I’ve been thinking about putting together a dedicated thread for this interesting Israeli firm for a while now, and I finally found the time. So, let’s get into it!

What is InMode?

InMode (XNAS:INMD) is a medtech company founded in 2008 that develops and markets devices for aesthetic and medical treatments. The company is based in Israel, where its headquarters and R&D are located. However, the company has subsidiaries and distribution worldwide (10 subsidiaries + sales teams). The company sells its products in over 70 countries, with the US being clearly the most important.

The company’s founder-CEO is Moshe Mizrahy, who is the company’s largest shareholder. According to Yahoo Finance, insider ownership is just over 35 percent.

What does InMode sell?

The majority of InMode’s revenue comes from device sales, where the firm sells platforms used for various aesthetic and medical treatments directly to medical clinics (90% of revenue @ Q3/2021). It is important to know about the devices that they are all based in one way or another on “non/minimally-invasive” technologies, i.e., the treatments performed with them aim to make the smallest possible incisions or holes in the skin, or even none at all. The platforms are consoles costing hundreds of thousands of dollars that control the execution of treatments. By far the majority of these come from the aesthetics side, as the push into general medicine is still in its early stages. The equipment can be used to treat and affect, for example, the skin, adipose tissue, cellulite, wrinkles, and other aesthetic features. The rest of the sales come from the “handpieces” used to perform the treatments themselves (10% of revenue @ Q3/2021). At the end of 2020, their price was reported to be $300 per customer, meaning a single handpiece cannot perform an infinite number of treatments. Their sales are more recurring and naturally grow along with the growth of the installed base and the number of treatments performed.

The US is absolutely the most important market for InMode, accounting for 65-70% of its revenue. However, the share of the rest of the world has been on the rise: in 2019, 79 percent of revenue came from the US, and in 2020, that figure was 73 percent. The company has invested outside the US by establishing subsidiaries and sales teams. The company aims to sell devices directly through its own distribution network and avoid dependence on third-party distributors; as of Q3/2021, 81% of sales were direct.

What is InMode’s market like?

InMode’s target market is growing strongly. A word of caution: the size and potential of the market depend heavily on which part is being studied, but all the market analyses I’ve seen concerning InMode share a CAGR growth forecast of over 10 percent for the period 2019-2028. Even though COVID has managed to disrupt those forecasts, the primary drivers for market growth haven’t changed: an increasing part of the population is aging and needs treatment for health issues, and InMode’s technology makes it easier to treat diseases and perform aesthetic procedures. These drivers apply regardless of the country. So, the market outlook should be good: one market study is linked below.

One “hidden risk” for InMode is its market position: although the company is financially sound, it doesn’t have a massive share of its market. Based on various sources, I’ve estimated that its share of the current market is in the range of 4-8 percent. The company reports four direct, listed competitors in its 10-K report: Cutera, Apyx Medical, Venus Concept, and Viveve Medical. Among these, InMode is by a somewhat clear margin the largest and most profitable (the article below has a link to an Excel sheet showing 2020 figures). It’s still worth remembering that large pharmaceutical companies like J&J and AbbVie operate in the aesthetics and medical device field, so this isn’t just a pond for small fish.

https://seekingalpha.com/article/4430360-inmode-a-profitable-growth-story-with-lots-of-potential

What are InMode’s key competitive advantages?

InMode’s most important competitive advantage is technological: the company’s devices use radiofrequency technology, which allows treatments to be performed without the need for surgery or long recovery times. As shown in the article linked below this section, InMode’s technology aims to provide a better alternative to the difficulty and cost of surgical treatments, and simultaneously to the lower efficacy of laser treatments. This leads to lower prices and, from the customer’s perspective, a better and more beautiful result (e.g., fewer scars). Evidence of the quality of the competitive advantage includes InMode’s faster-than-market growth and its ability to expand even more strongly into both new countries and new customers (the majority of sales are new sales). The company has also patented its technology (until 2027), and there is research evidence of its effectiveness. Finally, as a strong competitive advantage, it’s worth mentioning a degree of customer stickiness: InMode’s devices are investments of several hundred thousand dollars, so switching them to a competitor’s product is not something done for light reasons.

I’ve summarized information about competitive advantages in this text, but I recommend reading the SeekingAlpha article linked below, which features charts and more extensive information on the same topics.

https://seekingalpha.com/article/4457104-inmode-inmd-stock-wonderful-business-deep-economic-moat

What are InMode’s key risks?

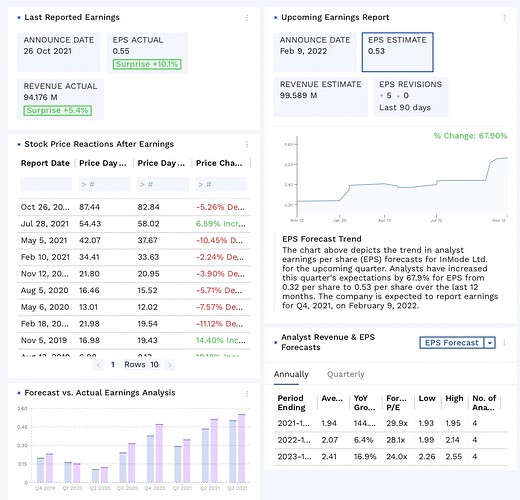

In the (hopefully) short term, the clearest risk factor is COVID lockdowns, which already caused treatment delays during 2020 and thus slowed the company’s growth (and on the other hand, caused unfairly high growth figures for 2021!!!). If customers cannot or do not want to go for treatments due to the COVID situation, InMode’s sales will weaken. Additionally, for a company combining medicine and technology, one must always remember the disruption from competing technology and potential regulation as risks that could significantly weaken InMode’s sales. Regarding sales, it must also be mentioned that the majority of revenue comes from device sales, which are somewhat cyclical and one-off—this is a potential risk factor. The company’s valuation should also be considered a risk. At the time of writing, the company is trading at a TTM P/E of 39, and the EV/S figure is over 15. So, it is by no means a value investment, though I won’t take a further stance on valuation here.

What does InMode look like in numbers?

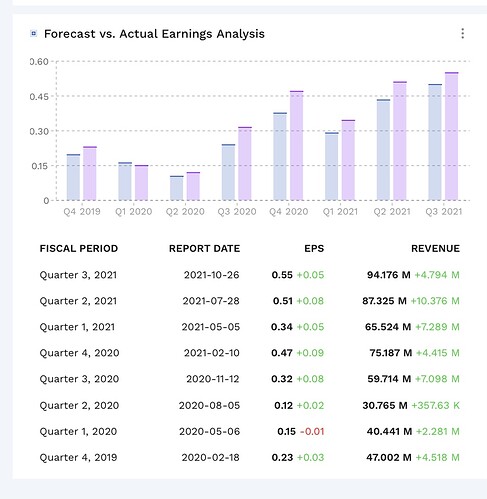

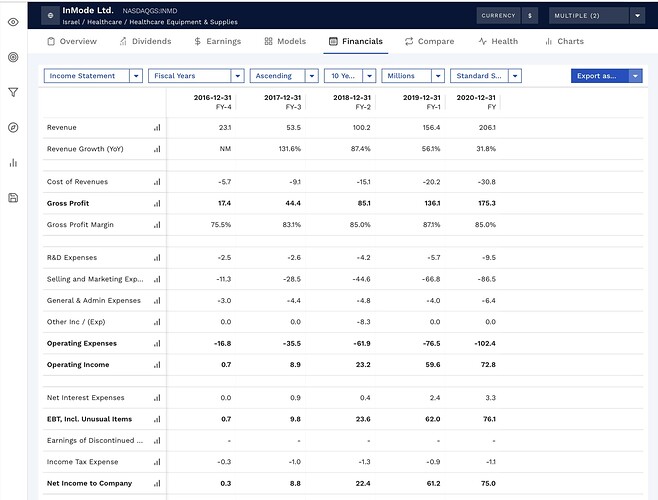

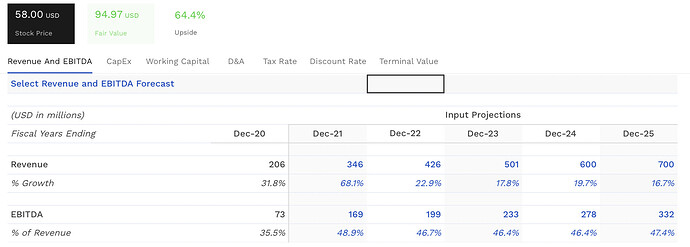

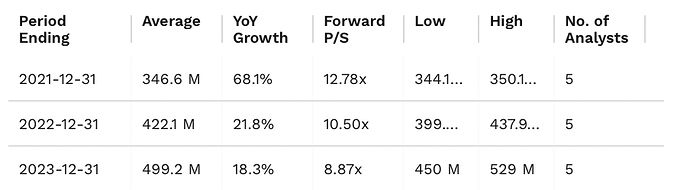

InMode’s financial figures are peerless. The growth figures for this year are staggeringly high, but the comparison period from the COVID year should not be forgotten. The company forecasts revenue of approximately $345 million for the current year, and the analyst EPS forecast is around $1.95.

Below are a few key figures for the company (all figures TTM unless otherwise stated, source: Yahoo Finance):

- gross margin 85%. This is the company’s internal requirement for new products: if a product’s gross margin doesn’t reach this in forecasts, the product is not launched. This level has held for several years.

- EBIT margin 46.2%

- return on equity 48.2%

- operating cash flow 163.6 MUSD

- net cash approx. 384 MUSD (Q3/2021). The company has a negligible amount of debt.

The company’s profitability is top-tier, and the balance sheet is in pristine condition: in this sense especially, the previously mentioned listed competitors are light-years behind InMode.

**What does InMode’s future look like?**As I already mentioned in the market segment section, InMode operates in a strongly growing market and actively seeks to expand into new products. InMode aims to release at least two new devices annually, and starting this year, the company has begun expanding its offering from pure aesthetics to the medical field. For example, the latest product release, EmpowerRF, provides a treatment for gynecological procedures, and additionally, a product is being developed for next year for the treatment of eye diseases, among other things (Revenio bulls beware…). This expands the future market and, on the other hand, reduces cyclicality, but first, of course, proof of the technology’s effectiveness must be shown. According to the company’s CEO, the revenue for that EmpowerRF platform next year would be approximately 20 MUSD based on a conservative estimate, meaning we are talking about a few percent of the entire group’s figures.

According to the company’s own comments, high-growth countries are found almost everywhere, and in the November webcast, China, South Korea, and Italy, for example, were mentioned by name. InMode indeed plans to continue its expansion in various markets, and a new subsidiary is expected to be seen in Europe during next year. The growth plans are therefore clear, and it will be interesting to follow how the company’s strong growth continues in the coming years.

Closing words

The undersigned owns shares and aims for long-term holding of the company.

A big thank you also goes to @LakeBoodom, with whom InMode has been discussed in depth, and whose help is very significantly reflected in this opening post as well. ![]()