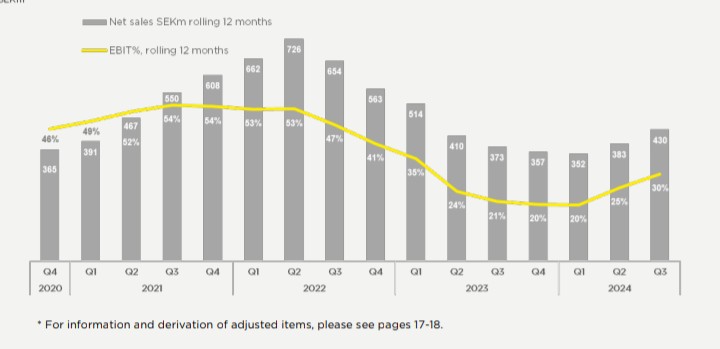

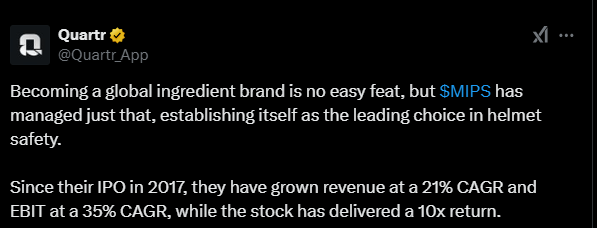

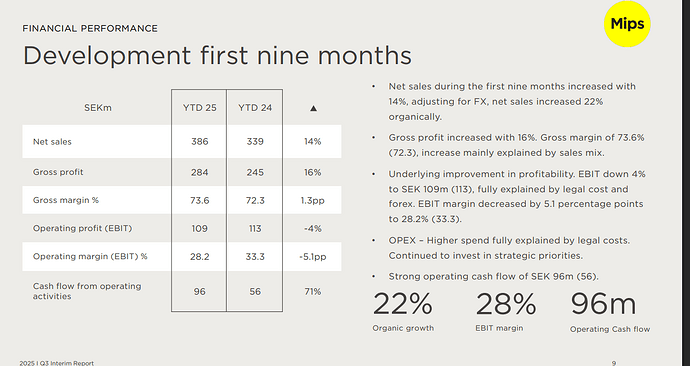

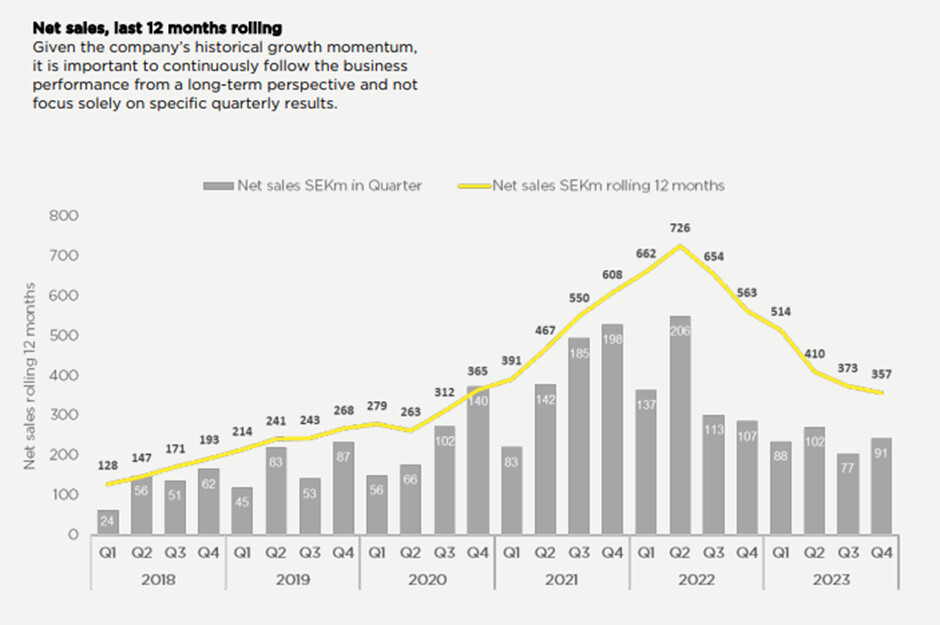

I like the MIPS story a lot, but the stretched-looking valuation has kept me on the sidelines for now. The revenue decline has slowed, and I understand that dealer inventory levels have normalized, although the high inventory levels in the Motorcycle category are still a burden. If I remember correctly, the CEO mentioned in the Q3 webcast that sales shouldn’t be compared to 2019 levels because the customer base has grown by about 150% since then, so the ingredients for a much better performance should definitely be present.

According to Quartr, the consensus expected revenue of 106 million and an operating profit of 35 million (actual: 91 million and 17 million). The share price reaction (-3%) seems so muted that buy-side expectations were likely lower than the consensus estimates, or else the market is already looking past the short-term challenges. Forecasts currently predict nearly 40% revenue growth for 2024, so the company is expected to return to a growth path with a fairly steep trajectory.