Business Insider has a short segment on the US forest and especially the cardboard packaging industry. Duration 12 min. ![]()

![]() International Paper’s mill as an example.

International Paper’s mill as an example.

American board manufacturers have cut production by 10% for 2025 according to the video. Stora Enso’s new board machine in Oulu, one of the largest in the world, was built primarily for the American market. So, a giant machine was built for a shrinking market, where profitability relies more on volume than high margins ![]() In addition, the production line is only running at about half capacity and constantly requires more money from the company; this year, the new line is estimated to have a €120-140m negative impact on earnings.

In addition, the production line is only running at about half capacity and constantly requires more money from the company; this year, the new line is estimated to have a €120-140m negative impact on earnings.

It’s not easy for Stora. We’ll see how far into 2026 we get before new closures are announced.

Hasn’t UPM been the furthest along in its developments in, for example, biomedicals and biochemicals? It has been very quiet since the biodiesel plant, and as mentioned above, it is very interesting to see how Leuna starts to scale up and how the price positioning of the end products will settle in the consumer market compared to traditional ones. I saw an ad somewhere about a collaboration with Nokian Tyres, for example, regarding carbon black. How many are willing to pay a premium? By the way, how much more expensive is renewable diesel at the pump compared to traditional diesel nowadays?

An interesting document; that “bulkiest” part of the packaging world—fluting and corrugated end-uses—seems to be in an even tougher spot than the folding boxboard business, which itself has been over-invested in over the last ~10 years (e.g., Kotka, Husum, Oulu). One of the critical key survival factors for various production lines in the future will likely be cost-efficiency and, by extension, raw material supply. What is most efficient: running integrated / non-integrated setups with domestic raw materials, or importing cheaper Euca (Eucalyptus), for instance, to non-integrated mills to fight for market share? For Stora, as mentioned above, there’s the additional challenge of getting the new machine to full capacity and making the investment pay off.

What on earth is happening in the markets?! Is the rally finally starting? ![]()

The headline of our business paper screams today “Stock Market: Forest companies in a strong upswing” And based on the curve below, this rise shouldn’t be just some daily fluctuation, but a deeper change in the market—but from what?

China has just started encircling Taiwan with military equipment, the sick-minded Kremlin crew continues their games, and no sharp rises in general economic indicators are in sight (or are they?).

Clearly, Sormusten Ritari doesn’t know what they are talking about.

Finland’s economic foundation is largely built on highly efficient forest industry integrates, and there are quite a few patents in this country related to paper manufacturing and paper machine technology.

AI’s response:

“Valmet holds approximately 1,500 patent families, and the company protects about 100 new inventions annually, investing heavily in product development and protecting its solutions, particularly in valve technology, automation, and wood fiber pulp production.”

In heavy industry, making inventions isn’t quite as simple as it is when making small electronic products.

It’s been said on this forum as well that when the turnaround for forest companies begins, it will be unexpected. If it has indeed started now, the timing is certainly a surprise.

Is this the reason for yesterday’s rise? Suzano will raise pulp prices in Europe and North America by €120/tonne starting from the beginning of next year.

https://www.gurufocus.com/news/4085817/suzano-suz-to-raise-pulp-prices-globally?mobile=true

The news certainly contributed to the rise. It’s a different matter how well the increase materializes and how competitors act. The strength of demand for end products (cardboard, etc.) will, of course, ultimately affect the success of the price hike.

There have been relatively few educated guesses regarding the UPM-Sappi JV. Personally, I see the JV as a very smart strategic move in its execution. It will be interesting to see the competition authorities’ stance—the company’s market share is very large in Europe. Can anyone estimate why it would or wouldn’t go through? Synergies, pricing power, and the controlled phase-out of capacity in the coming years would be much more efficient through the JV. Pricing power would also be stronger.

Based on the article linked below, the JV’s market share would rise to a very high level in Coated WoodFree papers and LWC. Since there is significant overcapacity in the industry, the JV could certainly ease the situation in the eyes of the competition authorities if it wished, by announcing that x tons will be closed if the merger goes through. In general, merging companies also typically lose market share to competitors, which also corrects the situation from a competitive perspective. In other words, the merger must yield very large synergies that would offset these typical negative consequences in the market.

By the way, is the Versowood and UPM deal already finalized, or did they have to wait for the competition authorities’ decisions (and if so, have they been issued)?

Exactly. That’s why many acquisitions end up being unprofitable for the buyer or the payback period is very long. In this case, magazine and fine paper capacity in Europe will need to be closed indefinitely at a varying pace depending on the economic cycle (as well as what happens on other continents, including China and potential tariffs). Personally, I see that this JV could make sense for both through controlled capacity closures and pricing power (investment needs are very low, maintenance only). I see the biggest risk as the competition authorities not approving it or the conditions being harsh. In the European shakeout, this JV would be in a strong position (vs Norske etc.).

The strategic partnership agreement announced by UPM and Versowood in September 2025 has received the necessary regulatory approvals, and the agreement entered into force on December 31, 2025.

In accordance with the agreement signed by the companies, UPM will receive high-quality pulpwood and wood chips produced as a sawmill by-product from Versowood, which will strengthen the wood supply for UPM’s pulp mills in Finland’s tight wood market. In turn, UPM will supply logs obtained through its own wood procurement to Versowood’s sawmills.

Furthermore, UPM’s Korkeakoski sawmill has transferred to Versowood’s ownership, and UPM has acquired a minority stake in Versowood.

Here is Viljakainen’s company report on Metsä Board. ![]()

We reiterate our Reduce recommendation for Metsä Board and our target price of EUR 3.00. The company’s short-term outlook is difficult, although the massive ongoing efficiency measures are creating a path toward an earnings turnaround, and the declining price of wood is also giving the company some breathing room this year, at least momentarily. However, we further lowered our short-term forecasts for Metsä Board, but we did not make significant forecast changes for the medium term. We still do not see Metsä Board’s expected return as attractive, considering that the earnings turnaround will take time even in the best-case scenario and the operating environment may have structurally weakened.

I recommend a trip by train from Tampere to Oulu and back by car.

There are so many windthrows that there’s plenty of pulpwood material.

And wood chip material too, and of course sawlogs as well.

I would imagine that timber is being offered to forest companies quite briskly now; I wonder if prices will continue their downward trend.

According to UPM and Stora representatives in a KL article, the impact on wood supply is local and temporary. The estimate was apparently that a total of 300,000 cubic meters of timber were downed in Storm Hannes.

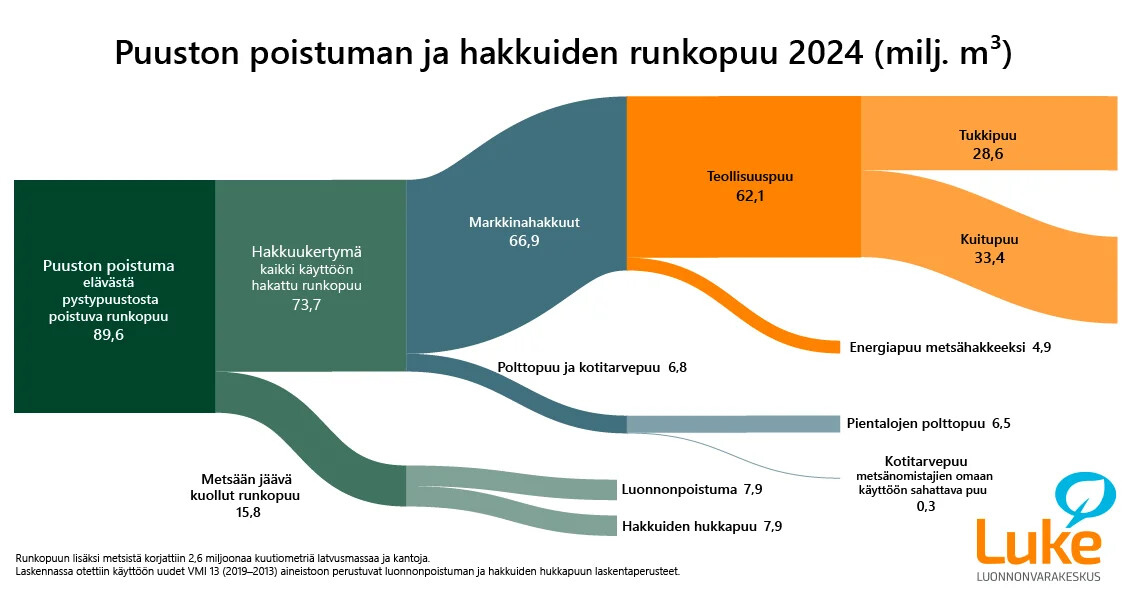

Approximately the same amount should fall in the wind every weekday; those three hundred thousand cubic meters correspond to slightly more than a day’s drain:

Yeah, one storm doesn’t make a summer!

BUT is the reason why Finland just keeps getting poorer in that picture of yours..?

Over half of the growing timber is put into the pulp vat and sold abroad as raw material.

Forests are logged prematurely due to the agenda of the forest companies?

Previously, I had compared UPM’s 10-year development.

https://forum.inderes.com/t/sellulove-eli-stora-upm-metsa-jne/725/3891?u=taystumpelo

Based on that, it’s more a case of treading water than actually becoming poorer.

In relation to this, I once came across an article that stuck with me: https://suomenluonto.fi/artikkelit/onko-suomessa-metsaa-enemman-kuin-koskaan/ Immature trees have always been harvested. The link states, “In the mid-19th century, the growing age of sawlogs was generally assumed to be 140–200 years, and an age of about 150 years was commonly used as a criterion for sawlogs.” or “For example, the Finnish Economic Society stated in its 1845 opinion that the growth of a pine tree to full maturity takes 180–200 years in Finnish conditions, but it is suitable for construction timber as early as 140–150 years of age. Metsähallitus, for its part, stated in a report given through the 1874 forest committee that a 110-year-old trunk was still considered small-diameter wood, and only 160-year-old logs were starting to be full-sized, ‘mature’ timber.”

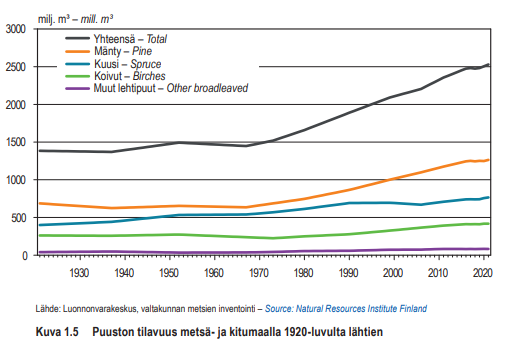

With those classifications, we would now be harvesting trees planted in the late 1800s, if they had been planted back then. I once looked at statistics showing that forest volume has increased quite significantly since the 1970s; I would imagine that planting has a rather large impact on the current volume of standing timber as well:

I don’t know if this was a sarcastic remark or not, but I need to correct this: pulpwood comes from thinning operations as well as from the tops of trees. Thinning is a very essential procedure for wood quality, and if thinnings were not carried out, the quality of the stand at final felling would be significantly lower, leaving it in a clearly weaker position for mechanical wood processing.

Countries like Canada are also (slowly) moving towards thinning operations, as they can be used as a measure for multi-objective forest management (such as wildfire risk prevention, wind damage prevention ((timely thinning!!)), and as a defense against biotic damage). Furthermore, without these thinnings, overall annual forest growth would be about 30% lower when looking at the entire rotation period.

So, even though the media nowadays portrays forests as ‘raw material for pulp digesters,’ most of the research community stands firmly behind thinning operations.

One more edit: fundamentally, the relative added value and national economic impact of the fiber-based industry is greater than that of mechanical wood processing, so you could almost say that if anything goes out into the world as raw material, it’s log wood and the products processed from it.