Lupasitko itsellesi “Ei koskaan enää biotechiä”? ![]()

Prolight Diagnostics (PRLD)

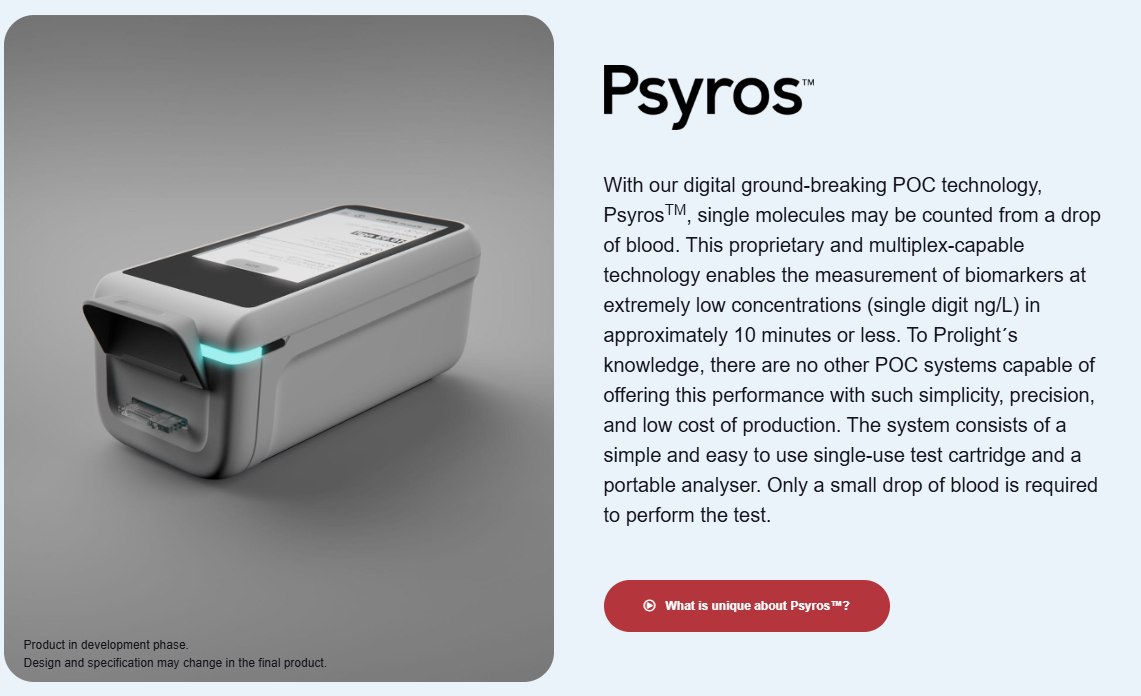

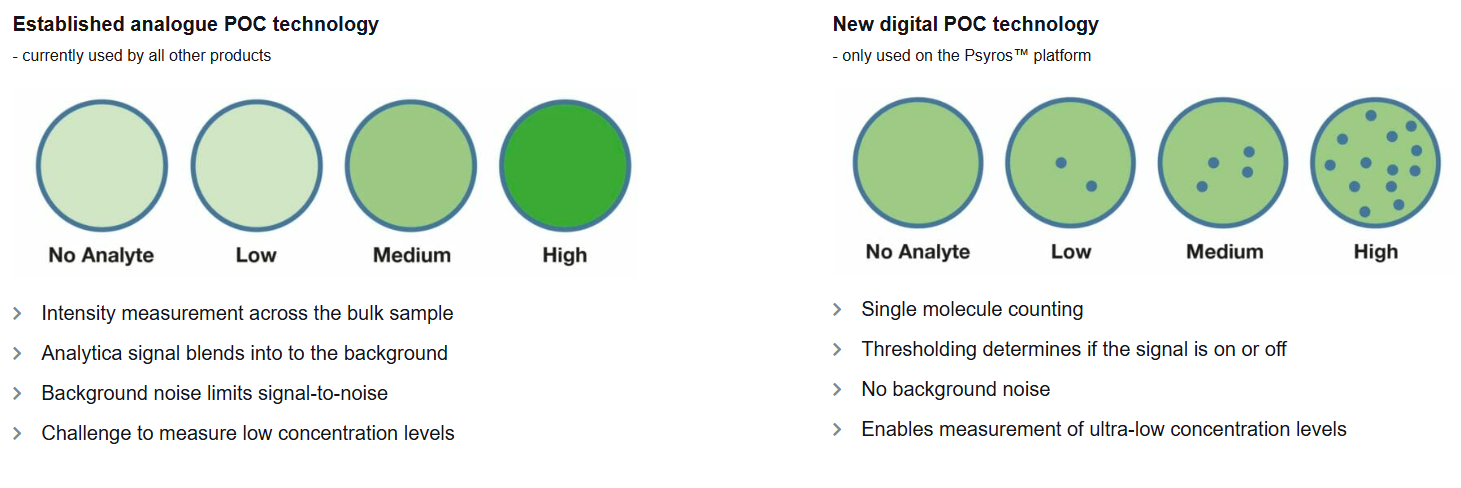

Prolight Diagnostics on vuonna 1999 perustettu biotech-yhtiö, joka listautui 2017. Osake löytyy tällä hetkellä First North Sweden-markkinalta. Yhtiö kehittää pienikokoista, valoon perustuvaa POC-diagnostiikkaa, jolla voidaan mitata verestä lähes mitä tahansa molekyylejä erittäin pienillä pitoisuuksilla kannettavalla ja edullisella laitteella. Yhtiön omien väitteiden mukaan teknologia tuo keskuslaboratorion tasoisen mittausalueen ja tarkkuuden pieneen kannettavaan ja kustannuskilpailukykyiseen pakettiin, joka kulkee mukana vaikka ambulanssissa. Yhtiön päätuote kulkee nimellä Psyros.

Psyros:

Prolightin Psyros-teknologia mahdollistaa “yksittäisten molekyylien laskemisen” veripisarasta. Käytännöstä biomarkkereita voidaan mitata hyvin pieninä pitoisuuksina (x ng/L) muutamassa minuutissa ja helposti. Teknologia perustuu kertakäyttöiseen testikasettiin ja kannettavaan analysaattoriin, ja se vaatii vain pienen veripisaran. Toisin kuin monella muulla POC-järjestelmällä, veriplasmaa ei tarvitse erottaa sentrifuugilla. Prolightin itsensä mukaan vastaavaa suorituskykyä, yksinkertaisuutta, tarkkuutta ja edullista tuotantokustannusta ei ole muilla POC-järjestelmillä (Note to self: olemme kuulleet tämän ennenkin)

Yhtiö aikoo hakea markkinalupaa ensimmäisenä troponiinin mittaukseen, mahdollistaen sydänkohtauksien diagnosoinnin paikan päällä, kuten ambulanssissa tai vanhainkodissa. Käytännössä troponiinin mittaus nykyistä herkemmin mahdollistaa oikean hoitoon ohjauksen useita tunteja aikaisemmin ja huomattavasti ketterämmin. Alusta on kuitenkin suunnitelty ns multiplexaavaksi, eliteknologialla voidaan kuitenkin mitata myös muita merkkiaineita samanaikaisesti. Yhtiö siis aikoo laajentaa samalla laitteella myös muihin merkkiaineisiin.

POC - eli Point Of Care

POCilla kuvataan hoitoyksikössä suoraan toteutettavaa diagnostiikkaa. Markkina on voimakkaasti kasvava. Selväähän se on, ettei näytteitä kannata kuskata ampulleittain keskuslaboratorioon kalliisti, hitaasti ja kankeasti, jos teknologia mahdollistaa tarkan ja luotettavan mittauksen nopeasti, edullisesti ja välittömästi vaikka ambulanssissa tai vanhainkodissa ilman veriplasman erotusta tai muuta käsittelyä. Kysymys on siinä, kuka vie markkinat, sillä erilaisia POC-teknologioita kehitetään lukuisen firman toimesta.

Patentit:

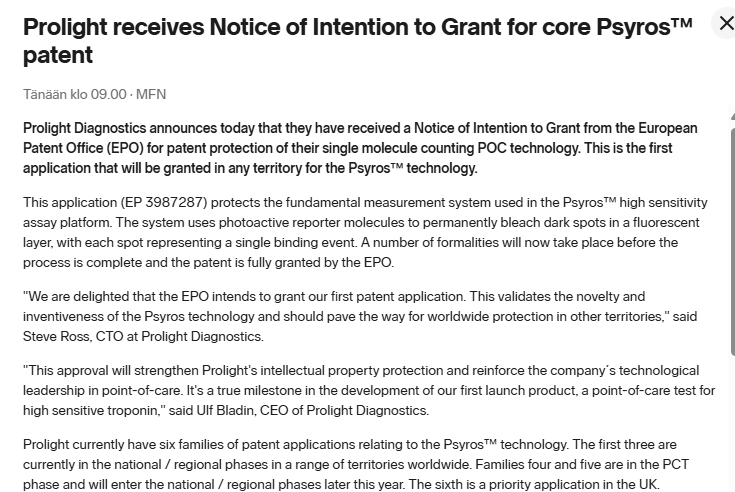

Prolightilla on tällä hetkellä viisi patenttihakemusta, jotka liittyvät Psyros™-teknologiaan. Kolme näistä on siirtynyt kansalliseen / alueelliseen vaiheeseen ja niitä käsitellään useissa eri alueilla, mukaan lukien Eurooppa, Yhdysvallat, Kanada, Kiina, Japani ja muut. Jäljellä olevat kaksi ovat kansainvälisessä PCT (Patent Cooperation Treaty) -vaiheessa ja siirtyvät kansalliseen / alueelliseen vaiheeseen vuonna 2025. Lisäksi Microflex-tuotteella on viisi patenttia, joista kolme hakemusvaiheessa. Hiljattain yhtiö viesti uusista bisnesmahdollisuuksista uuden MicroFlex-tuotteeseen liittyvän patentin myötä. [Lähde]

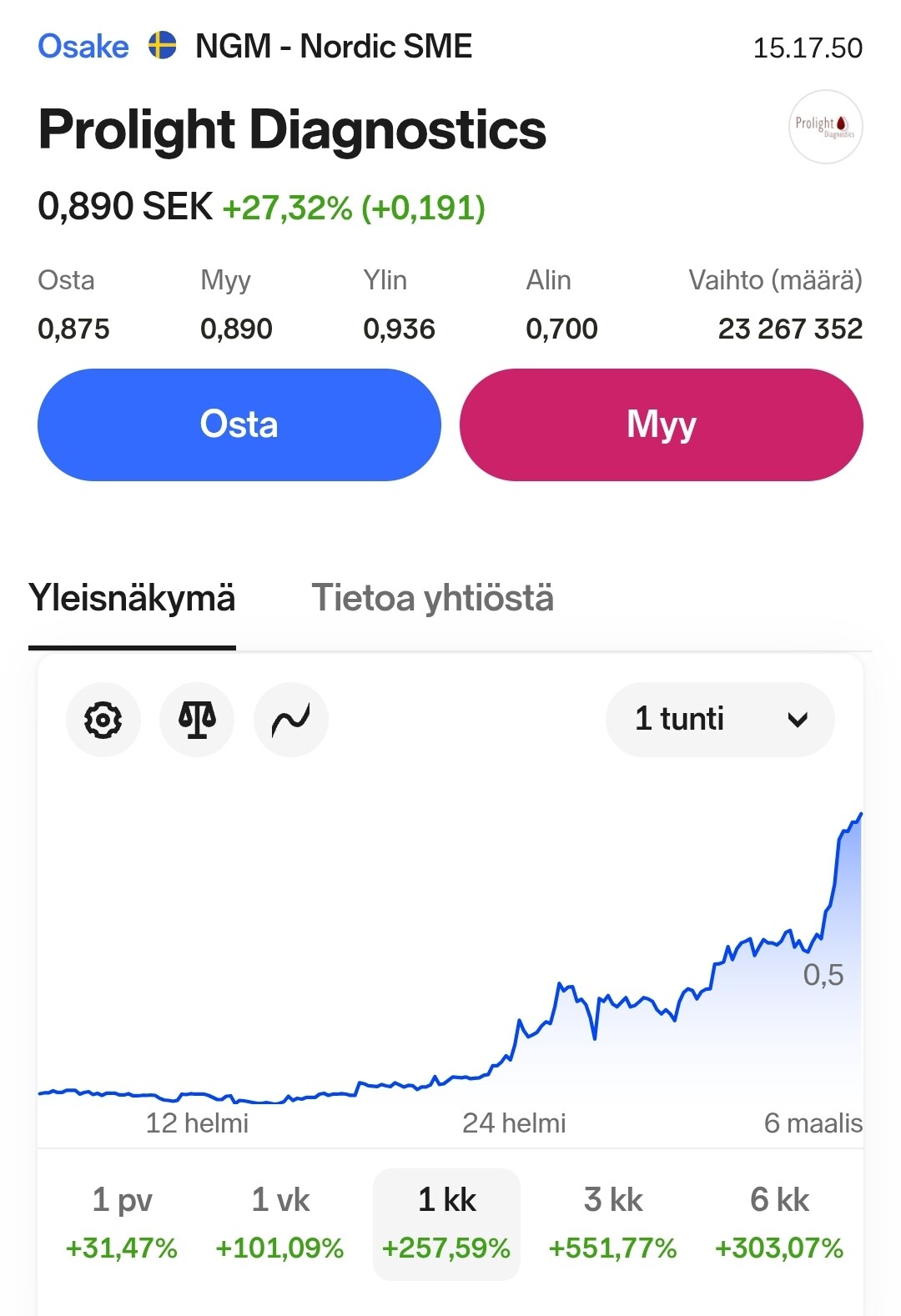

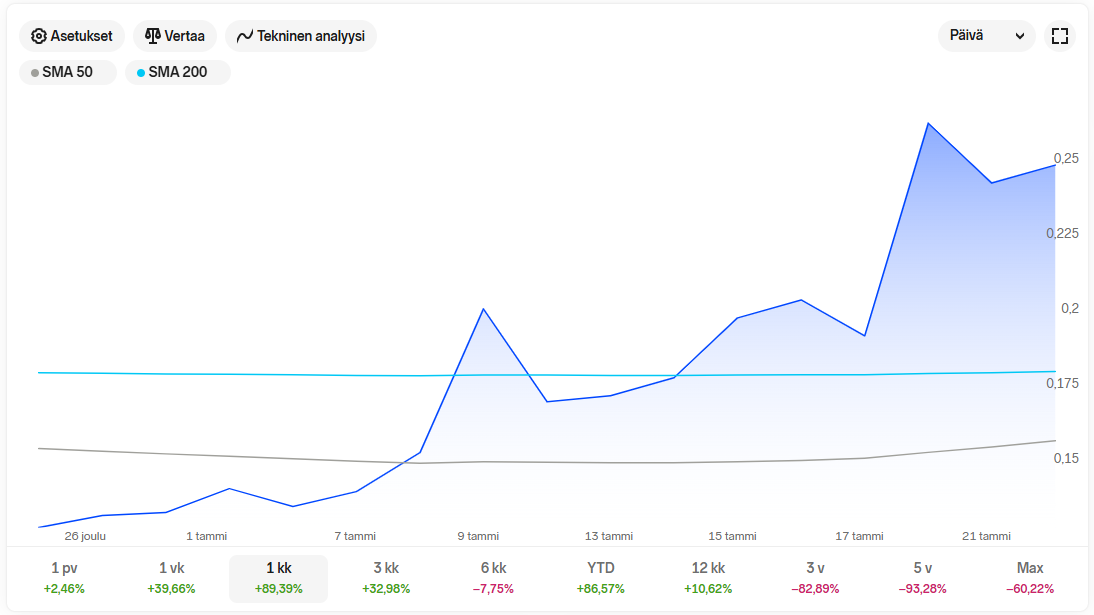

Osakkeen kehitys

Yhtiö on ollut ensimmäisille sijoittajille biotechien tapaan ollut karmea sijoitus. Oman tuntuman perusteella sijoittajat eivät ymmärrä kuinka pitkistä ja kalliista prosesseista on kyse, puhuttiin sitten lääkinnällisistä laitteista tai lääkkeistä. Osaketta on dilutoitu useamman kerran kun kehitykseen tarvitaan rahaa.

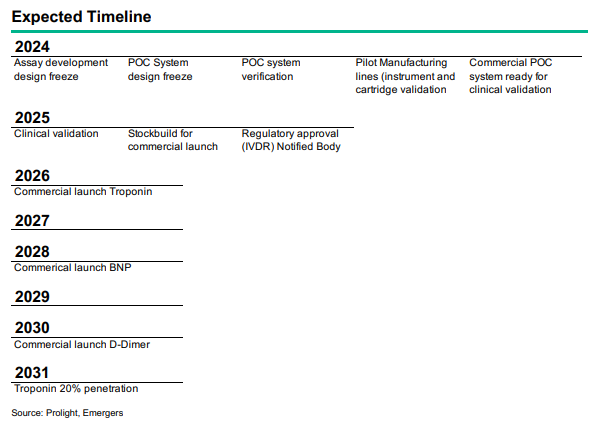

Nyt yhtiö on kuitenkin “loppusuoralla”:

- Lopulliset tuotantoprototyypit laitteesta ovat valmiina [Lähde]

- Kertakäyttöiset näyteyksiköt ovat viimeistelty [Lähde]

- Pilottilinja näyteyksiköiden tuottamiseksi on valmis tai melkein valmis, ja se tuottaa tarvittavat näyteyksiköt pre-validointiin ja lopulliseen validaatiotutkimukseen [Lähde]

- Täysin automatisoitu massatuotantolinja miljoonien näyteyksiköiden valmistamiseksi on suunnittelussa yhteistyössä FlexMedical-yhtiön kanssa [Lähde]

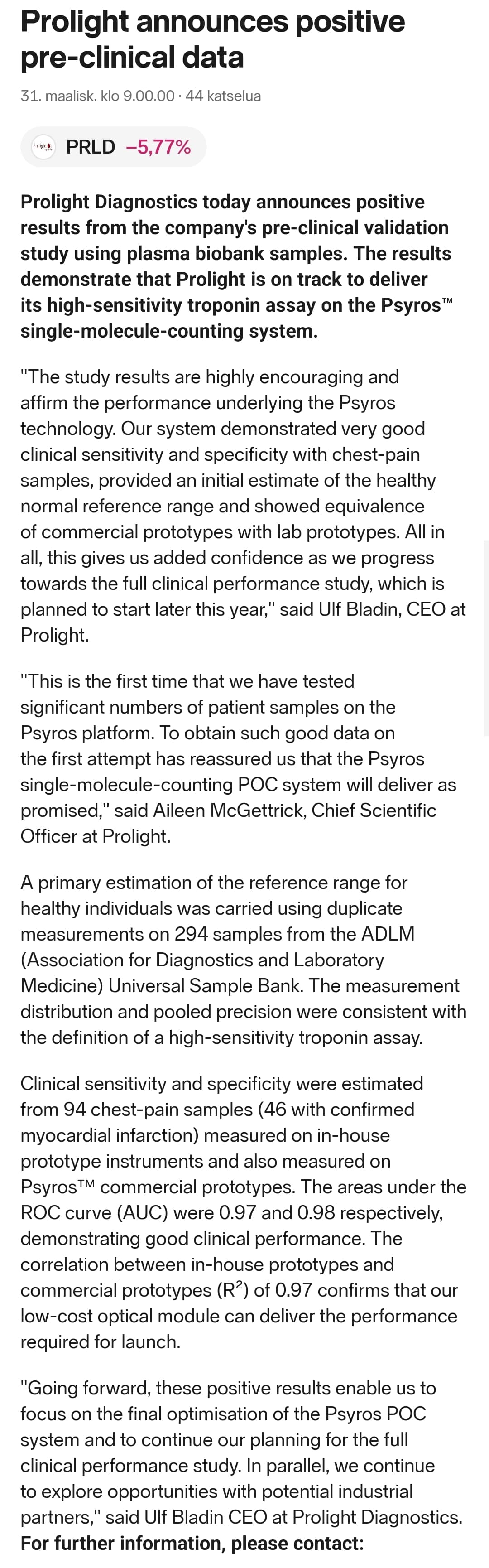

- Markkinahyväksynnän edellyttämä pre-validaatiotutkimus on meneillään ja sen raportin tulisi tulla julki Q1 2025 aikana.

- Pre-validation pohjalta toteutetaan varsinainen validointi 2025 aikana.

- Markkinoille pääsy voi tapahtua vuoden 2026 alussa.

Markkinoille tulon lähestyessä osakkeen kiinnostus näyttääkin kohottaneen osakkeen lyhyen aikavälin nousutrendiin:

Pre-Validation:

Q1 2025 aikana tullaan julkaisemaan alustava raportti joka linjaa markkinahyväksynnän edellyttämän validointitutkimuksen yksityiskohdat.

\u003eThe pre-validation study that includes fresh blood samples from approximately 120 cardiac patients at St. Thomas’ Hospital in London and approximately 1,200 frozen plasma samples from biobanks. First results from the study, expected in Q1 2025, will fine-tune the system, minimising risks and ensuring the robustness of the final design. This progress aligns with the clear path to IVDR certification and commercialisation in 2026.

Nostoja tiiviisti:

- Kassavirtaa ei käytännössä vielä ole, grantin maksuja lukuunottamatta. Yhtiöllä on vielä noin 17M SEK maksamattomia avustuksia.

- Rahoituksen riittävyys on kysymysmerkki.

- Emergers antoi osakkeelle käyvän arvion 0.9-1.0 SEK tai yrityskauppatilanteessa 2.1 SEK, mutta osake on pyörinyt pääosin 0.15-0.25 välillä. Merkittävää piristymistä on kuitenkin ilmassa.

- Yhtiöllä on 17 M SEK avustus briteistä, joka kattaa ilmeisesti suuren osan validoinnin kuluista

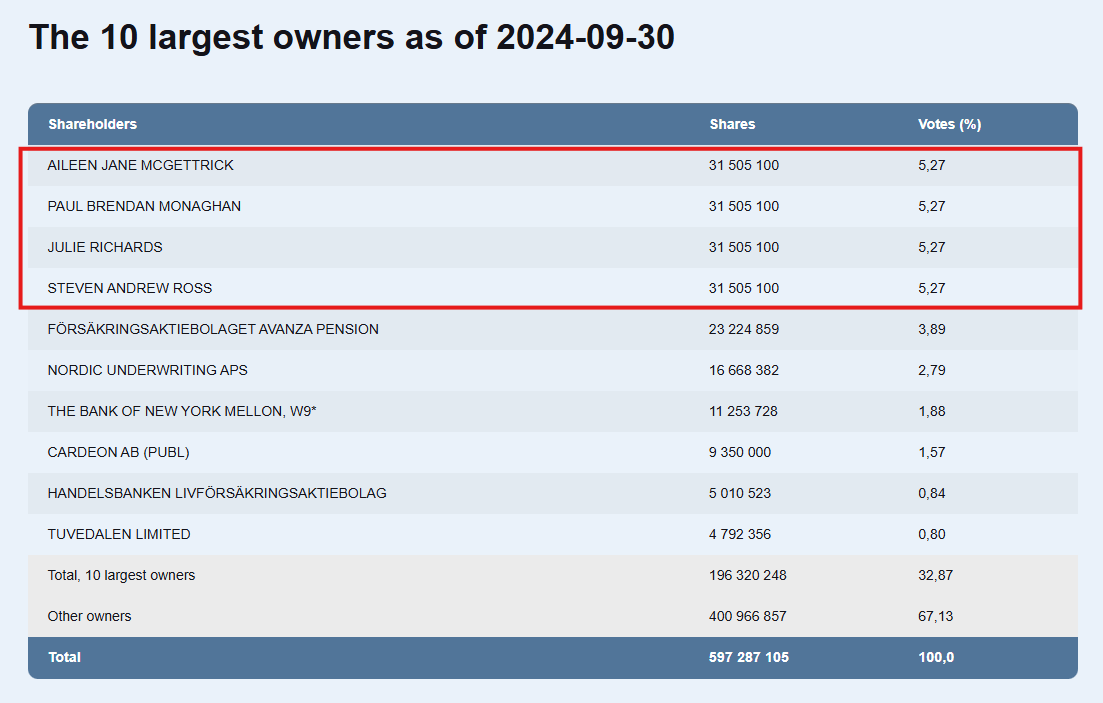

- Yhtiö on kerännyt rahoitusta warranteilla. Viimeisin TO7 warranttikierros merkattiin käytännössä täysin viime lokakuussa. Samalla johto merkkasi kaikki warrantit omalla rahallaan, mikä lienee positiivinen merkki: October, the TO7 warrant

program was exercised at a 96.4% rate, raising SEK 12.6m before costs.

Management and board members fully exercised their warrants, increasing

their ownership to 22.8% of total shares—a strong signal of insider confidence

in Prolight’s progress and potential. - Yhtiöllä on myös toinen tuote tuote Medflex jota kehitettiin ensimmäisenä. Sen suorituskyvyn erityisesti pienillä biomarkkereiden pitoisuuksilla koettiin heikommaksi kuin myöhemmin yrityskaupalla saadun Psyroksen. Medflexin kehitys kuitenkin jatkuu, ulkoistettuna kolmannelle.

Yhtiön osakesivu Nordnetissä: Prolight Diagnostics (PRLD) osake | Nordnet

Viimeisin Emergersin valuaatio-arvio 20.1.2025

Viimeisin kvartaaliraportti Q3 2024

Yhtiö on kiinnostanut itseäni jo pitkän aikaa, ja viime aikoina osake on myös osoittanut voimakkaita elpymisen merkkejä. Päätinkin aloittaa tästä ensimmäisen Inderes-ketjun, etten sokaistu “fomoon”. Päivittelen aloitusta ajan myötä.

Keskustelun virikkeeksi:

- Voiko yrityksen kassa riittää markkinoille asti, vai tarvitaanko lisää rahoitusta?

- Onko Psyroksella oikeita kilpailuetuja, ja mikä on myyntipuhetta?

- Mikä on POC-markkinan tulevaisuus?