GRANGEX AB is a company unknown to many Finns, and even if one were to visit Kirkenes, Norway, one might not necessarily encounter the company’s most important asset and investment target, namely the enormous Sydvaranger iron ore mine, which has a glorious past behind it. The mine was founded in 1906, and production continued through the wars until 1997, when operations were shut down due to unprofitability. A new attempt was made after this in 2007, but the subsequent owner, Northern Iron, also went bankrupt with the mine in 2015. After this, the mine and Kirkenes awaited a new owner, and these hopes were answered in May 2024, when the Swedish company GRANGEX AB managed to secure financing to purchase the mine. The purchase price was 33 million USD, and at this price, GRANGEX AB thus acquired full ownership of the mine. In addition to Sydvaranger, GRANGEX AB has other projects, but since their impact on the share valuation is very small, it can be stated, with only slight exaggeration, that GRANGEX AB is synonymous with the Sydvaranger mining project.

GRANGEX AB cannot alone develop the mine to full production; further financing arrangements are needed, for which, according to the company, all options are open. However, the Norwegian state provides a tailwind for the project, as, being a non-EU country, it can more freely support this project. Furthermore, the municipality of Kirkenes needs more jobs after the closure of the Russian border, meaning the state and decision-makers in Finnmark have significant goals for promoting this project themselves. Directly, the mine would employ 450 people, and indirect effects would, according to calculations, bring approximately 1000 additional jobs to the region. Last but not least, according to the latest estimates, the mine has every chance of generating strong cash flow throughout its lifespan.

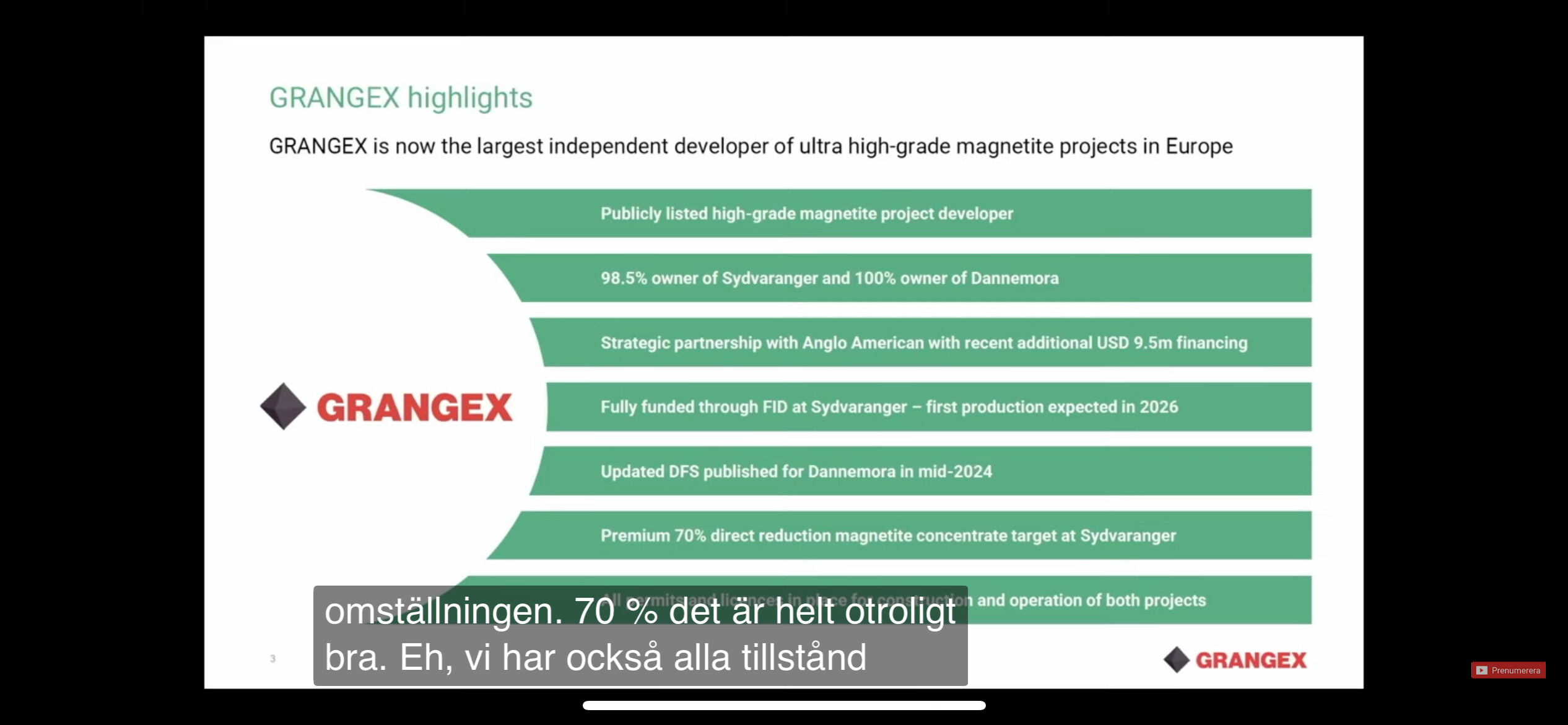

So far, everything is going well; at least on paper, the mine’s start-up is quick, the mine’s production is high-quality, the infrastructure is ready, permits are in order, and skilled labor is available. What could go wrong?

In fact, the mine, and consequently GRANGEX AB, has one major production bottleneck that could determine everything, and that is the quality of production. Previously, this has been a challenge, but GRANGEX AB intends to solve it by using direct reduction with hydrogen. When constructing an investment thesis, one must practically take a stance on whether this production method will succeed, as everything else in this project has been pre-conceived, researched, professionally prepared, and partially financed.

This investment story is simultaneously simple yet very challenging. It involves restarting production at an old mine, and with infrastructure, workforce, and permitting in order, the mine’s operational ramp-up can begin directly in 2027. However, the share price has been ‘finding its level,’ which has clearly frustrated Grangex’s management. One challenge likely lies in the fact that, despite its scale, this project is not widely known, even though comprehensive material has been prepared for investors and the company strives to be visible to small investors as well. Consequently, the share’s valuation is at an interesting level.

This is naturally a high-risk investment, and it is highly advisable to study the investor material before even considering investing. Furthermore, individual news items can strongly sway this stock in one direction or another. On the other hand, the risk/reward ratio might be more favorable in this case because the company is likely still relatively unknown to the general public. I particularly encourage you to familiarize yourself with the project’s PEA and other extensive investor materials, as well as the assessments of industry experts and analysts. Hopefully, all the knowledge and expertise of the Inderes community will also accumulate in this thread, as this forum has analyzed other somewhat similar projects.