LYNCHING IN LUND

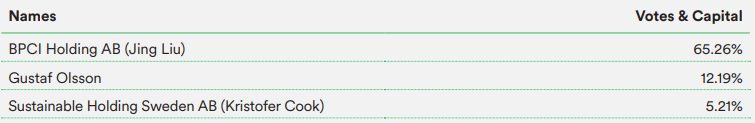

I decided to write this travelogue in this thread, as a familiar Finnish name has appeared on BPC Instruments’ ownership list.

The Proprius crew had also visited the office and reportedly acquired their nearly 300 euro share by buying directly from the market.

Arimatti kindly wrote about the company a year ago in the Swedish small companies thread, so I am spared that trouble.

[quote=“Arimatti_Alhanko, post:21, topic:46966”]

Let’s also add one of my own favorites here, BPC Instruments.

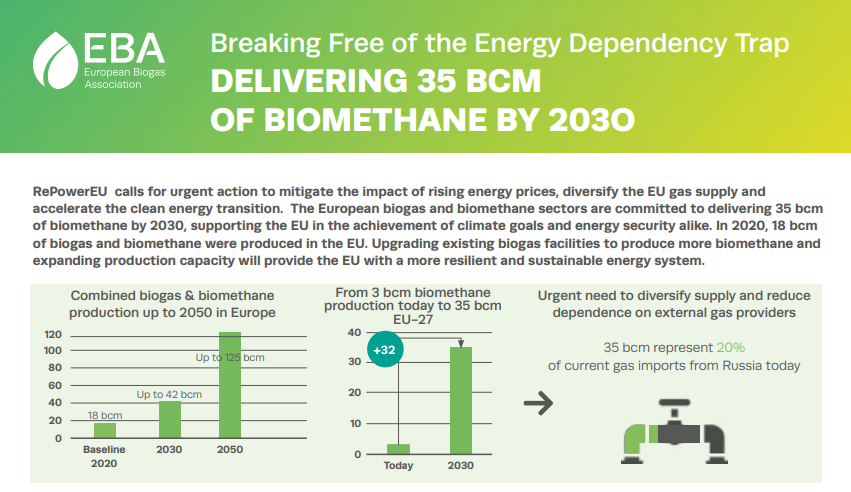

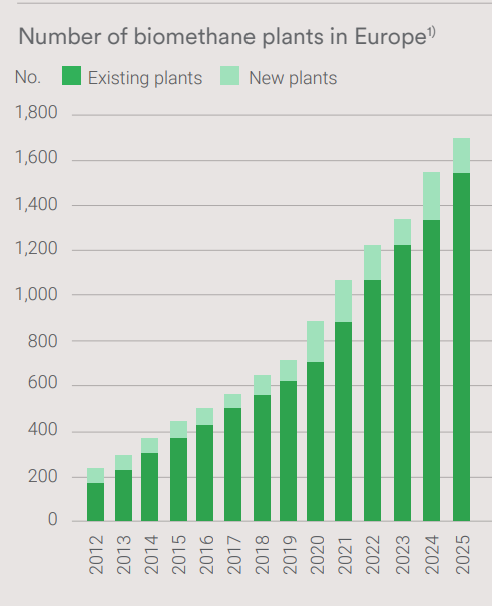

BPC develops, manufactures, and sells measurement and analysis instruments for both industrial customers and research use. These instruments are increasingly replacing time-consuming manual work where raw materials are analyzed in biogas production. Previously, customers did not have precise information about what material was being put into the process, leading to poor efficiency. Biogas production in Europe is expected to grow at a 32% CAGR until 2030. In addition, BPC has made progress in the US and Asia; for example, India has become a significant market for BPC alongside China.

The company was listed at the end of 2021. At that time, the IPO prospectus spoke of attractive opportunities to expand business beyond the biogas industry. Evidence of this has recently emerged. For example, last year BPC Blue was launched, which can be used to analyze the biodegradability of plastic materials. Other mentioned industries include wastewater analysis.

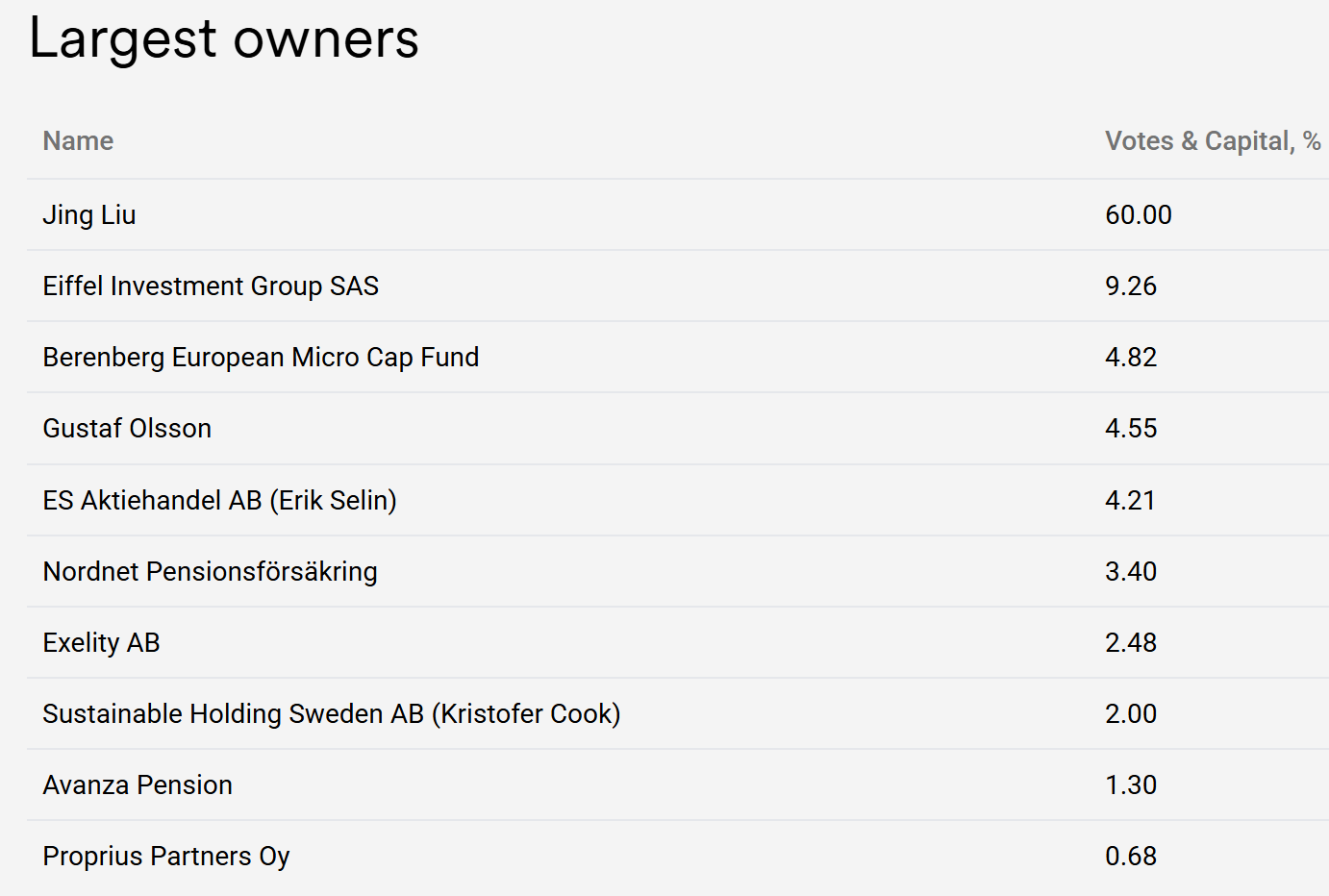

BPC was founded in 2005 by Jing Liu (CEO), Gustaf Olsson (Chairman of the Board), and Kristofer Cook (Board Member). Jing owns 65% of the company, and the other two have 12% and 5% ownership, respectively.

Jing is the only one of them who is actively involved in operational activities today. In fact, she plays a very significant role at BPC. At the end of 2023, the company had only 12 employees, and when I visited their office in Lund, Sweden, last April, it felt like she was responsible for everything. Product development, sales, marketing, China contacts, etc. What would happen to the company if Jing were no longer in the picture for some reason…? Perhaps from a shareholder’s perspective, a bodyguard by her side might be appropriate? ![]()

.

.

.

[/quote]I have personally owned the company since the beginning of 2023. The company is small and doesn’t have analyst coverage, so I’ve tried to glean information directly from the CEO via email, to which he has very kindly responded. This summer, I decided to ask if a visit would be possible on my way home to central Europe, driving through Sweden, and to my delight, the visit was successful.

NUMBERS

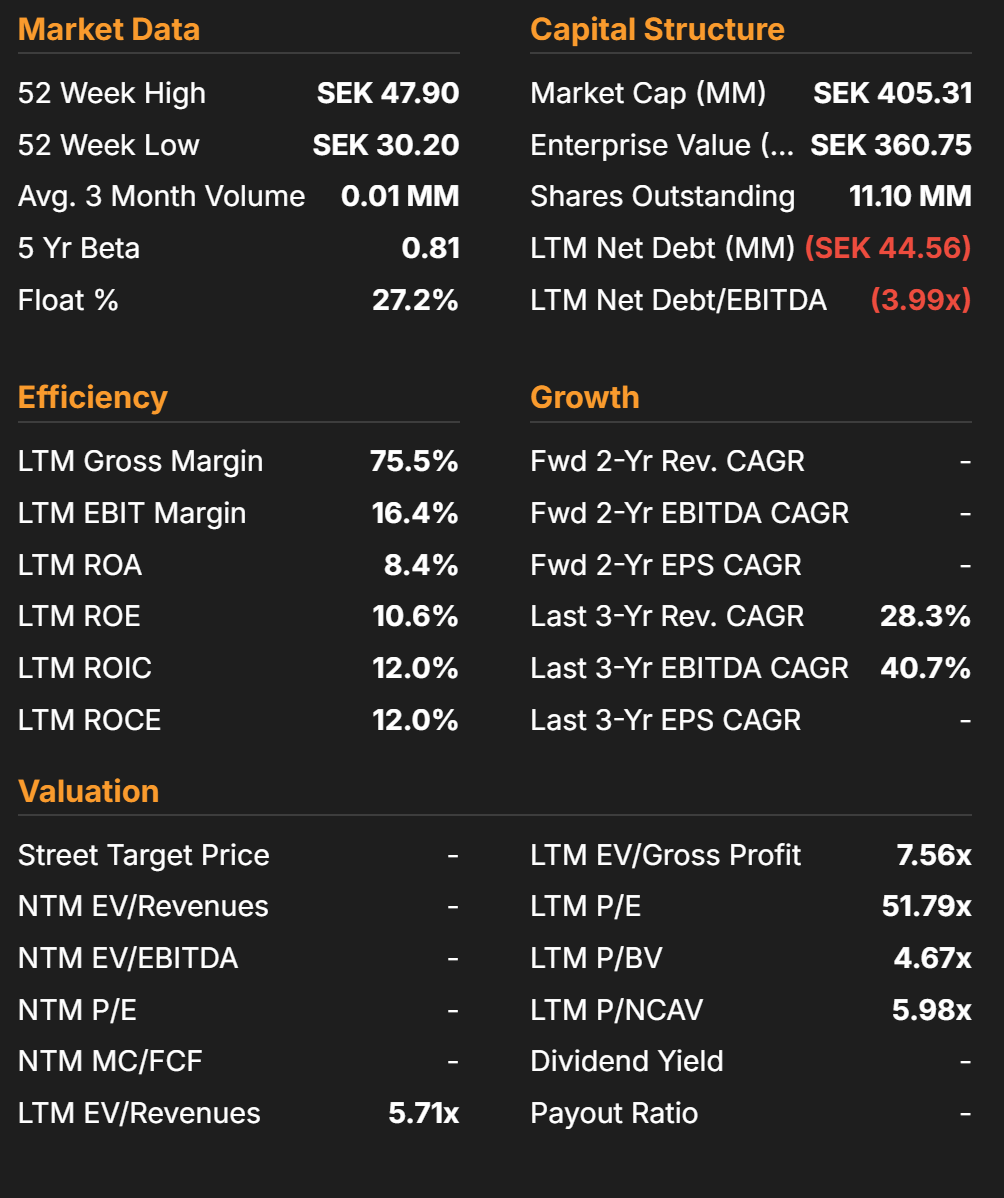

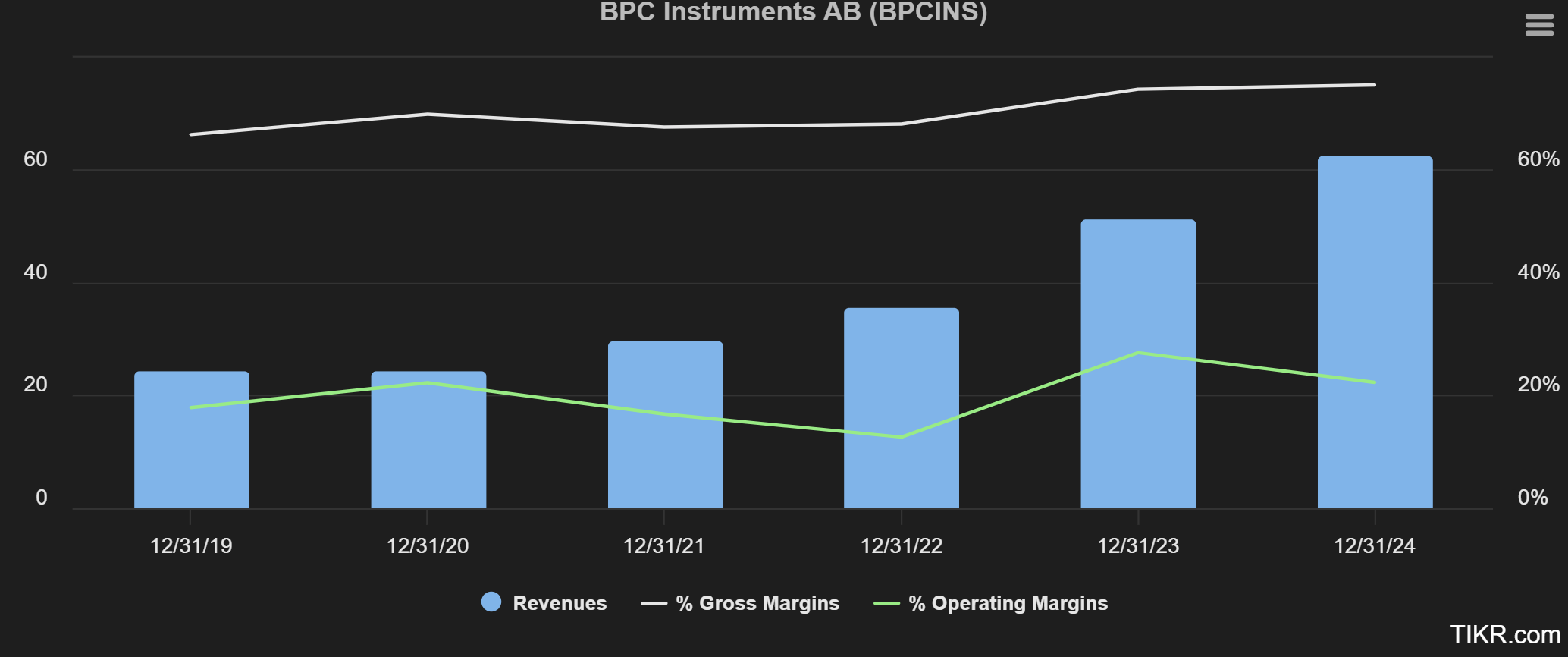

The following information can be found on TIKR:

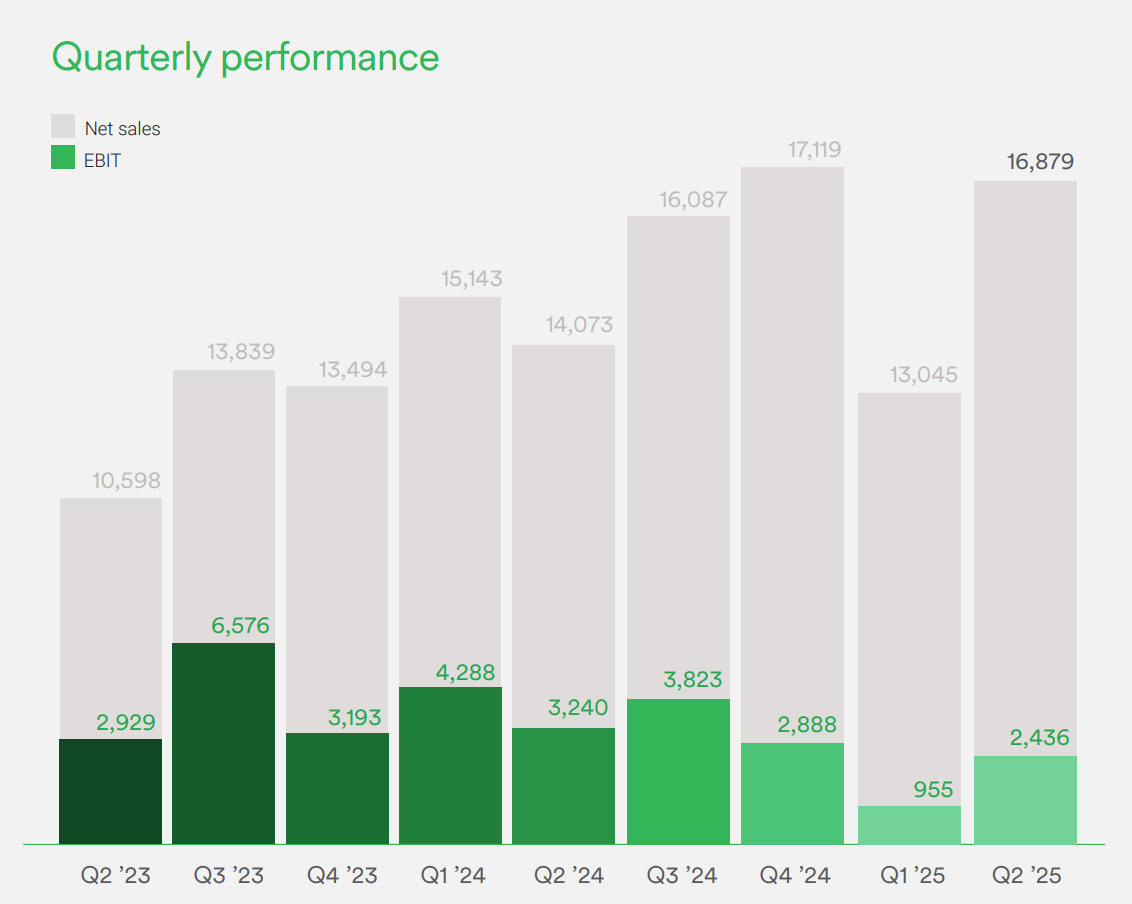

And quarterly figures, for example, from the company’s Q2 report:

As can be seen, the company’s gross margin percentage is on par with Revenio, over 70%. In some quarters, it has even reached over 80%. However, the EBIT% has recently started to decrease as the company has hired employees, currently totaling 20. Hopefully, this will translate into growing revenue in the future.

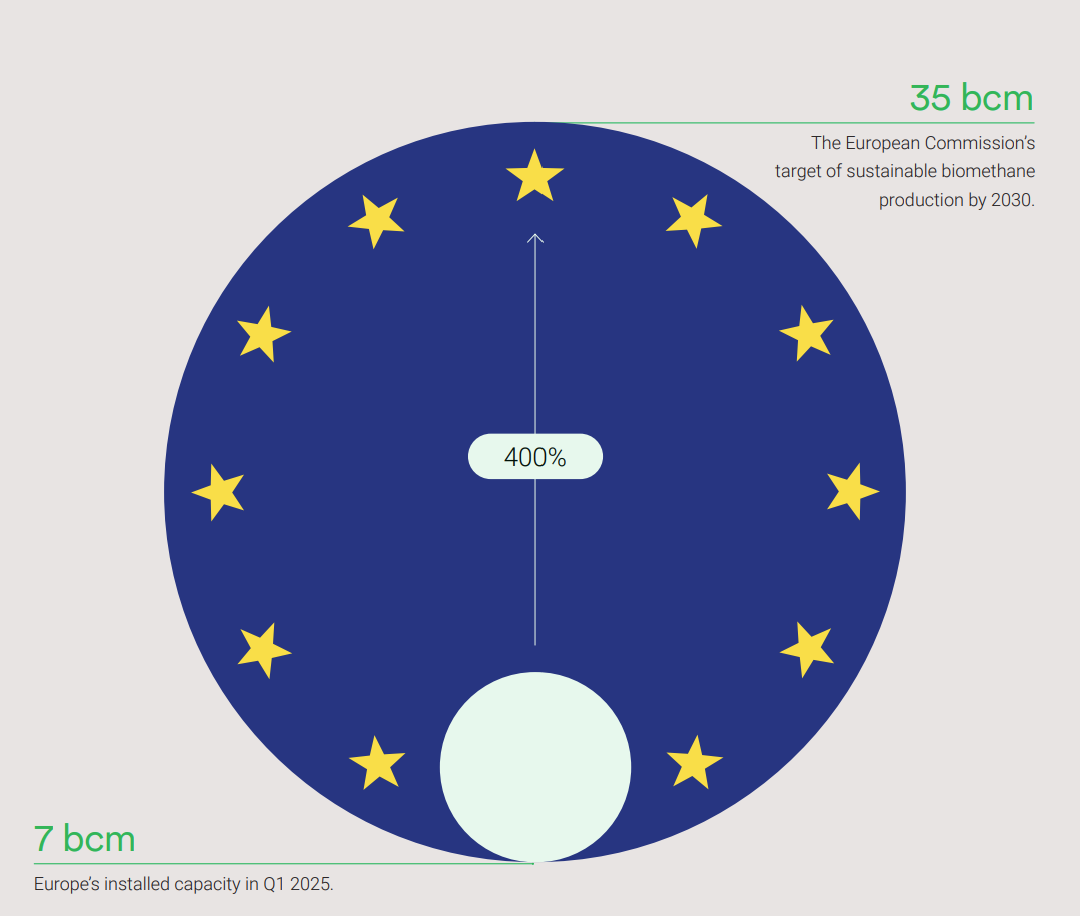

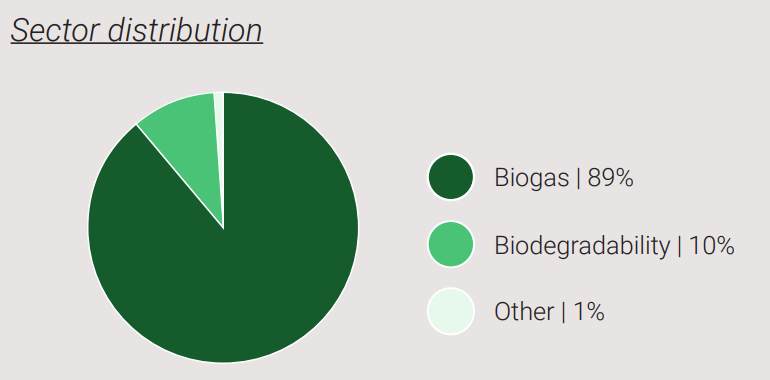

The company primarily generates its revenue from the biogas segment, for which the EU has ambitious growth targets.

.

.

Although targets are just targets and are unlikely to be fully met, the industry’s growth has been quite good recently.

In addition, the company aims to gain more business from other verticals:

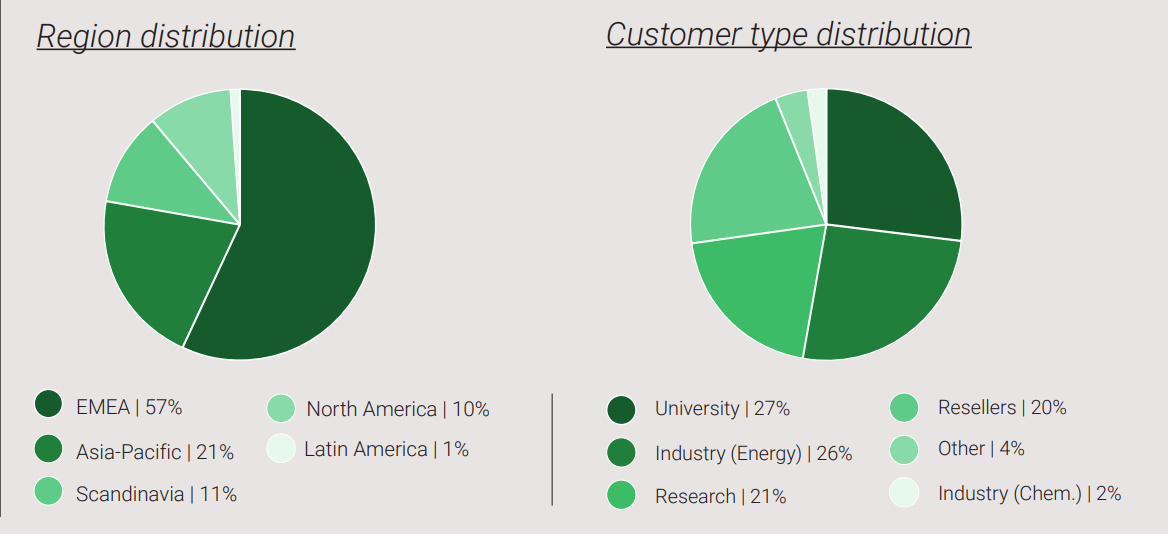

Although its operations are relatively small, the company still operates in several industries and has customers from as many as 80 countries.

According to the CEO, most sales are still made from Lund. Originally, the business started expanding from universities to the private sector.

QUALITY

According to the company’s own statement, they have a 90% market share. Their products serve as an industry standard; for example, in scientific research, BPC’s products are used as a benchmark. The moat is based on a small market with little competition. There are some Chinese copies, and they don’t seem to give up even after losing lawsuits. However, Liu says they have a technological lead, which they aim to maintain through product development.

I also got to visit their product development lab. In the picture, Liu is explaining how they are currently trying to deepen their moat, for example, by expanding the equipment for new applications.

The company’s technology is primarily based on Liu’s expertise. He has experience in biotechnology, electronics, and sales. Even today, the latest innovations stem from his ideas, although the implementation is handled by employees.

Often, the risk in product-sales-based businesses like this is that to grow, you first have to sell the same amount of product as in the previous comparison period, and then some more. However, this industry is not as volatile as, for example, a sauna heater based on consumer behavior. Furthermore, their revenue includes some recurring revenue-like components. According to the CEO, 6-7% of revenue comes from spare parts, and an additional 40% of sales are based on expanding the equipment base of existing customers, and this group is constantly growing with new customers.

FUTURE GROWTH

Liu stated that one of his strengths is his market knowledge. He said it’s difficult to estimate the market size because new pockets are constantly being discovered (as is currently said in Inderes circles). For example, he said that great potential lies in the opportunity to sell more directly to producers instead of manufacturers. However, it requires increasing the visibility of the technology, and according to LinkedIn, the company attends many fairs around the world. Liu said that developing this strategy and finding new revenue streams is his most important task at the moment.

Something that speaks to their confidence in future growth is that the company is moving into new premises, which are currently far too large for the current 20 employees. However, the company has signed a 15-year lease for the premises, and the intention is that by the end of that period, the facilities will be too small for the company.

Growing the organization naturally also requires Liu to develop as a leader, but he mused that life is continuous learning anyway, so it shouldn’t be a problem.

ANALYST COVERAGE

The company’s ownership structure is very concentrated, and Liu said they currently have no real need for analyst coverage. They prefer to focus on developing the business. The company’s ownership base has expanded slightly recently through sales by major owners to institutions, as well as through directed share issues. Thus, the company has a good cash position, which they intend to use for investments and possibly acquisitions that could expand the product range, but they plan to be particularly cautious in that regard.

Although the company doesn’t strictly need new investors, Liu seemed pleased when I told him about the Inderes community and how I always write about my trips here on the forum. I told him that the interest of Finnish private investors would surely grow through this writing and especially through Proprius’s position. That is one reason why I am writing this post in this thread. I promised to send this article to Liu, and that I would get at least 50 likes, so please hit the like button so he can see how unique our investor community is here. Perhaps through that, he might eventually be inspired to purchase Inderes’ services as well.

P.S.

This time it was quite tidy, and even the leftover coffee tasted pretty good.