On the other hand, you could have achieved an even better return than that by investing directly in the S&P 500 index.

The success of index funds proves that short-term stock ownership and constant churning yield excellent returns. While a long-term owner might make changes to their portfolio once a year or less and prays to hit those rare stock market mega-winners, an index fund actively and broadly buys and sells portfolio stocks with an extremely simple algorithm every single month.

So why should an investor sit on their hands any longer or develop sophisticated investment strategies? Everyone claims to be a long-term owner, and nearly everyone loses to a passive index-churning portfolio, so it is obvious that long-term ownership is a poor general strategy.

@Verneri_Pulkkinen In previous moments of uncertainty, Inderes has released compilation videos on how analysts see the uncertainty affecting the companies they cover.

Now that the “AI is eating software” sentiment is prevalent, it would be nice to hear the analysts’ views. Especially regarding smaller companies or those that provide services to small and medium-sized enterprises. Are small companies more prone to “vibe coding” systems for themselves? Which sectors are protected by legislation? etc.

It’s probably safer in this case. The lending is done through my holding company. If I were lending personally, it would be a different story.

In the big picture, indices are not particularly active traders. Buys and sells occur mainly when companies enter or drop out of the index, and these changes are usually small on an annual level*.

Take Nvidia for example, which is now around 7% of the S&P 500 index. Index funds haven’t bought the company to that weight; rather, it has been part of the index and thus the index funds’ portfolios since 2001, and it has grown in the index/portfolio to that weight simply by being held.

- Sometimes larger-than-average changes occur in indices, e.g., when Tesla was added to the S&P 500 index in 2020 and jumped directly into the group of the largest companies with a 1% weight.

The task of an index fund is to attempt to track an index’s portfolio allocation, which requires regular rebalancing of holding weights; otherwise, the fund’s composition will begin to deviate from the index. Depending on the fund’s rules, purchases and sales are conducted monthly, quarterly, or perhaps only once a year. The less frequently holdings are adjusted to match the index, the larger the discrepancy between the index’s return and the index fund’s return. This leads to so-called tracking error.

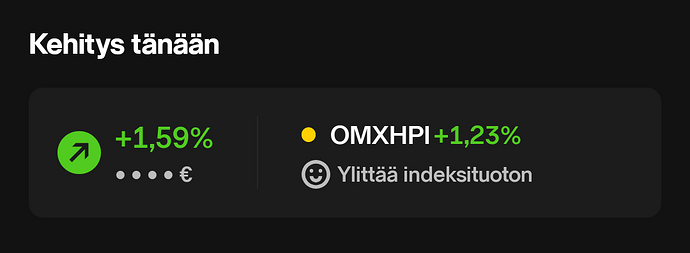

What on earth is happening here… Is it 2021, with this being the third day like this in the portfolio in a row. It’s starting to make me fear a repeat of 2022

Edit: And let’s record here that the portfolio return just crossed the 100% milestone. It took almost 6 years.

A little while ago I was still beating the index YTD, and I can breathe a sigh of relief that I don’t have to be nervous anymore; I’m just playing my own familiar game. ![]()

Congratulations! ![]()

I’m in the red and it’s taken me just over eight years. ![]() Somehow I don’t feel nostalgic for 2022, as I’m living through that kind of period anyway:

Somehow I don’t feel nostalgic for 2022, as I’m living through that kind of period anyway:

I just heard a story that perhaps aptly describes the Finnish character. In Sweden, when a neighbor buys a new car, the neighbor brings over a bottle of wine or at least a cake to celebrate the purchase. In Finland, on the other hand, the neighbor starts thinking about getting a new car, and damn it, it has to be even nicer than the neighbor’s car. Even if they can’t afford it…

I strongly doubt this. I’m a bit puzzled by the common notion that envy is a uniquely Finnish trait. If there’s any difference, it’s perhaps that Finns don’t bother hiding it, ![]() .

.

Is this a truth revealed by a slip of the tongue, or has the grandmaster of share buybacks been forced to change his stance? In that “buybacks vs. dividends” thread, there is sometimes a fierce debate over which is better. Information should be taken there too, that only dividends…

Today the portfolio broke the €90,000 mark for the first time.

No lottery win.

No inheritance.

Five-year return +57.8% while OMXH25 is +25%

Along the investment journey, there have been:

• COVID dip

• inflation panic

• rising interest rates

• geopolitical crises, war

• and dozens of moments when I felt like doing “something,” including Trump’s tariffs.

Most of the time, the best decision has been to do nothing.

€100,000 is no longer far away. Hopefully!

Thanks also to this forum. From here, I’ve gained a huge amount of ideas, perspectives, and above all, the peace of mind to stick to the plan when the market tries to lure me away from it.

The snowball is rolling. And compound interest.

Honest talk for once. Usually, on these forums, everyone is making a killing. It’s a bit like with sports betting etc., everyone wins. Though you certainly can make money in stocks when you find the right horses.

They do trade for many reasons.

- Changes in AUM (Assets Under Management)

- Reinvestment of dividends

- Changes in share counts

- Index deletions/additions

- Corporate actions

- Covering expenses

- Free-float changes

Some of this happens during index rebalancing, e.g., quarterly, and some on every trading day. However, the most important thing is to understand the scale of these events; for example, the Vanguard Total World ETF turnover was 3.4% last year. You would have to be a true “buy and forget” investor to stay below that.

Congratulations on reaching the milestone! But above all, congratulations on that ability you mentioned to calmly stick to the plan! If only I could learn that myself ![]()

Good morning ![]()

Image uploading to the forum is currently broken, we are looking into it!

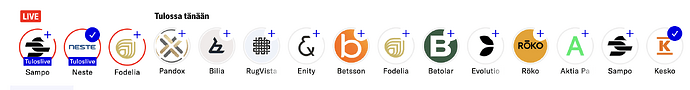

Today is a busy earnings day, by the way, so inderes.fi offers several earnings live streams and releases that you can watch instead of memes ![]()