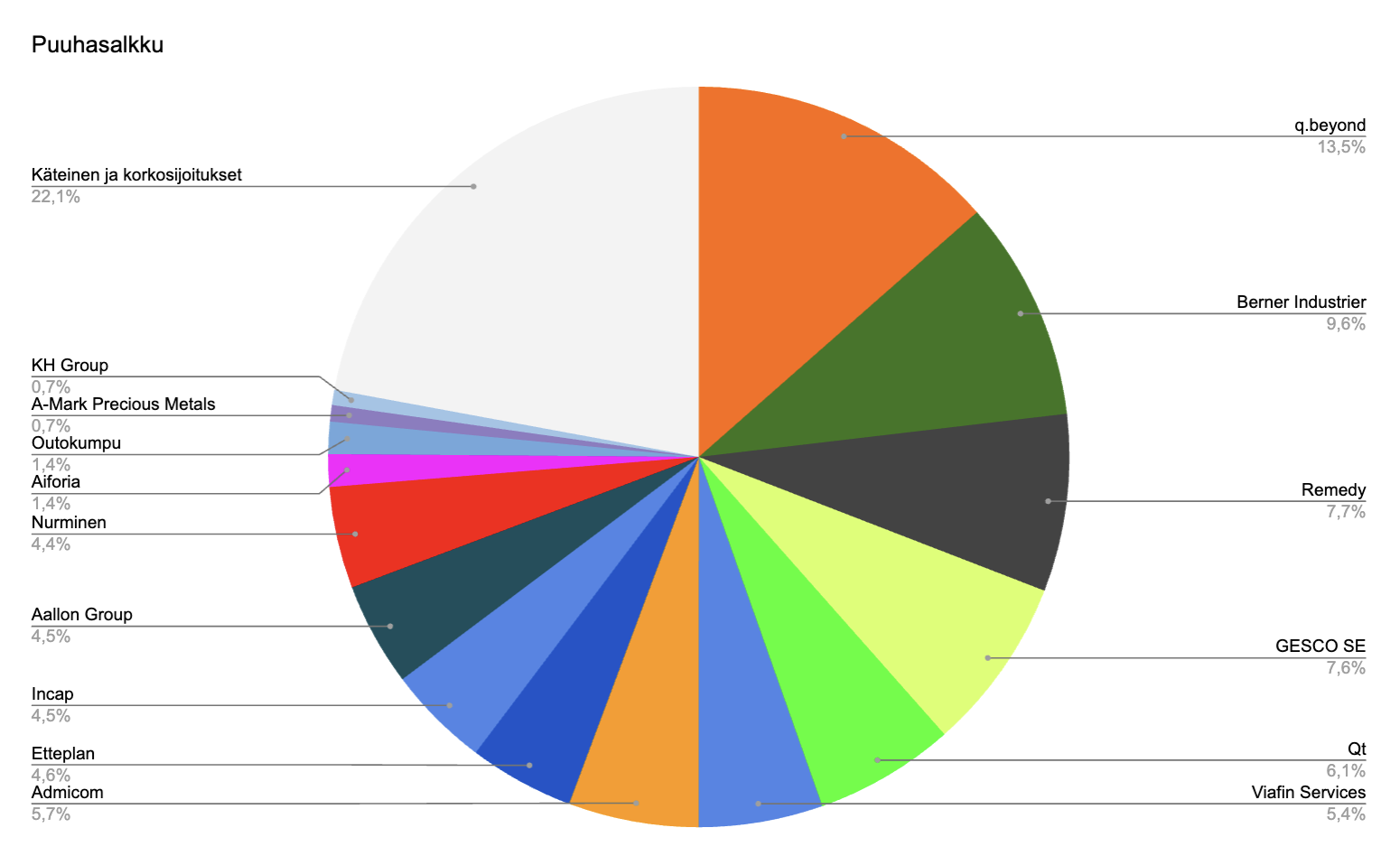

Omaa salkkukatsausta taas pukkaa, viimeisestä onkin jo yli vuosi. Edellinen oli 12.04.2024 ja nyt siis salkkukatsaus 29.05.2025 salkun arvoilla. Ensimmäistä kertaa mennään yli 900 000 euron rajan salkkujen arvossa ja lisäsin loppuun myös palkkatulojeni kehityksen.

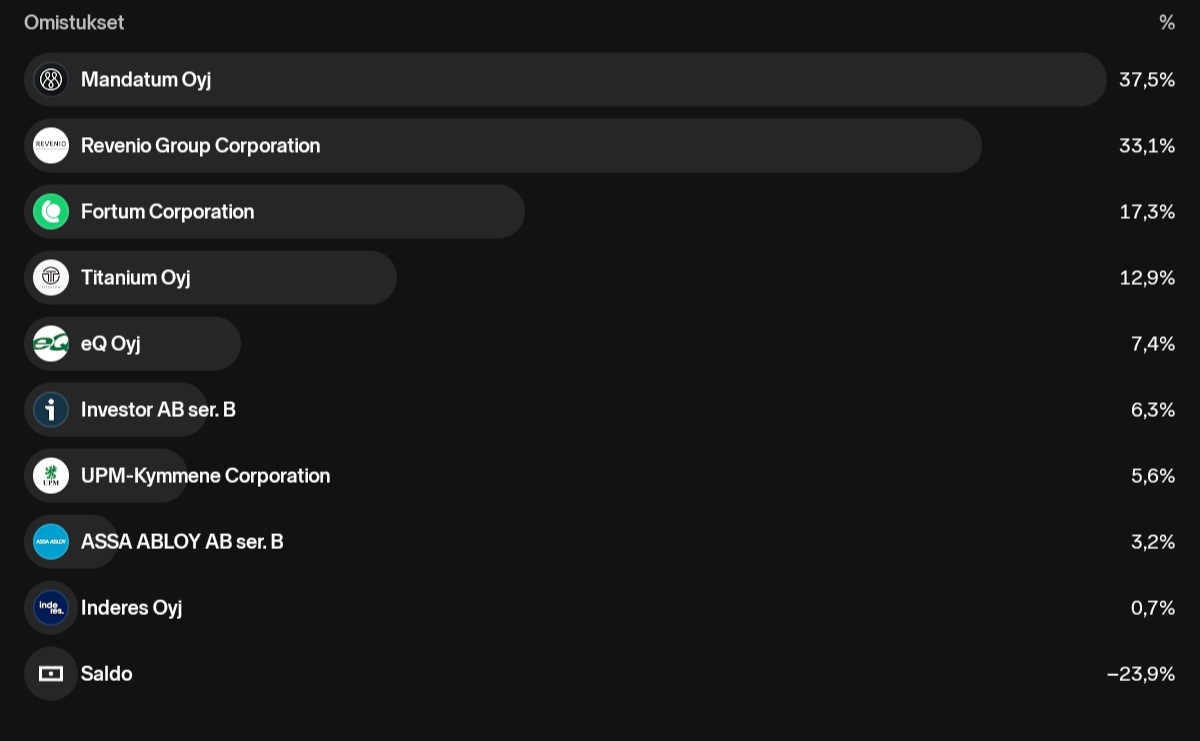

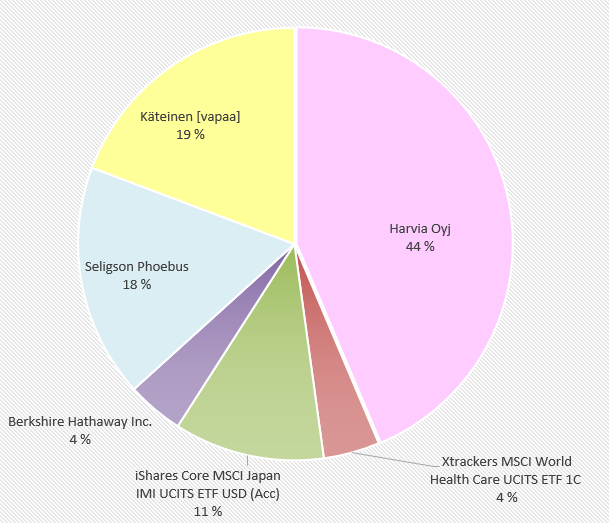

AOT Nordnetissa (29.05.2025):

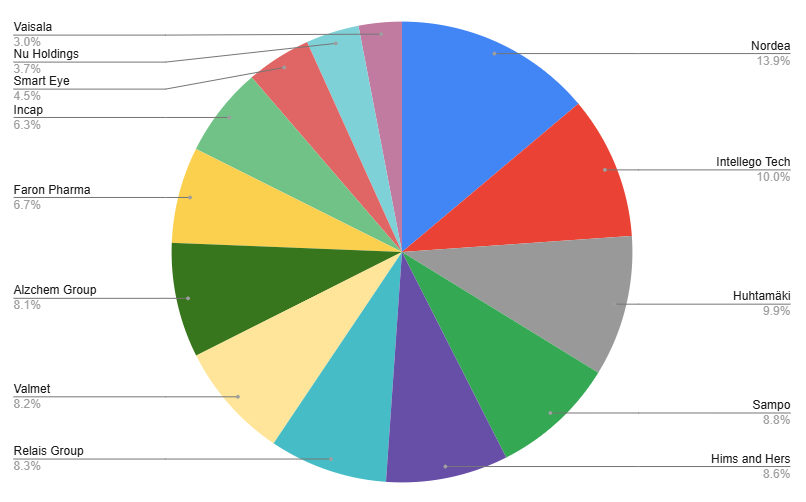

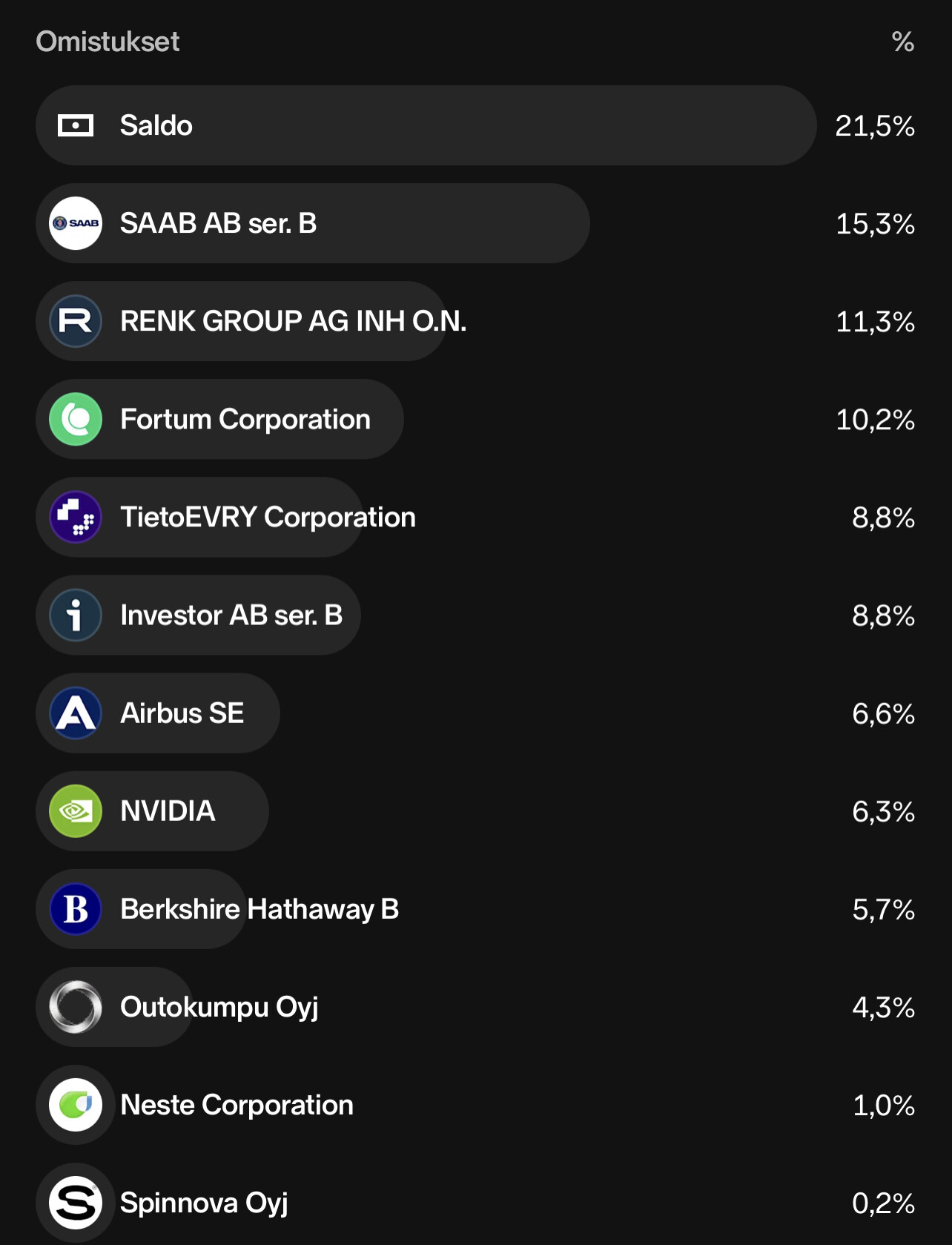

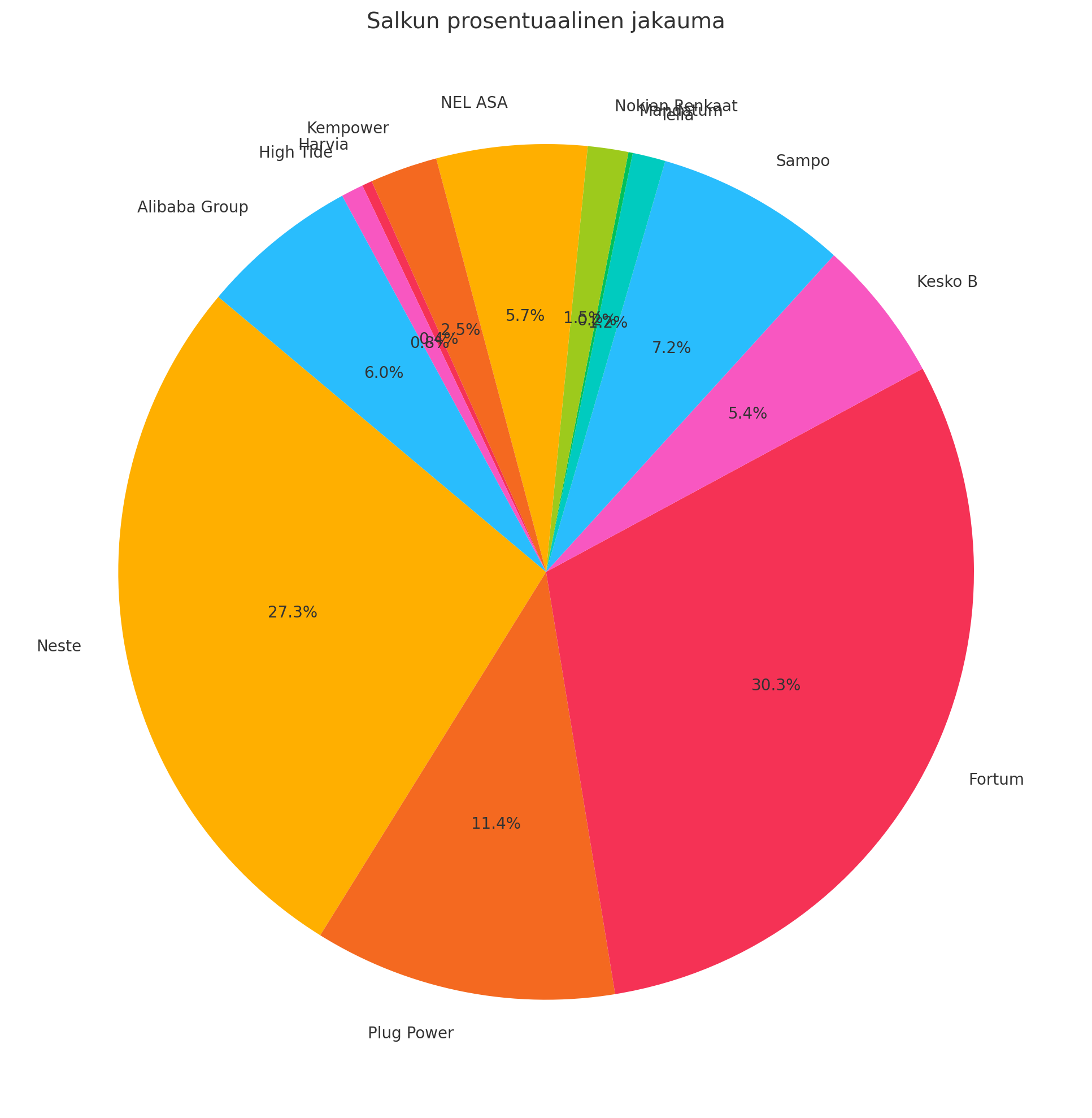

OST Nordnetissa (29.05.2025):

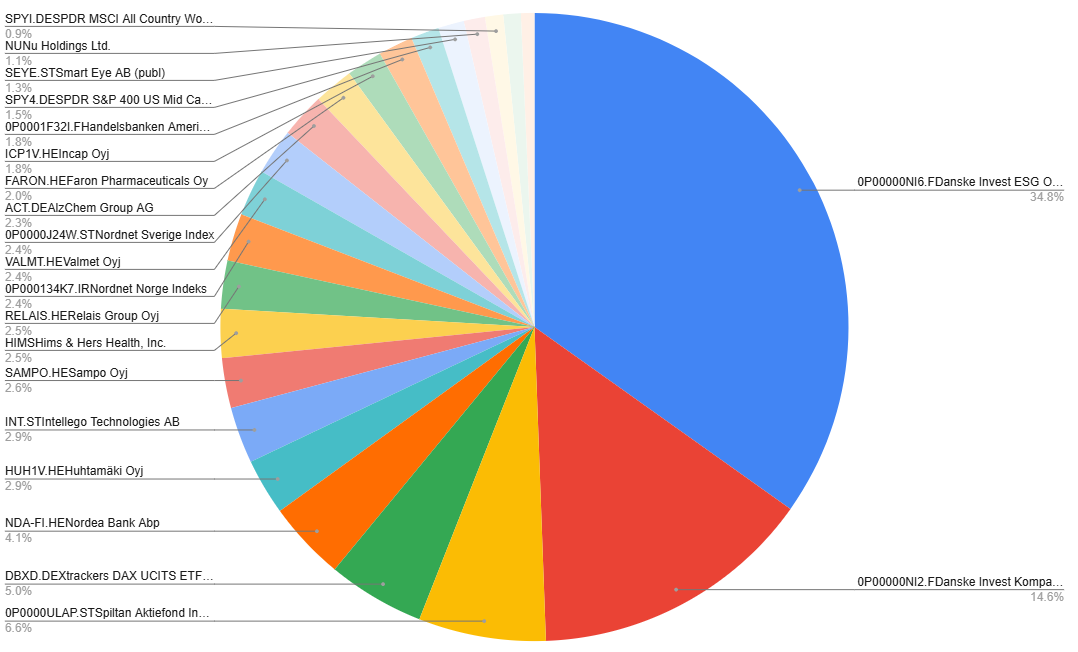

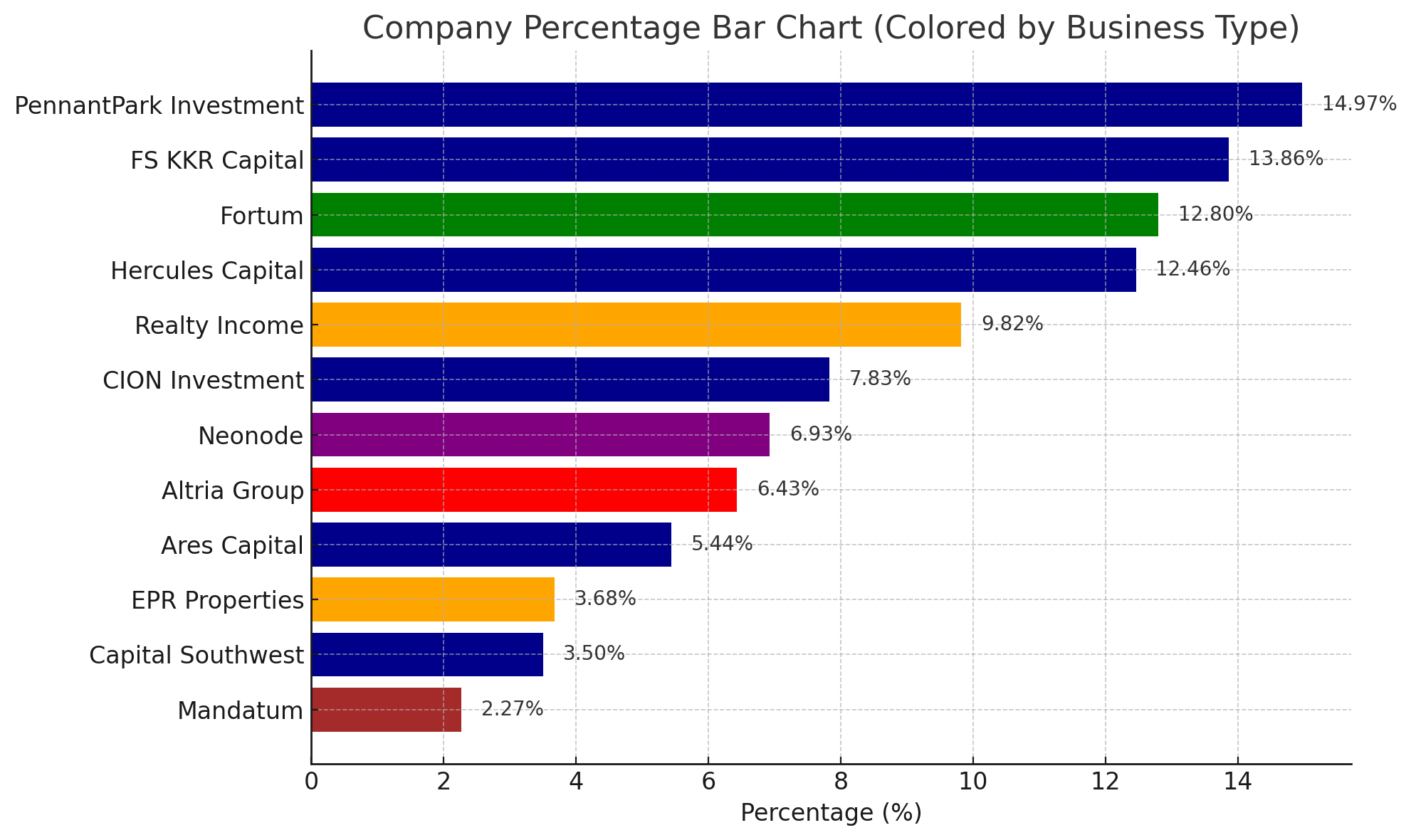

Osingot Nordnetissa (29.05.2025):

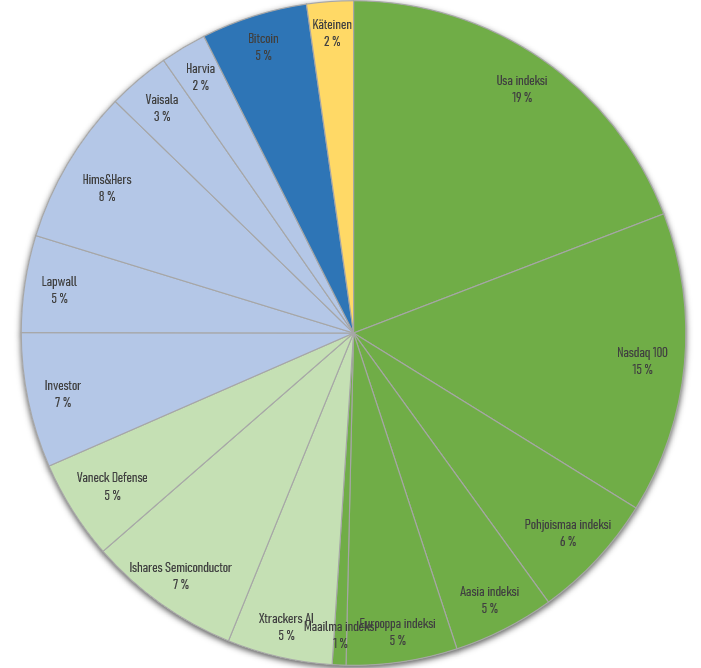

Tapahtumia ja näkemyksiä viimeisen n. vuoden ajalta:

Salkku on pärjännyt kokonaisuudessaan melko lailla samaa tahtia kuin vertailuindeksi OMXHGI. OST 12kk tuotto +1,77 % ja AOT +8,02 %. OST pärjännyt tällä kertaa huonommin kuin AOT kun viimeksi oli toisinpäin.

Yllättävän paljon taas ollut myynti- ja ostotapahtumia viim. vuoden aikana: 105 kpl. Olen kyllä hieman normaalia enemmän kevennellyt ja veivaillut positioita, vaikka edelleenkin päästrategia on perinteinen “osta ja pidä” ja osinkopuolueen jäsenyys. Mutta laskeskelin, että keventelyillä ja lyhyen aikavälin veivailuilla tein viim. 12kk aikana n. 20 000e voittoa, joista vähän yli puolet selittää Wärtsilän ja Konecranesin keventelyt, jotka olivat pitkällä aikavälillä kasvaneet vähän turhan suureksi salkussani kurssinousun myötä, joten pienet keventelyt olivat paikallaan. Paljon on ollut myös kaikenlaisia pienempiä lyhyemmän aikavälin myyntejä, joista kertynyt myös myyntivoittoja: mm. Stora, Kalmar, Terveystalo ja Treasury bondin myynti.

Viimeisen 12kk aikana olen ostanut pitkällä tähtäimellä näitä:

- Aktia OST

- Evli OST

- Neste OST

- UPM OST

- Scanfil OST

- Orthex AOT+OST

- Taaleri AOT+OST

- Target AOT

- Stora AOT

- Pfizer AOT

- Huhtamäki AOT

- Kojamo AOT

- TietoEvry AOT

- Fortum AOT

- Puuilo AOT

Keventelyjä tein näihin:

- Scanfil OST

- Konecranes OST+AOT

- Valmet OST+AOT

- Fortum OST

- Wärtsilä OST+AOT

Veivailut lyhyellä tähtäimellä:

- Tokmanni, Evli, Stora, Aktia, Anora, Kalmar, Nokian Renkaat

Puhtaat myynnit pois salkusta kun näkemys muuttunut:

Myynneistä siis keventelin hieman joitain isoja positioita, joita tuli ostettua ehkä aikoinaan liikaakin, mm. KC, Valmet, Wärtsilä, Fortum, Scanfil. Kamuxit onneksi sain myytyä OST:ltä pois aika lailla +/-0 tuotolla kesällä 2024 - tämä oli ehkä yksi parhaista vedoista, koska AOT:n puolelle Kamux valitettavasti jäi ja siellä se on yksi suurimmista kurapositioista. OST:n puolella olisi kyllä ottanut päähän, jos Kamuxit olisi sinne jääneet, koska ei siellä myyntitappioita voi mitenkään edes verotuksessa vähentää.

Kamuxit myyn kyllä joskus AOT:lta pois ja siitä tulee mukavat myyntitappiot (luokkaa 20ke), mutta vähän auki vielä milloin ja mihin hintaan - onko järkeä enää odottaa parempia aikoja, koska ainakin itselläni usko on mennyt täysin ko. firmaan jo aikoja sitten. Kukapa olisi uskonut, että tuosta tulee Intrumin tasoiset tappiot. Kekkonen sanoisi “saatanan tunarit” kun ei noin yksinkertaista businesta osata hoitaa kunnolla. Pajuharjulle sanoisin kiitos ja näkemiin - tulos tai ulos.

Terveystalosta tuli myös ihan ok voitot - saatan vielä joskus sitäkin ostaa takaisin, jos halvalla saa, mutta se ei ole kyllä kovin mieluisa yhtiö itselleni poliittisten riskien takia. Nesteen ostot OST:lle ovat myös menneet ajoituksellisesti pieleen, mutta sen suhteen en ole kyllä luovuttanut vielä, tosin en enää lisääkään osta.

Korkopuolella olen pitänyt kiinni kaikista muista korkosijoituksista paitsi “iShares $ Treasury Bond 20+yr” olen myynyt pois ihan hyvällä voitolla - ja hyvä niin. En tuohon kyllä enää koske Trumpin aikana. Trumpin tulli-sekoilujen pahimpaan aikaan ostin dipistä aika lailla pohjilta vähän sitä sun tätä osaketta ja sain joitain pikavoittojakin kun joissain osakkeissa päiväliikkeet olivat luokkaa +/-10%. Jos Trump tarjoilee lisää dippejä, tulen hyödyntämään niitä jatkossakin. Vaikka Trump onkin täysi mielipuoli ja pilannut jenkkien maineen joksikin aikaa, en usko että hän pystyy koko järjestelmää täysin romuttamaan ja ehkä tuurilla voi tästä jotain hyvääkin seurata pitkällä aikavälillä.

Kojamoa ostelin aika monta kertaa laskeviin kursseihin ja se on tuottanut ihan hyvin tähän mennessä. Olen sitä kevennellyt jo hieman ottaen myyntivoittoja kotiin, mutta annan sen olla salkussa kyllä vielä jonkin aikaa kunnes asuntomarkkinan tilanne tästä selvästi paranee. Kojamon lasken ihan puhtaasti asuntosijoitukseksi vaikka se osakepaperi onkin: en aio fyysisiä asuntoja varmaan koskaan ostaa ja vuokrata, ja asuntorahastot kierrän myös kyllä kaukaa, mutta Kojamo on tähän mielestäni ihan hyvä likvidi instrumentti, jos haluaa ottaa jotain näkymystä Suomen asuntomarkkinaan. Mieluummin ostan asuntoja tämä kautta alennettuun hintaan kuin ottaisin isoa riskiä ja lainaa yksittäisillä asunnoilla.

Suurin osa tämän vuoden osingoista on jo tullut, mutta loppuvuonna tilille tippuu vielä jotain. Tällä hetkellä käteisen määrä Nordnetissa on hyvin vähissä, eli melkein kaikki on osakkeissa ja korkorahastoissa kiinni. Uutta rahaa laitoin Nordnettiin edellisen salkkukatsauksen jälkeen näköjään vain n. 18 000 e ja siihen päälle tulleet osingot kaiketi luokkaa n. 30 000 e, eli melkein 50 000e lisää rahaa tullut salkkuun sitten viimeisen salkkukatsauksen, loput on sitten arvonnousua. Collectorin säästötilillä itselläni odottaa 40 000 euron sotakassa.

Osakesalkkujeni (AOT + OST) yhteenlaskettu markkina-arvo on nyt pysytellyt hieman 900 000 euron rajan yläpuolella ollen tänään 914 979 e, tosin pitää ottaa huomioon, että lasken tähän nyt mukaan myös korkorahastot Nordnetissa, joita on nyt hieman yli 160 000 euroa. Noin 17 % salkun arvosta on nyt koroissa, joka kuulostaa minulle edelleen oikein järkevältä tällä hetkellä. Pyrin pitämään tämän edelleen n. 10-20 % tuntumassa niin kauan kun koroista saa järkevää tuottoa. Lisää korkoja en kuitenkaan enää osta, koska paras hetki meni jo.

Korkoja on nyt karkeasti:

- 40ke käteinen Collector bankin säästötilillä 3,25 % korolla (laskee kesäkuussa 2,75 %)

- 113ke lyhyissä koroissa Evli Likvidi B, n. 2,99 % YTM (vuosi sitten oli 4,8 % YTM)

- 47ke semi-pitkissä koroissa Eur Corporate Bond, n. 3,2% YTM (vrt vuosi sitten 3,7% YTM) + positiivinen vipu, jos korot laskevat

Korot ovat aika paljon laskeneet sitten viime salkkukatsauksen, esim. Evli Likvidi B:n YTM tippunut 4,8 % → 2,99 % ja varmaan tulee laskemaan vielä tuosta. Parhammillaan viime vuosina YTM taisi olla Evli Likvidi B:ssä 5,04 % ja Vanguardin Corporate bondissa 4,24 %. Omat korkosijoitukseni olen tehnyt mielestäni aika optimaaliseen aikaan ja tuotto/riski on ollut todella hyvä. Vuotuinen tuotto Evli likvidissä ollut itselläni 4,6 % ja Corporate Bondissa 6,6 %. Korkorahastojen myyntejä olen harkinnut, mutta osakkeista en löydä mitään niin houkuttelevaa ostettavaa, että saisin noin isot summat lapioitua osakemarkkinoille. Mikäli YTM pysyy jossain 3% pinnassa niin taidan vain istua käsieni päällä vielä jonkin aikaa korkojen kanssa. Kamuxin tulevia myyntitappioita ajattelin kuitata ehkä sitten joskus myymällä korkorahastoja ensi vuoden puolella.

Salkun kurssikehityksen sijasta seuraan isommalla mielenkiinnolla osinkojen kehitystä, johon voin kurssikäyrää enemmän vaikuttaa ostamalla lisää kasvavaa osinkoja maksavia firmoja. Osinkoja viime vuodelle tuli 32 614 e bruttona (26 001 eur nettona). Nordnet laskee Treasury Bondin ulos maksaman korkotuoton osinkona, koska teknisesti se oli osinkoa, mutta itse lasken sen kyllä korkotuloihin, siitä siis johtuu ero Nordnetin ja omian laskujeni välillä osingoissa. Osinkovirtaa tälle vuodelle pitäisi tulla n. 34 862 euroa bruttona (27 909 eur nettona). Korkotuloja tuli viime vuonna paljon odotettua enemmän: itse arvioin alunperin luokkaa 7000 - 9000 e, mutta korkorahastot kehittyivät paljon paremmin ja korkotuloja tulikin vähän yli 13 000e (sis. säästötilien korot ja korkorahastojen tuotto/arvonnousu 2024 vuonna). Eli yhteensä passiivista tuloa tuli viime vuonna bruttona 45 945 e (sis. osingot ja korot). Tänä vuonna tuskin noin paljon tulee korkotuloja, mutta osingot + korot ovat tänä vuonna myös melko varmasti lähemmäs 42 000 euroa bruttona. Seuraava tavoite voisi olla vaikka saada osinkotuloja yli 30 000 eur nettona, joka voisi olla saavutettu ehkä parin vuoden päästä. Olisihan se myös kiva nähdä yli miljoonan euron arvoinen salkku, mutta siihen en voi oikein itse niin vaikuttaa kun markkinaliikkeet ovat mitä ovat, eikä tuo tavoite edes oikein tunnu enää miltään…

Mitä sitten teen loppuvuoden? Riippuu paljon varmaan Trumpin sekoiluista, tuleeko hyviä ostopaikkoja. Mikäli markkinat ovat seesteiset, kasvatan varmaan sotakassaa Collectorin säästötilille kohti 70 000 euroa, jota isommaksi en sitä ajatellut kasvattaa. Sijoittelen sitten samalla myös tulleita osinkoja tehden pieniä lisäyksiä nykyisiin positioihin. Olen muutoin ihan tyytyväinen nykyiseen salkkuun, paitsi Kamuxista haluaisin tosiaan eroon. Joitain positioita haluaisin myös ihan vähän keventää, mutta parempaan hintaan (Citycon, Neste, Pfizer, Telia, Tieto) - näiden kanssa minulla ei ole mitään kiirettä, joten odottelen parempia paikkoja kevennellä. Mitään ostoslistaa en ole vielä tehnyt, mitä ostaisin, jos tulisi laskumarkkina. Jos korot tuosta vielä paljon laskevat niin korkorahastojen myyntejä pitänee miettiä, milloin se olisi järkevää - en tosin usko, että tämän vuoden puolella teen niille mitään, mutta ehkä ensi vuonna. Jos jotain isoa romahdusta tulee, alan pikkuhiljaa likvidoimaan Evli likvidi B:tä ja siirrän siitä rahaa osakkeisiin ja ehkä johonkin indeksi ETF:ään.

Nyt yritän lähinnä nauttia kesästä ja olla vilkuilematta osakkeita kesän ajan.

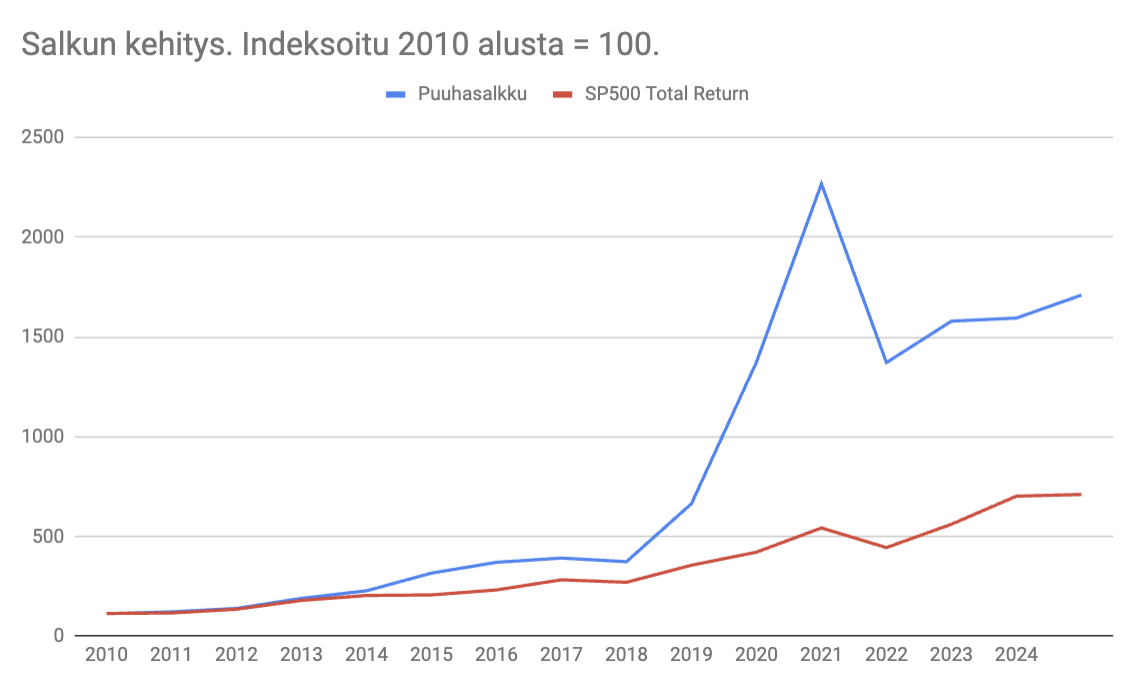

Alla vielä perinteisesti salkun, osinkojen ja korkotulojen kehitys alusta asti:

Salkun markkina-arvon kehitys:

01.03.2011: 0 e

01.04.2011: 21 000 e

01.12.2011: 40 000 e

01.01.2012: 50 000 e

01.12.2012: 74 000 e

01.04.2014: 100 000 e

01.12.2014: 140 000 e

01.11.2015: 174 000 e

01.08.2016: 211 000 e

01.12.2016: 256 000 e

01.12.2017: 308 000 e

01.12.2018: 330 000 e

23.03.2019: 355 833 e

28.11.2020: 503 148 e

01.01.2021: 502 015 e

02.07.2021: 601 904 e

31.12.2021: 609 729 e

04.06.2022: 596 525 e

31.12.2022: 593 880 e

04.08.2023: 627 523 e

02.12.2023: 731 735 e

12.04.2024: 803 420 e

29.05.2025: 914 979 e

Osinkojen kehitys bruttona:

2011: 1370 e

2012: 3170 e

2013: 3770 e

2014: 4270 e

2015: 6450 e

2016: 9320 e

2017: 11 260 e

2018: 13 920 e

2019: 17 150 e

2020: 17 600 e

2021: 22 650 e

2022: 27 740 e

2023: 31 477 e

2024: 32 614 e

2025: 34 862 e (ennuste)

Korkotulojen kehitys bruttona:

2011: 434 e

2012: 149 e

2013: 161 e

2014: 0 e

2015: 0 e

2016: 0 e

2017: 732 e

2018: 773 e

2019: 402 e

2020: 461 e

2021: 553 e

2022: 832 e

2023: 4725 e

2024: 13331 e

2025: 6000 - 8000 e (ennuste)

Uutena lisäsin alle myös palkkatulojeni kehityksen, koska nämä tiedot sai näkyviin Ilmarisen työeläkeotteesta niin helposti. Tämä on siis vuosipalkka bruttona työstä, ei sis. pääomatuloja. Sisältää siis ennakonpidätyksen alaisen palkkatulon sisältäen kaikki etuudet kuten puhelin, lounarit jne. verotettavat tulot. Kokonaissumma saadusta palkkatulosta 2024 vuoteen asti on yht. 870 890 €:

2005: 6 240 €/vuosi

2006: 6 500 €/vuosi

2007: 6 254 €/vuosi

2008: 6 146 €/vuosi

2009: 8 335 €/vuosi

2010: 8 666 €/vuosi

2011: 12 984 €/vuosi

2012: 25 023 €/vuosi (vakituinen työ alkoi, tätä ennen kesätöitä ja osa-aikaista)

2013: 42 322 €/vuosi

2014: 47 369 €/vuosi

2015: 48 367 €/vuosi

2016: 48 643 €/vuosi

2017: 51 154 €/vuosi

2018: 53 286 €/vuosi

2019: 61 964 €/vuosi

2020: 64 155 €/vuosi

2021: 65 238 €/vuosi

2022: 71 009 €/vuosi

2023: 70 981 €/vuosi

2024: 74 254 €/vuosi

2025: 76 000 €/vuosi (ennuste)

2026: 77 500 €/vuosi (ennuste)

![]()