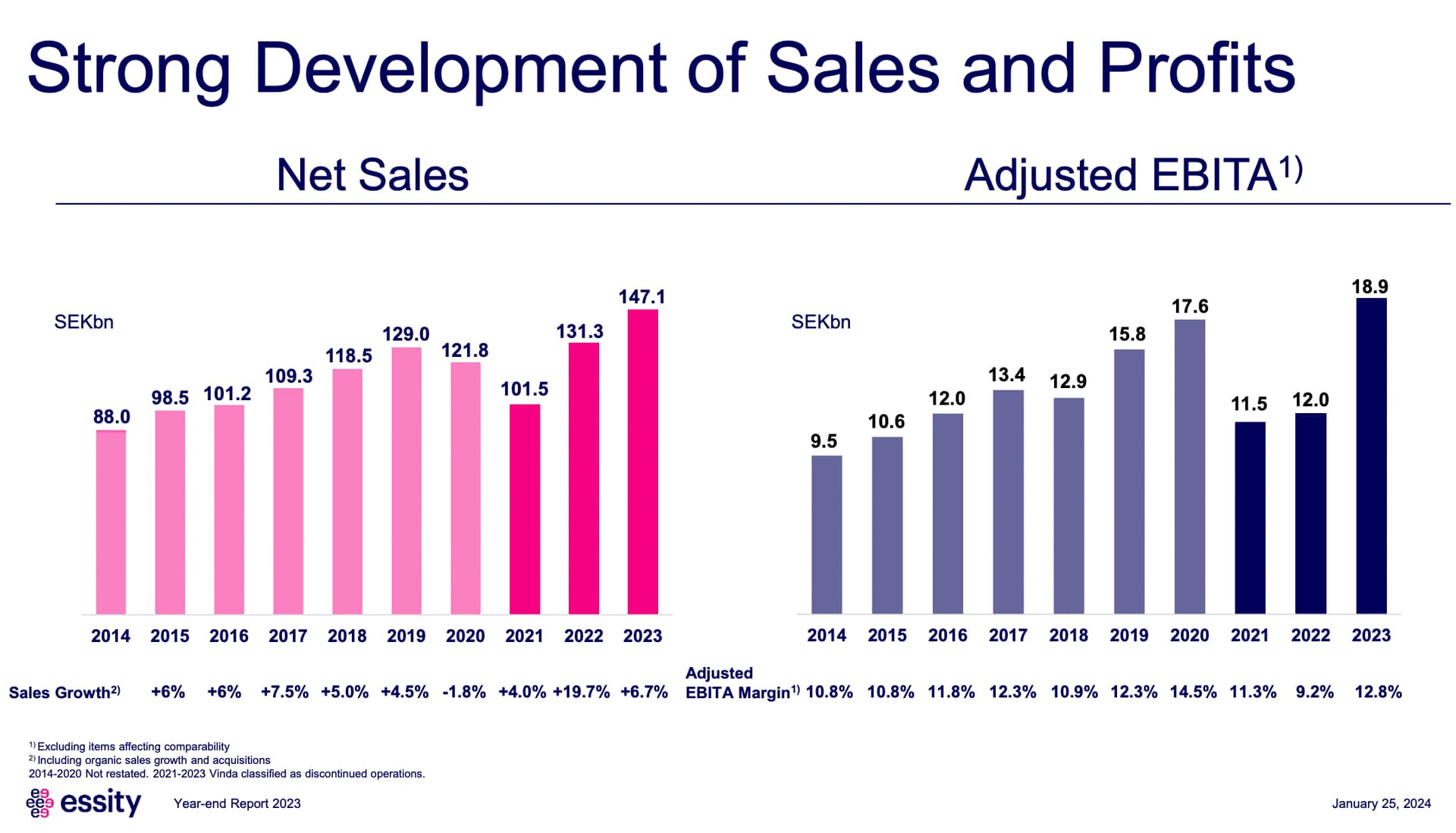

Essity has very high-quality businesses. The company went public at a valuation that was a bit too high, but the valuation has now settled at reasonable levels. If growth continues, the company’s value should catch up at some point. I would consider it a company with a similar growth profile to Huhtamäki. No major dividend yield as a starting point, but a fairly significant growth option that has been well-realized historically.

Personally, I like companies where the product portfolio remains relatively similar from year to year. It’s nice to build a compounding effect on something that doesn’t need to be reinvented every year.

In Essity’s case, we saw how the consumer ultimately pays for inflation and that strong companies have pricing power.