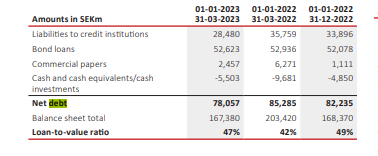

Toki tässä kohtaa voi nähdä hopeareunuksen, jos tämä on lottolappuna näiltä kurssihinnoilta vetämässä ja on vasta nyt poiminut kyytiin. Firmalla on tällä hetkellä sellainen n. 75 jaardia kruunuissa velkaa ja tasearvo on tuon uutisen perusteella n. 134 jaardia, eli jos koko roska saataisiin kaupaksi tasearvoon, niin siitä jäisi sitten velkojen jälkeen n. 59 miljardia. Tuo olisi kyllä ihan unelmaskenaarioiden huipentuma tällä hetkellä, eikä varmasti tule toteutumaan, mutta esimerkiksi 3/4 tai 2/3 hinna saaminen olisi huomattavasti suurempi, mitä firman tämähetkinen 8,5 jaardin markkina-arvo on.

Jos menisi puoleen hintaan, niin eikös firmalle jäisi kaiken realisoinnin jälkeenkin vielä 8 Mrd velkaa? Semmonen 38% alennus tase-arvoihin nähden, niin päästäisiin veloista eroon ja jäisi nykyisen markkina-arvon verran rahaa. En ole tsekannut itse lukuja sen tarkemmin, mutta oletettuna tuolla 134 mrd kp-arvolla ja 75 mrd velalla. Mikähän voisi olla realistinen alennus tase-arvoihin nähden, ilmeisesti se mitä pörssikurssi antaa ymmärtää?

Oho, nolo typo tuolla, eli piti olla 3/4 osa ei 1/2 osa ![]() -50% alennus tasearvoon olisi kyllä erittäin huono juttu.

-50% alennus tasearvoon olisi kyllä erittäin huono juttu.

Tarkistin nuo tarkemmat luvut:

Eli velkaa on hiukan enemmän, mitä tuossa alkuperäisessä viestissä mainitsin, mutta koko roskan arvo on oikein.

Eli jos paketti saataisiin kaupaksi 70-80% hinnalla, niin siitähän jäisi sitten nykyhintaan verrattuna alimmillaankin tuplasti jäljelle nykyhintaan verrattuna. Tietenkään tuota ei voi noin yksinkertaisesti laskea, mutta suuntaa antava ainakin. En usko, että kiinteistöjä siis aletaan kauppaamaan yli 30% alennuksilla, kuin vasta ihan pakon edessä.

Koko roskalle on kyllä vaikea löytää ostajaa tuon velan takia. Ainoa joka tulee mieleen on Brookfield, joka nytkin omistaa ison kasan osakkeita.

Uskoisin, että nuo major shareholderit on käyty jo läpi ja kyselty heidän intressinsä eikä sieltä ainakaan kovin mairittelevaa indikaatiota ole saatu, kun CFO:kin heitti omat lappunsa laitaan.

Sinänsä potti on kohtuullisen kokoinen, että kyllä sijoituskapasiteetin osalta tuolle ostaja pitäisi löytyä. Ostajalla tulee vain olla itselläänkin LTV matalalla tasolla ja oma velka pitkänä, että on edes mahdollista haihatella tämän perään, jos SBB:n hallituksen pyyntitaso on -20-30% alle taidearvojen.

According to Dagens Industri: a cut (to adjust the value of SBB real estate portfolio relative to current interest environment) would likely wipe out SBBs own equity.

The problem is that SBB cannot determine what anything is worth at the moment and what they would like to sell for. They are at the mercy of the market. And that is entirely their own making.

As I stated before I have no sympathy for SBB mgm, but I do for all their ca 300000 shareholders. And these shareholders are buying even more. ![]() Nordnet Sweden states that SBB was one of the most bought shares among Nordnet custumers in Sweden the last month.

Nordnet Sweden states that SBB was one of the most bought shares among Nordnet custumers in Sweden the last month.

Edit. One of most read articles on Bloomberg yesterday was on SBB. And the article ended with a quote from the CEO "If we sell the entire company, we will want a very good price,”. I think this sums up rather well the management “quality” of SBB.

Jos JM osakkeita (jo myydyt ja vielä myymättä olevat) arvo on jossain 3,2 miljardin kruunu luokassa? Nyt myydystä potista saivat 2,8 miljardia. Eli laskit tuon JM kaupan jo vähentäen 31.3.2023 tilanteessa jäljellä olevaan velkaan ~78 → ~75 miljardia kruunua?

Hieman vähissä on nyt keinot kyllä. Kiinteistöjä pitäisi saada isommissa määrin kaupan. Kyllähän jenkeissä edelleen tapahtuu REIT sektorilla yritysjärjestelyitä ja kuvittelisi että yhteiskuntakiinteistöt pohjoismaissa pitkillä vuokrasopimuksilla olisi käypää valuuttaa. Haiseeko ostajille veri nyt liian vahvasti meressä ja kaikki odottavat joudutaanko SBB ajamaan konkurssiin ja sieltä sitten poimimaan kiinteistöjä?

Yeah, CEO signals false confidence yet again. SBB is not in a position to say what it wants. It’s all about who’s willing to take the risk that there ain’t fishy accounting involved. CEO’s reputation doesn’t help a bit to solve this mess.

These aren’t the stories a retail holder comes out with a medal and a victory lap. Probably the state is forced to arrange a shotgun wedding to get this saga to an end. Probably the lefts make sure there aren’t hefty wins for the shareholders involved.

Potentiaalinen ostaja voisi olla joku opportunistinen PE-rahasto, niillä käsittääkseni on paljonkin “kuivaa ruutia” tällä hetkellä.

This could almost go in the ‘wondering about share prices’ thread, but I tried to find out what caused today’s massive crash. Is this what it’s about?

No this news came yesterday.

This time around it is that SBB has breached some covenants according to Danske Bank and Dagens Industri. And this in turn enables the shortsellers to put in a final squeeze. And small shareholders are still buying like crazy ![]()

A press release is out regarding today’s rumor mill.

From Chrome translate:

SBB does not meet the interest coverage requirement because the loan condition is defined in the Eurobond base prospectus, as seen in a comment from a Danske Bank credit analyst and reported by Dagens Industri.

News agency Direkt

According to SBB’s Eurobond base prospectus, the earnings line “profit before financial items” must be divided by net interest.

Over a rolling twelve-month period, SBB’s ratio was 1.1 at the end of March, which is lower than the covenant requirement of 1.5.

Read more: Wallenskog: “Everyone probably thought this would last”

DI writes that Danske Bank’s lead credit analysts Louis Landeman and Marcus Gustavsson drew attention to a possible covenant breach in a market comment Wednesday morning and see it as an explanation for why SBB announced changes to its income statement on Monday.

“According to the prospectus, the real estate company has 90 days to rectify the breach of contract after the lenders have pointed it out. If the matter is not resolved within this period, bondholders have the right to demand immediate repayment,” writes DI. This opens the risk that hedge funds could buy bonds at a discount and try to pressure the company into bankruptcy.

Late Wednesday afternoon, SBB rejected the information from Dagens Industri and Danske Bank

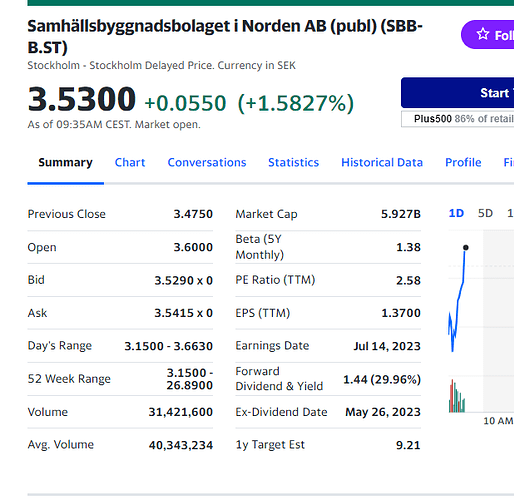

→ SBB disagrees on this, the stock price is collapsing again. My own position has already melted away to almost nothing, and it probably isn’t worth adding significantly in this situation; I added some small “lottery positions” to my portfolio because I can’t assess the situation. You can lose 70%, but the upside from these levels is clearly much higher. Could someone here comment on the situation? Is the stock price crash just due to shorts and a “buying opportunity of the century,” or is insolvency actually ahead and it would be better to just sell while you can still get more than zero?

The volatility is wild; now the price is already in the green, which in my opinion would be the logical reaction to the company’s announcement considering yesterday’s price reaction.

My view is that this is more of lottery ticket than anything else at the moment. That said one never knows.

There is value in SBB but the management has placed the company in really bad situation where the future of the company is not any more in their hands.

Dagens Industri/Bloomberg reported yesterday that the CEO is in London trying to sell the company, or parts thereof. But it is now a buyers market. This is especially the case of SBB, but also others e.g. Corem which is also in a bad position.

Yesterdays collapse in the share price was a result that Avanza and Nordnet lowered the percentage of how much one can borrow against SBB shares. On May the 15th Avanza had a 60% loan ratio, and now they lowered to 0%. Nordnet lowered to 20%. This probably forced some margin calls among their customers.

With regard to the shorts, yes, their collective action results in that the share price takes perhaps a more severe beating than otherwise. But at the end of the day this is not the shorts fault, they see an opportunity to make money on an unprofessionally managed company. The reason the company is in trouble is not because of the shorts. It is entirely the fault of the CEO. The market has no trust in what the company states or reports, as time and again the company has proven to not tell or report the entire truth.

Edit: Dagens Industri just reported that SBB will not anymore be part of Stoxx Europe 600. This will come in effect on June 19th.

I have a question about Corem’s situation. At SijoitusTieto-forum someone wrote this:

Coremin loan-to-value on minun laskelmillakin SBB:tä terveempi 60% tuntumassa. Velkojen keskikorko saa nousta reippaasti jotta osinkojen jälkeen jäisi miinukselle, ja shorttaajiakin on vain yksi rupinen kohtuullisen pieneltä tuntuvalla potilla verrattuna SBB:hen. Ehkä 2023:lle osuva pankkilainojen korkea määrä huolettaa?

Ie. Loan-to-value (with hybrid bonds and bank loans?) is 60% vs. SBB’s 80% (according to the writer), average interest rate of Corem’s loans has room to rise before result after dividends would go to minus, and there is only one shorter with a small position. He wonders if there is something in 2023 expiring bank loans… He thinks that Corem’s reaction might be overblown as it has been more undervalued than SBB.

I’m confused. Is Corem in a bad situation or not? How bad? And why?

I hope SBB goes bankrupt. Festering sores like this should be removed from the stock exchange and maybe some investors would learn something. Thanks to Viceroy for getting the snowball rolling.

My insights of Corem is dependent on Dagens Industri and they had yesterday a report warning that their interest costs will increase significantly.

Based on their reporting they now pay on average 4.1 %, and that will increase. Now ca 53% of their profit goes to interest payments. They assume that that will increase to 75% in the near future. DI further state that this is unsustainable and a new emission of shares need to take place. However since the main owner is deeply in debt, that will probaby not happen. ![]()

Which way is the wind blowing now? There’s certainly no shortage of twists and turns. So far, the lottery tickets have paid off.

Bloomberg reports of indications of Brookfield showing an interest in certain assets (they already own some assets together with SBB).

The volatility in the share is just through the roof. Som daytraders probably make a big buck here.

The thing is that if you have long contracts (whole portfolio is avg 10 years according to our Kauppalehti) and stable tenants like kindergartens then how much discount should you accept? I think these tenants are paying double digit rents for the 100% price. Of course everybody should be interested in these. Lets note that the interest rates are peaking just now and will go down next year at latest. SBB owns a lot of properties in Finland also (200 or so according to Kauppalehti).

I think that this does not matter at this point of time (as such) because you have a motivated seller. The question is not that the these assets would not be attractive but if the owner is on the brick of bankruptcy the buyer hold all the cards.

Also, if I remember correctly SBB already sold 5-10 percent below reported in the book to Brookfield in 2022. So if that logic applies I would bet that the possible price would be definitely lower than that.

By the way: I have never owned SBB and have no plans to do. My reporting is just based on things I read.