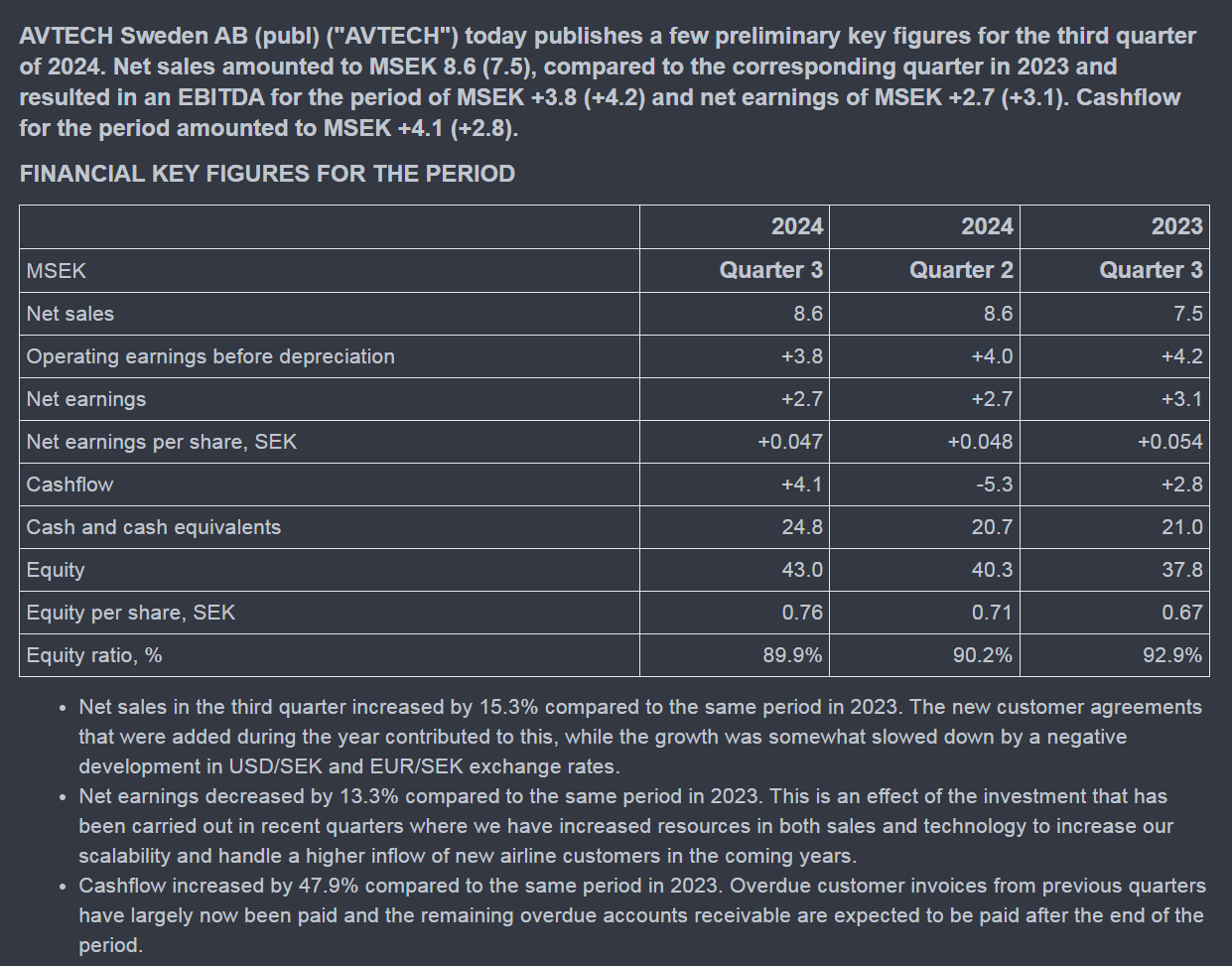

AVTECH is a small Swedish SaaS company with sales of a few million euros that develops software for airlines. The aim is to reduce fuel emissions by optimizing flight routes and to help aircraft avoid unpleasant turbulence. The company has been listed since 2011, but its focus has meandered a bit over the years. The current CEO started in 2020, and the company’s operations have become clearer since then. Currently, the main source of income is the Aventus product (providing more accurate weather data for flight routes). Another selling product is Clearpath, designed for turbulence avoidance. Other products have been under development for years. The staff consists of 11 people, and the company is recruiting more to support growth. The company is very profitable, with an EBIT margin of over 30%. Cash flow is being generated (though in Q2, late payments from some customers turned cash flow negative), and the company has even started paying dividends.

As I understand it, Aventus is at a more mature stage, and the question is how large it can be commercialized and how well new products will then sell. There are about 30,000 commercial aircraft flying in the world right now, but I doubt every single one will become an AVTECH customer. ![]()

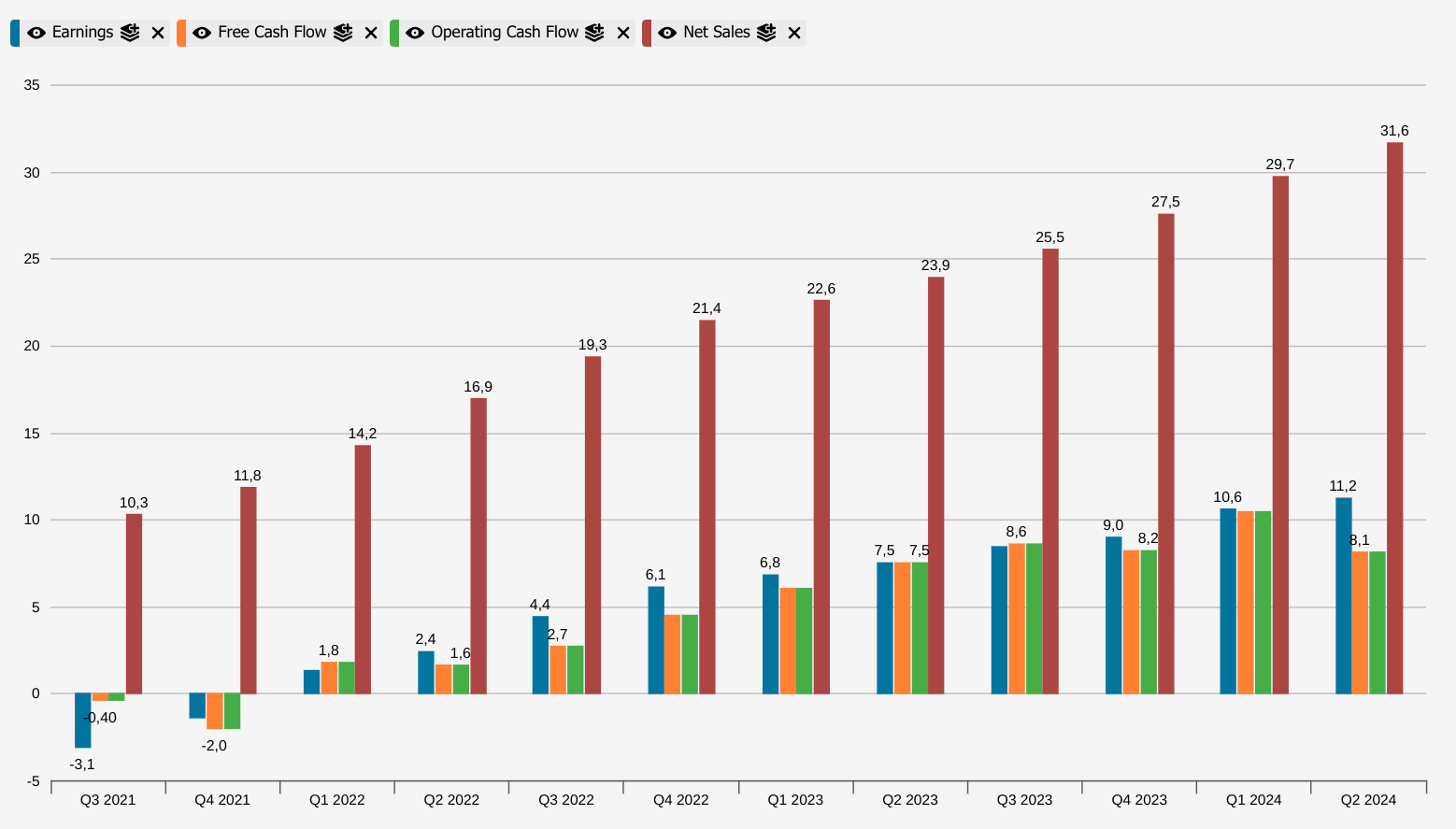

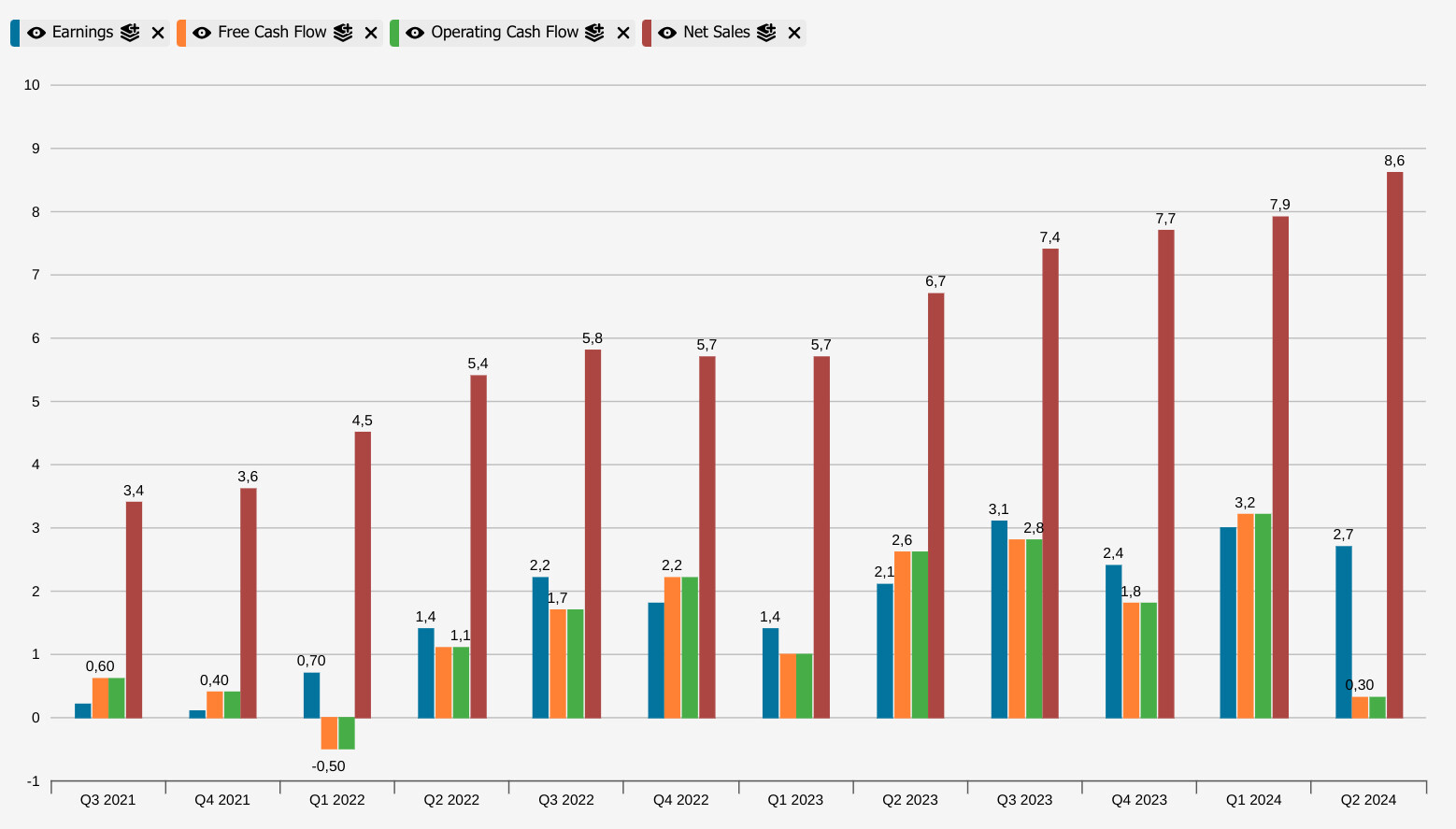

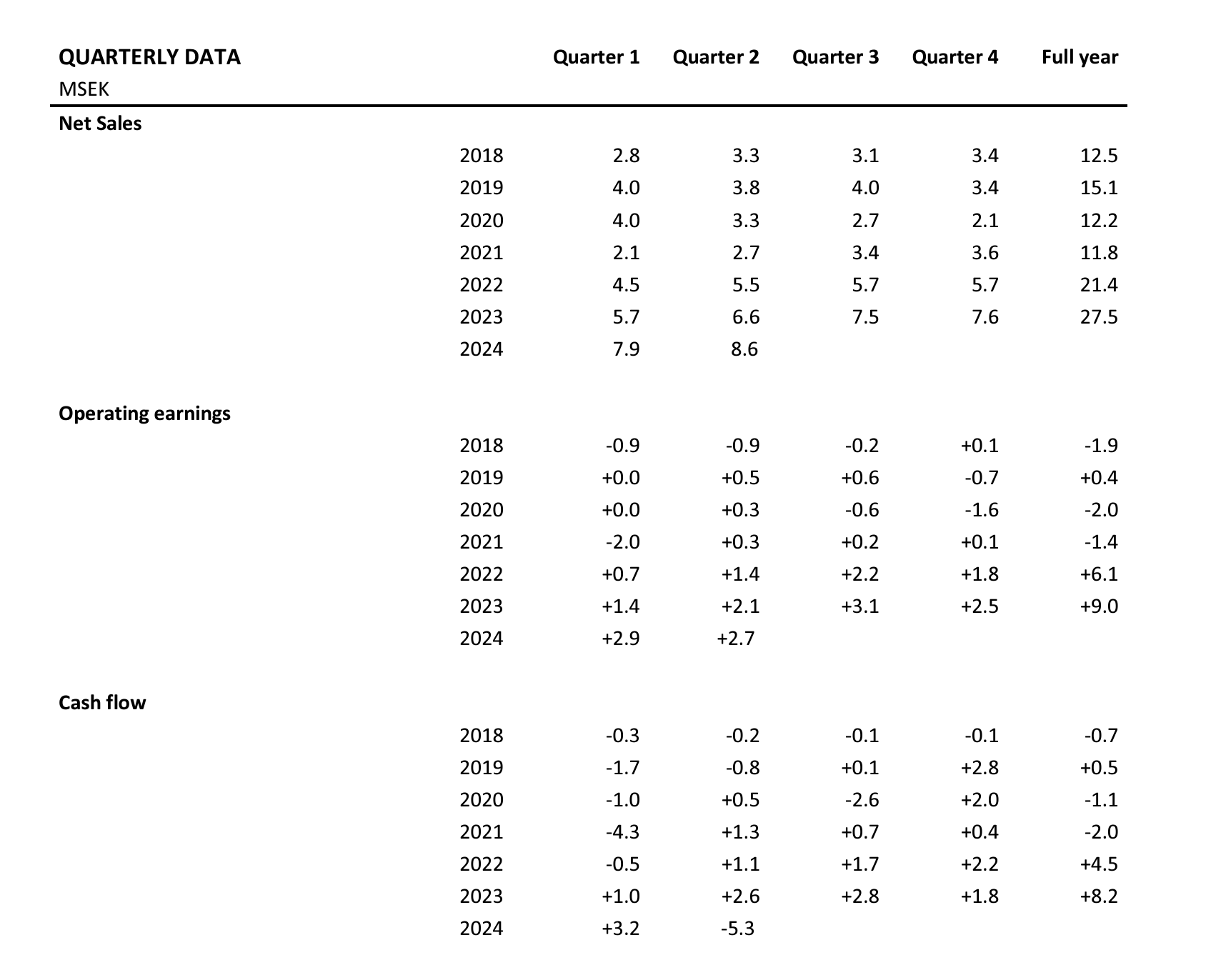

Revenue and a few highlights from recent years regarding the mentioned products that I’ve noted down:

2017 10.4 MSEK: Met collaboration, SIGMA (turbulence warning system), Nowcast.

2018 12.5 MSEK: SIGMA, TTAM, proFLIGHT app.

2019 15.5 MSEK: Proflight delays

2020 12.2 MSEK: Terrible pandemic year, talking about Clearpath now, CEO David Rytter took the helm (at the firm since 2012), proFLIGHT commercialized, Rytter bought shares as one founding partner left.

2021 11.8 MSEK: Clearpath progressing, collaboration with Volotea etc.

2022 21.4 MSEK: 1,300 planes using the service commercially, 300 planes in the queue at the start of '23, AVENTUS, SIGMA, proFlight and ClearPath as products, 2.5% fuel savings with these products.

2023 27.5 MSEK: 1,600 planes using commercially

2024: Over 1,600 planes using commercially, new airlines testing the product. Revenue mainly from AVENTUS and Clearpath products.

Here is a screenshot from the Q2 report showing the company’s historical development in light of the numbers:

The market cap is roughly 300 MSEK, or about 27 MEUR. EV/SALES based on trailing 12-month figures is 9x, though valuations for such a small firm are debatable if the company succeeds in significantly commercializing the product. For example, Redeye estimates the revenue potential for Aventus and Clearpath at 72 MSEK once the aircraft in the sales pipeline are onboarded.

Avtech has had a somewhat bumpy history, but now growth seems to have accelerated into the skies. It’s interesting to see how large the sales of current products can actually grow. The firm is small, so the importance of individuals is highly emphasized, but the current CEO’s performance has been exemplary. As I understand it, Airbus and Boeing also make similar software (common sense says planes must have weather and turbulence info from somewhere), but apparently AVTECH does something better since airlines are buying this software tool.

I own a tiny amount of shares at the time of opening this thread.

P.S. While writing this text, which was based on earlier entries in my investment diary, I remembered once again that I don’t know the company very deeply. ![]() If there are other shareholders or people familiar with the industry on the forum, comments are very welcome!

If there are other shareholders or people familiar with the industry on the forum, comments are very welcome!