Basic information about the fund:

” The fund invests its assets in securities, primarily shares, of small and medium-sized Finnish companies where the companies’ business prospects appear promising in relation to the pricing and risk level of the company’s share.

The Special Investment Fund Proprius Partners Micro Finland is an actively managed equity fund, the investment objective of which is to achieve the highest possible appreciation for the fund unit in the long term by diversifying assets in accordance with the investment fund law and the fund’s rules.

Furthermore, in accordance with Article 8 of the SFDR, the fund aims to promote combinations of environmental and social characteristics, and the companies in which investments are made must adhere to good governance practices. To promote and monitor these objectives, the fund uses sustainability assessments maintained by external parties to evaluate the sustainability risks and factors of its investments. The fund clearly aims for higher returns than funds that diversify their investments more broadly.

The minimum subscription for the fund is €50,000.

Investment Strategy

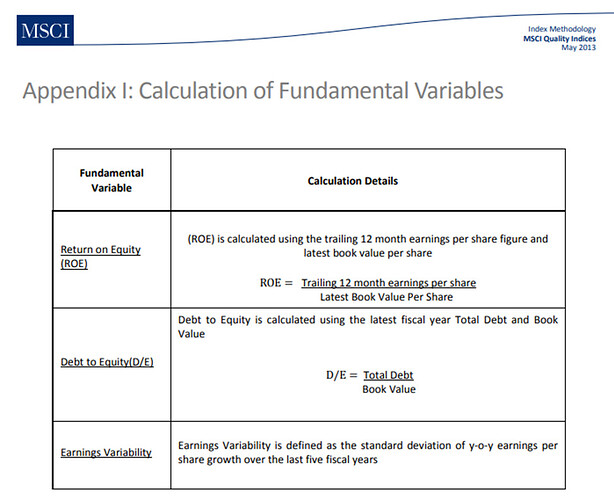

The fund invests its assets in securities, primarily shares, of small and medium-sized Finnish companies where the companies’ business prospects appear promising in relation to the pricing and risk level of the company’s share. We use numerous different quantitative and qualitative criteria as part of our investment process. However, we believe that even the best company can be a poor investment, which means that in addition to the qualitative criteria of the business, we always pay attention to the price paid for the share or security. The fund’s investment activities are based on a so-called bottom-up approach, meaning we make our selections based on company-level analysis.

Finnish stocks have performed well in various historical return comparisons, and numerous highly successful companies have also been found in the small-cap sector, which have generated high returns for their owners historically. The size of the Finnish stock market is limited both in terms of market capitalization and the number of companies, which often leads to international large investors, for example, focusing their interest on the largest and most liquid stocks by market capitalization, while small and medium-sized companies may receive less attention. It is also difficult for a large fund to operate in the illiquid small-cap sector, and there is no ETF product (index fund) for the Finnish small-cap market.

Academic studies have shown that small-cap stocks tend to perform better than average (the so-called small-cap anomaly). In return for high return potential, small-cap companies often entail higher company-specific risk than, for example, large-cap companies. Therefore, our portfolio managers strive to avoid major failures while seeking potential multi-bagger stocks. As part of risk management, efforts are made to consider risks related to stock liquidity and the fund’s sector weightings, in addition to company-specific risks. Investments are generally made with a long-term horizon, but sometimes shorter-term opportunities may arise in the markets where an attractive risk/reward ratio justifies making an investment.

The fund only partially follows the company and sector weightings of the Helsinki Stock Exchange. Investment decisions are made without the limitations set by general indices. As a result, the fund’s performance may differ significantly from the general market development. This, in turn, is due to our fund presumably having a very high active share, meaning the fund’s composition clearly differs from that of comparable general indices. Proprius Partners Micro Finland prioritizes maximizing long-term returns rather than minimizing volatility. The fluctuation in the value of the fund unit can be very strong at times, and we also advise our clients to be patient with their fund investments.

To ensure agile investment operations, Proprius Partners intends to limit the size of the Special Investment Fund Proprius Partners Micro Finland, i.e., implement a so-called soft closing measure when the fund reaches the target size defined by the Proprius Partners board. The aim of this measure is to avoid the “elephant in a china shop” effect.”

The fund has not started its operations yet. More updates will be provided when available.

It will be truly interesting to follow the journey of this fund. Hopefully, communication will be transparent ![]()