As we know, biotech will be the trend of 2021, so I present to you the future big name and disruptor in the field: Cellink AB.

Company:

Cellink - not just 3D bioprinters and inks Redeye.se It is worth reading the content of the link carefully, as it contains more comprehensive information about the company itself than the material below.

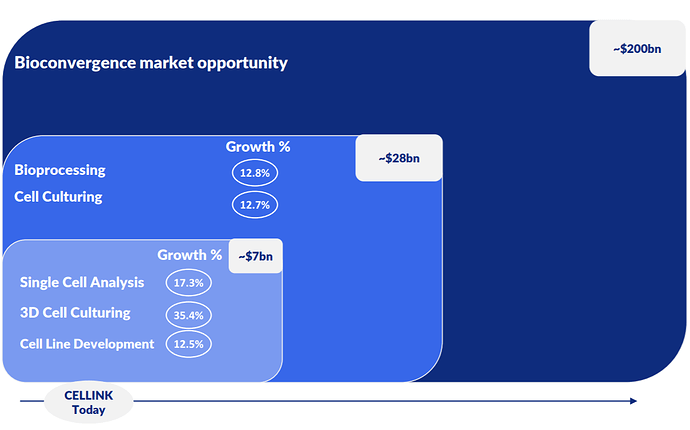

Cellink is a Gothenburg-based life science company that is a market leader in the rapidly growing segments of “3D bioprinting” and “single-cell processing / precision dispensing”. The company currently operates in over 1800 laboratories in more than 60 countries, with most of the top 25 pharmaceutical companies as its customers.

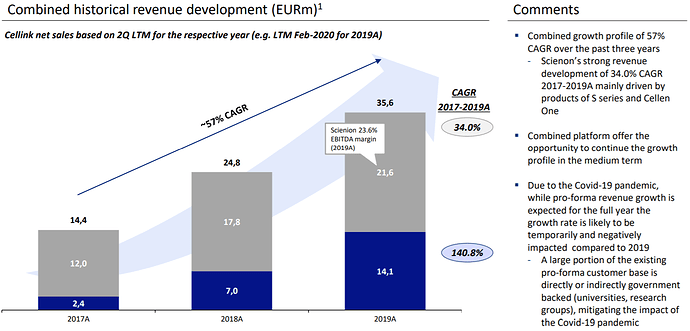

Following the acquisition of the German company Scienion, Cellink’s end-market focus shifted from universities/laboratories to pharmaceutical and diagnostics companies. Now, over 60% of sales come from the latter. This development is likely to continue, as larger pharmaceutical and diagnostics companies use completely different quantities (instruments, consumables) than, for example, a research group at Harvard.

From the outset, Cellink was a company focused solely on selling 3D bioprinters and associated bioinks, primarily to universities and cosmetics companies as an animal substitute. Today, the majority of Cellink’s sales consist of 3D bioprinting and ink, but this is rapidly changing thanks to recent acquisitions.

Through the three most recent acquisitions (Cytena, Dispendement, and Scienion), the company has become something entirely new; the company itself describes the acquisitions as a three-stage rocket with “very good synergies.” A big step has been taken in the market, clearly referred to as “3D cell culture.” This area includes everything from cell analysis to single-cell dispensing and bioprocess workflows. According to the common denominator, everything you do is based on printing cells or supporting workflows and processes for bioprinting. To simplify, it can be said that Cellink’s classic 3D printers print a combination of several different cells (multicellular printing) to create human tissue, while Cytena, Dispended, and Scienion typically print only a single cell or handle extremely precise dispensing or analysis of already printed cells/tissues.

Cellink’s basic idea is to become a comprehensive supplier of bioprinting. The acquisitions made so far are intended in many ways to support Cellink’s “old” bioprinting devices (BIO X, BIO X 6, etc.). It’s about complementing the workflows that customers already use today when printing tissue. 3D printing requires many surrounding processes to function optimally and yield the best possible results. For example, it can prepare cells before they are used in the printer itself, or distribute printed cells to an analysis device with precise accuracy.

History:

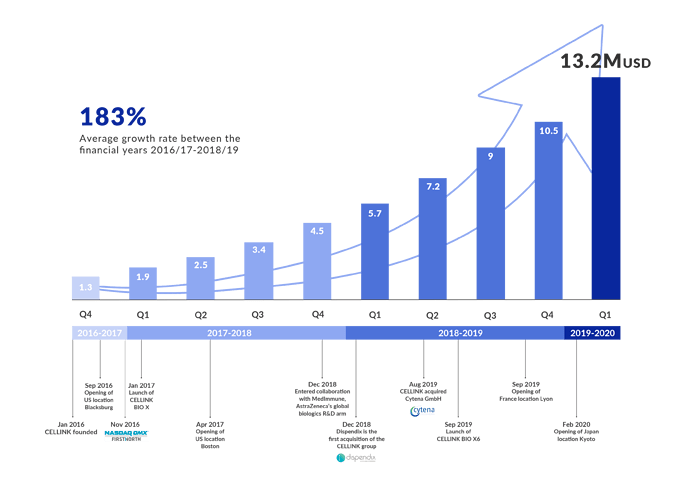

Cellink was founded in 2016 by the company’s CEO Erik Gatenholm and Héctor Martinez. They developed and sold the world’s first universally compatible bioink to simplify bioprinting for researchers and pharmaceutical companies, who at the time were mixing their own biomaterials in their companies. The company released its first bioprinter in 2015 and continued to design new bioinks to support more specialized bioprinting applications.

Ten months after its founding, Cellink was publicly listed on the Nasdaq First North exchange. The IPO was oversubscribed by 1070 percent.

Because the company’s technology enables the printing of tissues such as skin, liver, and cartilage, its technology also allows for the printing of fully functional cancer tumors that can be used to develop new cancer treatments. In 2018, Cellink received a $2.5 million grant from the EU to fund the TumorPrint project.

In 2017, the company was described as “the world leader in bioprinting.” It established its US headquarters in Boston the same year. In January 2018, Cellink announced a collaboration with Ctibiotech to enhance 3D bioprinting technology in cancer research. Cellink acquired the German biotech company Cytena in August 2019 for a transaction price of $33.8 million.

For the investor:

In the words of RedEye user zimpan: Cellink is difficult matter, it’s probably even the most complex company I’ve looked at. You have to partially accept that you can not understand all the products and their different uses. Especially since Cellink themselves often do not know how their customers use their products, especially in 3D bioprinting.

Market cap atm: 11.71 billion SEK

P/S: 54

P/B: 7.7

EBITDA: -272.90

Profit margin: -26.25%

EPS: -1.5

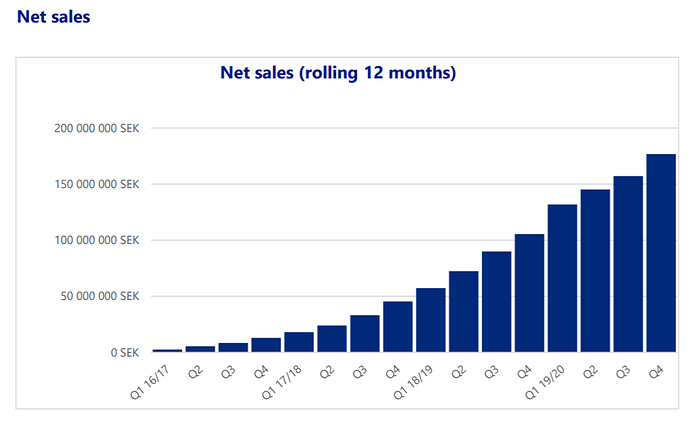

Revenue: 236 million

Cash: 995 million

Debt: 62 million

Insiders own 42%

Institutions own 27%

According to analysts, the company will already be profitable in 2021 Q3.

And as a “lightening” note, a prediction from some no-name analysis site: At Walletinvestor.com we predict future values with technical analysis for wide selection of stocks like Cellink AB (CLKKF). If you are looking for stocks with good return, Cellink AB can be a profitable investment option. Cellink AB quote is equal to 10.870 USD at 2021-01-05. Based on our forecasts, a long-term increase is expected, the “CLKKF” stock price prognosis for 2025-01-14 is 44.768 USD. With a 5-year investment, the revenue is expected to be around +311.85%. Your current $100 investment may be up to $411.85 in 2026.

Links:

PowerPoint Presentation (cellink.com)

Interim Report Q4 (cellink.com)

“The firm that can 3D print human body parts”

“Swedish scientists successfully implant 3D-print human cartilage cells in baby mice”

“Inside Cellink, the Swedish company building 3D printers for living tissue”

“A 3D Bioprinting Stock That’s Not Organovo”

“ARAB HEALTH. CELLINK, A Market Leader in Bio-Ink Production”

–

I stole the opening pitch from RedEye’s zimpan, as it was more competent than my own scribbling. But this will get us started. Thank you and apologies.