Hewlett Packard Enterprise (HPE) is an American information technology company headquartered in Texas. HPE was founded on November 1, 2015, in Palo Alto, California, when the Hewlett-Packard company was split into two parts. With the split, HP Inc. focused on computers and printers, while HPE focused on enterprise services and products such as servers, storage, networking, and software containers.

HPE thus operates as an independent company and has its own ticker symbol (HPE). The company focuses particularly on business solutions and also provides consulting and support services. In 2017, HPE spun off its services business, which merged with Computer Sciences Corporation to form DXC Technology. In the same year, HPE also sold its software business to Micro Focus.

HPE is one of the largest American companies. The company’s name “Hewlett Packard Enterprise” is derived from the former Hewlett-Packard company, but without the original hyphen.

I’m highlighting a fun and interesting message from the spring:

Ilkka’s message April 5, 2024:

Investor reflections

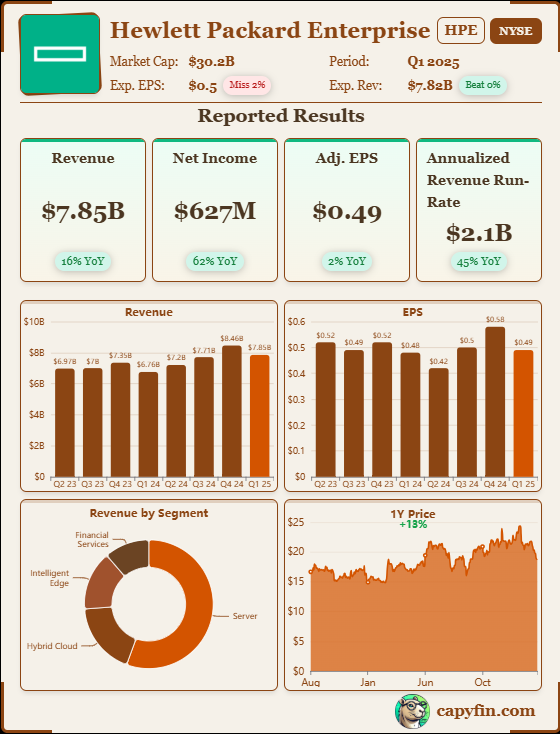

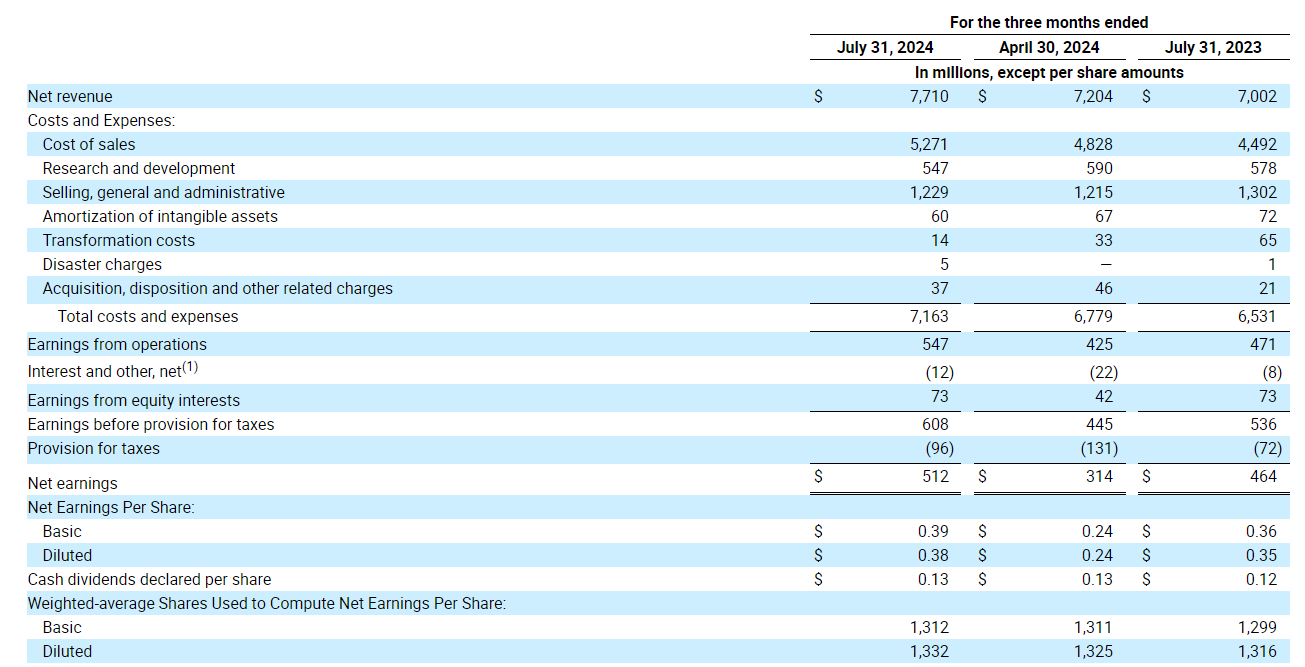

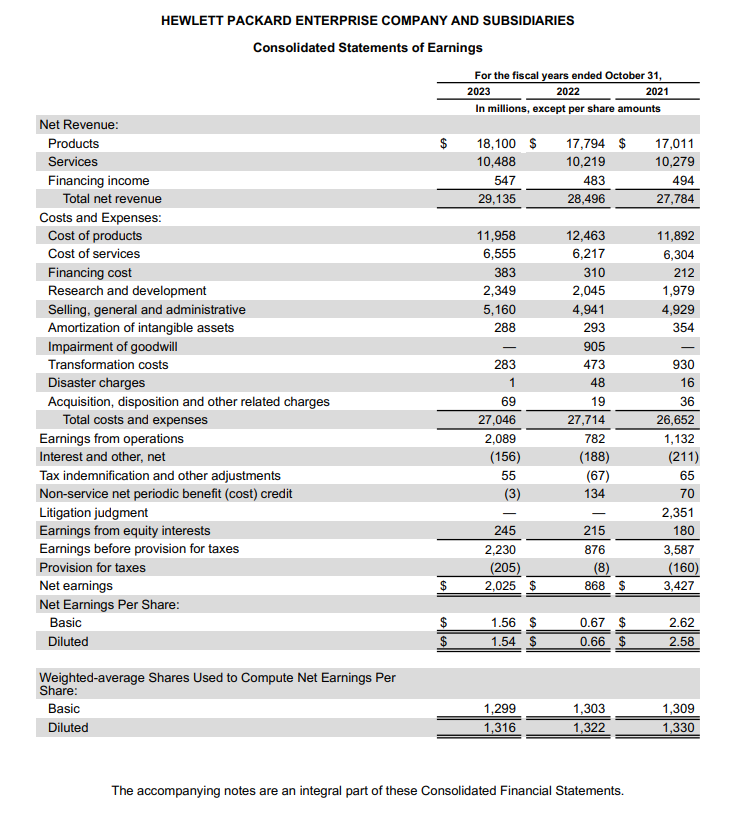

HPE has faced many challenges in recent years that have affected its growth and stock performance. Although HPE offers diverse solutions for businesses, such as servers, storage solutions, and cloud services, the company’s revenue has remained almost unchanged since 2019. While the company’s revenue briefly dropped during the pandemic, it recovered back to $29.1 billion, but this does not indicate significant growth.

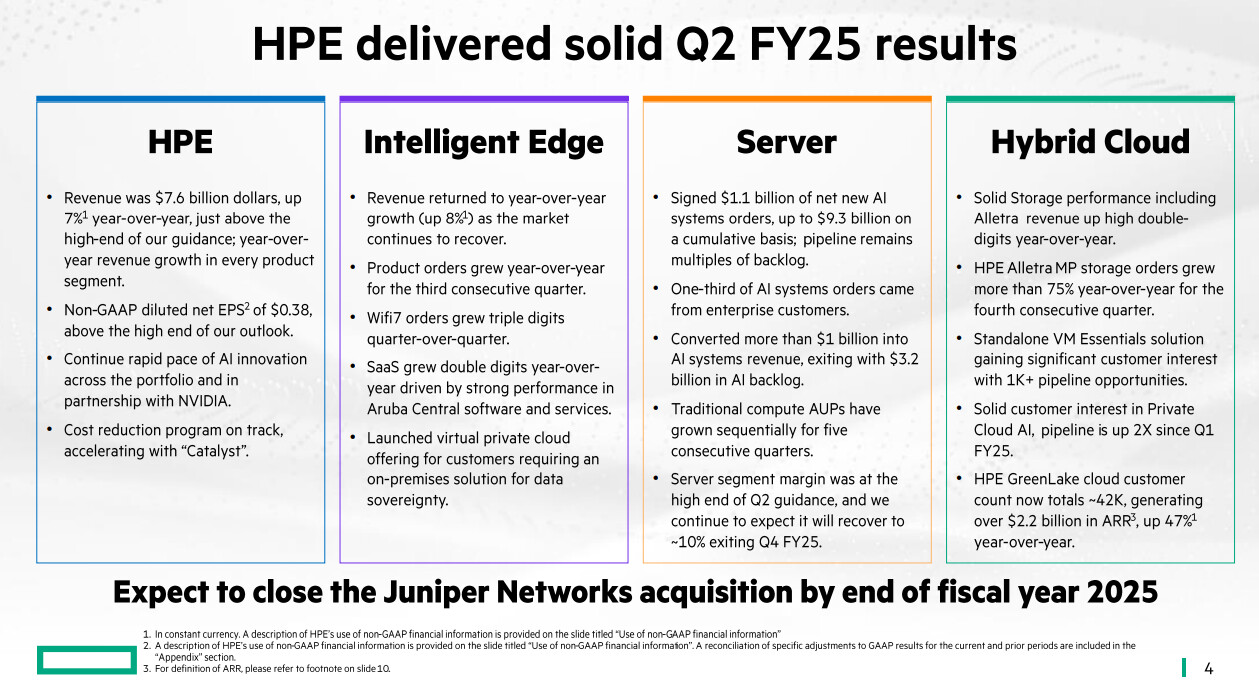

HPE’s greatest strengths are its server products, whose revenue grew by 35%, but the company’s other segments have suffered. The general growth in the industry, especially the rise of IT investments and generative AI, hasn’t benefited HPE as expected. If the company has fallen behind others in these areas, is it facing an even greater cycle of problems that cannot be fixed in a few years?

On the other hand, HPE has managed to improve its profitability through cost-cutting, which has raised net income to over $2 billion.

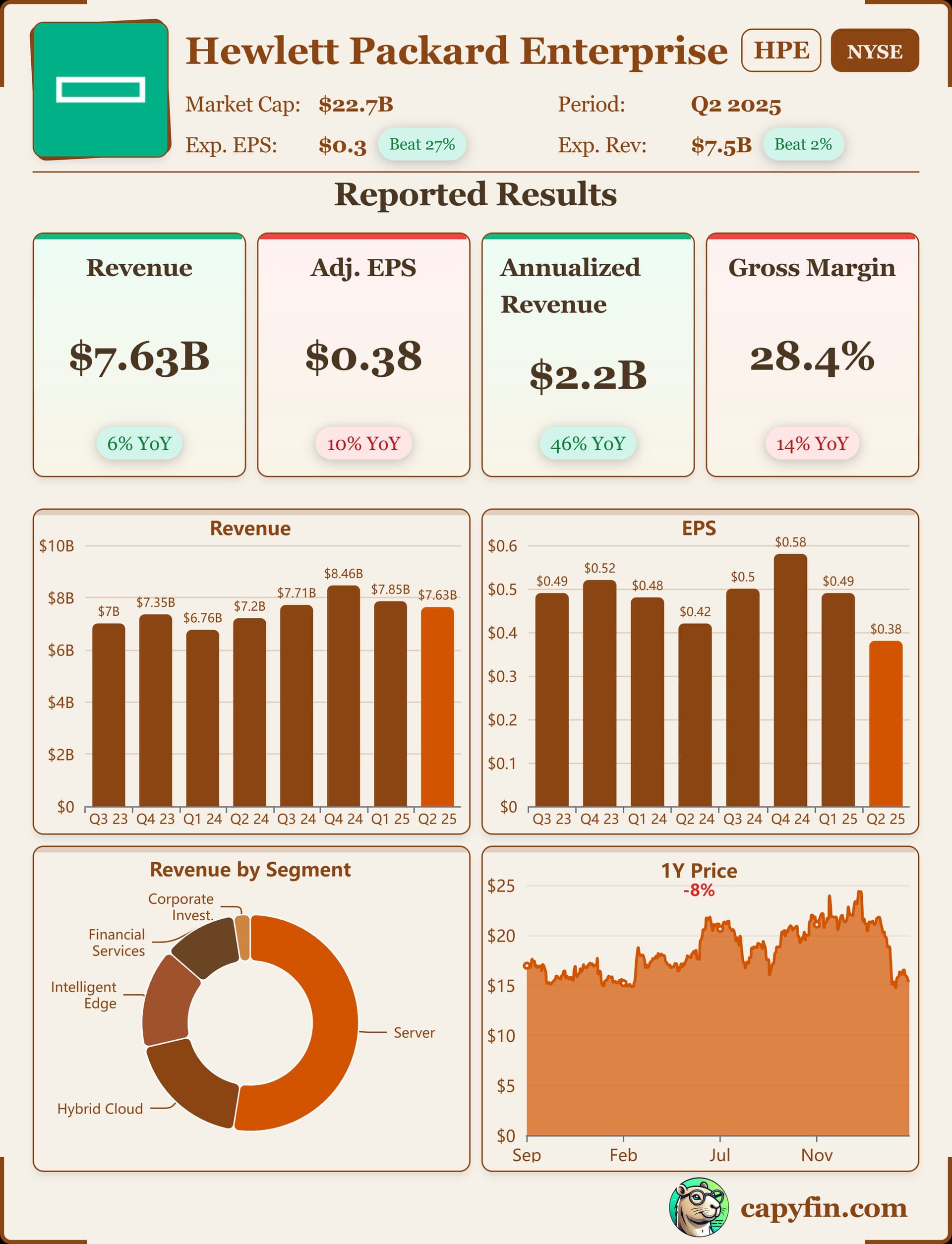

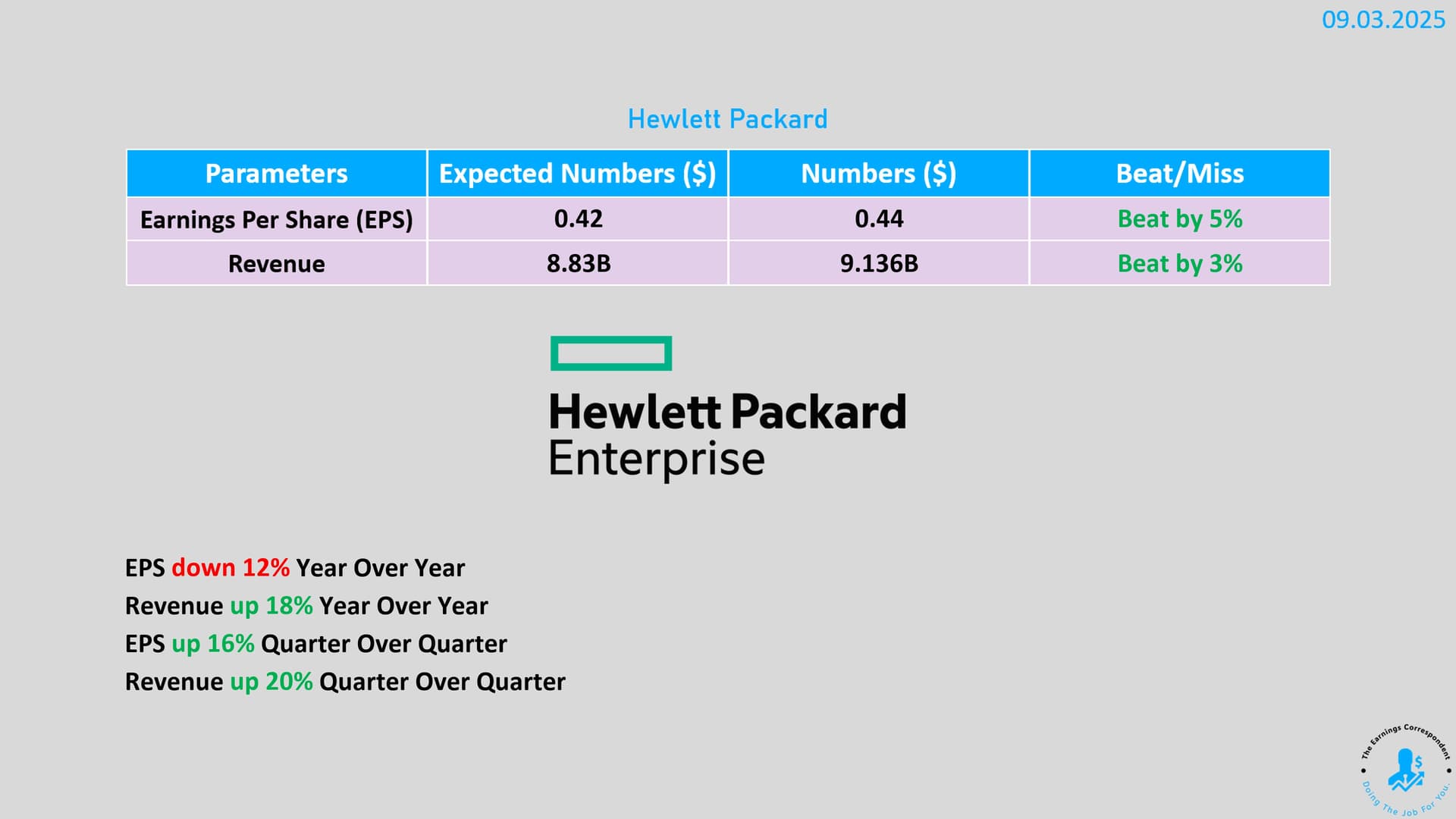

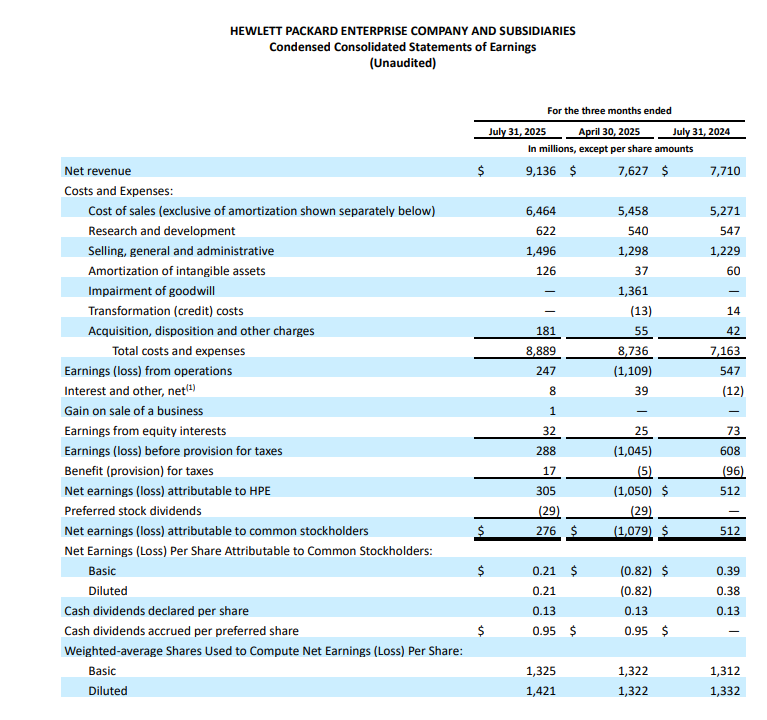

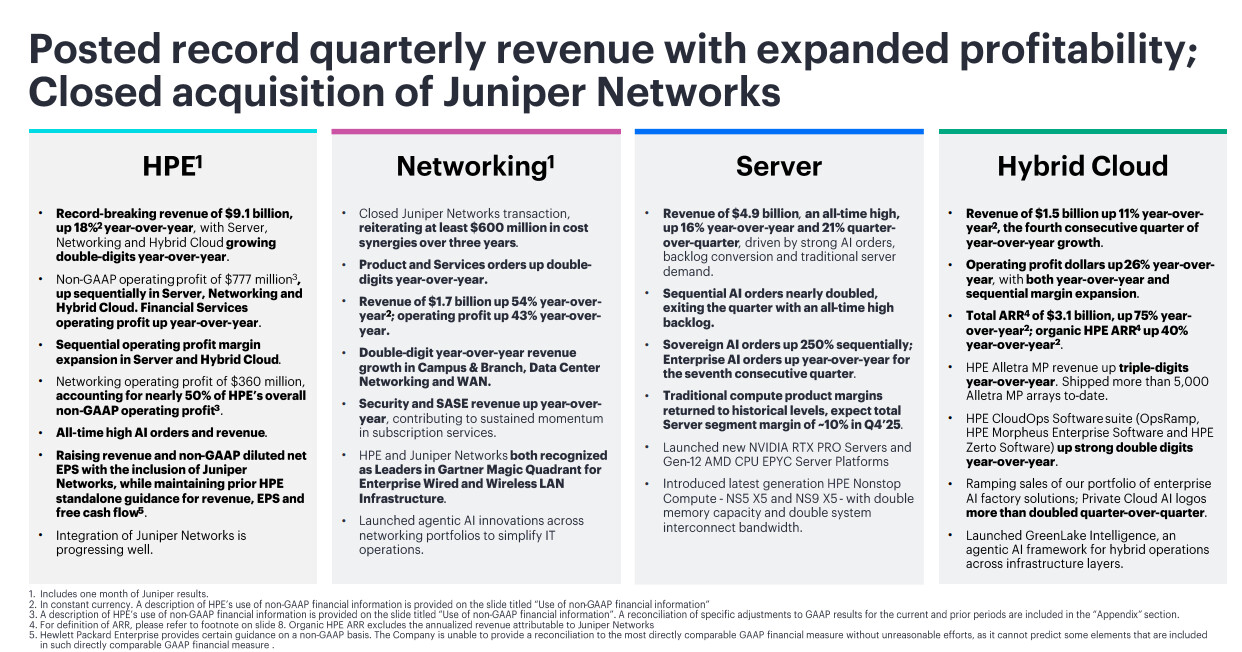

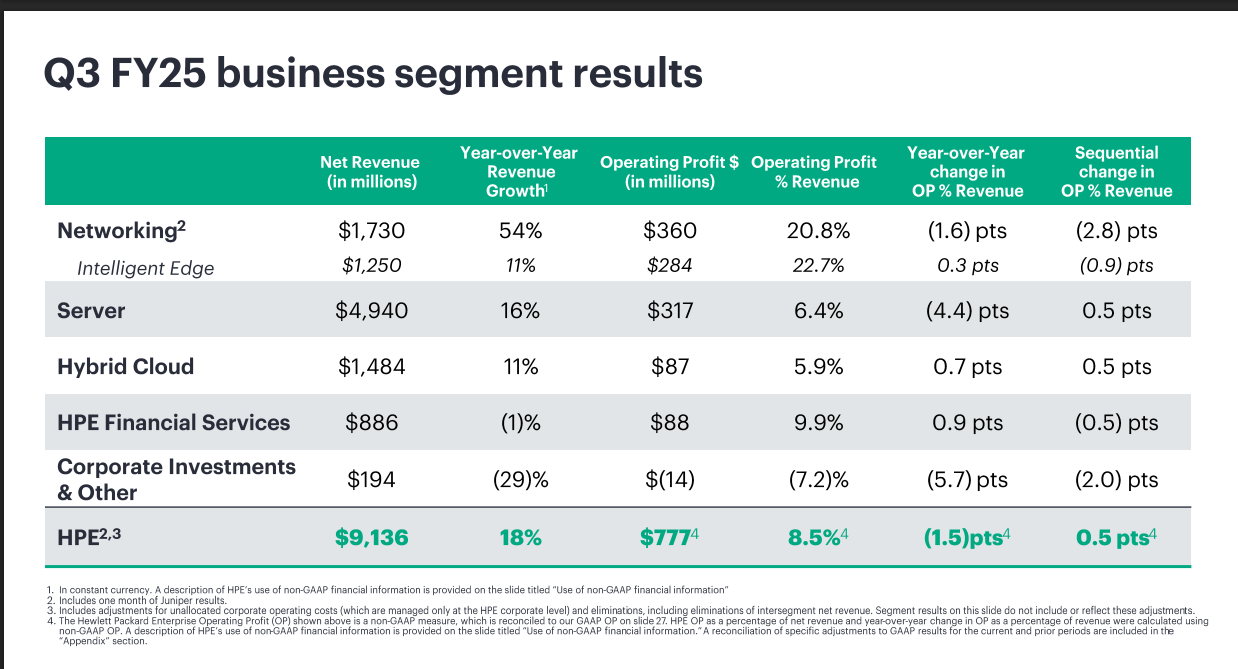

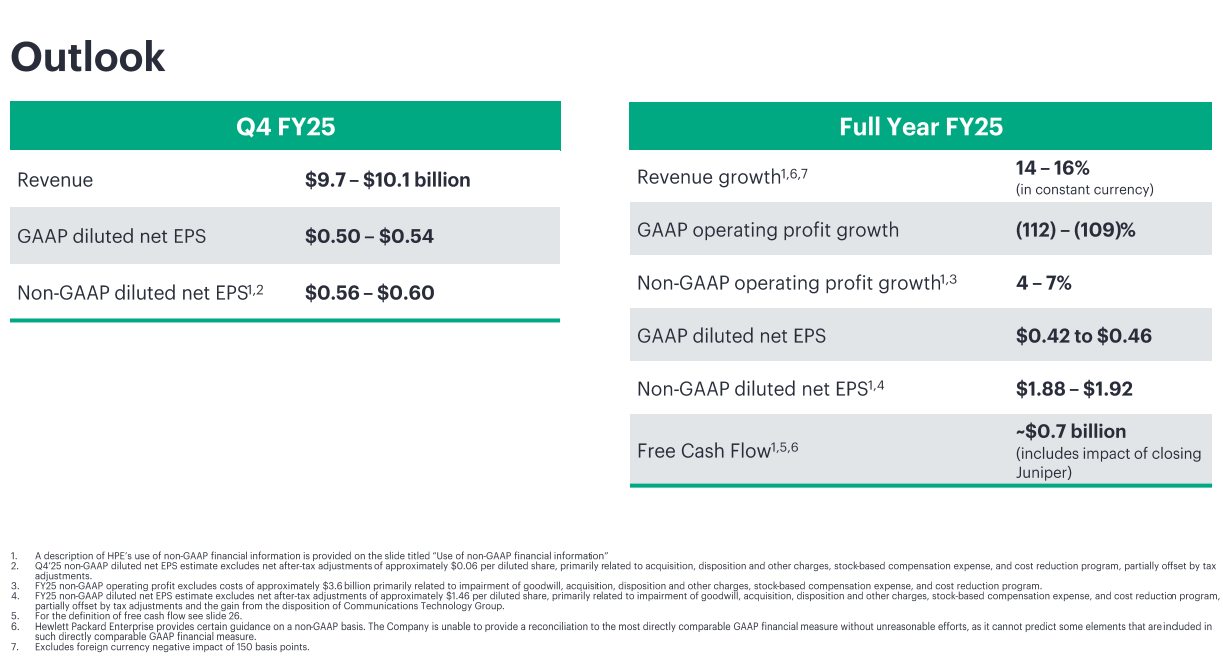

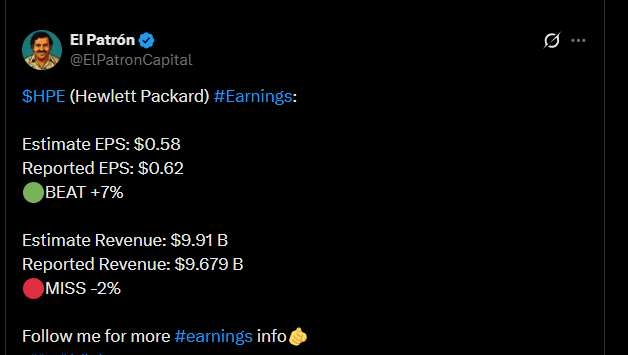

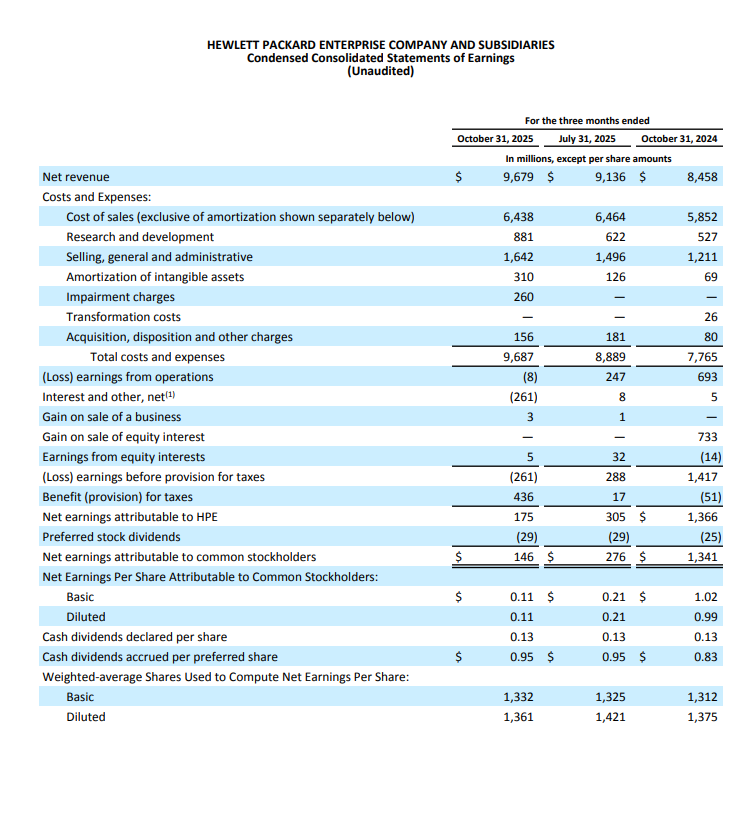

Latest quarter

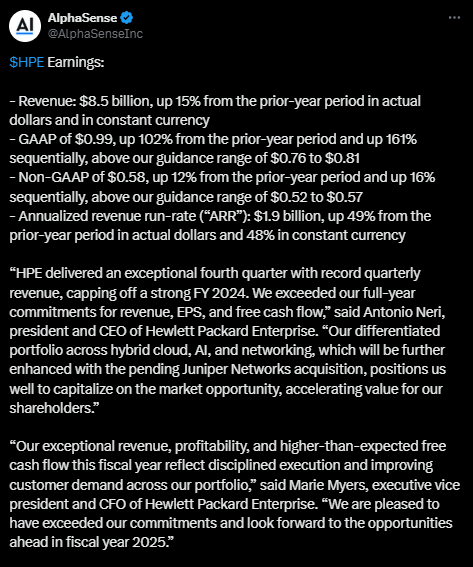

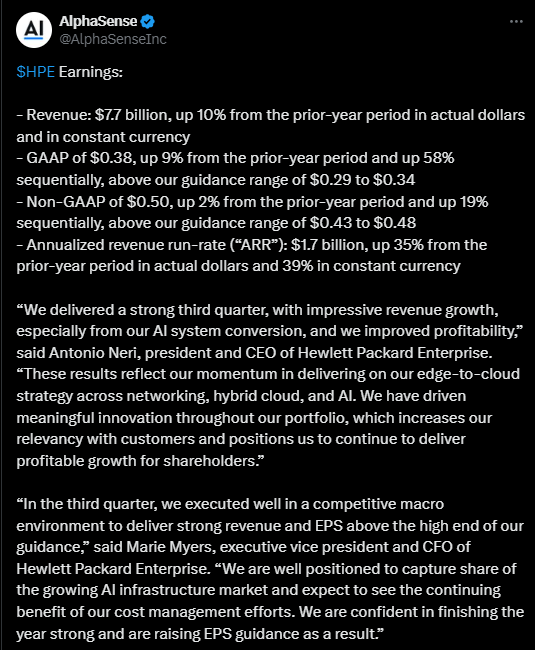

https://x.com/AlphaSenseInc/status/1831424046182928860/photo/1

2023

And some valuation multiples and other nonsense:

6.9.2024

P/E: 12.43

P/S: 0.8

P/B: 1.03

EV/EBITDA: 6.38

Annual dividend yield 2.97 %

Quarterly dividend 0.13 USD