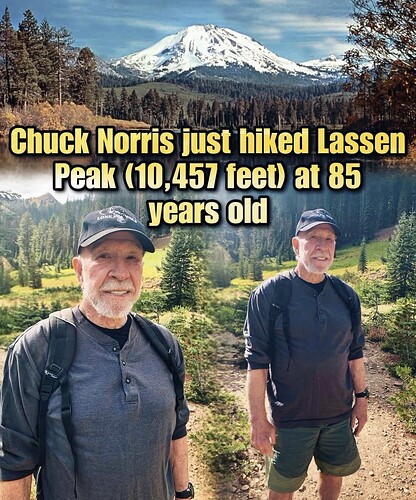

Chuck Norris on Chuck Norris ![]()

That’s probably just a legend. Actually, the mountain crawled under Chuck Norris ![]()

If for some reason it doesn’t start from the right spot, then from 3:33:21 onwards the guys from Sijoituskästi tell about their messaging with a certain listed company’s CEO.

It would be nice to know what company this desperate pump-and-dump rage-executive represented. ![]()

![]()

I have to say that there’s such a level of digging in the Intellego thread now that I can’t keep up anymore, but I take my hat off ![]()

![]()

In recent years, there have been increasingly frequent stories about “Private equity”. Just yesterday, I read a good tongue-in-cheek article by Bloomberg columnist Matt Levine, the beginning of which I’ll quote here.

A simple gloomy model you could have of private equity is:

- Once upon a time, companies were mispriced. Lots of companies were available cheaply. Their price didn’t reflect the present value of their cash flows, or at least, it didn’t reflect the present value of the cash flows they could reasonably achieve if you added some leverage and improved their management.

- A few ambitious risk-seeking entrepreneurs noticed this systematic mispricing and set out to fix it. They raised money from friends and family and patient investors who were willing to take risk, they bought companies at low prices, levered them up, fixed their operations and resold them after a few years at higher prices.

- It helped, in doing this business, that interest rates were declining for decades and valuation multiples were rising. If you bought a company, did nothing to it, waited five years and sold it, you’d have a profit just from valuation tailwinds.

- The people who started this business — private equity — made great returns for their investors and became billionaires themselves.

- This attracted many, many more people to the business. Who wouldn’t want to become a billionaire by buying and selling companies? Who wouldn’t want to invest with them?

- So now private equity is the default career path for smart ambitious people entering the financial industry, and private equity firms are now giant alternative asset managers with hundreds of billions of dollars under management.

- Why would companies be mispriced?

In other words, so much money is already floating in PE that the valuations and pricing efficiency of private firms are approaching (perhaps even exceeding) those of the stock market. ![]()

One could speak of a direct bubble when S-ryhmä (S Group) is involved.

You can also get private equity-style returns from stock market investments just by glancing at your portfolio once every five years. Private equity outperformance seems to be just hocus pocus.

The enthusiasm of big-pocketed investors to pour money into probably already overpriced unlisted companies is waning, so someone else needs to be found who wants to waste money on something for which there is no clear daily pricing mechanism, and at the same time the bank can collect juicy fees…

This primarily reminds me of “it’s morally wrong to let fools keep their money,” but it is theoretically possible that this arrangement produces something. It will certainly generate money for the bank; the rest is uncertain, there is risk.

At least the idea is the same. Feroldi has been followed for a long time, and I’ve probably seen a message from there sometimes. However, it’s such an old wisdom that I don’t believe it’s actually his “original.” It’s certainly not mine ![]()

For me, it has come to mind again through ball sports, where the form is “you control your performance, not the outcome.” As there’s also an opponent there. So, also an old thing in athletes’ mental coaching. I’ve been pondering similarities to investing recently.

In the old days, PE might have been about mispricing and correcting it, i.e., a valuation exercise for value investor grandpas, but nowadays the idea of PE investing is related to growth investing and the opportunity to get access to new top companies. The value creation of new companies increasingly circulates in the portfolios of angel investor/venture capitalism businesses, which later direct offerings to larger PE funds, and only when significant value creation potential is no longer observed, the investment is exited to the stock exchange for public markets.

So, in my opinion, the PE markets are no longer seeking excess returns based on mispricing, but rather an opportunity to participate in the markets. If you, as a Finn, want to own Oura, Iceye, IQM, Supercell, and Wolt at the point when large amounts of value are being created, there are no alternatives to PE funds. Of course, wealth managers and banks charge a huge amount for this access right, but what can you do? If you don’t pay, you’ll have to buy something like Cityvarasto, and the best new companies will end up owned by someone else ![]()

I don’t know if there’s any viable solution to this, other than crowdfunding platforms for early-stage unlisted companies like Springvest and Invesdor. However, even with those, there’s a big problem: companies only go to them after all other options have been exhausted, so you’ll probably still lose to PE funds that get to invest in those mega-winners.

I finally got enlightenment on years of struggling with valuation. A stock on the Helsinki stock exchange doesn’t require degrees or all sorts of fancy gimmicks. Let’s see how much the company pays in dividends and take a look at the industry’s average dividend yield. From this, we arrive at the fair value. If a dividend cannot be paid in a given

More so, he just tries (probably intentionally) to annoy the ordinary worker who carries sand onto the bank floor.

It doesn’t quite work that way. Pricing in PE markets has become more efficient as so much money has been poured into them, so high multiples have to be paid for these mega-winners, just like in the stock market.

Perhaps I wrote unclearly, but in the part you quoted, I meant participating in unlisted markets through crowdfunding services like Sprinvest/Invesdor compared to investing through a professionally managed PE fund.

The assumption is that the very best and most attractive companies primarily approach PE funds, and only those companies that have not received funding from any PE fund end up on those crowdfunding platforms. So, the worst unlisted companies seeking funding would end up on crowdfunding platforms, which is why an investor in unlisted markets via a crowdfunding platform would lose out to a PE fund owning mega-winners, which has already skimmed the cream off the top before the company even becomes available on a crowdfunding platform.

»Some investors in PepsiCo support suggestions by activist shareholder Elliott Investment Management that the global food and beverage company cut costs and ditch sleepy brands like Quaker«

This message is not related to Pepsi, so I’m replying to the coffee room @Sijoittaja-

Indeed, collective intelligence is really at play there as reasons are being sought, or whether there are any for the drop.

I raise my hat too.

This is exactly right. No sensible company would seek funding from hundreds of consumers if it’s possible to get it from one professional source. Hundreds of owners and different layers of shareholder agreements are by no means desirable.

Is there any information on how up-to-date Nordnet’s company-specific short-selling data is?

Today, a new one was found again:

”Key to Remedy’s investment story are the upcoming major game releases (Max Payne and especially Control 2), which, if successful, offer significant potential from current levels. Thus, we see the risk-reward ratio as attractive for investors who believe in the success of these upcoming games.”

Is this defined as a buy recommendation for Remedy fans and an avoid recommendation for others?

Remedy is a bit of a matter of faith right now. If you don’t believe those upcoming games will take off, you shouldn’t invest in it. I personally believe that Max Payne and Control 2 have good chances of succeeding, and that’s why I’m optimistic about the stock at its current valuation.

Have you played Remedy’s games yourself, or is your belief based on the success of Remedy’s previous games? I would personally guess that the success will be at most slightly below the level of Alan Wake 2.