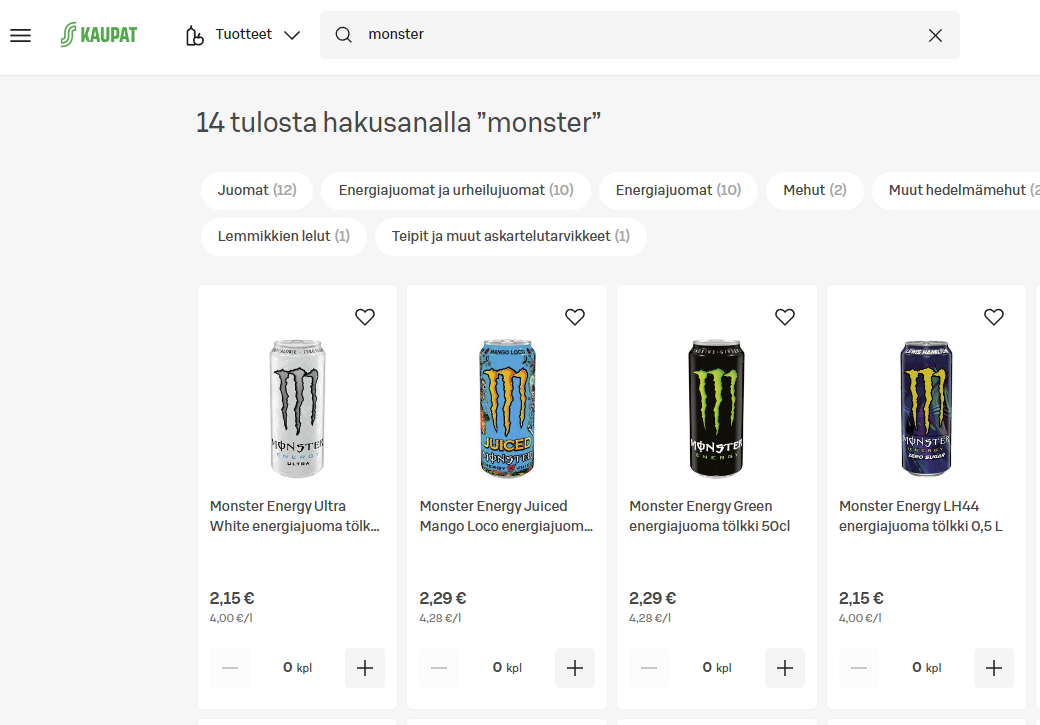

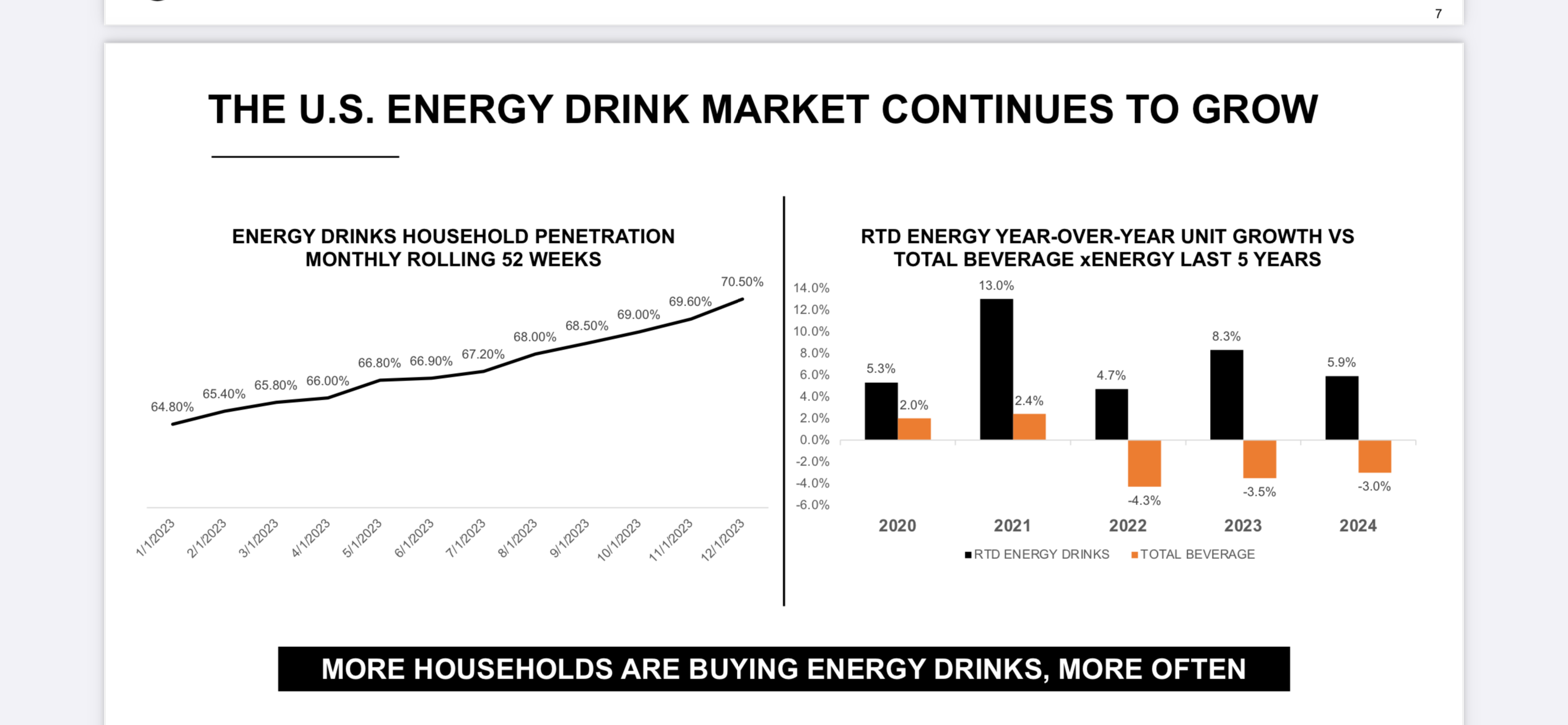

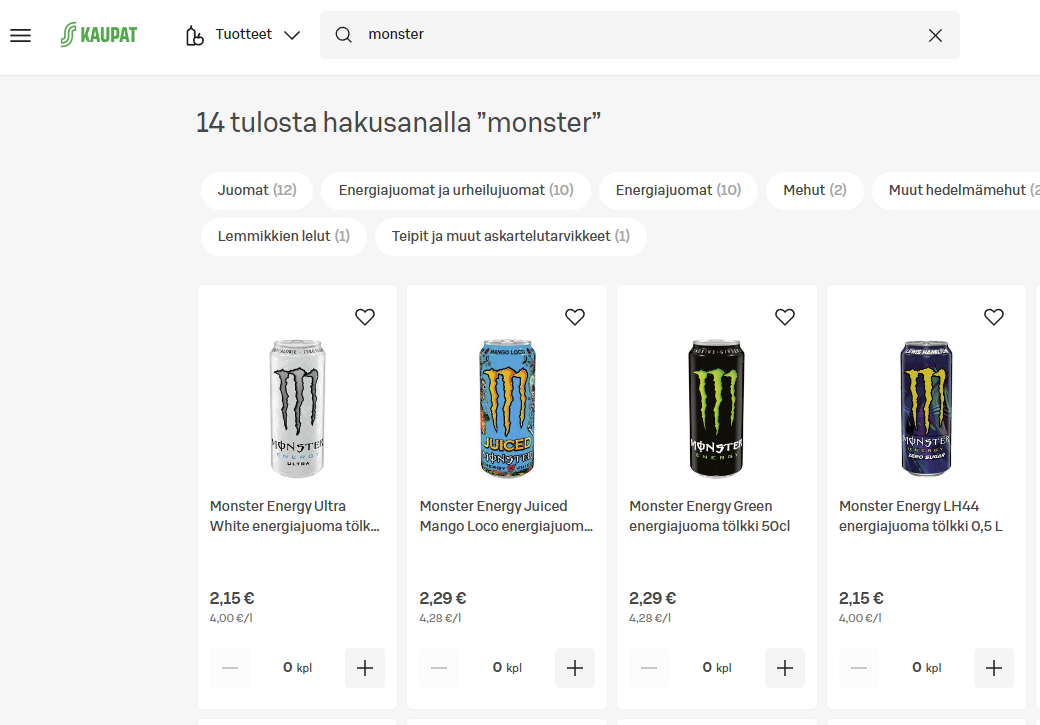

In principle, Monster (MNST) and other “similar drinks” could probably be merged into this thread. The drinks certainly differ from one another, but no one can drink more than a certain amount of them in a day, so they fall into the same category in the competition for daily beverages. Why not Coca-Cola and others as well, but these drinks seem to contain more caffeine and are thus in the energy drinks category.

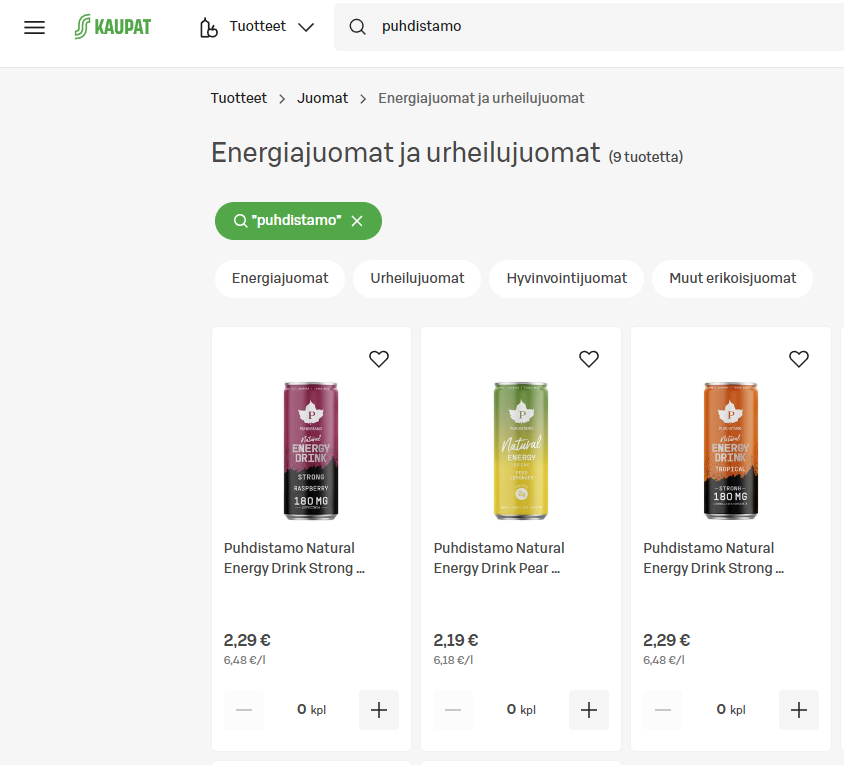

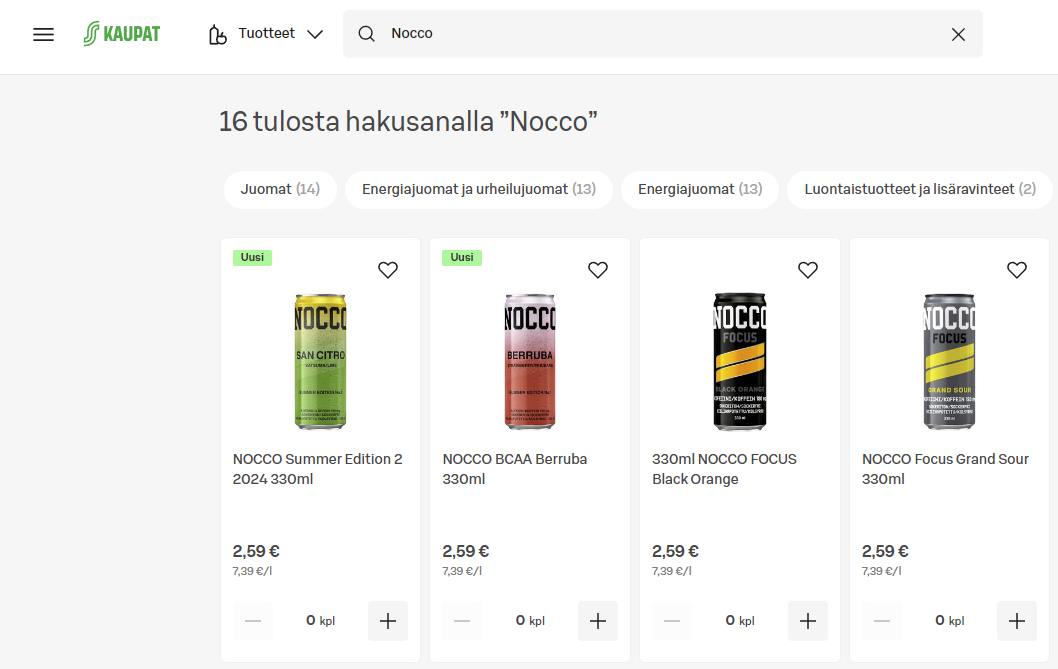

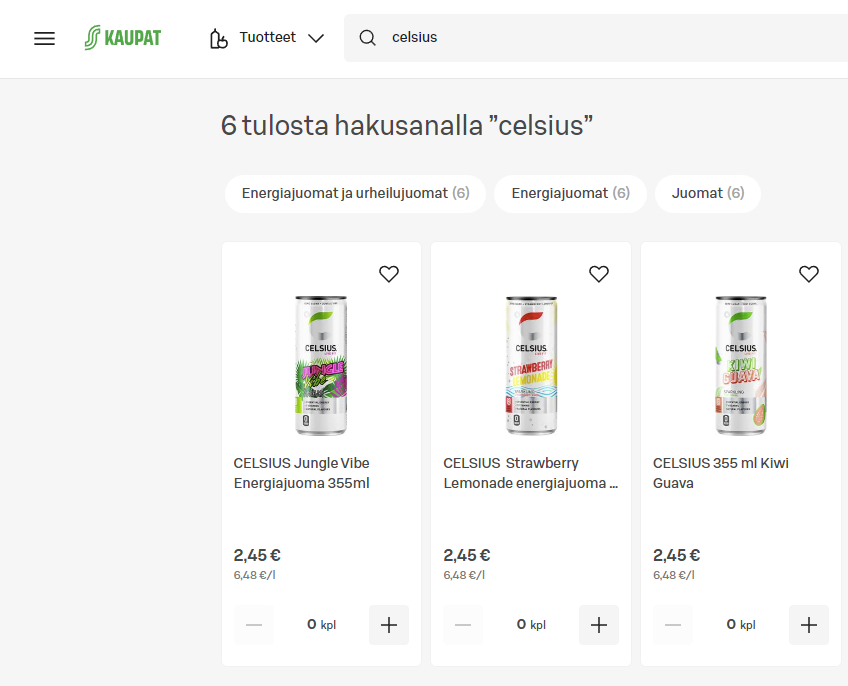

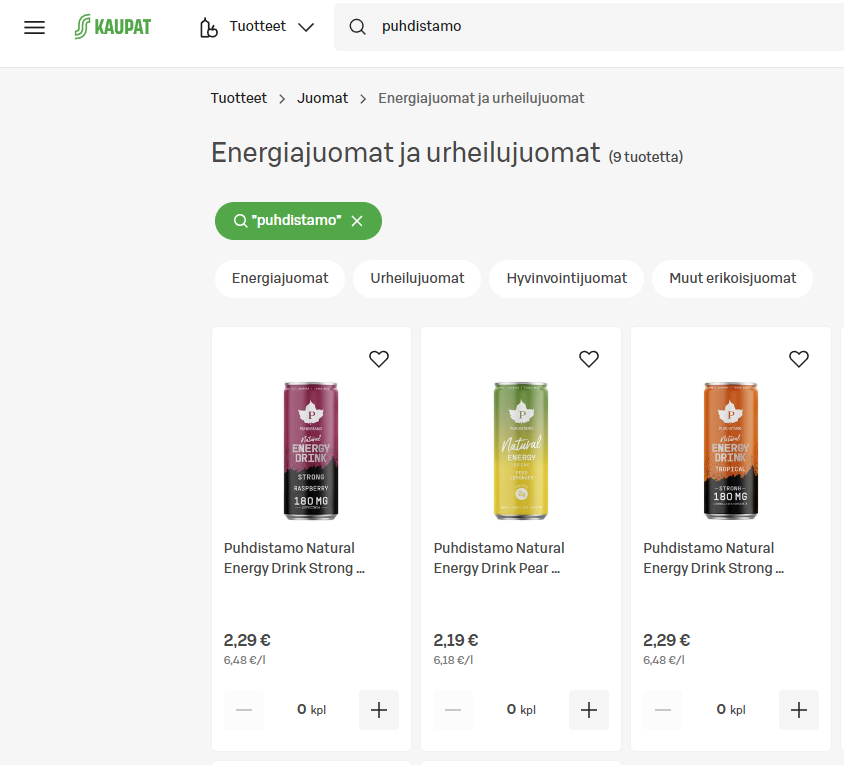

Celsius is indeed much less visible in Finland, whereas the Swedish brand Nocco, for example, is much more prominent in places like social media. In my experience, for instance on Instagram, you don’t even need that many followers to get a case or two (24-packs) of drinks for free in exchange for visibility (Puhdistamo/Nocco).

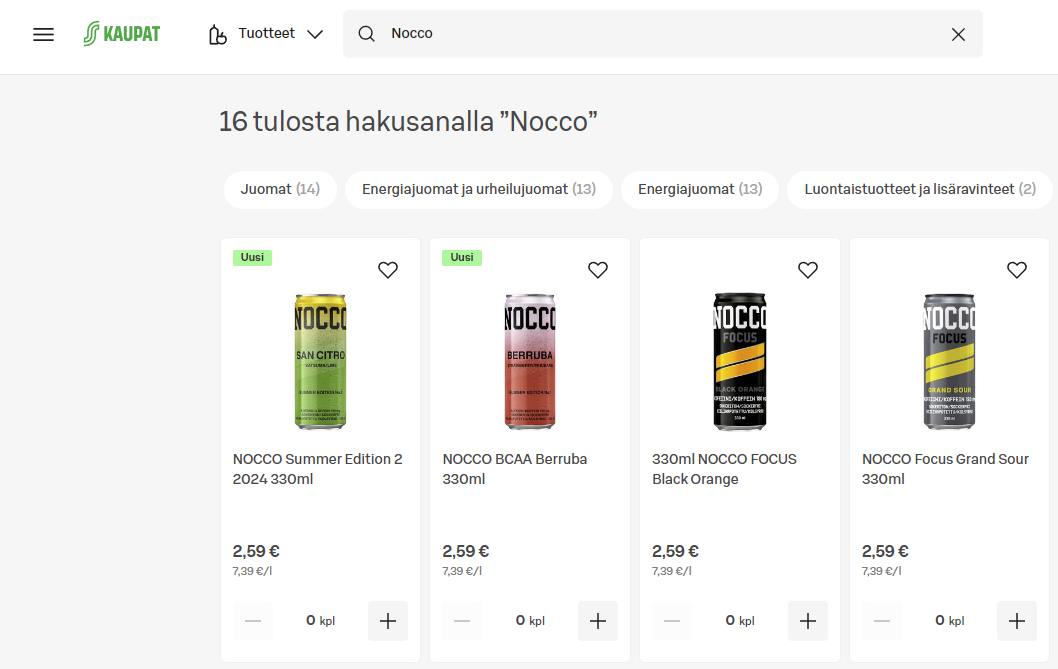

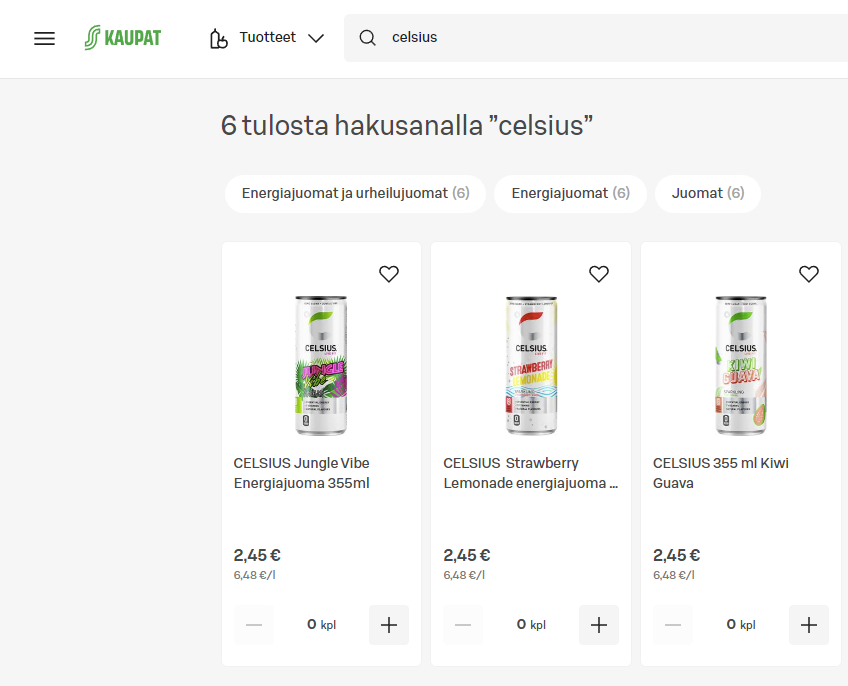

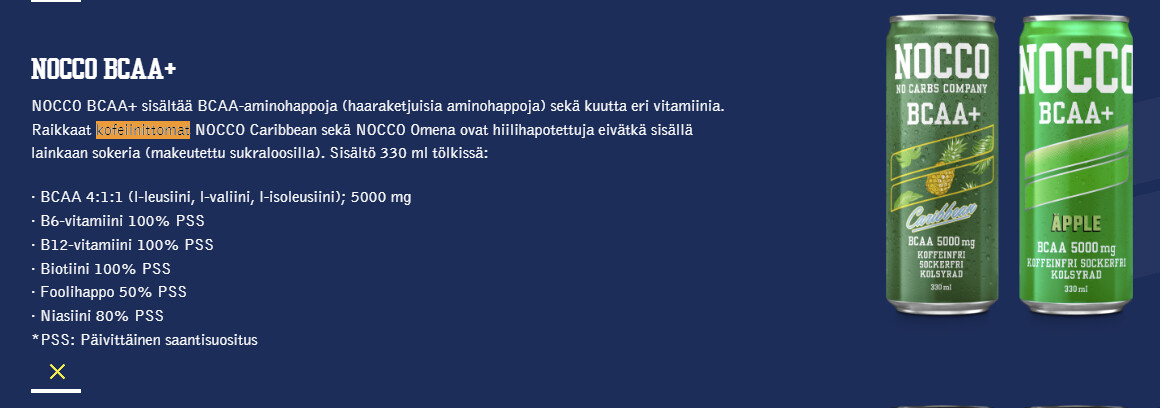

Overall, I believe this industry will continue to do well because drinking these beverage products is extremely trendy among youth and young adults. The price per liter is high and margins are certainly solid. Prices per liter seem to vary between €4 and €8. Celsius has a 355 ml can, so there would still be room for shrinkflation down to Nocco’s and Puhdistamo’s 330 ml pack size. Monster goes with larger 500 ml containers.

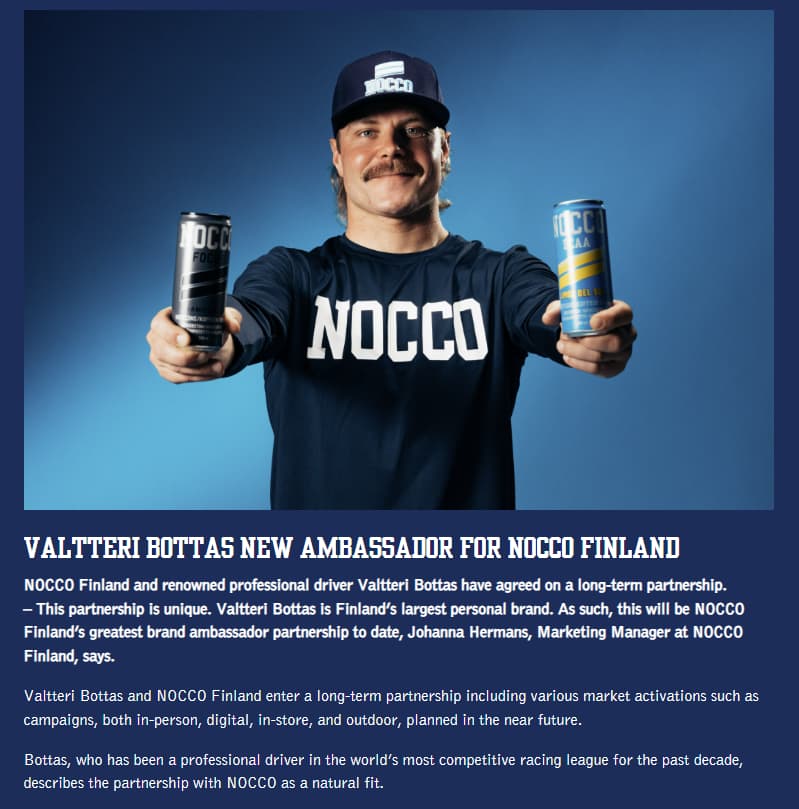

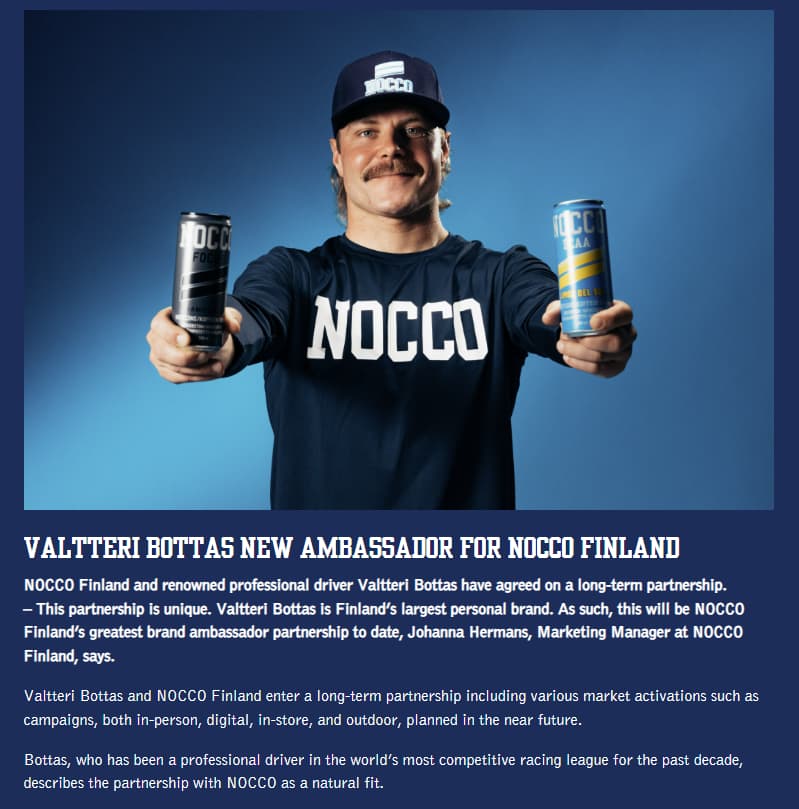

New drink flavors are released constantly, with hits staying on the market and flops gradually disappearing. And popularity isn’t diminished at all by brand advertising through influencers and celebrities. Even now, when I went to look for more information on Nocco, Valtteri’s face is on the front page along with an announcement of a new ambassador deal. Nocco belongs to the Vitamin Well Group and is not listed.

I am not a consumer of these products, but I’ve probably tasted at least one product from all the biggest brands. My own experiences with these drinks are mainly negative, at least in terms of taste. The products mostly leave an extremely industrial sweetener aftertaste in the mouth. The differentiating factor seems to be branding and advertising. Although I haven’t done any blind tests or taste comparisons, Celsius / Nocco drinks practically taste the same, and I certainly couldn’t say which drink is which if I drank them blind. So I can easily see a consumer buying Nocco because Valtteri Bottas advertises it? In other words, perceptions and advertising sell.

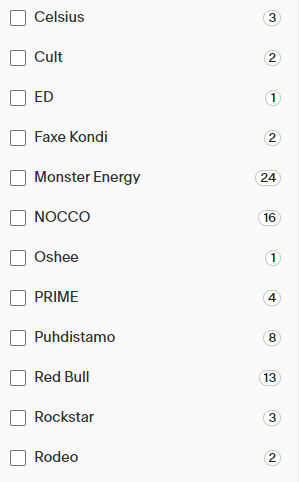

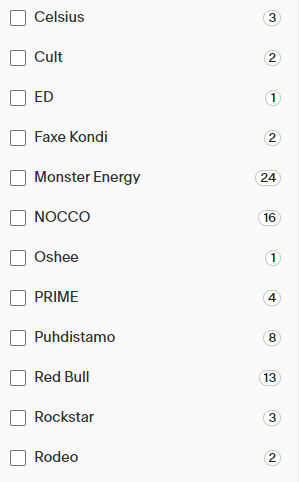

Verkkokauppa.com sells ‘energy drinks’ online in packs. The trend is clearly visible from the list available in-store/online:

Top 5:

Monster 24 products

Nocco 16 products

Red Bull 13 products

Puhdistamo 8 products

Prime 4 products

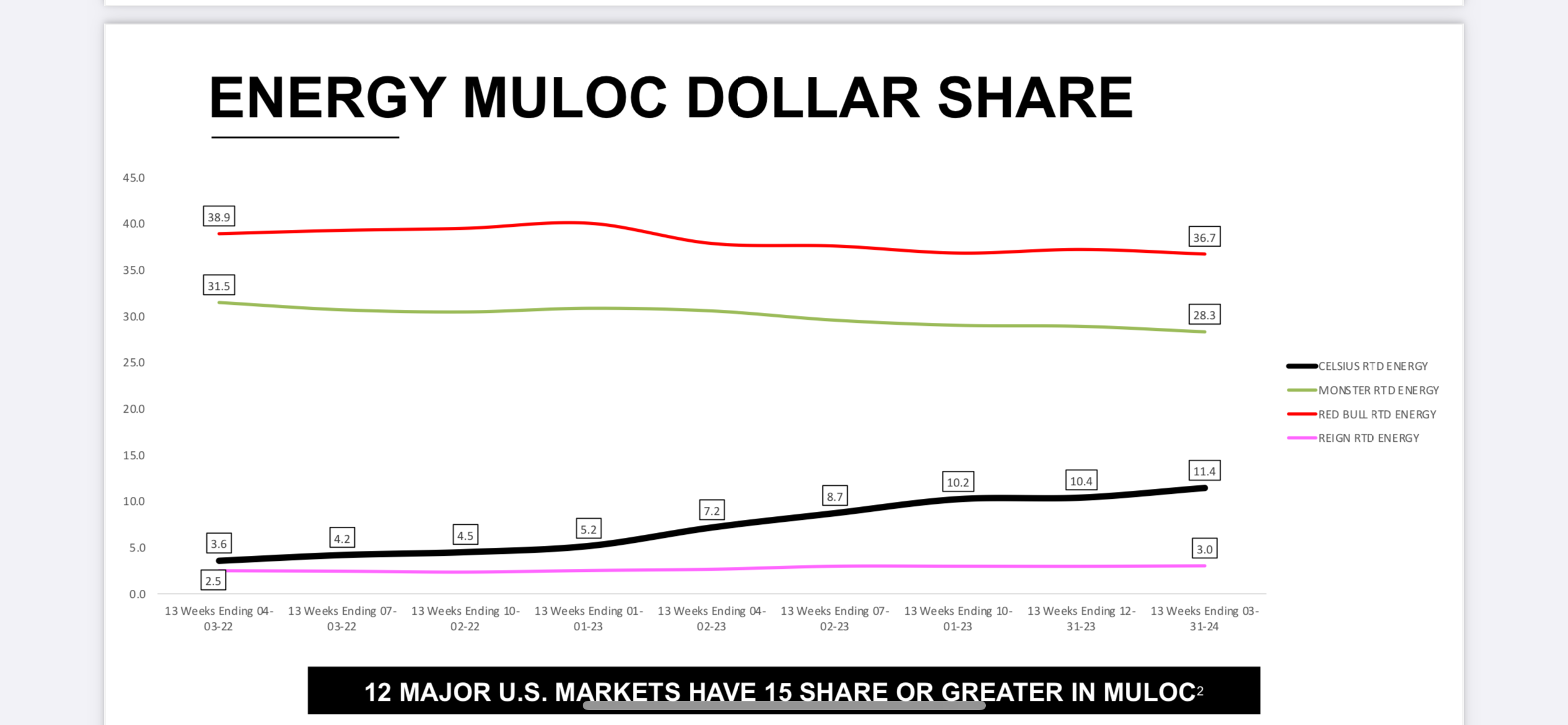

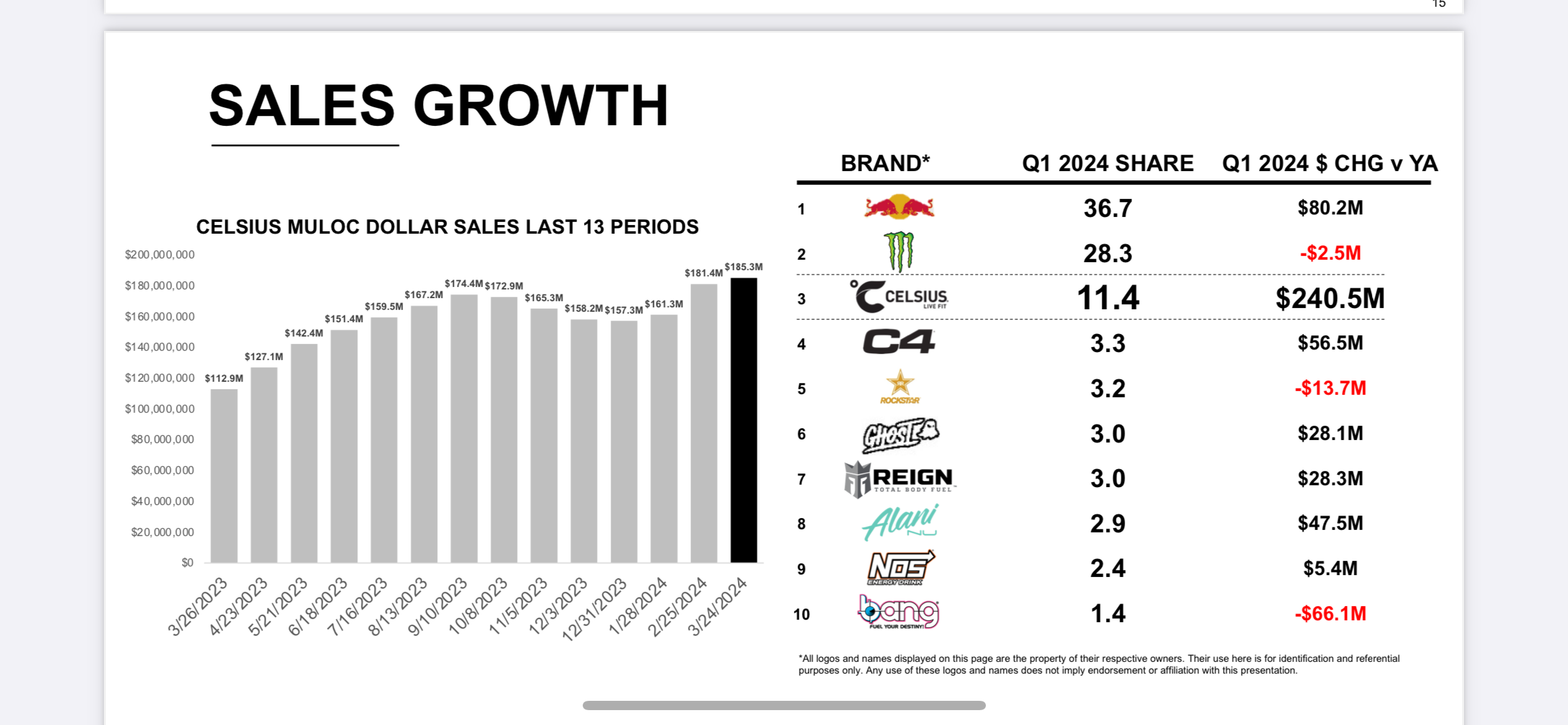

Overall, Celsius (CELH) has slid down -32% in three months and the valuation is still somewhat stretched. Somehow it feels like there is definitely a lot of faith/hope here for the same kind of share price development that Monster has had, though it certainly has had some. The share price was around 1.5 dollars in 2019 and the 5y growth has been +4500%. My own investment appetite has been limited precisely by the tight valuation, as competition is fierce in the beverage sector. On the other hand, if one were to take a tracking position because I believe in the “megatrend,” I would follow the stock and the industry more closely. In the latest report, revenue did not grow according to expectations, but profitability was better.

Celsius (CELH) 1Y chart: