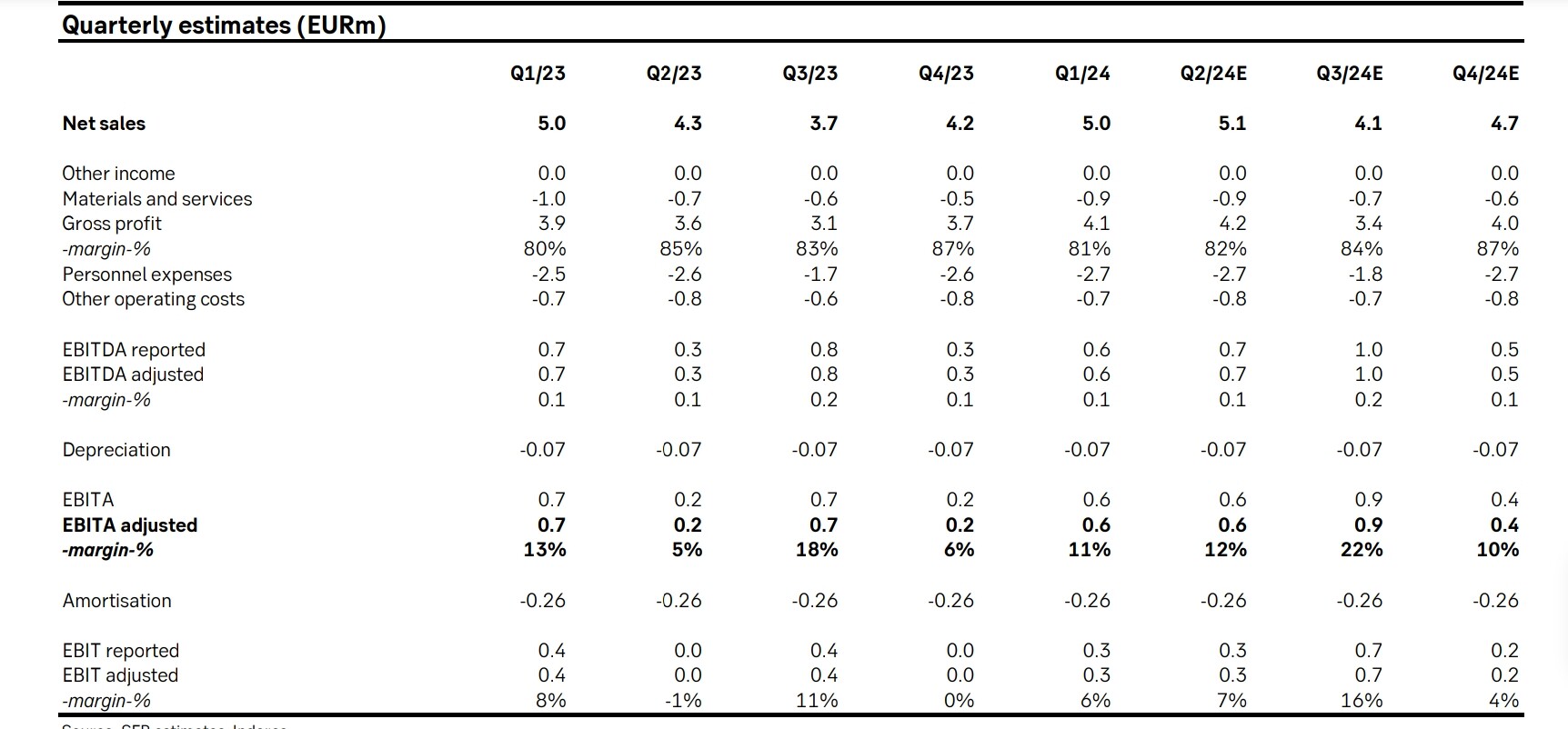

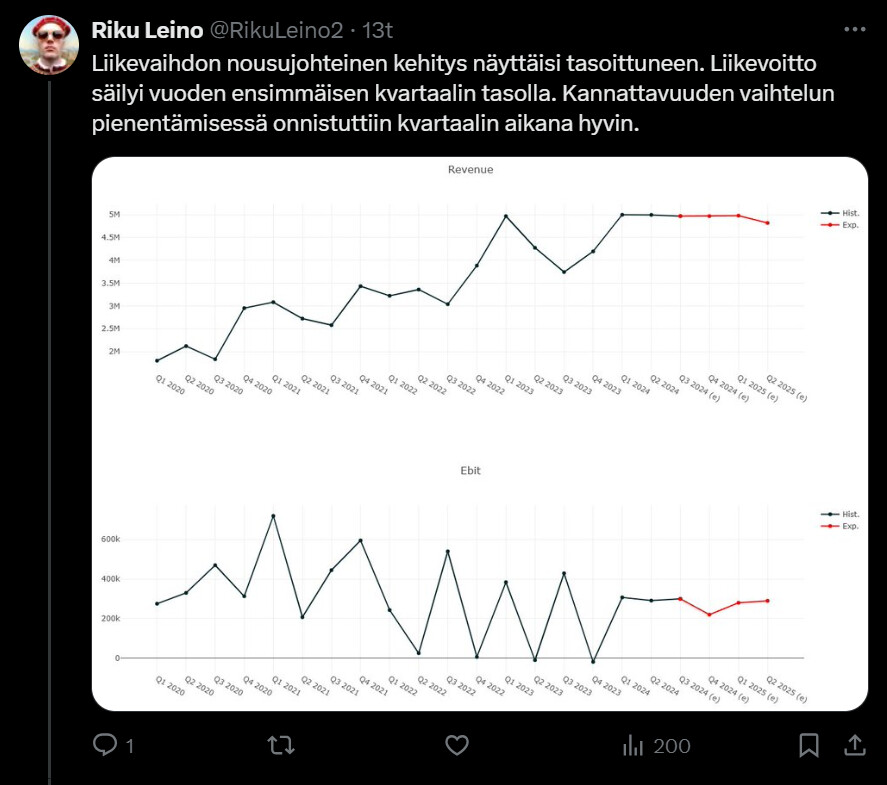

Revenue missed forecasts by a hundred thousand. EBITA just barely rounds out.

Revenue missed forecasts by a hundred thousand. EBITA just barely rounds out.

Let’s also add the July revenue figures for good measure: Inderesin liikevaihto kasvoi 11 prosenttia heinäkuussa 2024

Inderes’ revenue grew by 11 percent in July 2024 and was EUR 1.3 (1.1) million.

The facilities in Sweden look good too.

I expected that the good operating cash flow would have led to more generous “real dividends”. Even these had to be enjoyed under the CFO’s strict supervision.

Takeaways from ‘Lynching’ in Sweden

I thought I’d write down a few thoughts about visiting Inderes’ interim report event and the ideas that sparked from it.

I won’t go back to the interim report or the webcast itself; everyone can take a look at those on the company’s revamped website.

https://group.inderes.fi/

Instead, I thought I’d write about the conversations that took place before and after the cameras and mics were on.

Facilities and the Event

The facilities were quite similar to, for example, Sanomatalo. Apart from the undersigned, there were no outsiders present, if you don’t count the makeup artist. She didn’t stay to listen to the results announcement either, so she apparently wasn’t an active community member or shareholder. The technical execution was handled by the crew from Streamfabriken.

We talked a bit about the occupancy rate of the space, and during peak times, it’s almost at maximum capacity. At other times, there could be more use, but apparently, organizations like the local equity savers’ associations (osakesäästäjät) use the space every now and then.

A bit about the figures

If anyone is wondering why recurring revenue (jatkuva liikevaihto) decreased from the last quarter, it’s because not all companies have Q1 and Q3 reporting. This has probably been mentioned before. Materials and services were higher than usual due to high AGM (yhtiökokous) activity.

I talked with Mikael about the importance of Premium subscribers to the business. He said that while the sum might not be huge, it is significant because it drops almost as-is to the bottom line. In addition to private payers, that revenue also comes from Nordnet and similar players who buy the service for certain clients or employees.

We talked generally about how much companies should disclose segment figures to investors. Some companies justify limited reporting by saying they don’t want to confuse investors. In my opinion, that is underestimating investors. Mikael said that at this point, in Inderes’ case, they don’t want to lock revenue streams into specific segments because it could hinder internal flexibility. Or at least that’s how I understood it and I think I understand what he meant by it, so I accept the explanation.

The Swedish community

After the event, I talked with Tuuli, Isa, and Mikael about the burning question of the day: building the community in Sweden. In these discussions, it emerged that a community is more than just a forum. It can also be X, YouTube, or anything else. In Sweden, specific places and people where investment discussion takes place have already developed. @Isa_Hudd mentioned that she aims to interact a lot with these players. She promised to open up about that side here on the forum as well, as long as I remind her about it.

Perhaps @Yu_Gong could be reminded at this point to tell us how Swedish AGMs differ from Finnish ones, as it was mentioned in the webcast?

The future of analysis

We also talked a bit about the future of analysis, specifically the format. Mikael noted that they have been thinking about better technical solutions than PDF. Just as they have done with the morning report. In my opinion, this would allow for more dynamic solutions, for example, regarding presentations of different scenarios. Apparently, updating the website platform has taken up resources here. These will likely be discussed on the forum for a long time to come.

The guy from Financial Hearings

I was also introduced to a pleasant-seeming guy from Financial Hearings. I’ve already forgotten his name. He said that things are much nicer under Inderes, as there are more people handling things with their own specific tasks. As a small independent firm, tasks tended to pile up on everyone, and he said that symptoms of stomach ulcers have now decreased. He also saw great potential in cross-selling and felt that work is only just beginning. He said that although he isn’t strictly a salesperson, he is happy to tell clients about other Inderes services.

Mikael mentioned that in Sweden, they are soon moving everything under the same name. At the same time, they also plan to move to new premises. This is apparently also happening in Finland. In Sweden, the intention is to get better and more functional facilities. In Finland, as I understand it, the goal is to use the square footage and the work community more efficiently. Currently, they operate on three different floors in Ruoholahti. It will be interesting to see what happens when all the characters are crammed into the same space; to quote, it will likely create “great new ideas, but also conflicts.”

At this point, an internal briefing began, and I was kicked out.

At the door, I remarked to the CFO who was dragging me out that it would be nice if the share price went up. He said that the intention here is indeed to make money.

MY OWN THOUGHTS ON THE COMPANY

Over the past six months, there has been a dialogue of concerned interest regarding Inderes’ operations and future. There are many opinions, and they all have their place. I also find myself reflecting on it as both a user of the services and a shareholder.

Despite the fact that the services provided by Inderes are of very high quality by any measure, the standard expected for continuous development is high. In my opinion, quite rightly so.

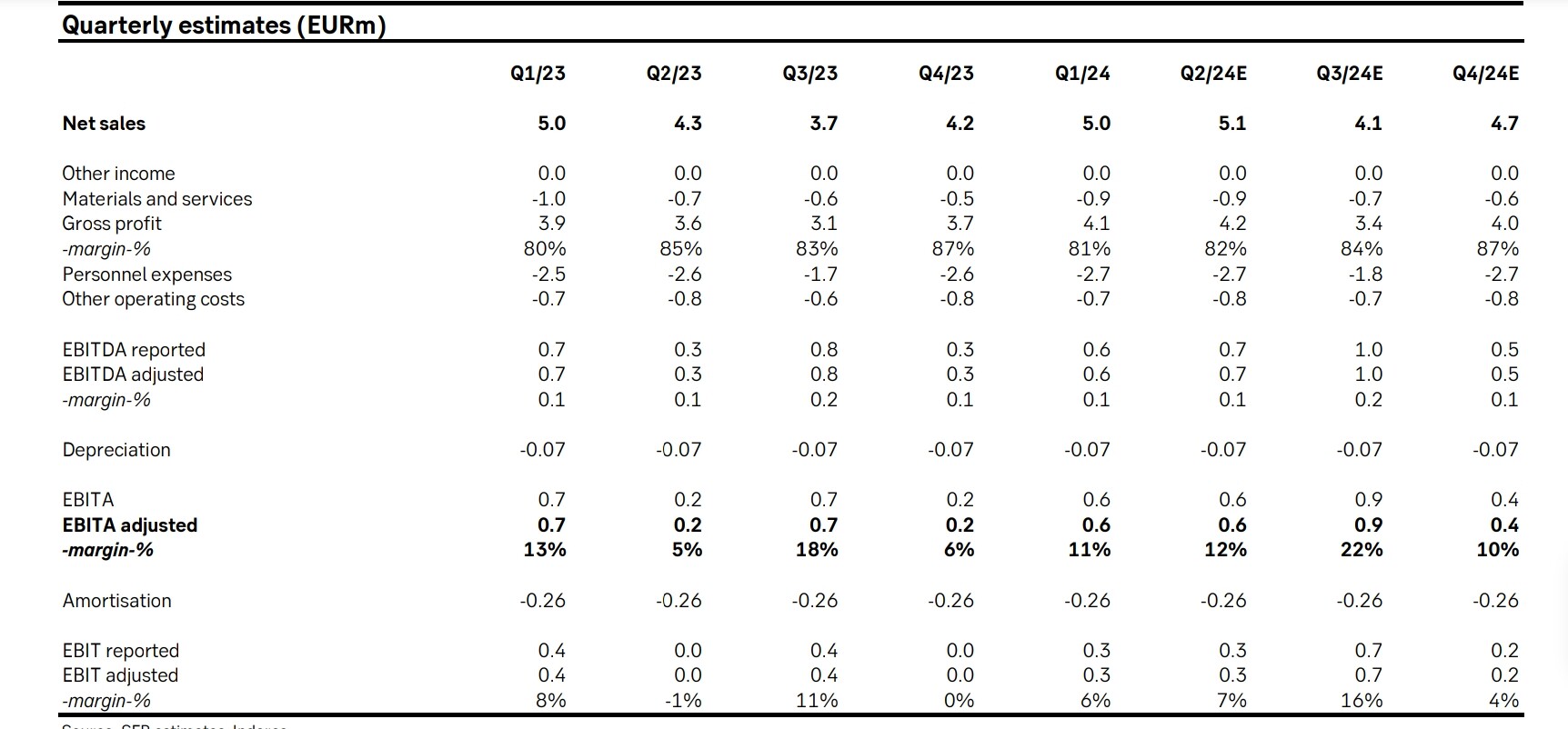

I’ve been thinking about a sort of marketing spiral model for Inderes, which I think well illustrates the diversity of Inderes’ services and community.

Here is a short introduction to the different levels, in case the idea isn’t immediately clear to everyone.

Top side - Investors

Potential new members: These are people who haven’t found Inderes’ service yet but could be interested if they knew of its existence or received some other spark to seek out the service. This could be someone interested in investing but who hasn’t started yet, or a seasoned investor who for some reason hasn’t sought out Inderes’ services. Such a character might need basic information and introductions. The first impression must succeed, as the churn rate for these is high if the content doesn’t interest them.

New members: These people have already found Inderes’ services. They aren’t necessarily on the forum, but perhaps they read reports or watch videos. They don’t necessarily have a complete picture of all Inderes’ services yet. These need guidance, advertising, and reminders about different services. You could also put less-new but infrequent users in this category.

Content users: They don’t necessarily make themselves heard on the forum, for example, but they might even be heavy consumers of the service. They watch most videos and read every extensive report in detail. This can be quite a niche group, but extremely important, and retention here is good. They demand quality.

Content creators and community developers: These people sacrifice a lot of time to investing and also share it with the community, e.g., through their own analyses or just to improve the well-being of the community. At their best, these people even help Inderes’ analysts and other employees with their work.

Bottom side - Companies

Companies actively interacting with the community: Analysis, webcast, interview, and an active company member on the forum.

Companies buying content extensively: Analysis, webcast, and interview.

Companies buying limited content: Only analysis or webcast.

Companies outside the partnership: No analyses or webcasts, but perhaps a community-created thread on the forum.

Left side - Employees

I left these undefined partly out of laziness, partly because I don’t fully know the job descriptions and don’t want to risk offending anyone by being wrong. The intention is just to express that there are various characters working there. From “Wannabe Inderesians” and behind-the-scenes grinders to hardworking analysts and social media wonders visible everywhere.As can be seen, the community includes members of many kinds and levels; certainly, many types were still left undescribed. However, Inderes should strive to serve all of these to the best of its ability in order to keep the flywheel in motion.

That’s all for this time. Overall, it was nice to see and talk with people again. I was well-received, felt that I was heard, and people were also open with me. And it was certainly nice to go do some “Lynch-style” scouting in Stockholm too.

Ps. The screen isn’t actually as dirty as it looks in the photo. Those are reflections from the tree above. ![]()

This could be divided into 3 segments:

Extremely small companies, of which there are more in Sweden than in Helsinki. In these, companies often do everything in Excel or with pen and paper, so the added value of our tool is low.

Companies with concentrated ownership, regardless of whether there are 30 or 100 participants in the meeting; in these companies, the largest owners control the companies quite strongly. In Finland, these companies always offer their shareholders at least voting slips, and some even a mobile app for voting during the meeting. In Sweden, on the other hand, it’s customary in these companies to raise a hand if you want to object (in practice, no one raises their hand due to peer pressure), and companies haven’t historically been used to providing tools even for voting with a slip; they sort of trust that there won’t be a vote. Despite this, our advance voting, on-site registration/bookkeeping, and reporting tools for the AGM are value-adding components, especially when combined with production/design and hybrid/virtual features; our winning recipe seems to work.

Large meetings: These can also have the phenomenon of concentrated ownership mentioned above, where on-site voting components are not necessary, but some also provide voting slips and are very suitable as our target customers, especially if there is also a need for hybrid and virtual components. In this segment, combining with production and design expertise also makes us shine in Sweden. Definitely the most attractive segment.

Hopefully, this information helps you understand the AGM services business better, and let me know if I can clarify! ![]()

Would there be a demand for the services provided by Inderes in Germany? At the very least, it would be worth conducting some market research in that direction. It is a short distance from Denmark to Germany.

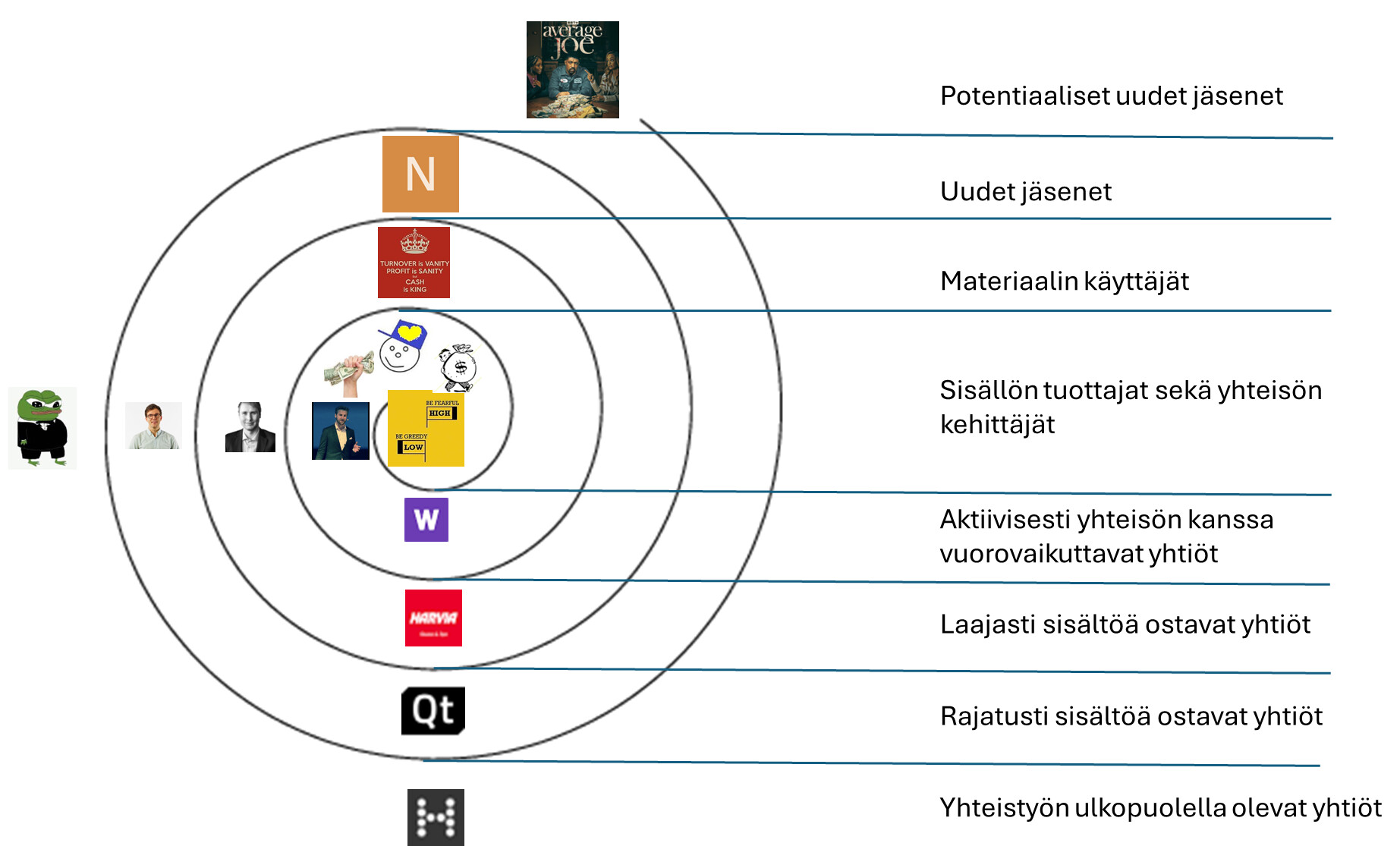

Here is Riku Leino’s timely tweet thread about Inderes, it’s worth following Riku on X. ![]()

https://x.com/RikuLeino2/status/1823248562483790106

Tässä on sitten vähän virallisempaa lyysiä SEB:in tapaan. ![]()

Inderes reported Q2 broadly in line with our expectations. Also July sales were reported and sales for the month were slightly above our estimate as the IR software business kept performing. Swedish business ticked up from a low base roughly in line with our assumptions. Our first impression is neutral to slightly positive thanks to the continued increase in commission research contracts and the emerging breakthrough of the IR software business.

Tässä vielä yön yli analyysia: Inderes Group - Fight against the market - SEB

Another intense and energizing trip to Stockholm is behind me, many thanks to the grandmaster of Lynch-style investing @_TeemuHinkula for the visit! I will get back to the questions in the queue here in the coming days ![]()

Indeed, @Isa_Hudd mentioned that she aims to collaborate with Swedish investor influencers.

I took a look at some of the figures interviewed on the Inderes Nordic channel.

https://www.youtube.com/watch?v=mnr2kFVj5Tg&t=23s

The video has been viewed 8,500 times. Nicklas Andersson has just under 90,000 followers on X.

https://www.youtube.com/watch?v=d_0piqpqwIc&t=13s

The video has been viewed 2,900 times. Albin Kjellberg has 26,000 followers on X.

https://www.youtube.com/watch?v=slMj4QAN_Fo&t=56s

The video has been viewed 1,300 times. Elin Wiker has just under 10,000 followers on X.

Utilizing influencers like this is likely a good way to raise awareness of Inderes among Swedish investors when they share videos on their own channels.

This group also seems to be using Inderes’ facilities for their own projects. Perhaps that increases awareness, at least within the “inner circle.”

Noniin, kiitos hyvistä keskusteluista. Koitan vastailla kysymyksiin ja antaa omia näkökulmia keskusteluun vähän teemoittain. Pikkaisen taas tj:n ajatuksenvirtaa, mutta kevyempi lähestyminen sallittakoon foorumikontekstiin ![]()

Kansainvälistymisestä, muutoksesta ja kulttuurista

Omistajan ja arvonluonnin näkökulmasta mielestäni Inderesissä keskeinen kysymys on onnistummeko löytämään reseptin, jolla Inderesin toimintamalli viedään uuteen markkinaan. Tämä on se ratkaistava ongelma, minkä eteen omassa tj-roolissani teen ajatustyötä vähintään yhtä pakkomielteisesti kuin mitä 10 vuotta sitten pohdin tilausanalyysiliiketoiminnan rakentamisen reseptiä. Nykytilanteessa on erityistä se, että pääsen tekemään tätä työtä huomattavasti isomman ja moniosaavan tiimin kanssa. Pyrin lähestymään tässä myös analyysiin kohdistuvaa kritiikkiä kansainvälistymisen teeman kautta.

Monesti kuulee puhetta kulttuurin suojelemisesta ja kulttuurin ”viemisestä” uuteen maahan, mutta Inderes yhtiönä ja meidän kulttuuri tulee muuttumaan valtavasti, kun tämä kv-matka etenee ja kiihtyy. Tietyt ydinarvot ja periaatteet meillä pysyvät muuttumattomina, mutta muilla alueilla on ajettava jatkuvaa muutosta ja uudistumista yhteisön, asiakkaiden ja kilpailun kirittämänä. Foundereilla voi olla rooli varmistaa, että tietyt yhtiötä määrittävät ydinarvot kuten riippumattomuus on sementoitu tukevasti tekemiseen. Hyväksyn myös sen, että jos onnistumme siinä mitä yritämme tehdä, meistä tulee ns ”iso” kansainvälinen pörssiyhtiö, joka ei enää tunnu samalta.

(Playbookissa on kuvattu tasapaino muutoksen ajamisen ja ytimen välillä)

Foorumin ja yhteisönrakennuksen rooli kansainvälistymisessä ja ollaanko Ruotsin foorumin kehitykseen tyytyväisiä?

Muutama ajatus siitä miten foorumi kytkeytyy meidän strategiaan - huom tämä on siis nykyinen näkemys go-to-marketista ja taktiikka voi muuttua matkalla. Jos meillä olisi iso aktiivinen foorumi, se tietenkin helpottaisi huomattavasti Ruotsin markkinalle menoa. Strategiassamme foorumi ei kuitenkaan tule ensimmäisessä vaiheessa vaan paljon myöhemmin, enemmänkin se on seurausta analyysissä onnistumisesta ja seurantaportfolion kasvusta. Suomessa meillä oli karkeasti 30 hengen analyysi&yhteisö -tiimi, 100 yhtiötä seurannassa ja takana 10 toimintavuotta ennen kuin meillä oli relevantti foorumi pystyssä. Ruotsissa laitoimme foorumin heti alussa pystyyn, pienimuotoisenakin se auttaa meitä oppimaan tekemisen kautta jatkuvasti. Luvut ovat vielä pieniä, mutta niitä on relevanttia jo nyt seurata ja oppia niistä.

Suomessa hyvin toiminut taktiikkamme (jonka uskon toimivan myös Ruotsissa) oli jalkautua jo olemassa oleviin keskustelualustoihin ja toimialan verkostoihin (talousmedia mukaan lukien), osallistua keskusteluihin ja alkaa tätä kautta rakentamaan nimeä ja vähitellen yhteisöä. Tämä taktiikka oli ja on mielestäni monesti edelleen hyvin vieras ajatus suljetuissa ekosysteemeissä toimivalle rahoitus/analyysitoimialalle. Se taas luo erottumistekijän. Yhteisöä siis pystyy rakentamaan myös olemassa olevissa ”muiden” alustoissa ilman itse omistettua alustaa. Tämän osalta Ruotsissa tiimi on muuten saanut hyviä päänavauksia kuten Uppesittarkväll. Kun riittävä luottamus käyttäjiin alkaa syntyä ja omalla alustalla on jotain vielä parempaa myös tarjolla, alkaa oman alustan käyttäjämäärät kasvaa vähitellen, kehityksen näyttäessä alussa usein tuskaisen hitaalta.

Tavoitteemme yrityksenä ei ole voittaa kilpailussa muita keskustelualustoja ja siihen kilpailuun ei kannata edes lähteä, jos markkinalla on jo huippuhyviä vaihtoehtoja olemassa. Ylipäätään Ruotsissa ohjaava ajatuksemme on sijoittajatiedon demokratisointi – ei muiden voittaminen. Tämä ajattelu lähtee enemmän siitä, että kytkeydymme toimialan ekosysteemiin yhtenä toimijana, joka tuo yhtälöön jonkin lisän, joka hyödyttää kokonaisuutta. Siinä rikastamme kokonaisuutta ja olemme uniikki, että Inderesin alustalla kaikki sijoittajat, turkulaiset putkiasentajat, pääsevät keskustelemaan analyytikoiden ja tulevaisuudessa kasvavassa määrin myös yhtiöiden edustajien kanssa. Tämä on se niche, missä meillä on varmasti jotain erottuvaa annettavaa Ruotsin sijoituskeskusteluiden kilpaillulla kentällä. Jotta se voi toteutua, tarvitaan polttoaineeksi tietenkin analyysiä. Analyysituotteemme on näkemykseni mukaan kilpailukykyinen markkinassa jo nyt ilman aktiivista foorumia, mutta vahvasta foorumista rakentuu tuotteelle epäreilu kilpailuetu.

Kehittyykö analyysi tarpeeksi nopeasti?

Otan kritiikin analyysiä koskien nöyrästi vastaan ja koitan muistuttaa itselleni miten etuoikeutettu yrityksenä Inderes on, kun saamme jatkuvaa näin suoraa välittävää palautetta. Olen viime päivät tunnustellut mielessäni tätä ”välittävän palautteen” käsitettä, se on loistava ajatus ja parhaimmillaan heijastelee laadukasta yhteiseen päämäärään suuntautuvaa keskustelua ja väittelyä, josta jää turha provosointi pois.

Näin yhtiöketjussa Inderesin osakkeenomistajan näkökulmasta olennaisin kysymyksenasettelu tai tulokulma haastaa analyysiliiketoimintaa (ja kaikkia muita tuotteita) on kysyä, onko analyysituotteemme riittävän kilpailukykyinen kansainvälisille markkinoille? Inderes on hyppäämässä pienen Suomen piirimestaruuskisoista isompaan liigaan ja uhmaa pärjäävänsä Euroopan aivan ylivoimaisesti kehittyneimmällä pääomamarkkinalla. Tuotteen pitää olla maailmanluokan kunnossa ja samalla kehittyä jatkuvasti kovemmalla kellotaajuudella muuttuvan markkinan mukana, jotta siinä markkinassa pärjää. Jos kuvittelemme, että tuote on jotenkin valmis eikä tässä hirveästi voi enää sitä parantaa, olen ihan samaa mieltä, että laajentuminen ei tule onnistumaan ja jossain vaiheessa lähtee Suomessakin pohja murenemaan. Pohjolan1 näytti kalvoa, josta oli jätetty pois Tanskan ja Ruotsin liput, mutta Inderesin analyysibisneshän on kaikkea muuta paitsi kypsä strategiassa valittujen markkinoiden kontekstissa (vasta reilu 10 % penetraatio). Meillä on sisäänrakennettuna valtava tahto kehittyä paremmaksi siinä mitä teemme ja kansainvälistyminen nostaa riman taas korkeammalle.

Tilausta ja tarvetta Inderesille näillä markkinoilla on. Mitä tulee analyysiin niin sijoittajatieto ei ole demokratisoitu. Kansainvälistyminen on myös paljon enemmän kokonaan uuden kategorian luomista kuin olemassa olevan kakun syömistä kilpailijoilta. Inderesille ominaista on, että A) menemme niihin pääomamarkkinan kategorioihin, missä on selkeitä toimimattomia rakenteita ja toimimatonta kilpailua (kuten AGM ja IR-softa) tai B) luomme pääasiassa itse omat markkinamme tyhjästä (kuten tilausanalyysi ja IR-tapahtumat) johonkin rakoon, jossa markkinalla on selkeä tarve. Jos markkinalla on jo huippuhyviä palveluita, sijoittajatieto on jo demokratisoitu eikä varsinaista ratkottavaa ongelmaa ole, ei sellaiseen bisnekseen ole mitään järkeä mennä. Meidän strategiassa valituissa tuotteissa ja markkinoissa näemme paljon kohtien A ja B kaltaista dynamiikkaa – toimimattomia, usein monopolistisia rakenteita tai sitä, ettei palveluita ole alkuunkaan sijoittajien tai yhtiöiden saatavilla. Olen siitä eri mieltä, että muiden tuotealueiden rakentaminen olisi vienyt fokuksen pois, uusien tuotteiden menestys ei ole mitenkään pois analyysin fokukselta vaan vahvistaa liiketoimintamallia kokonaisuutena.

Palataan hetkeksi Suomeen ja historiaan siltä osin kuin se auttaa meitä hahmottamaan uuden markkinan avaamisen haastetta. Tilausanalyysikategorian luominen aikanaan Suomeen edellytti ihan valtavaa kellotaajuutta uuden kokeilussa. Tämä näyttäytyi mm. siinä miten veimme analyysisisältöjä kulta-aikaa eläneeseen some-maailmaan aikana jolloin Zuckerbergin algoritmit ruokkivat meille aivan käsittämättömän suurta näkyvyyttä täysin maksutta… kunnes Markista tuli ahne ja Inderesin oli reagoitava kehittämällä omaa alustaa ja menemällä uusiin alustoihin. Ja sinne matkalle mahtui myös paljon epäonnistumisia ja suorastaan hölmöjä sekoiluja jotka maksoivat rahaa ja saivat osakseen kaikenlaista ivanaurua. Uskon että seuraavan markkinan avaamisen reseptin löytäminen ja ylipäätään eteenpäin kehittyminen vaatii korkeaa kellotaajuutta uuden kehittämiseen (lähestulkoon ilmaista teknologiaa ja työkaluja kehittymiseen on taas moninkertaisesti enemmän kuin 10 vuotta sitten) sekä rohkeutta epäonnistua, meidän hpj:n sanastoa lainatakseni työskentelyä kreisihäröilyn sallivassa ympäristössä. En itse tule todennäköisesti keksimään niitä seuraavia uusia isoja innovaatioita, mutta työni on varmistaa että niiden syntymiseen johtava ajattelutapa ja keskustelu kukoistaa läpi organisaation, pysyä poissa tieltä kun kreisihäröily lähtee laukalle ja varmistaa ettei edes kakkaemojitykkien ja osarinuotioiden kaltaista möhlimistä tarvitse pelätä.

Seuraava pointti menee nyt vähän selittelyn puolelle ja ammun sen heti alas, mutta onhan meihin vaikuttanut myös se, että kun bisnes on tulikuumaa ja tulosta syntyy (kuten 2017-2021), niin silloin on tosi helppo kokeilla ja pilotoida kaikenlaista. Kun mennään laskusuhdanteeseen ja kutistuvaan markkinaan, on pakko pitää huolta perustasta ja ehkä vähän jarruttaa, koska jatkuvasti terve ja kannattava liiketoiminta on meidän tietoisesti tekemä valinta. Tämän sanottuani on minulta johtamislaiskuutta väittää, etteikö meillä resursseja olisi toiminnan kehittämiseen. Koko Inderesin menestys on perustunut siihen, että äärimmäisen niukoilla resursseilla saadaan isoja vaikuttavia asioita aikaan, ja toisaalta resurssejahan yrityksenä meillä on tänä päivänä kiistatta enemmän kuin koskaan.

Tähän väliin kiitos palautteista! Jos palvelumme kehittyy yhteisön silmissä liian hitaasti, on se syytä lukea tarkkaan ja tarkkaan se luetaan. Nykyaikana kuluttajapalveluiden odotetaan kehittyvän nopeasti. Tämä meidän pitää nyt vieläpä pystyä yhdistämään sen kanssa, että meidän B2C-palveluiden kehityksestä tulee taas samaan aikaan kokoajan kompleksisempaa, mitä enemmän on käyttäjiä, eri tuotteita ja toimintamaita. Ja sen olemme myös tunnistaneet, että voisimme olla parempia siinä miten aktiivisesti kerromme ja markkinoimme uudistuksista.

Onko analyysin kilpailukyky heikentynyt?

Kilpailussa Ruotsin analyysimarkkinalla on ollut jonkin verran aika sakeaakin menoa, mutta on siellä myös hyviä toimijoita, jotka tekevät kovaa kehitystyötä. Tällä hetkellä monien seurantojen kutistuessa olemme käytännössä yksi harvoja tilausanalyysitoimijoita, joka kasvaa Pohjoismaissa. Siitä voi olla ylpeä, että näiden numeroiden valossa kilpailukykymme ei heikkene, mutta ei pidä sokaistua sen tarkoittavan meidän kilpailukyvyn olevan huipussa. Kilpailua toki käydään muustakin kuin tilausanalyysisopimuksista Inderes-kontekstissa. IR-some-skenessä on Sijoituskästin kaltaista palveluntarjoajaa nousemassa myös Ruotsissa. Tanskassa taas HCA otti IR-some kategorian Tanskan markkinassa käytännössä yksin haltuun muutamassa vuodessa täysin uutena toimijana. Toimintakenttä elää tavallaan tosi nopeasti B2C-puolella ja digitaalisessa ympäristössä. Sitten taas reguloidummassa päässä toimialaa muutos tuntuu olevan verrattain hidasta.

Rakastan kilpailua silloin kun se pitää meidät varpaillaan ja auttaa kehittymään paremmaksi. En rakasta kilpailua, kun se on ylimielistä, tunkkaista ja vähättelevää. Molempia on kohdattu alallamme, ja uudet modernit toimijat edustavat poikkeuksetta ensimmäistä. Tässä keskustelussa välähtänyttä Sijoituskästiä ei kannata vähätellä. Kun sijoittajaviestintä siirtyy pankkien kabineteista digitaaliseen maailmaan, uusia palveluntarjoajia ja formaatteja syntyy varmasti. Osa niistä voi antaa meille inspiraatiota, osa on suoraa kilpailua ja usein uusi kilpailu myös kasvattaa meidän kategoriaa kokonaisuutena. Pointti Sijoituskästin ja muiden uusien toimijoiden suhteen ei ole se, mitä kaverit juuri nyt tekee, vaan miten nopeasti ja ketterästi kehittyvät. Puhuin Sijoituskästin kavereiden kanssa pitkän puhelun viime talvena, loskaisella kävelyllä toimistolle läpi Södermalmin, jossa sparrasin kavereita käytännön tasolla miten IR:ää ostajana kannattaa lähestyä ja minkälaisia asioita asiakassopimuksissa kannattaa ottaa huomioon. Terveiset Teemulle ja Kevinille! Itse fanitan kun joku nuorena ja ennakkoluulottomana lähtee tekemään uutta, koen innostavana jos voin itse jotenkin inspiroida tai sparrata uusia yrittäjiä.

Jos muuten keskustelujen seasta unohtuu jonkun kysymys vastaamatta niin pingatkaa vain minua rohkeasti täällä tai privaviestillä!

I forgot to answer this! I will answer on a general level without referring to specific clients. Our contract periods are always valid for at least 12 months at a time, meaning we always continue coverage at least until the end of the period. During that time, the company cannot withdraw the coverage even if they wanted to. This is also a promise from us to investors to ensure continuity in coverage. If a client has financial challenges, they are always handled on a case-by-case basis; the best solution is to pick up the phone and discuss what the best long-term arrangement would be. If a company is doing poorly or there are major changes, investors’ need for information often only increases, and of course, we aim to find a solution in these situations that allows us to serve investors.

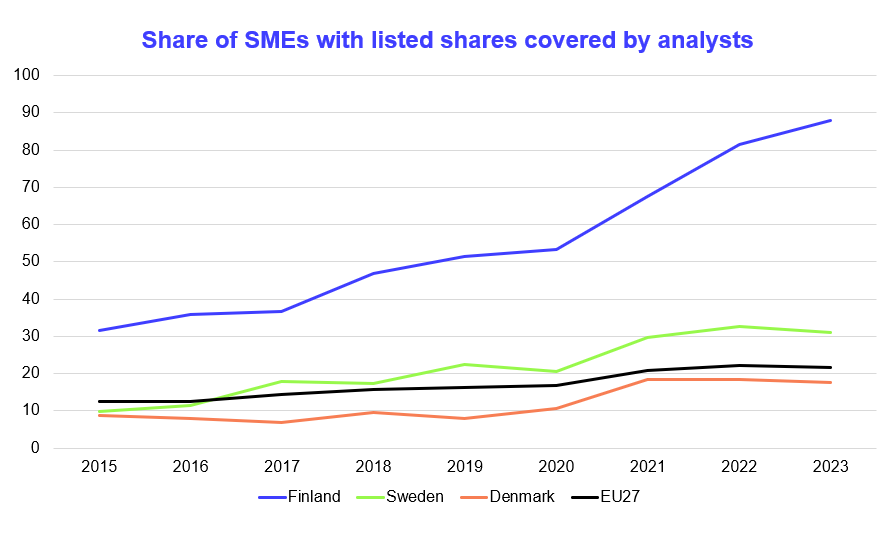

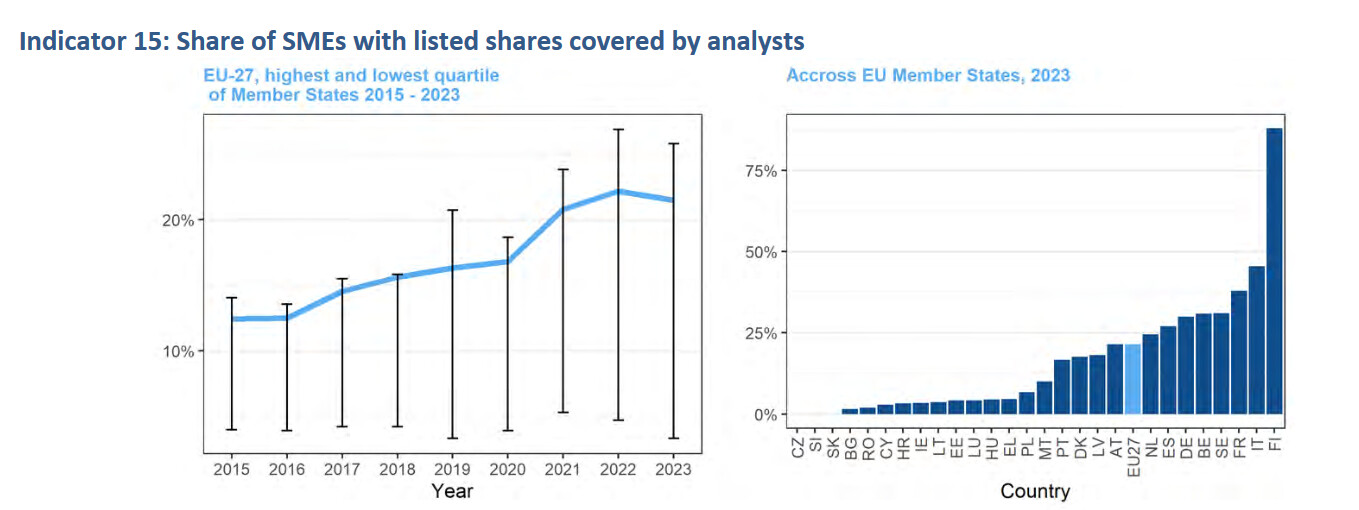

Fresh data from the European Commission on analyst coverage for small and medium-sized listed companies; I’ve plotted the statistics for our operating countries on a timeline. Finland reached 88%, but in Europe, four out of five small/mid-cap companies lack analyst coverage entirely. At the EU level and in Sweden, there was a slight decline in 2023 after a slow upward trend — in the previous bear market at least, it was specifically analyst coverage for small and medium-sized companies that was heavily cut. There is plenty of market potential and work to be done!

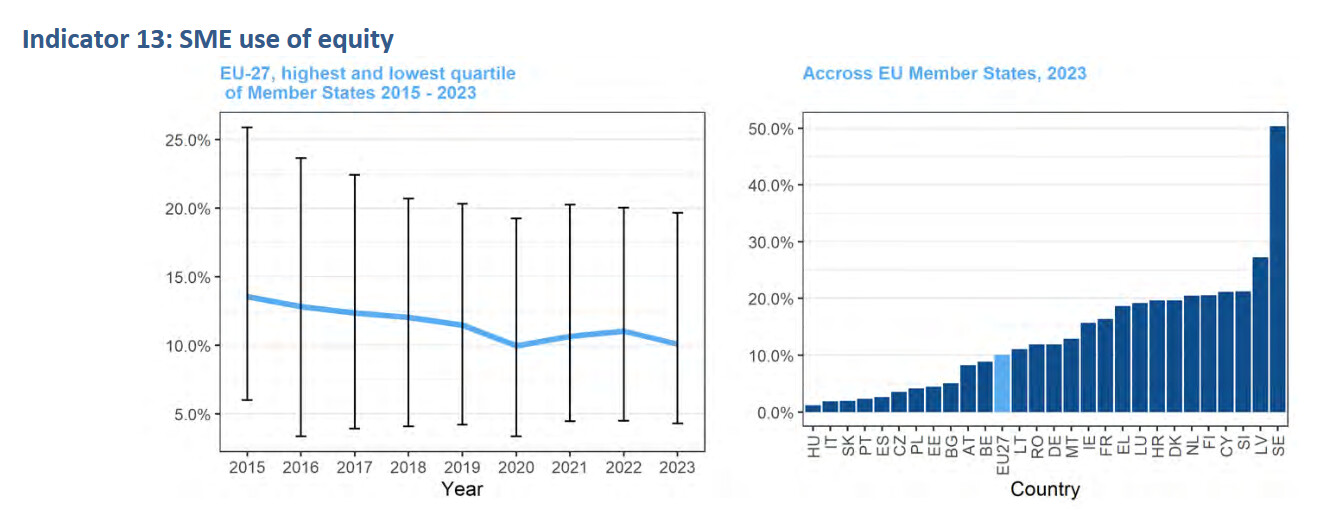

Swedish companies, however, consider equity financing to be the most relevant among the different countries (Share of SMEs indicating in SAFE that equity is relevant for them)

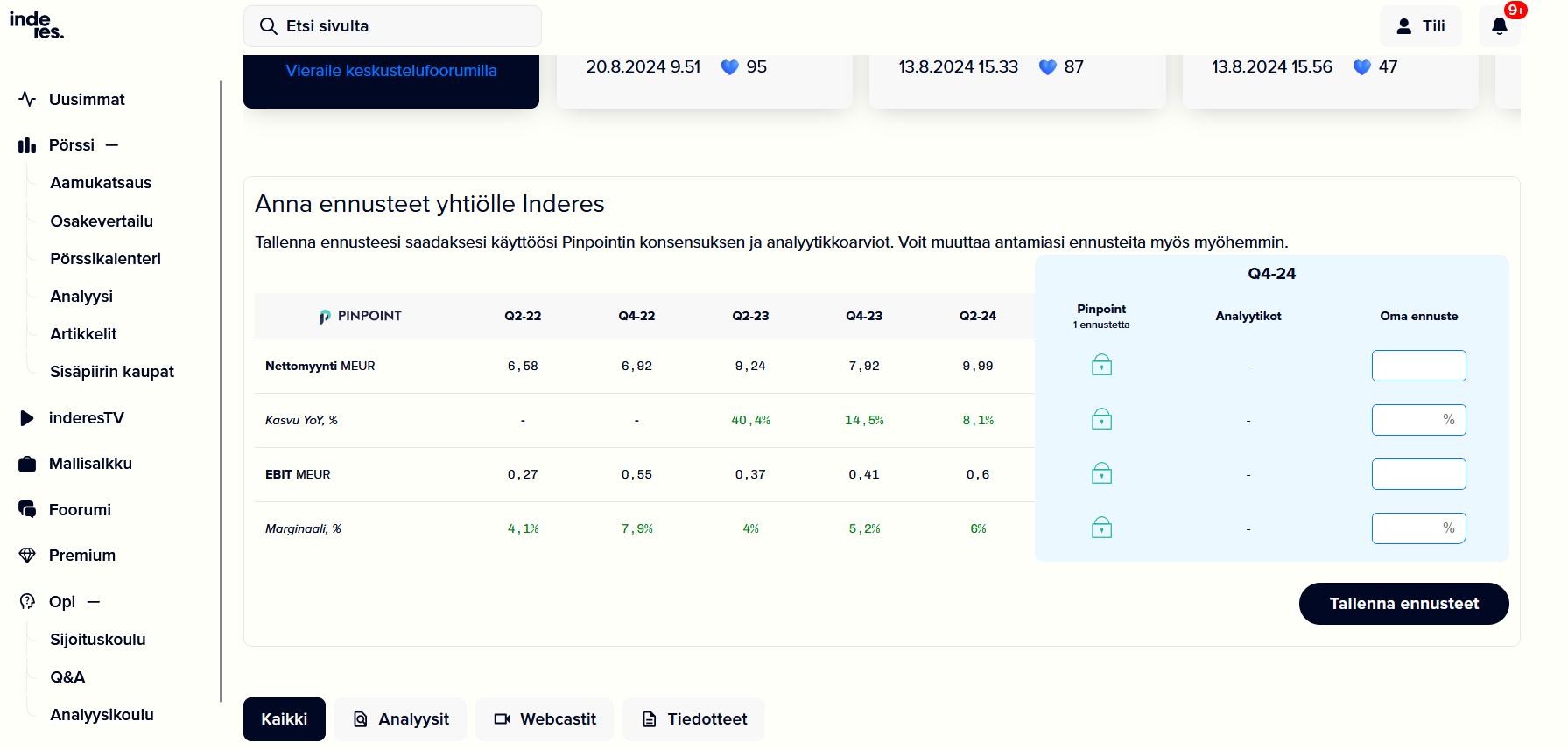

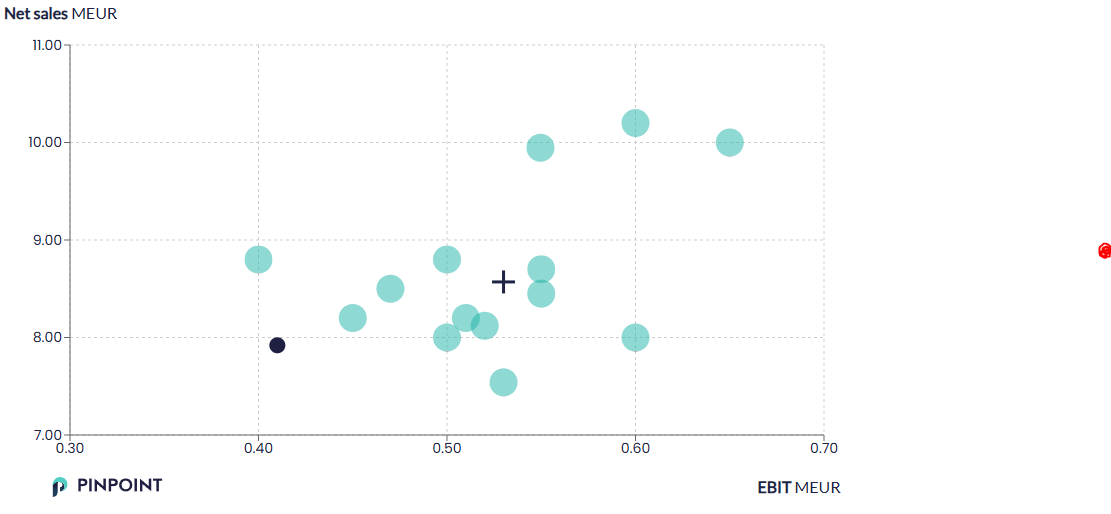

Can I ask for a little help with testing? We have introduced Pinpoint Estimates’ forecasting feature to our company pages. The idea is that the community can provide their own forecasts, and from the resulting consensus, companies and investors can gauge where market expectations stand. It’s a Stockholm-based startup that’s doing quite well and, as I understand it, this has gained some traction in Sweden. The business model is to sell IR services to companies.

So, if you’ve looked into our numbers at all, you can go there and enter your own forecasts for the H2 results. Let’s see what comes out of it ![]() Note: we are forecasting EBIT, i.e., operating profit after FAS (Finnish Accounting Standards) depreciation, not EBITA.

Note: we are forecasting EBIT, i.e., operating profit after FAS (Finnish Accounting Standards) depreciation, not EBITA.

If you have anything to discuss regarding the functionality itself, then https://keskustelut.inderes.fi/t/inderes-fi-sisallon-kehitysideat/71 is the right thread!

And the company page can be found here:

3 posts were merged into the thread: Inderes.fi content development ideas

Inderes seems to have overtaken RedEye in the number of companies under coverage.

Inderes 173

RE 171

Pinpoint consensus currently expects EUR 8.57 million in revenue and EUR 0.53 million in operating profit from Inderes for the remainder of the year. Analysts have slightly higher expectations (red dot), if I understood the report correctly at a quick glance. One could imagine that there will be movement in the share price or analyst forecasts, as there is a fairly significant difference in expectations.

Thanks to everyone who has submitted estimates! I just spoke with the folks at Pinpoint; they are seeing if they could change it so that Q1 and Q3 can also be forecasted, and if we replace EBIT with EBITA, there’s no need to guess goodwill amortizations.

I would also be interested in long-term annual estimates; as I understand it, this feature isn’t in the Inderes service component yet, but by registering directly with Pinpoint, you can apparently submit longer-term estimates: https://pinpointestimates.com/fi

I’d love to hear your feedback on this—if the feature is well-received and we start getting interesting forecast data regarding market expectations, we’ll consider their IR service!