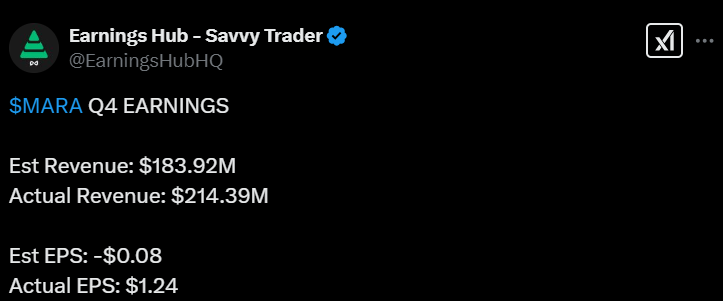

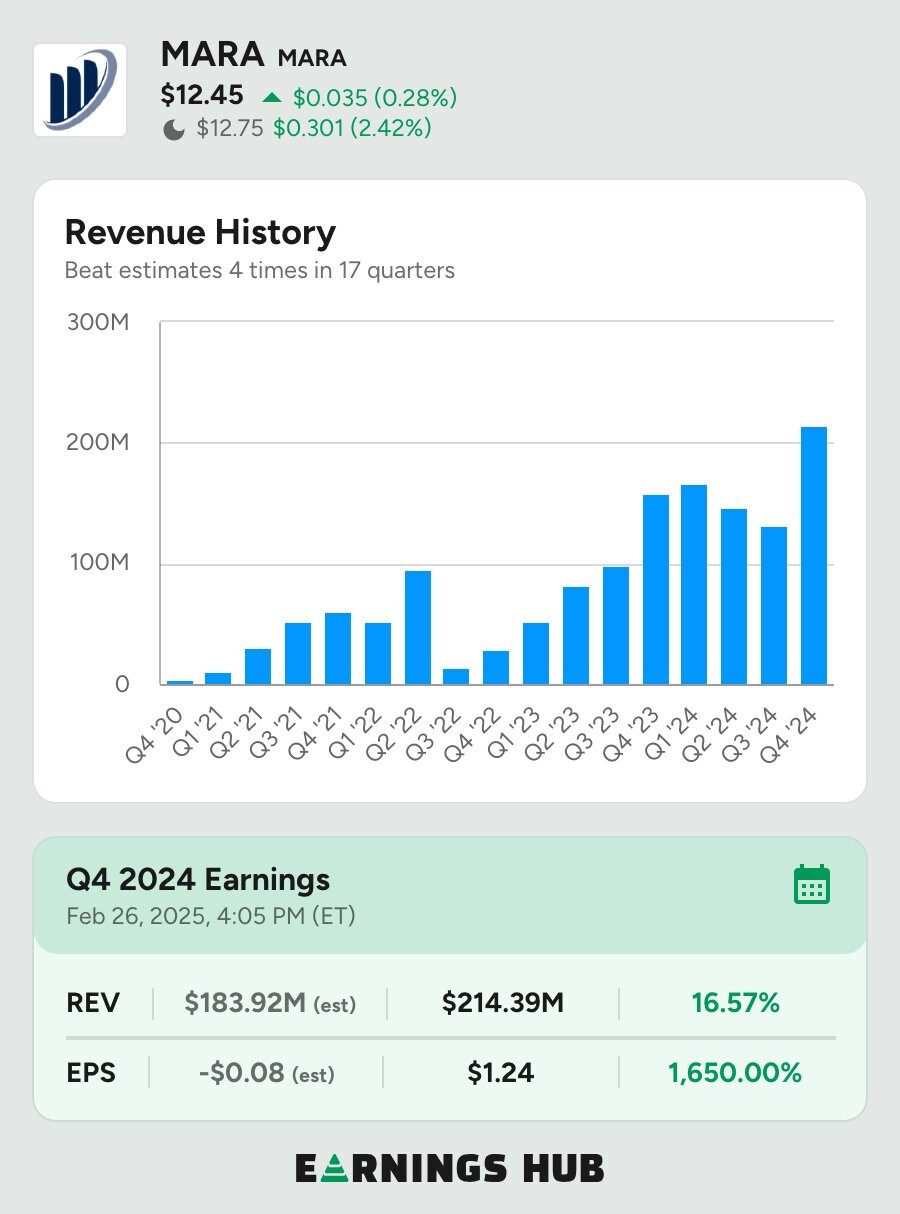

Marathon Digital Holdings (MARA)

Marathon doesn’t have its own thread yet, so let’s open a discussion if this interests others.

Company Information

-

Company Profile

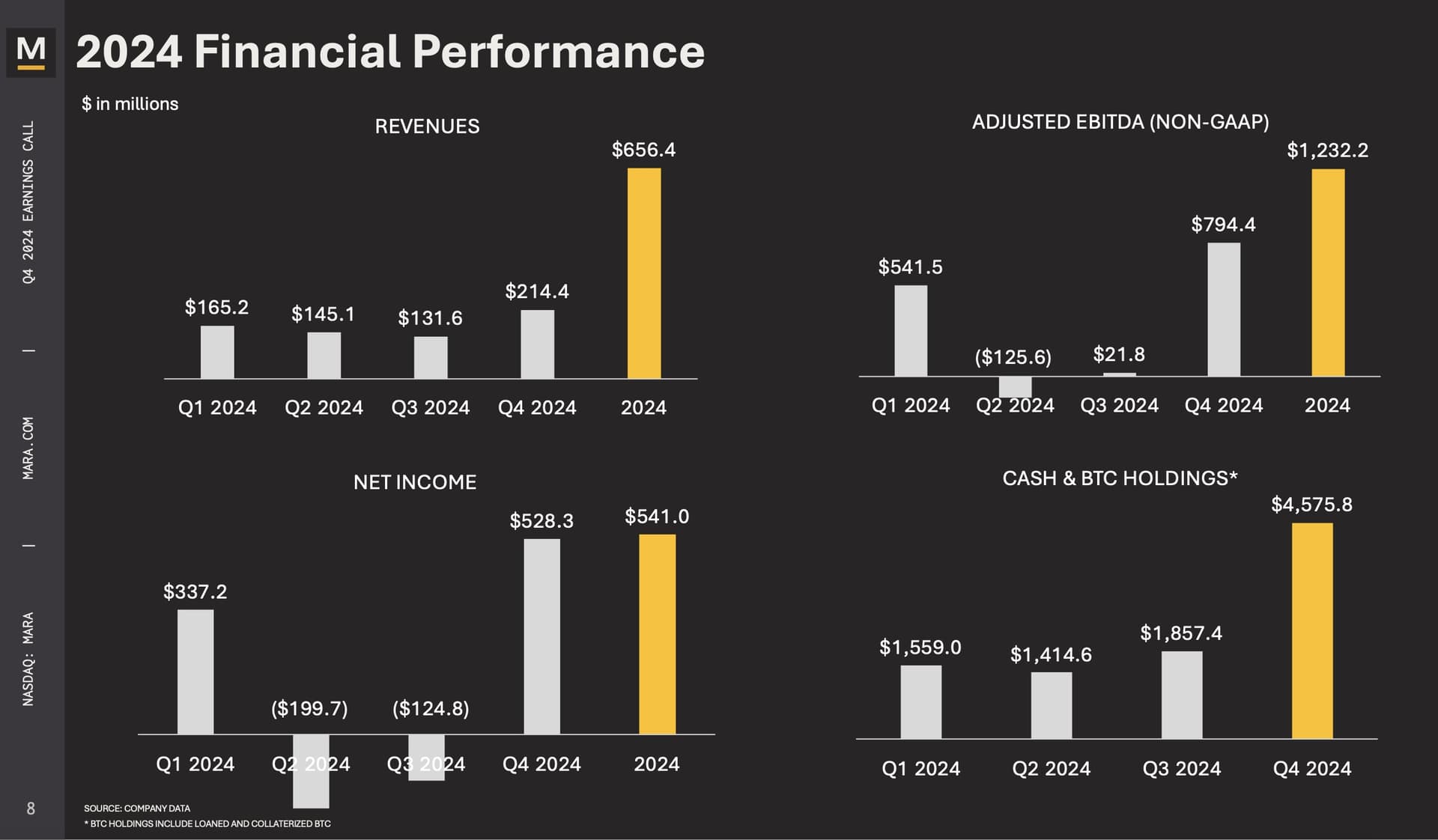

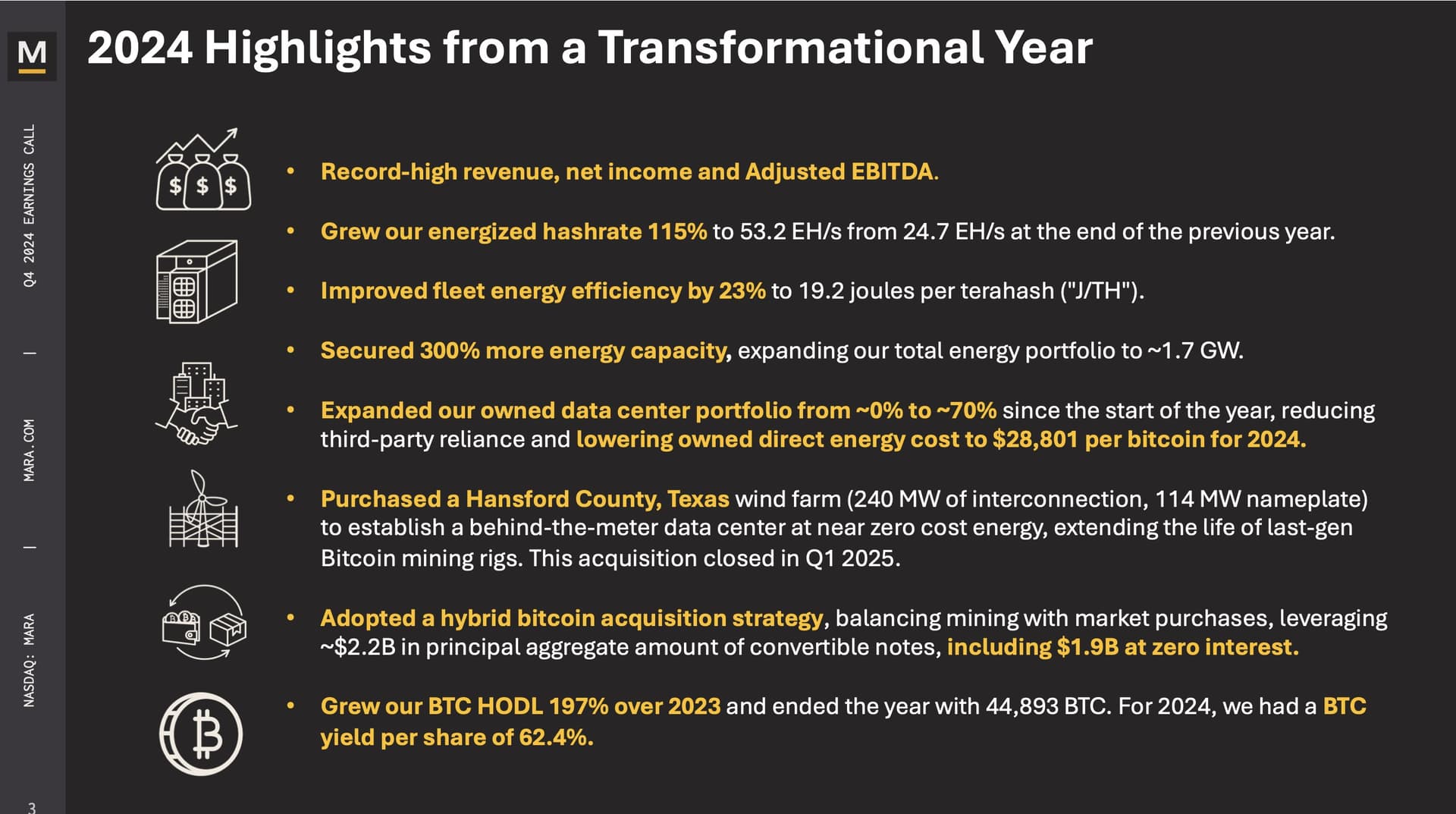

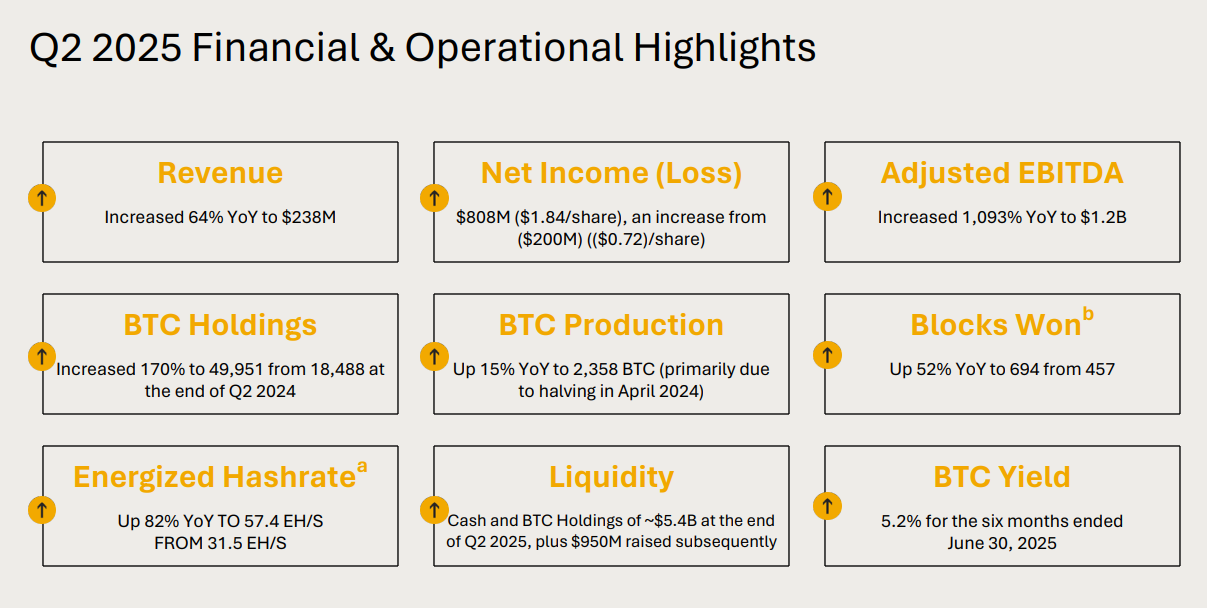

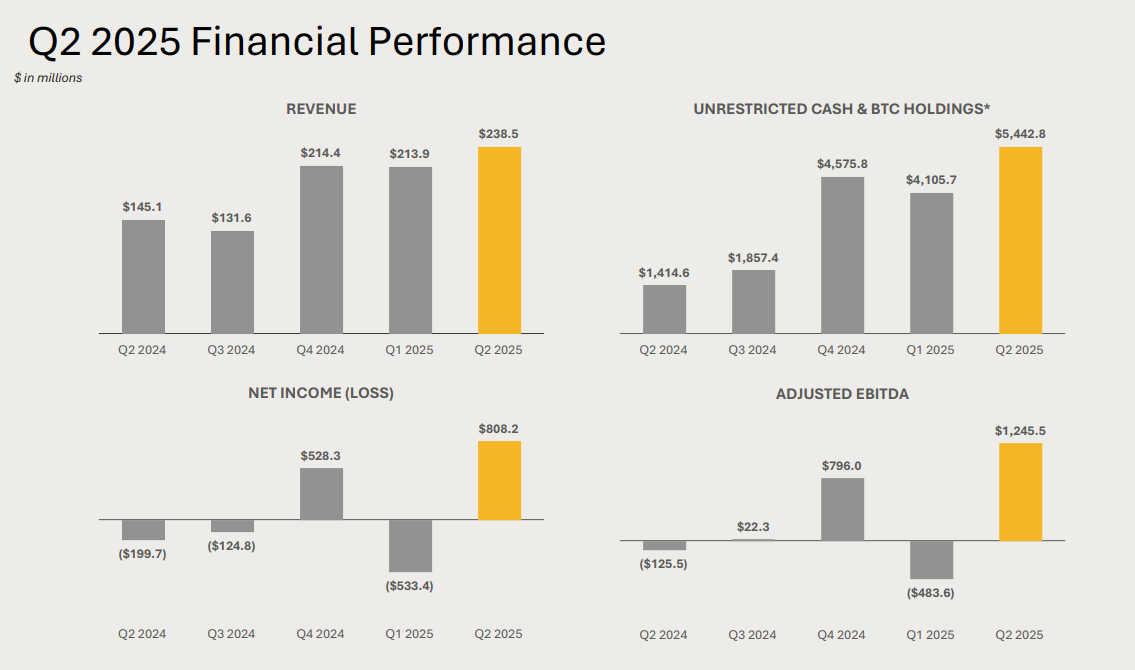

Marathon Digital Holdings (MARA) is a U.S.-based Bitcoin mining company known for its large and energy-efficient mining operations. The company strategically combines Bitcoin mining and purchasing. It currently holds approximately 40,000 Bitcoins. Its mining power is over 50 exahashes, which means about 1000 Bitcoins mined per month. -

Renewable Energy

MARA is committed to sustainability. For example, its wind farm in Texas uses 100% renewable energy. This reduces mining costs and supports environmental goals. -

Goals

The company’s strategy is to expand its operations cost-effectively and maintain its competitive advantage by mining Bitcoin at a lower cost than the market price. -

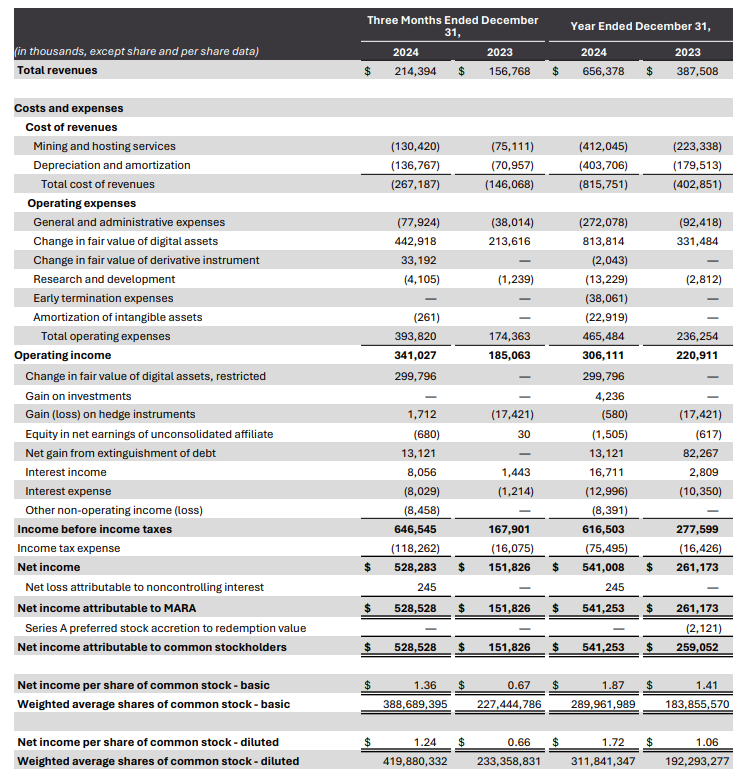

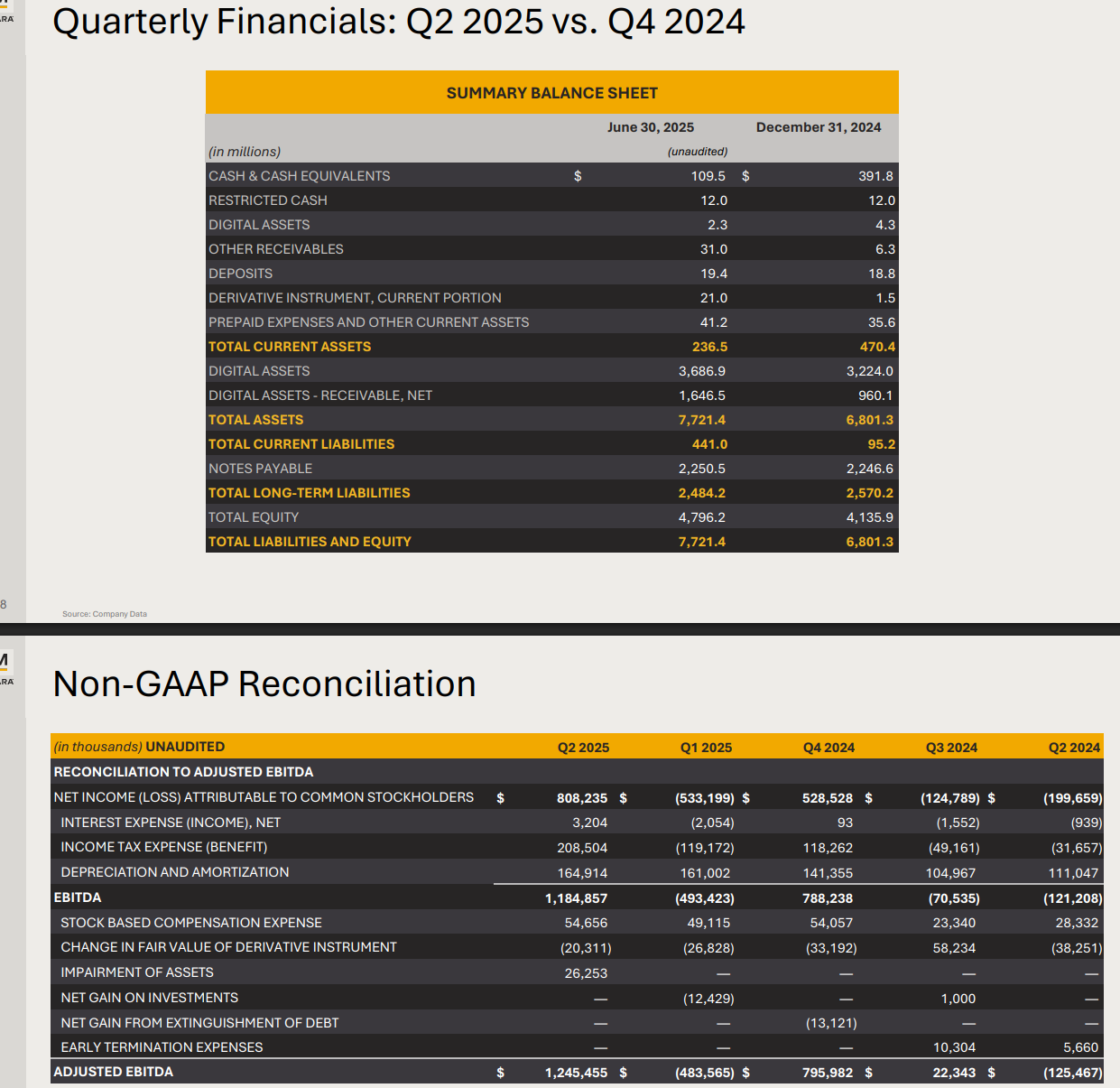

Financial Position

MARA’s growth is supported by strategic financing, such as the recently completed $700 million convertible note offering. This financing is used for Bitcoin purchases and general corporate operations. MARA has previously sold some of its Bitcoins to finance its operations, but the company now states a HODL strategy. It has approximately $900 million in cash.

Conclusions

MARA is a leading player in the Bitcoin mining industry, with a market capitalization of approximately $7.3 billion. The company’s valuation may show a premium due to Bitcoin holdings, but mining operations are not valued as highly.

It would be interesting to hear other opinions. Is MARA a potential long-term investment, or is it better suited for trading and speculation? I personally own a small tracking position, but with Bitcoin at peak levels, I am considering adding more.

Sources

- MARA Bitcoin Production and Mining Operation Updates – November 2024

- Marathon Digital Purchases Texas Wind Farm

- Seeking Alpha: MARA – One of the Cheapest Companies in the Bitcoin Mining Industry

X-ticker: $MARA