MIND Technology, Inc. provides technology and solutions for exploration, surveying, and defense applications in the seabed, hydrography, defense, seismic, and security industries. MIND Technology’s headquarters are located in The Woodlands, Texas, and it has key operational sites in the United States, Singapore, Malaysia, and the United Kingdom. Its Klein and Seamap units design, manufacture, and sell specialized, high-performance sonar and seismic equipment.

History

Mind Technologies Inc. was previously known as Mitcham Industries. The name eventually changed in 2020. In 2016, Mitcham Industries acquired Klein Marine Systems. Klein’s founder, Martin Klein, is an American engineer and inventor. He is widely regarded as a significant inventor and developer in the field. His invention, Side Scan Sonar, led to the discovery of the Titanic wreck, among other things. Mitcham Industries focused almost exclusively on the rental and sale of seabed mapping tools required for oil and gas drilling, while Mind’s repertoire is considerably broader.

The company’s development has followed the same pattern familiar to small businesses. Profitability has been just around the corner, and development work has consumed cash at a commendable rate. Equipment from Mitcham’s legacy has been sold to cover costs, as cash flow from actual operations has been negligible. The COVID-19 pandemic hit the company at a bad time. The company, which largely gained recognition at trade fairs, was unable to showcase its products, and there were also country-specific problems with testing. The can was kicked down the road, albeit for an understandable reason. The company was debt-free for a long time, and the recently raised debt of USD 3.75 million is its only institutional debt. The company is indebted to its shareholders because it printed preferred shares #MINDP worth USD 25 million. One share was available for USD 25. The preferred shares have a cumulative 9% dividend. If Mind does not pay dividends on these shares by the end of this year, the owners of #MINDP shares have the right to elect two members to the company’s board of directors.

Mind Technologies Inc. Positive Drivers

The global situation tightened after Russia’s invasion of Ukraine, and military budgets received significant increases. For Mind, the situation appeared as an opportunity.

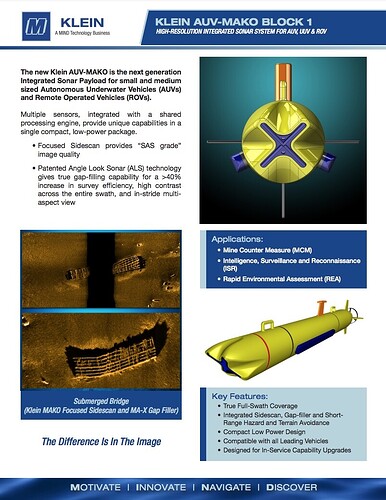

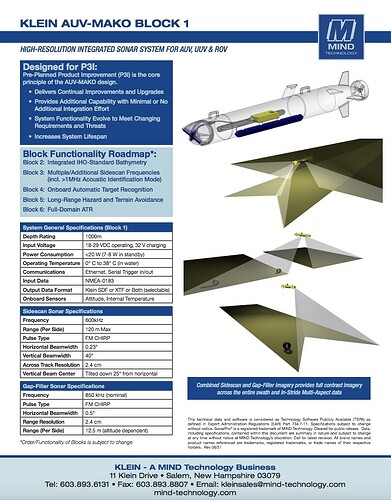

Mind secured a contract with the US Navy – there is a press release about this, but information regarding the interaction is naturally highly confidential. A European partner has been discussed for a long time. For a moment, Mind’s website featured an image of an AUV where the company’s name was visible. There is no official announcement about this, but the company was SAAB.

Despite all the green transition efforts, the energy sector cannot forget oil and gas. When energy prices are low, energy giants refrain from investing. The search for new drilling sites must begin at some point.

In electricity generation, it has been realized that there is not enough space for wind power. Offshore wind farms are becoming one solution. The construction of these requires seabed mapping.

Mind for Investors

Share prices at the time of writing the thread on Friday, May 19, 2023 (closing prices)

#MIND 0.55

#MINDP 7.20

There are two share classes: #MIND and #MINDP

Fiscal year: 1.2-31.1

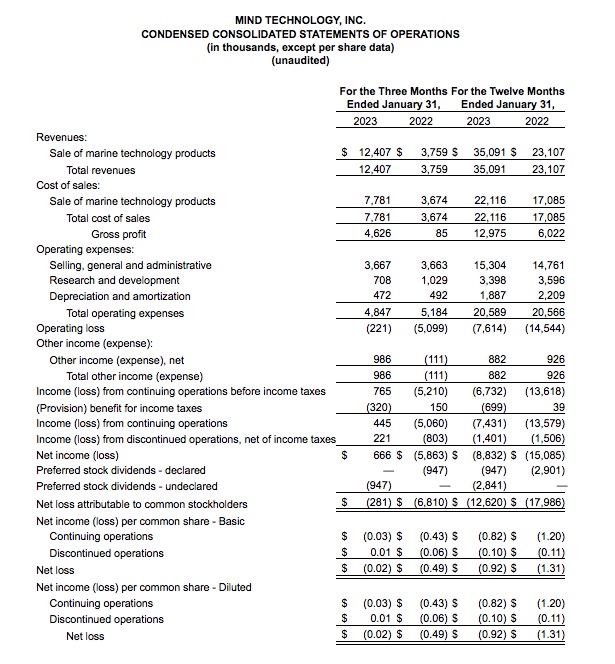

Revenue grew Q4 2021 - Q4 2022 by 330%

Backlog over 23 million.

Company market capitalization 7.3 million USD

A comparable company, Kraken Robotics, which generates 0 profit, is valued at a multiple of x15. In terms of revenue, these compete in the same league.

The company’s story is at an interesting juncture. The geopolitical situation and the challenges in the energy industry provide positive drivers for the company. Cash sufficiency is a challenge. However, the debt situation is at least tolerable, and rising interest rates do not directly affect the company’s operations. From the 2022 results, it can be concluded that the cash situation is easing, with the order backlog being record-breaking. If MIND were to be acquired, the buyer would first have to pay the full price of USD 25 for a #MINDP share, totaling USD 25 million (current share price 7.15), and all unpaid dividends for these, USD 2.8 million. Only then can the owners of #MIND shares dream of receiving something. This should be kept in mind if one intends to invest in this.

Pictures and videos from the company’s website, where you can also find the company’s press releases and reports. mind-technology.com I recommend reading the press releases from the last few years to get a more comprehensive picture of the company.