However, I recommend asking domestic resellers for a quote; you can immediately get 10-20% off list prices, and those who haggle get even more. At least if you can visit Helsinki, it’s easy to visit several merchants on the same day.

It’s worth thinking twice based on the watch enthusiasts Facebook group. You can find a lot of discussion about that site by searching there.

Edit. indeed, you often get a discount just by asking

I guess I should start listening to Christopher’s stuff more carefully…

From SEB, a segue to Wahlroos and Nurkkahuone. So, last night I finished Nalle’s latest audiobook, which I strongly recommend again. Nalle’s books feature fluent narration and the topics are naturally interesting. In Nurkkahuone, the central theme (or at least what stuck in my mind most) was various corporate acquisition attempts that ultimately did not materialize. Certainly, there was more decision-making based on numbers behind it than what was analyzed in the book, but pure intuition also played its part.

And when Raiko Häyrinen is the narrator, I don’t know a better way to spend the night.

Well, sleeping could, of course, be one.

And to follow Mr. Product Manager’s movements. ![]()

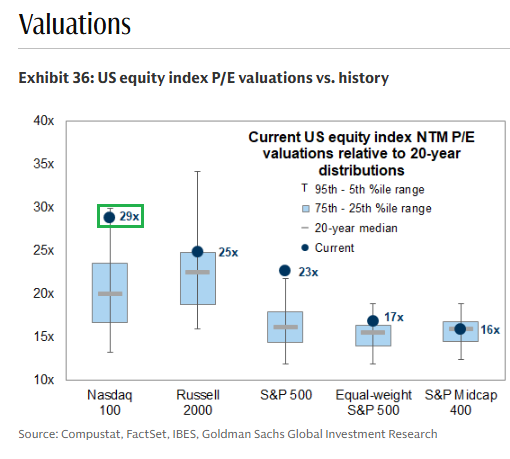

And here about market valuations, not through dividend yield, but the P/E ratio.

https://x.com/MikeZaccardi/status/1979916319253287408

[quote=“Wallet_Buffet_Omahan, post:8018, topic:59288”]

Is it QT?

-

Votes

-

44% Sh

This news, of course, reminded me of perhaps the best coffee review of all time from August. It’s worth reading the whole article if you haven’t already, but here’s the best part:

But back to the Yle article, I recommend watching the video, it’s 1 minute and 20 seconds long, and it has some very apt comments, at least about Juhla Mokka: “tastes like cardboard” and “doesn’t really appeal compared to these others,” and earlier coffees were described as poison ![]()

If you’re so busy in this hectic internet age and don’t have time to watch the video, the winner is:

Emilia Classic

I own this 1983 book about computers that I found in a shed, which always manages to surprise with its topicality. Today, opening a random page:

Could very well apply to some investment assets as well ![]()

It was a bit like what happened with Inderes when it sold Neste from its portfolio and bought Qt. ![]() These things happen.

These things happen.

At least some Neste analyst seemed to get quite a bit of flak on social media about Neste. Now the baton has passed to QT, and the Neste case is fresh in mind as a too hasty sale.

Although sometimes it has been something else.

Perhaps this was already discussed in some thread, apologies for possible repetition. Are Inderes analyses now moving to the “next level” as supervision takes care of quality? Or what kind of “supervision” is this about?

So, lead analysts can then focus on “more important” matters. Could there even be some kind of governance mechanism similar to a company’s board of directors, meaning there would be multiple supervisors. I don’t want to believe it’s a translation error ![]()

Amazon Web Services is currently in the middle of a massive outage. Half the internet is down ![]()

In my opinion, this is a good example of why every company should focus on its core business. This is what you get when some bookstore starts hosting IT services on the internet.

Yep, they could very well shut down the whole mess. It probably only accounts for half of Amazon’s profit, right?*

It appears to be just AWS’s US-EAST-1 that is down. Of course, this also affects a really wide range of companies and people, but if the entire AWS infrastructure were broken, it would be much bigger news. The issue has apparently been identified and fixes are underway. These things happen – just recently my colleagues and I recalled that it hasn’t been long since Microsoft’s Azure was experiencing issues.

\u003e Oct 20 2:01 AM PDT We have identified a potential root cause for error rates for the DynamoDB APIs in the US-EAST-1 Region. Based on our investigation, the issue appears to be related to DNS resolution of the DynamoDB API endpoint in US-EAST-1. We are working on multiple parallel paths to accelerate recovery. This issue also affects other AWS Services in the US-EAST-1 Region. Global services or features that rely on US-EAST-1 endpoints such as IAM updates and DynamoDB Global tables may also be experiencing issues. During this time, customers may be unable to create or update Support Cases. We recommend customers continue to retry any failed requests. We will continue to provide updates as we have more information to share, or by 2:45 AM.

*) As an avid reader, it’s a shame that as a bookstore, Amazon is now absolute garbage (excluding e-books).

This is once again a small reminder to AWS users that yes, it’s simpler and cheaper to run things in one AWS region, but then don’t cry and complain if the entire web service is down because one region breaks and others are working.

The companies whose stuff was running in multiple regions didn’t notice the outage except that perhaps response times increased slightly as traffic had to be routed to another region (e.g., Europe or US-WEST).

Those whose things were running only on AWS US-EAST-1 then watched as everything was in flames for a couple of hours ![]()

AWS specifically supports services running from multiple data centers to achieve fault tolerance, but penny-pinchers often omit this because, on average, AWS is so reliable that this fault tolerance is not valued against its implementation cost.

Is AI a bubble? In my opinion, AI has at least all the prerequisites for a stock market bubble to form, if it isn’t one already. New Premium article out now! ![]()

-“You can’t argue about taste”

-“On the contrary, taste is precisely what you can argue about”

It’s not an urban legend but a fact that in a blind test, wine experts could not distinguish red wine from white wine based on taste. (Participants were “tricked” in the sense that white wine was dyed red, but tannins, body, and spiciness were found in the “red wine”. As a white wine, the same was described with words like fresh, citrusy, floral. None of the 27 wine experts noticed they were drinking dyed white wine as red wine)

So, expectations influence what we “really” taste (or think we taste). Since I don’t always ride the crest of trends, my first encounter with natural wine in a restaurant was not biased by expectations: I tasted a spoiled wine, which as a home winemaker, I would have poured down the drain. My table companions were in the know and smiled approvingly at the sommelier’s distinctive choice.

When you pay a lot for something, there’s naturally an incentive to taste it as a top-tier wine. But this also works the other way: If you’re careful with your euros and buy cheap, there’s naturally an incentive to taste it as good. It’s a true win-win: good quality for cheap.

Regarding Emilia coffee: Some Lidl stores price it at 1.15-1.19 per package, some at 2.49 etc., and apparently sometimes “even more expensive”. As an experienced expert, my advice is not to brew it too strong; less is enough (winx3😁)

Pseudonym: At most 20+ packages in the corner of my study, as I thought it was just a fleeting promotional offer.

These wise sentences apply so well to investing too.

“None of the 27 analysts realized the company was an accounting fraud”

“Investors thought the company was a growth company, so they priced the stock accordingly”

“The company is an excellent investment because I bought the stock 50% more expensive than the current price and it will surely turn into a profit”

![]()