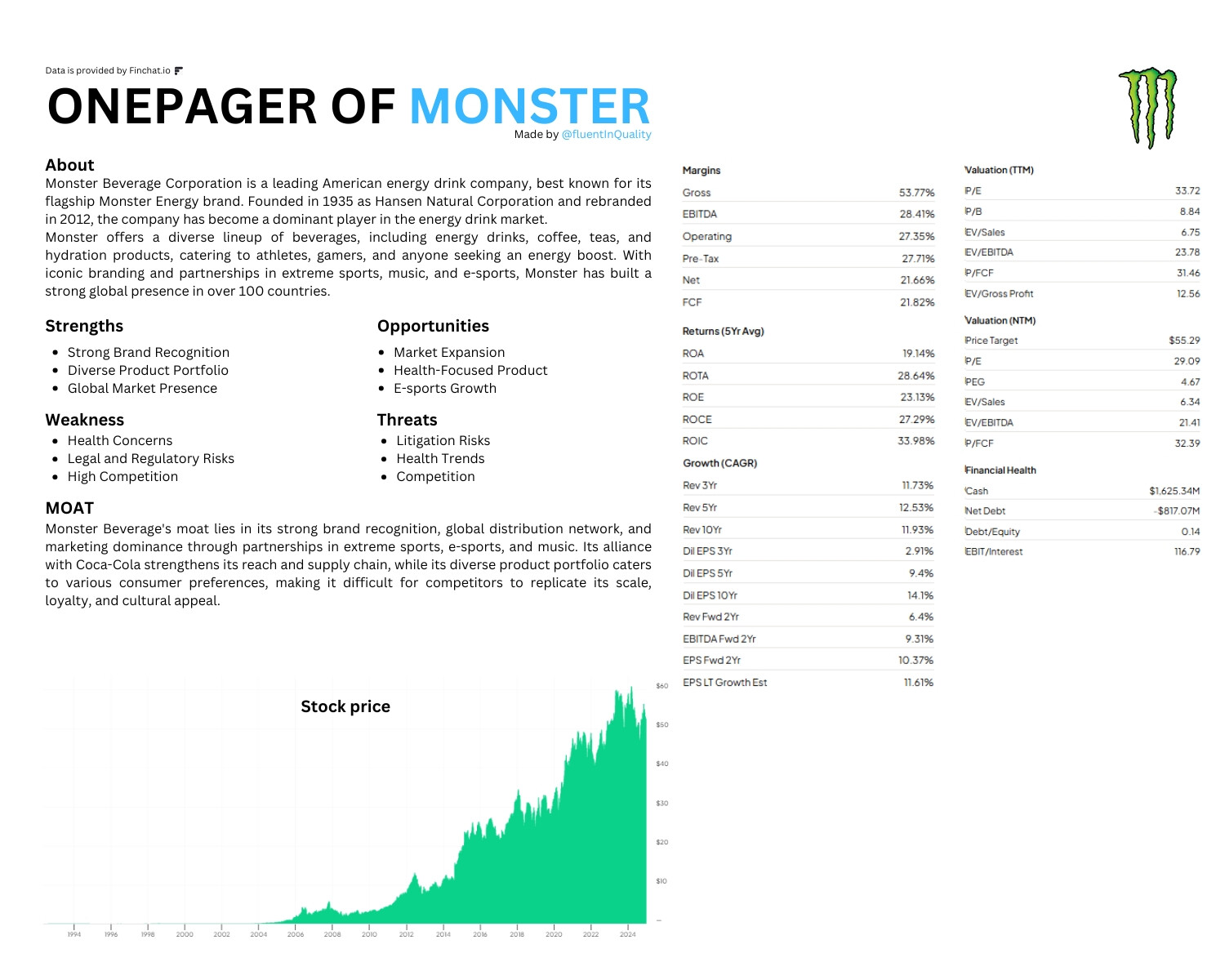

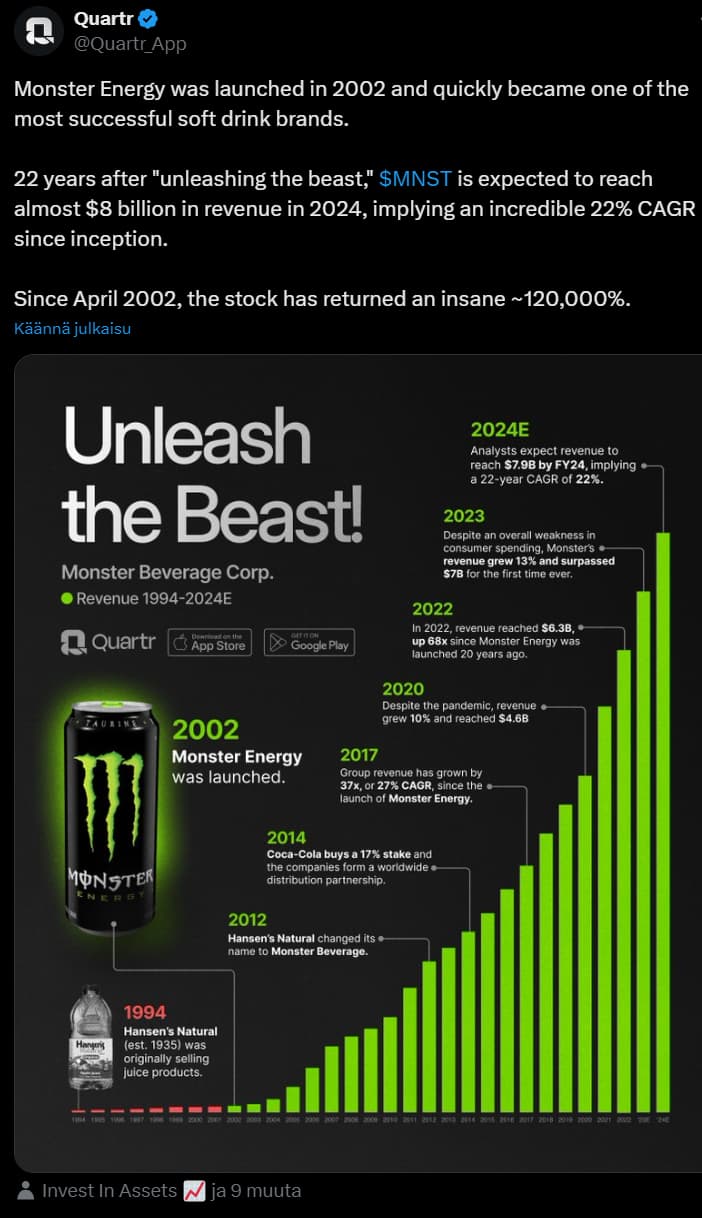

Monster Beverage Corporation is an American beverage company that manufactures energy drinks, such as Monster Energy and Burn. The company was originally founded in 1935 as Hansen’s in Southern California, and at that time, it sold juices. In 2012, the company changed its name to Monster Beverage after energy drinks became its primary source of revenue.

As early as 2020, Monster controlled 39 percent of the global energy drink market, being the second largest after Red Bull. The company has expanded its operations through acquisitions, such as the purchase of the CANarchy Craft Brewery Collective and the acquisition of Vital Pharmaceuticals, the owner of Bang Energy, strengthening its position in the energy drink market.

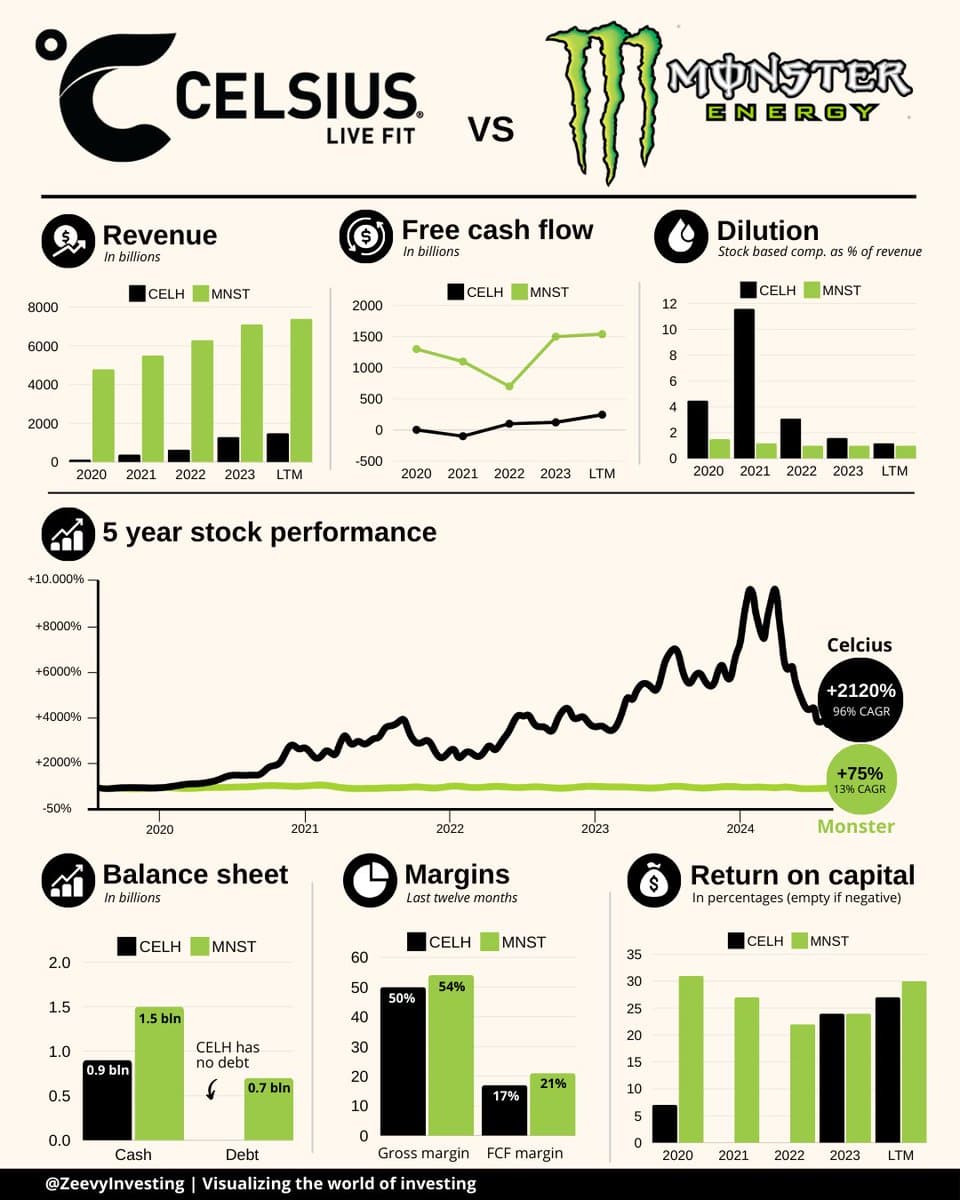

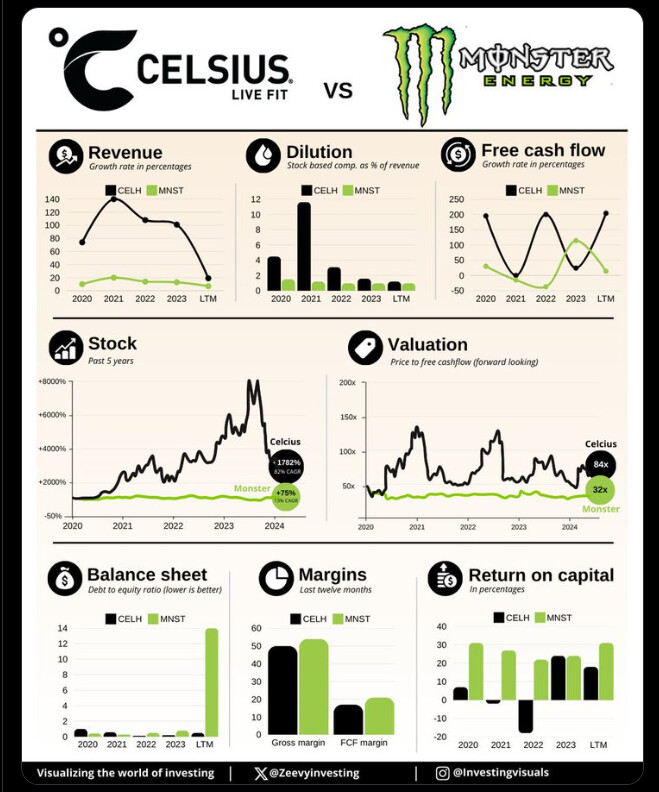

Through the eyes of an investor

Monster has indeed become quite a giant, and regarding Monster, I think it’s particularly important to understand the history a bit. ![]()

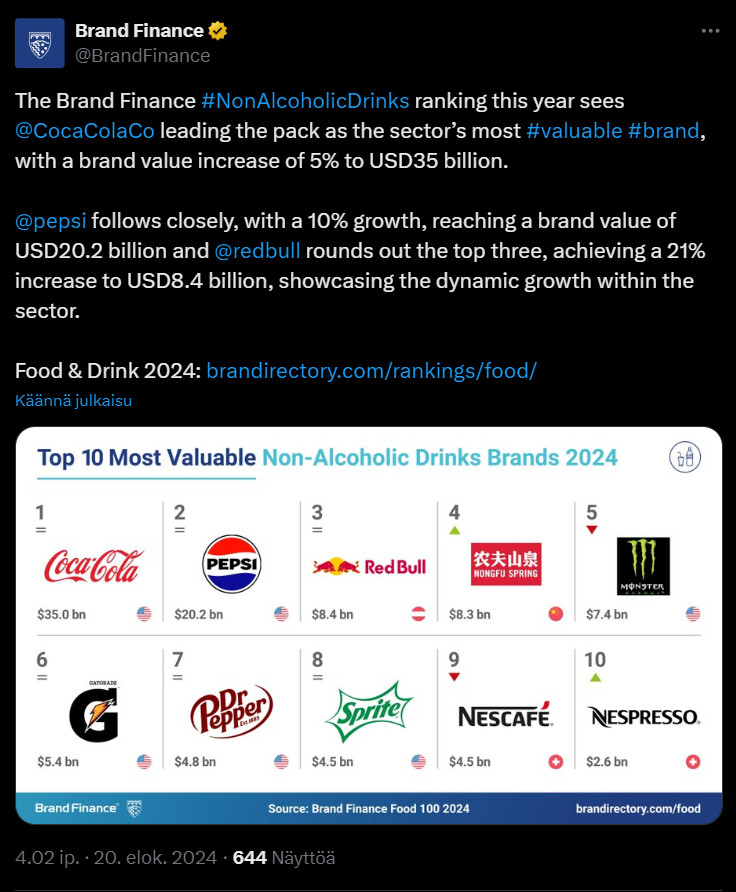

https://x.com/BrandFinance/status/1825881110607482926

https://x.com/Quartr_App/status/1795449965491224951

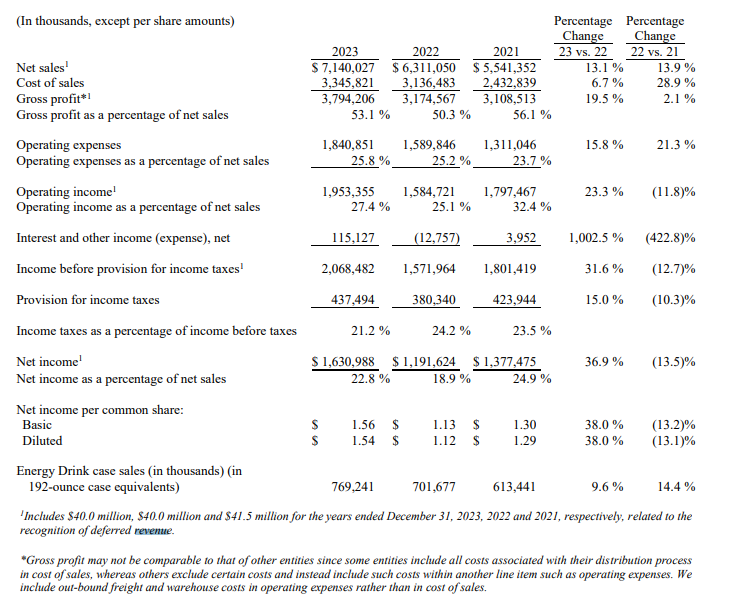

and then to the present day

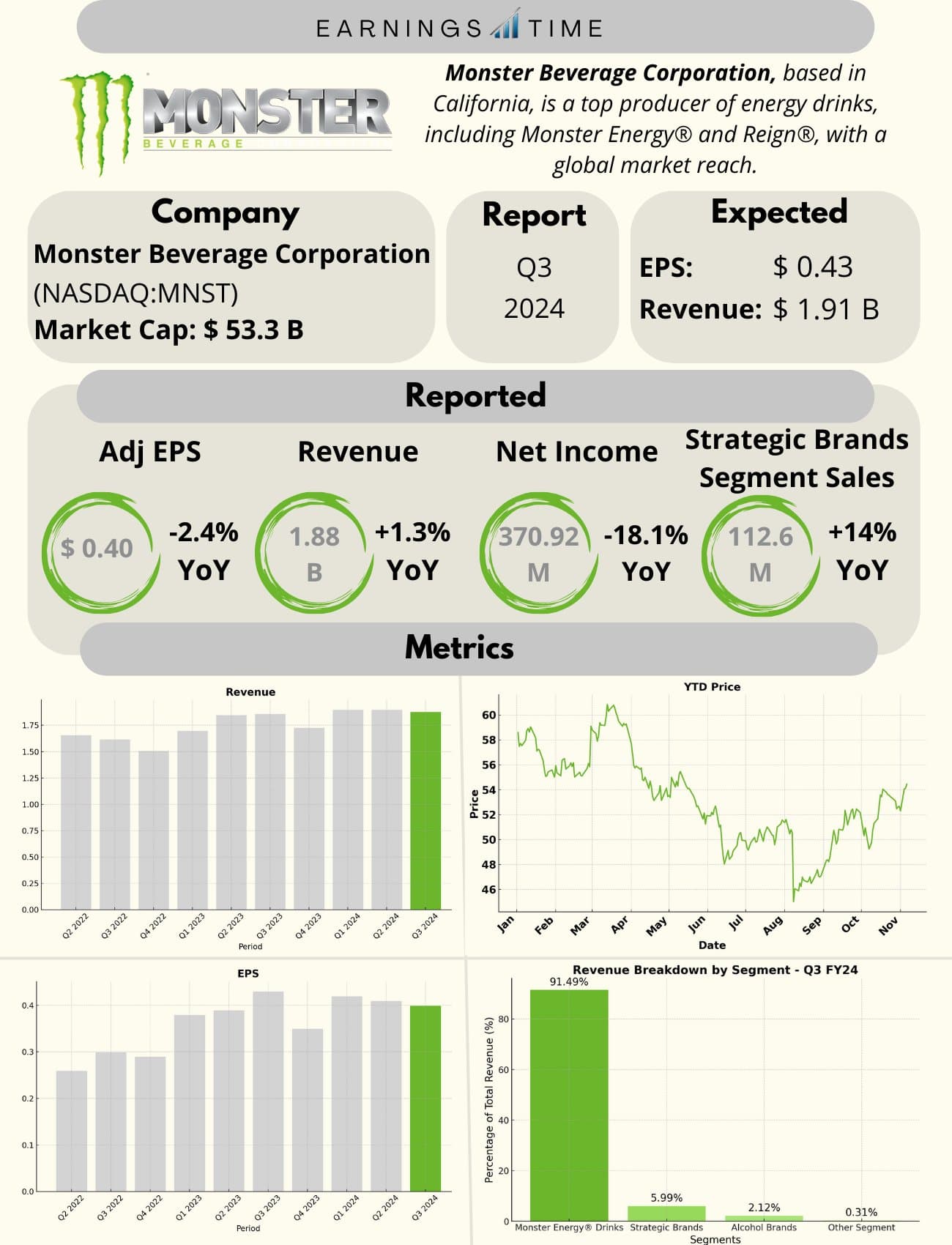

Demand for energy refreshment drinks weakened in the second quarter, which is especially reflected in the US market, where consumers are tightening their purse strings due to economic uncertainty. The company is raising its beverage prices by 5% starting in November, which could be a risk if consumers end up switching to cheaper alternatives; on the other hand, there are opportunities – after all, the company has always ultimately managed to keep revenue moving, and with small price increases, more is left on the bottom line.

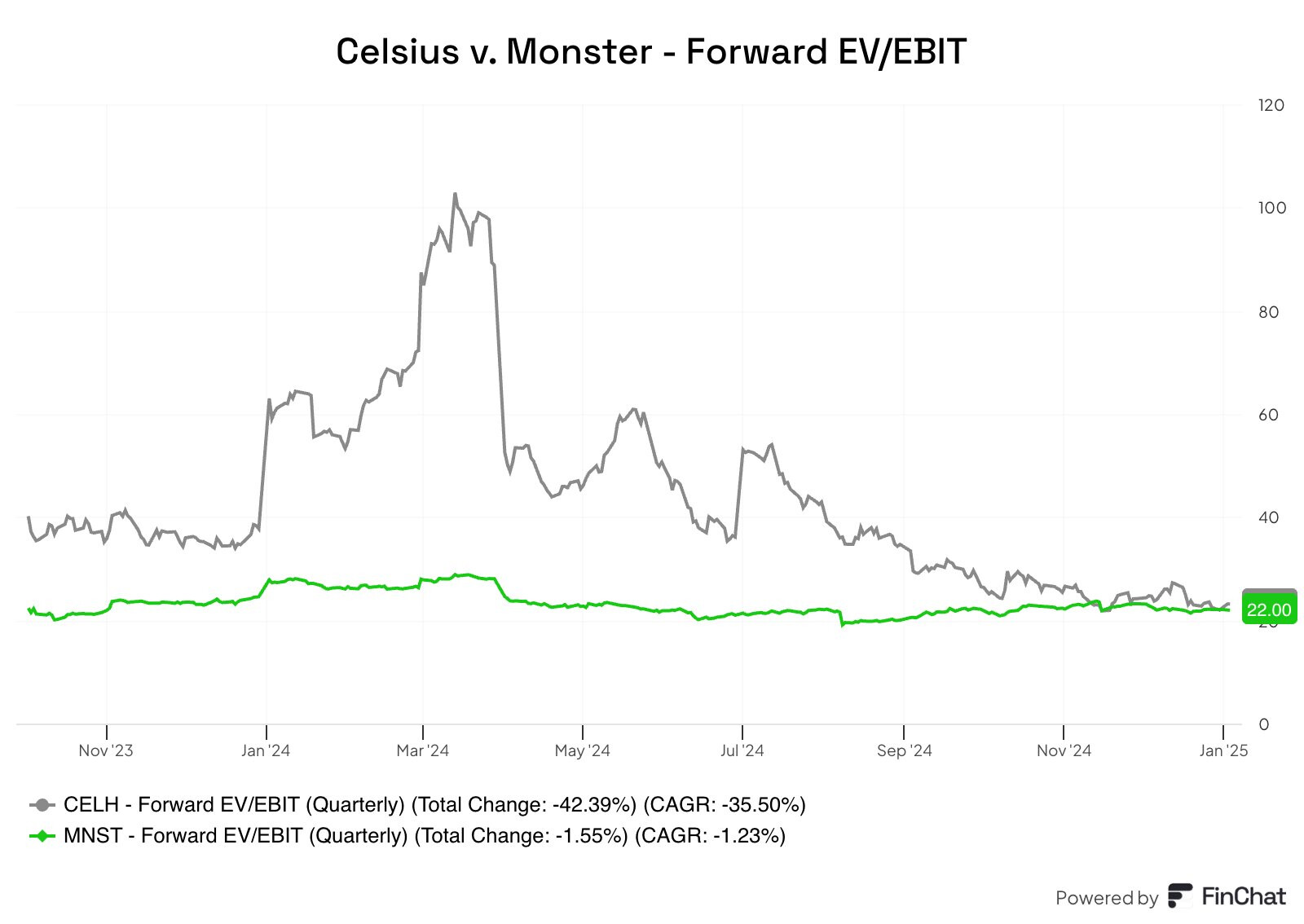

Analysts are, in any case, concerned that the price hikes might weaken sales, especially considering increased competition. TD Cowen lowered Monster’s sales and earnings growth forecasts and estimates that the company may have to offer discounts in the future to attract consumers back, meaning sales could start to stall and then discounts will have to be implemented anyway. It doesn’t help Monster that big retailers like Walmart and Costco are attracting customers away from traditional stores where energy drinks are often sold.

On the other hand, Monster is confident in its market position and its ability to raise prices. The company’s executives emphasize that while the situation is challenging in the US, demand for energy drinks has recovered in international markets following economic crises. Management believes that energy drinks are seen as “affordable luxury,” and the strength of the brand will carry it through market storms. I don’t know how the talk of optimistic and positive Americans should be taken… ![]()

The company continues to implement its growth strategy, especially internationally, which may provide safety if the US market specifically does not recover as expected. It is important to monitor the company’s reaction to the market situation and its ability to adapt to changes in the competitive environment.

At the time of writing, i.e., August 2024:

P/E : 31.1

P/S : 6.19

P/B : 7.79

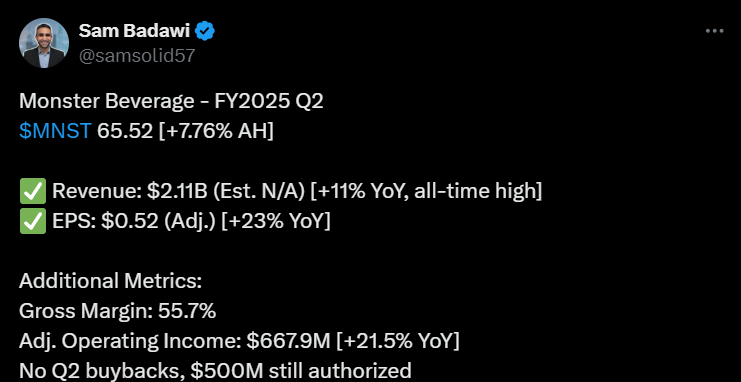

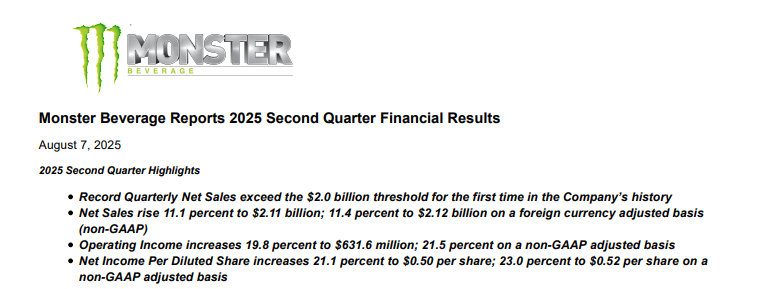

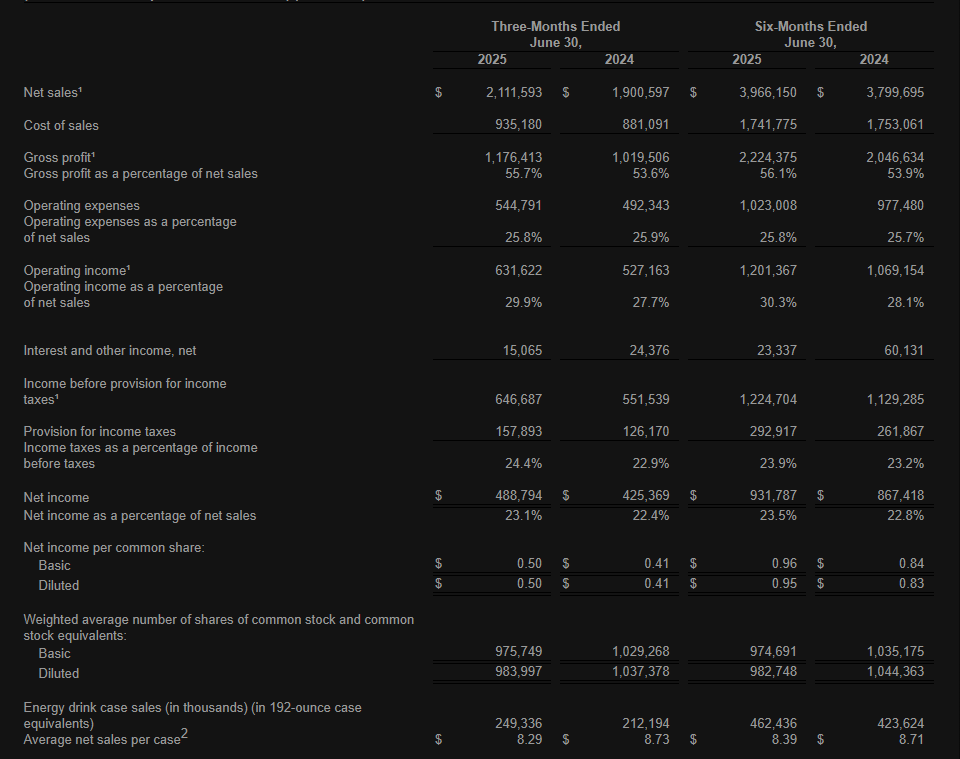

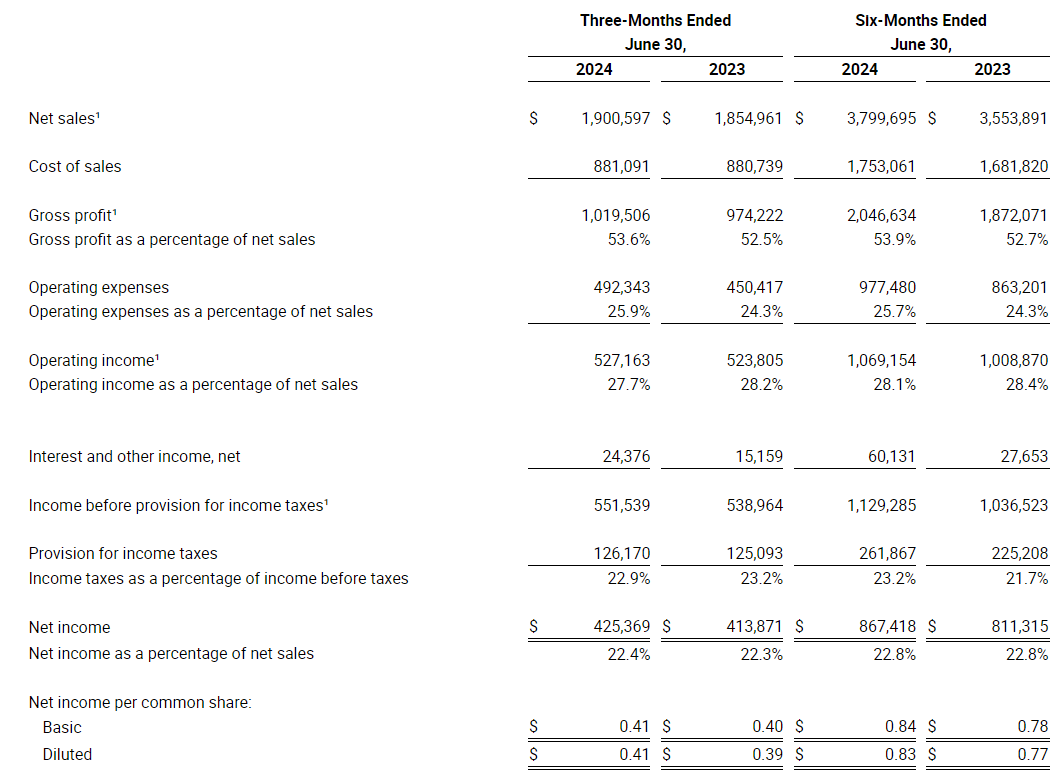

Monster’s Q2:

Monster’s second-quarter 2024 sales grew by 2.5% compared to the previous year. Net income rose by 2.8%, even though demand for energy drinks in the US and other countries grew more slowly and retail “foot traffic” weakened, global growth in the energy drink market continues.

More info from Monster’s page, including this: