This is a company listed on the Canadian stock exchange that provides telecommunications services to businesses, with the Middle East as its primary market. The company was founded in 1992, and its clients include Motorola, Vodafone, AT&T, Ericsson, etc.

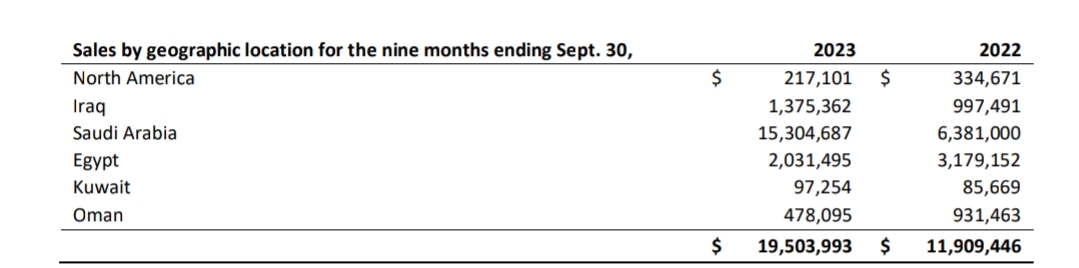

Sales by region.

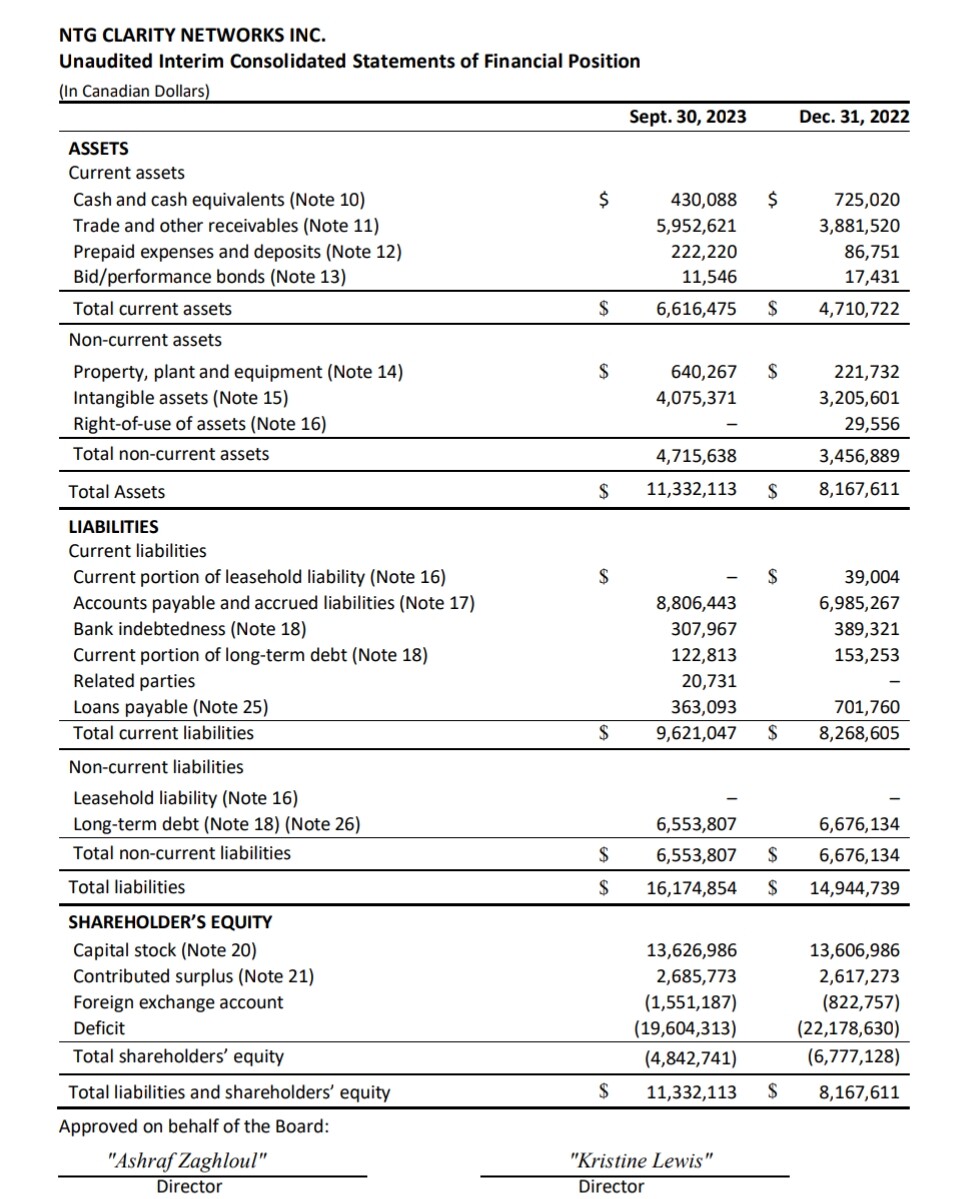

In my opinion, the company is valued very attractively, and the main reason is the negative equity on the balance sheet/the scary-looking balance sheet.

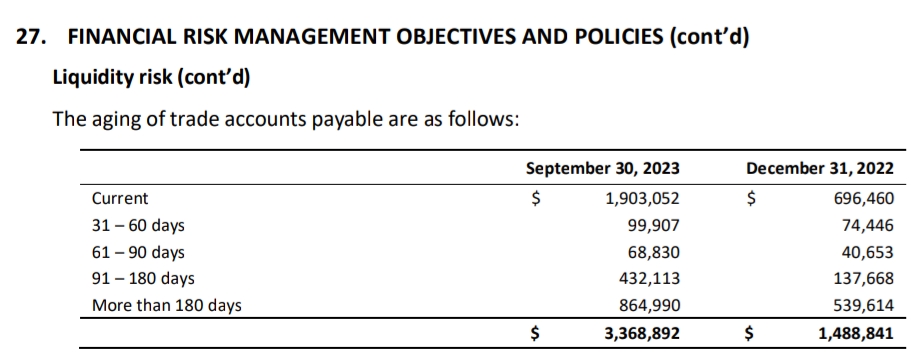

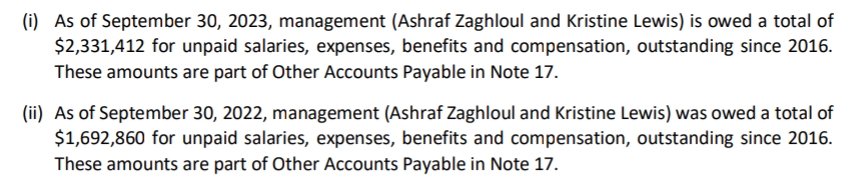

Fortunately, that negative portion has decreased by 1.93m this year. The company is consciously trying to improve that balance sheet, but so far this improvement comes through the growth of accounts receivable, not through the reduction of debt. However, the company itself says they are in no hurry to pay off that debt, as 65% of the balance sheet debt is owned by insiders (6.55m long-term debt + 4m unpaid salaries to two executives).

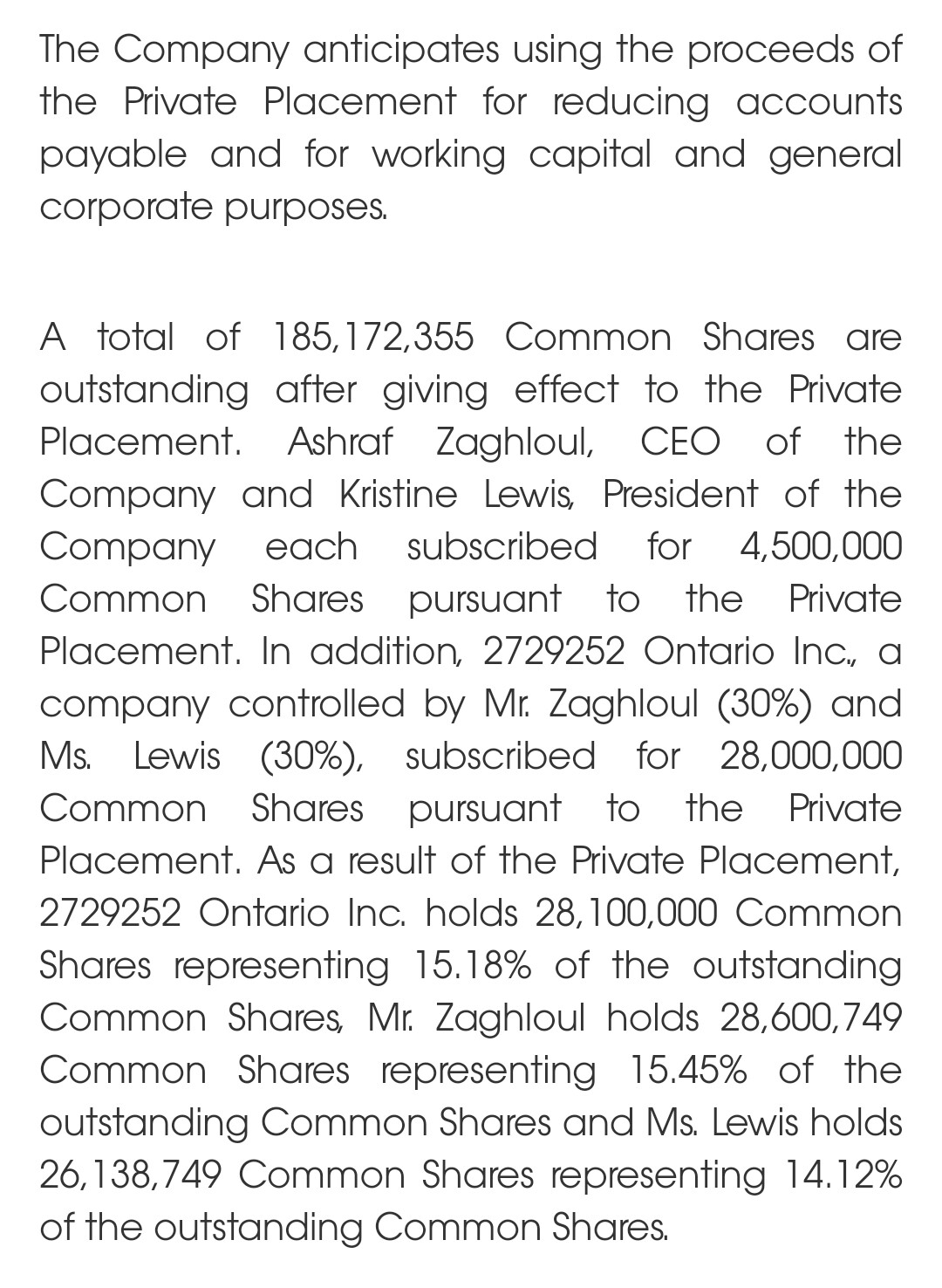

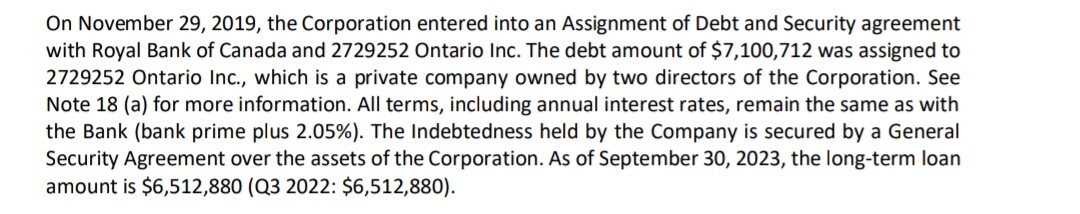

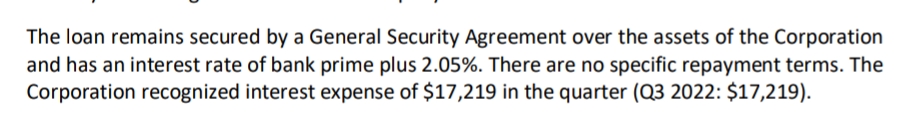

The company has 6.55m CAD in long-term debt, which was purchased from Royal Bank of Canada in 2019 by 2729552 Ontario, a company owned by management (2 individuals). Ntg pays a small interest of approx. 2% on the loan. This is indeed a loan, not a convertible bond.

The company also has debt from unpaid salaries to the same two executives amounting to 4m CAD. This doubles the current liabilities on the balance sheet.

So, regarding this, I think the ratio of current liabilities to accounts receivable is in order.

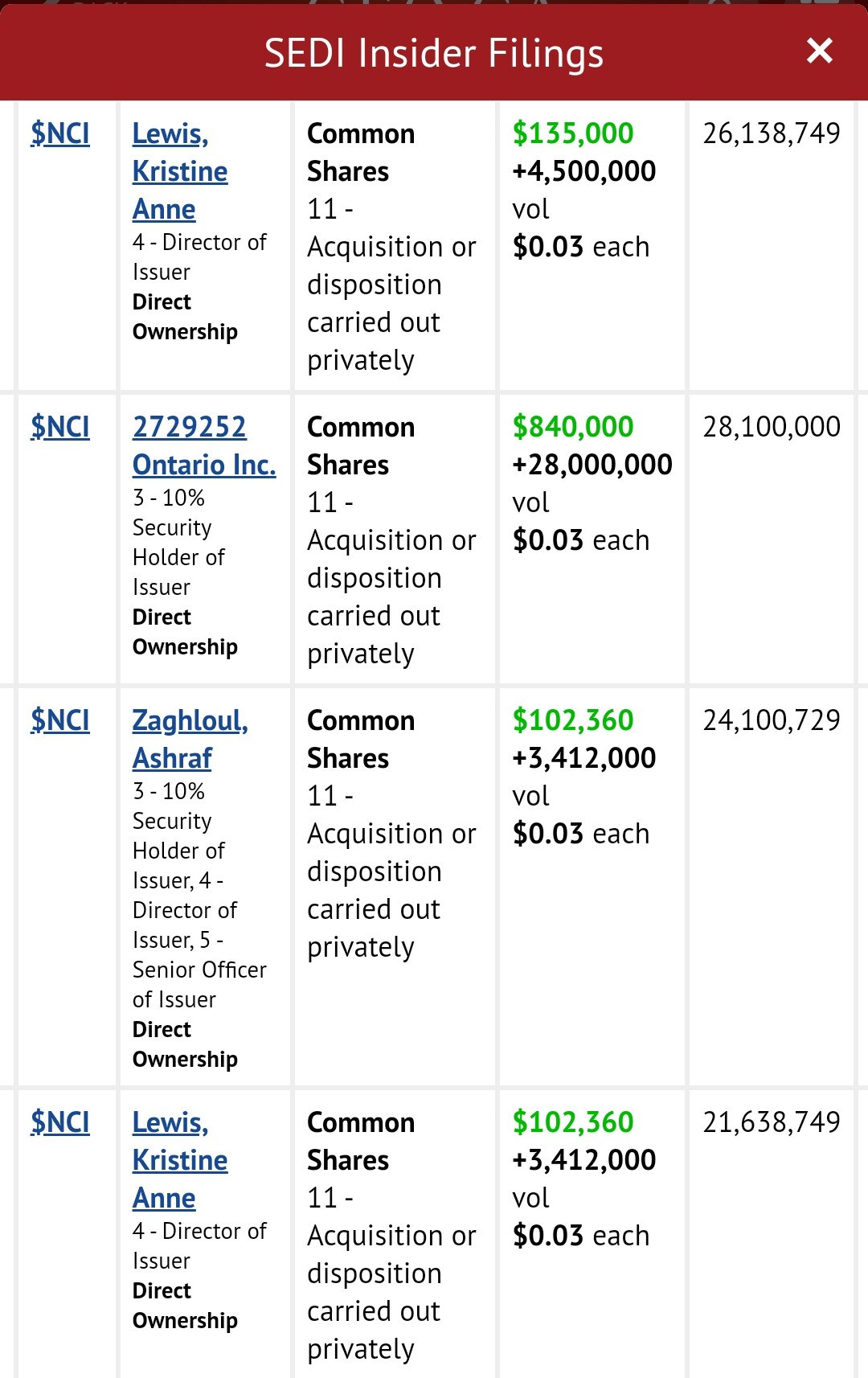

Additionally, insiders organized a share issuance for themselves last December at a price of 0.03 CAD, which brings the total number of shares to 185m. Insiders own approx. 46% of the company.

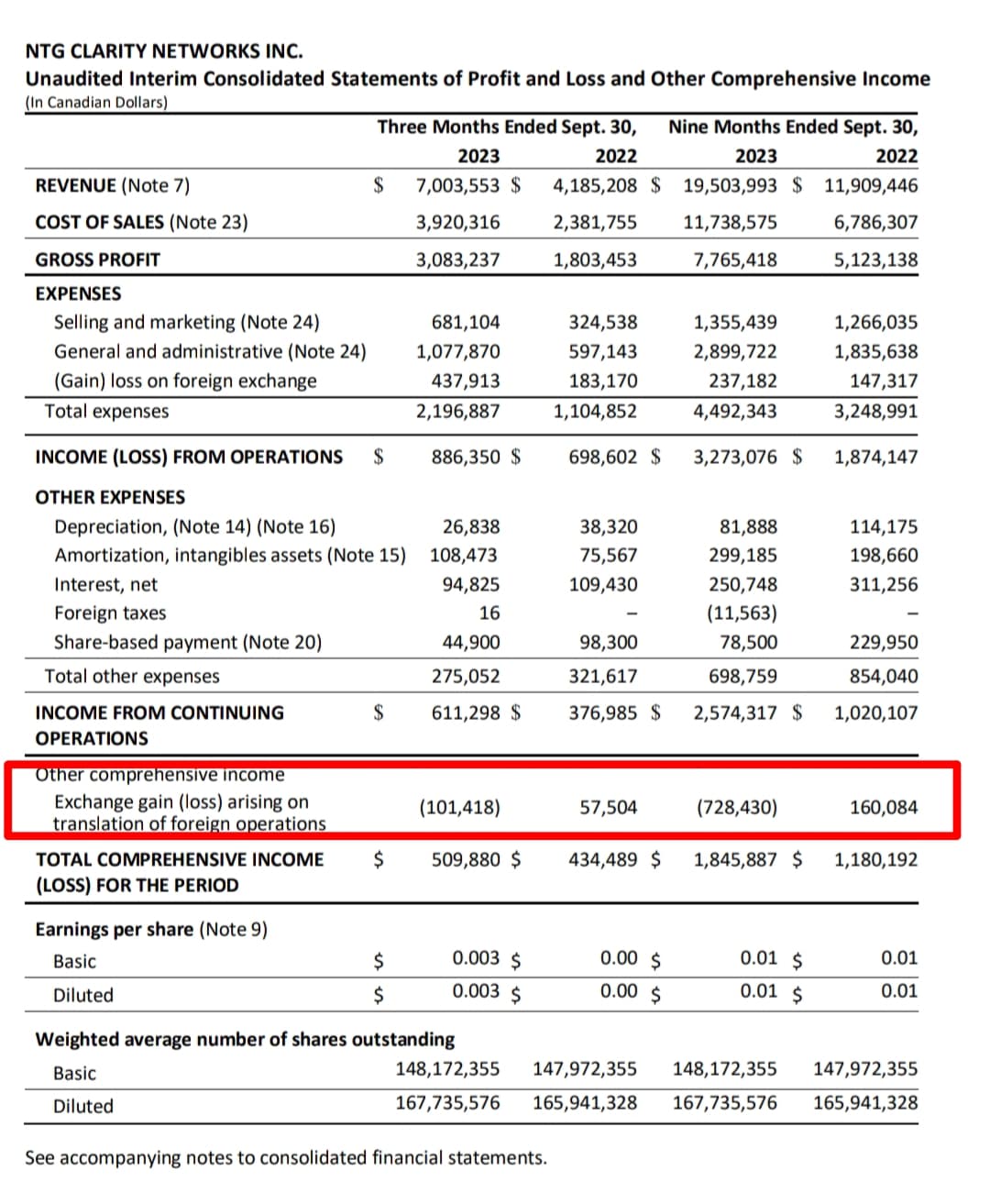

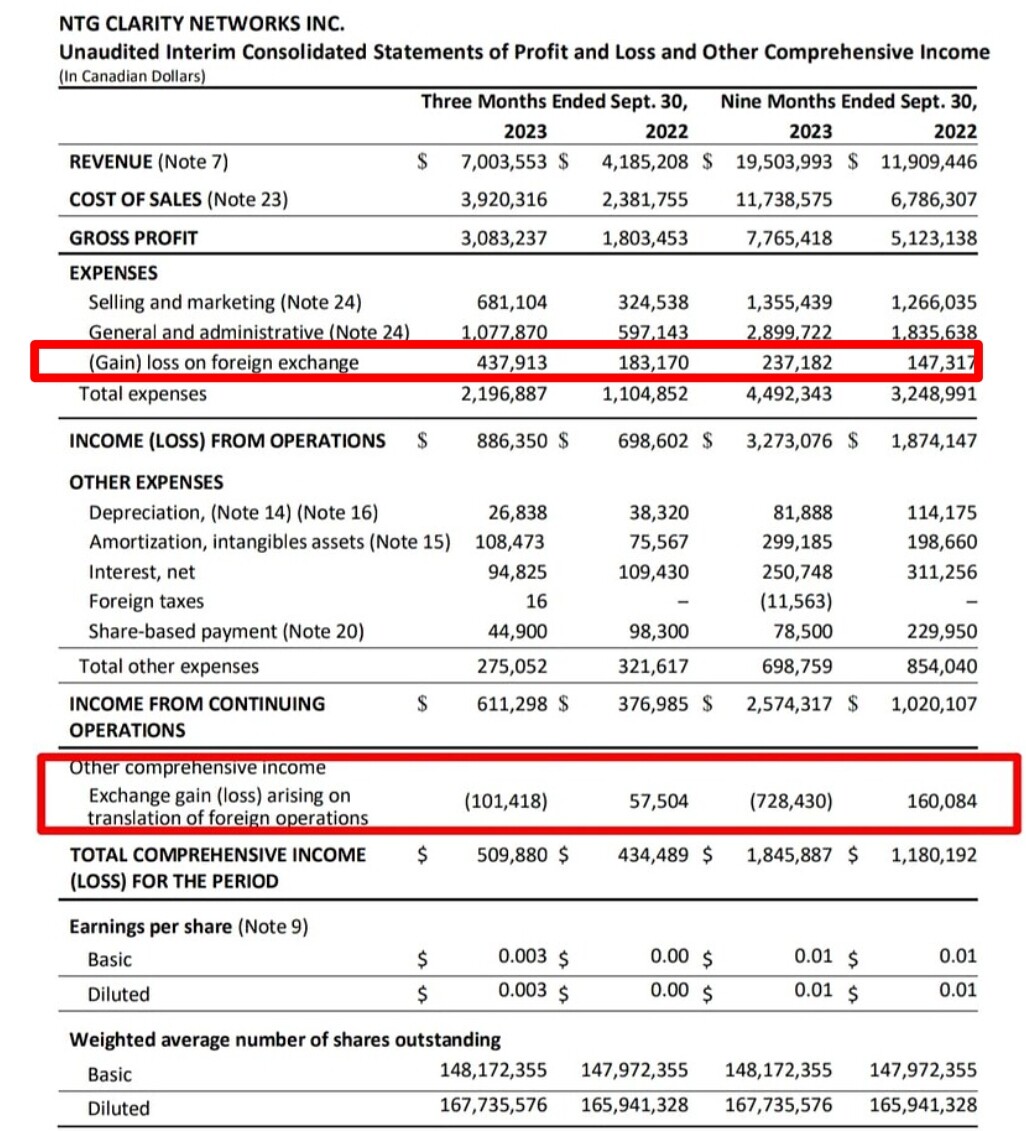

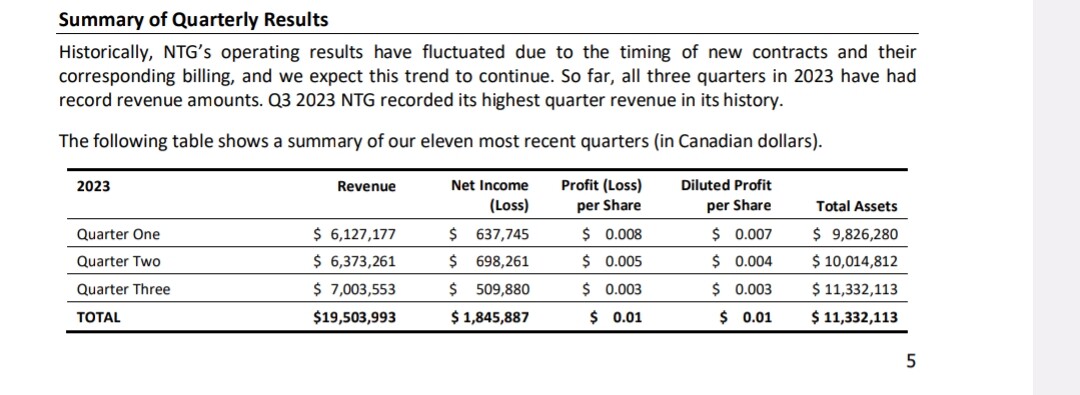

Then the good points, i.e., the numbers below.

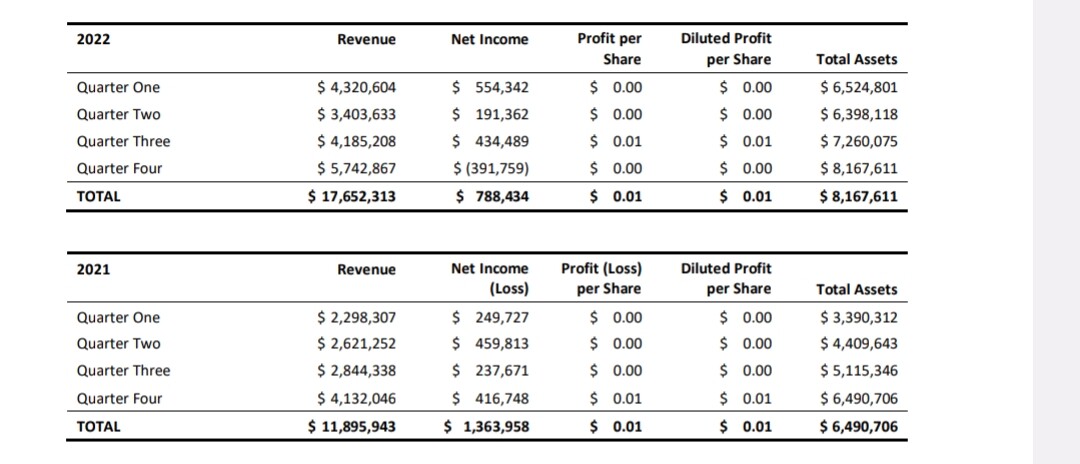

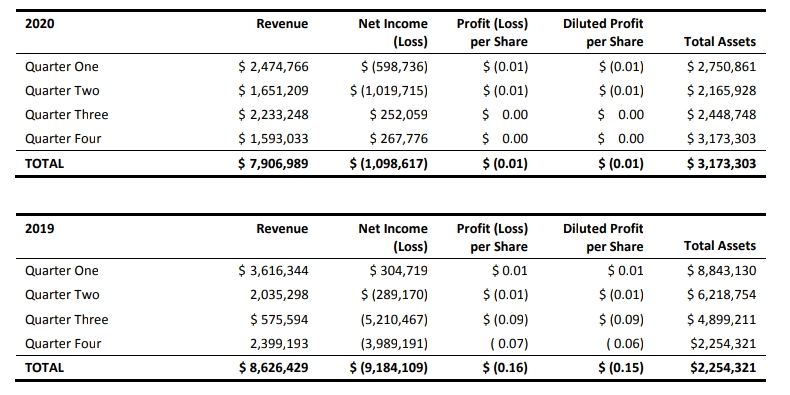

Rev 2020 7.9m cad net income -1.6m shares 103m fcf 956k

Rev 2021 11.9m cad net income 1.36m shares 160m fcf 253k

Rev 2022 17.6m cad net income 788k shares 165m fcf 1m

Ttm rev 25.2m cad net income 1.45m shares 185m + options 0.05 cad 19.7m

Fcf 600k

PE 4.15, EV/Ebitda 3.75 Mcap 8.3m, EV 14.8m

Operating cash flow has been between 400k-800k in recent quarters and free cash flow between 36k-440k

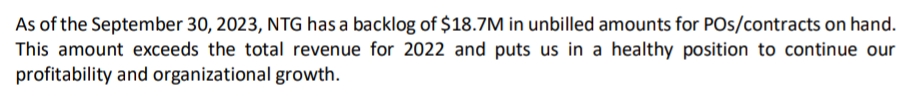

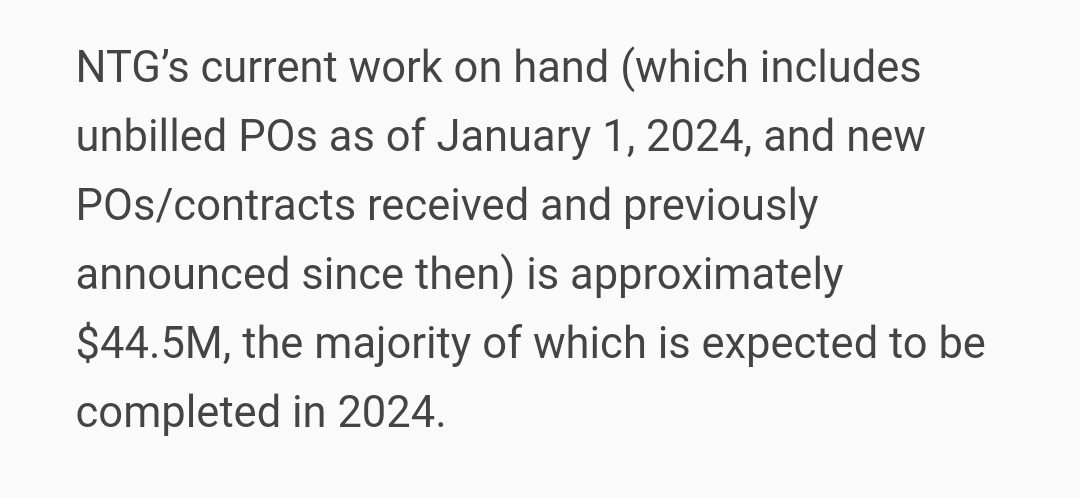

The company announced at the end of Q3/23 that their order backlog is 18.7m CAD and in January of this year alone, new orders have been received for 15.7m. So sales-wise, we will easily blow past last year.

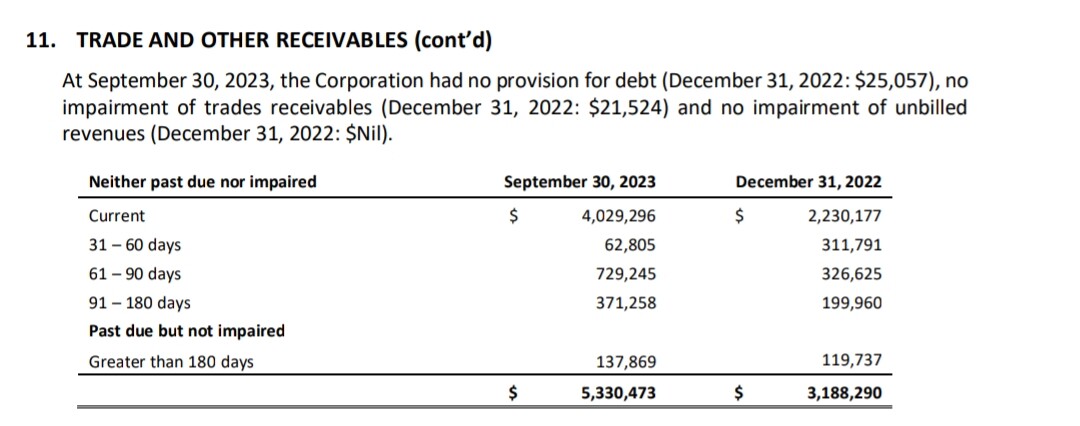

Accounts receivable are also very up to date.

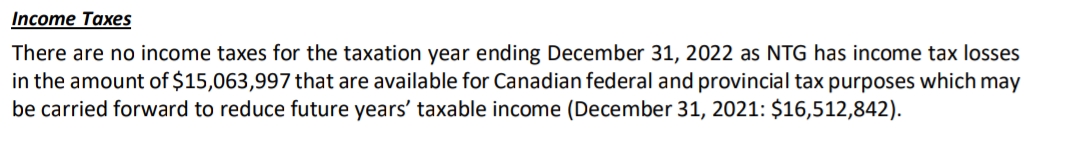

Additionally, the company has 15m CAD in tax loss carryforwards available, meaning the company won’t have to pay much tax on profits in the future.

If revenue and earnings growth continue at this rate, the balance sheet won’t be an issue in the future.

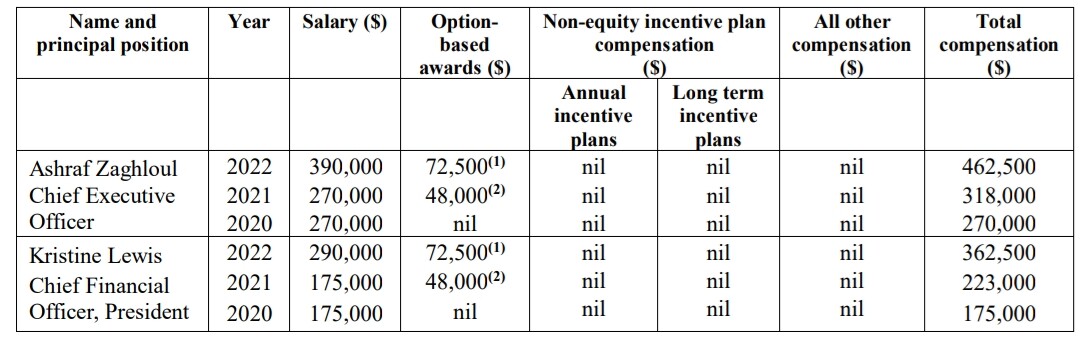

Management compensation is reasonable in my opinion.

There is no information on whether the company is currently paying a salary to those two managers, or if they are working for free, like Voxtur’s Kari. Those management salary receivables were not specified in the Q2 report.

Then if we play around with the numbers a bit, if this year’s net income is, say, 4m CAD and P/E is, say, 10, and there are, say, 200m shares, it would mean a price of 0.20 CAD. That’s 4x from the current price. The improved situation has not yet affected the company’s share price.

I also like the company’s transparency regarding, for example, the income statement, and the company’s contact person below doesn’t hide the balance sheet issue.

Website https://ntgclarity.com/

Investor presentation