Firman lappu:

Fourth quarter of 2025 (Q4 2024)

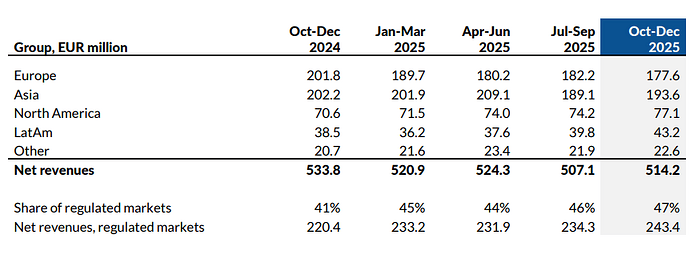

• Net revenues decreased 3.7% to EUR 514.2 million (533.8) and total operating revenues decreased 9.5% to EUR 565.9 million (625.3)

• Adjusted EBITDA (excluding other operating revenues) decreased 6.1% to EUR 341.5 million (363.6), corresponding to a margin of 66.4% (68.1)

• EBITDA decreased 13.6% to EUR 393.2 million (455.0)

• Profit for the period amounted to EUR 306.8 million (377.1)

• Earnings per share amounted to EUR 1.54 (1.83)

January-December 2025 (2024)

• Net revenues increased 0.2% to EUR 2,066.5 million (2,063.1) and total operating revenues decreased 4.3% to 2,118.2 million (2,214.1)

• Adjusted EBITDA (excluding other operating revenues) decreased 3.2% to EUR 1,365.7 million (1,410.7), corresponding to a margin of 66.1% (68.4)

• EBITDA decreased 9.2% to EUR 1,417.3 million (1,561.8) • Profit for the period amounted to EUR 1,062.1 million (1,244.0)

• Earnings per share amounted to EUR 5.24 (5.94)

Aasia:

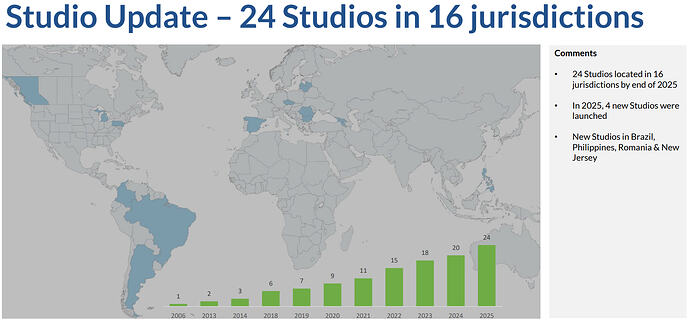

Zooming in on the fourth quarter, Asia has turned back to growth compared to the third quarter, signaling some progress in our hard work to combat cyber criminality. The progress is slow, methodical, and very important. Our studio in the Philippines is also continuing to develop nicely.

USA;

We continue to grow decently in North America even if we want it to go faster. It is still early days for the online gaming industry, and we believe the region will see an increasing share of Live. To increase penetration and options, we re-launched our second brand Ezugi during the quarter, starting in New Jersey with a clear goal to become the #2 Live Casino provider in the US. As a next step, we will establish a new studio in Grand Rapids to support Ezugi’s expansion to Michigan.

Latin America:

Latin America grew well year-on-year. Brazil is continuing to progress following the new regulation, and we see that players are increasingly discovering and enjoying our wide portfolio of games.

EU:

however, development in Europe was not good, burdened by unfavorable regulatory movements. We believe that Evolution currently has the strongest ring-fencing measures in place among all suppliers, but we also recognize that the regulated markets are losing ground. The regulatory scale is not in balance, and this development is bad for the most vulnerable players. However, the scale tends to swing over time, and we remain as committed as ever to providing European operators and players with the most entertaining experiences