year contract with tenants and the public sector paying the rent, these don’t need to be sold at half price, definitely not. Greed is starting to win again here.

How do you define the condition of public real estate, i.e., real value vs. required renovations? The absolute worst part of the real estate industry.

Well, it’s obviously impossible to answer this on a general level; you’d have to look at it property by property—the ideal would be a “net lease” contract tied to a cost index where the tenant is fully responsible for maintenance. Since I only own next to nothing in SBB, I haven’t bothered to look into their lease practices or even the average age of the buildings—if they even disclose them. Unfortunately, public sector entities are often so foolish that they might move into a new building with a 15-year lease, and the developer/landlord makes back their investment 1.5–2 times over during the first lease term already. What if it needs renovating after that? The property is already paid off with interest and can be dumped onto someone else.

edit: so there’s definitely risk here—what is the residual value? A building has a good price if it has a stable tenant on a long lease. It’s hard to assess how big the risk is in all of this and how it’s been accounted for—after all, the portfolio is extensive and certainly includes both old and new assets.

Precisely. Public buildings also come in many varieties, but they are often built specifically for their current purpose. If, at the end of the lease term, the city/state decides to close down that specific daycare center, sports hall, health center, fire station, police station, etc., that SBB owns, the building’s true value could be negative from that moment on.

Information on the properties SBB owns can be found on their website, allowing everyone to make their own assessments. At the very least, they are geographically much more spread out than many other large property owners; there are old administrative buildings and such in municipalities with declining populations.

On the other hand, while SBB is dependent on the current tenant in many properties, the current tenants are also dependent on SBB’s buildings. If the tenant wants to continue operations, SBB is in a completely different negotiating position compared to, for example, Citycon when leasing retail space.

I’m sure almost every municipality in Finland has encountered situations where indoor air quality is poor—even uninhabitable or plagued by mold. Or structural damage is discovered. Municipalities have tended to perform little to no maintenance. Then, once a certain threshold is crossed, the decision is made to build a new one. Having followed these developments in my own home municipalities over the years, I haven’t quite grasped what the root cause is. Are they originally built to last only a short time? Properties should surely last 100 years if they are maintained.

Here is an editorial from Kauppalehti that also discusses SBB. No paywall.

Worrying news has emerged from Sweden recently. Samhällsbyggnadsbolaget i Norden (SBB), which invests in social infrastructure properties, found itself in a bind with its maturing loans. Two credit rating agencies, S&P and Fitch, downgraded the company to junk status.

What’s been happening today? The price is already over 6. Burn baby burn when it comes to the shorts.

edit:

A few quotes from Kauppalehti today:

Leiv Synnes, who became the new CEO of SBB on Friday, is giving an extensive interview to Dagens Industri on Monday.

“I know real estate and I know finance. I have a good idea of how this situation is played,” Synnes states.

Synnes is also buying SBB shares.

It’s hard to close shorts without underhanded tactics. As KL also writes, here these parasites are buying bonds and shorting, and then demanding early repayment on the loans, trying to profit from the shorts. Despite this, the share price is slightly up today.

RECEIVED WARNING OF PAYMENT SUSPENSION FROM INVESTOR -BN (Direct)

2023-06-05 16:46

STOCKHOLM (Nyhetsbyrån Direkt) SBB’s board received a letter on Thursday from a law firm representing a group of investors who believe that the real estate company does not fulfill some of the covenants that apply to the company’s so-called social bonds.

Bloomberg News writes.

According to the letter, that would mean an “event of default” and lead to investors being able to demand repayment of these securities on June 29, writes Bloomberg.

I suppose this is just a correction after last week’s decline, but the stock is far from its former valuation. I personally still find it difficult to be positive about the company.