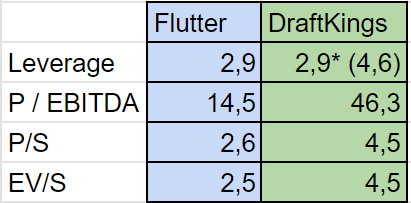

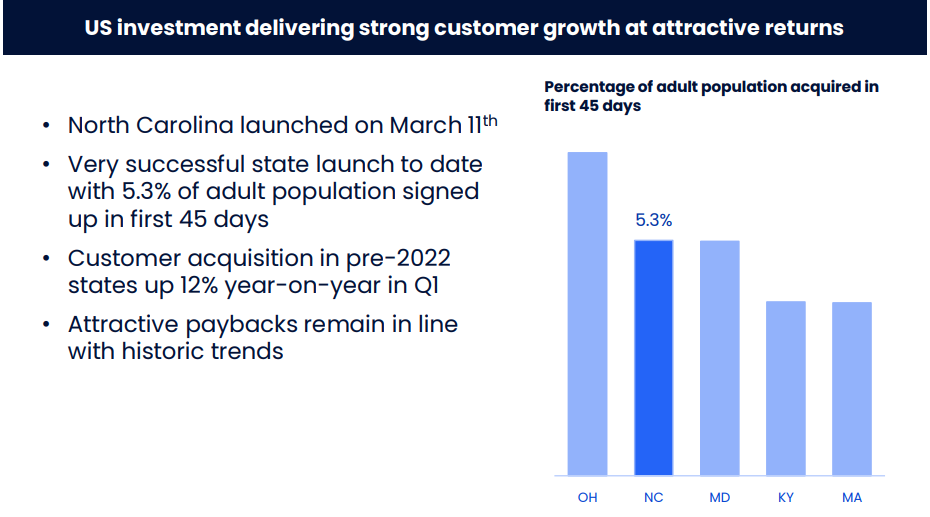

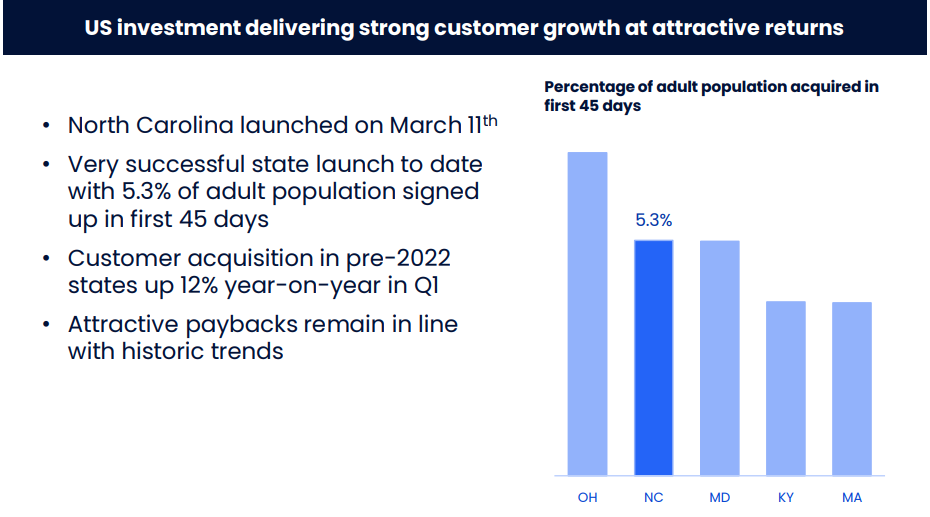

Excellent earnings report from Flutter. Unfortunately, even this report didn’t quite break the bank yet. The North Carolina launch was on March 11th, so its profit-bearing fruits will be seen in later reports. In the conference call, the CFO and CEO boasted about winning North Carolina. In some states, DraftKings is more popular, but according to management’s comments, FanDuel is now dominating NC.

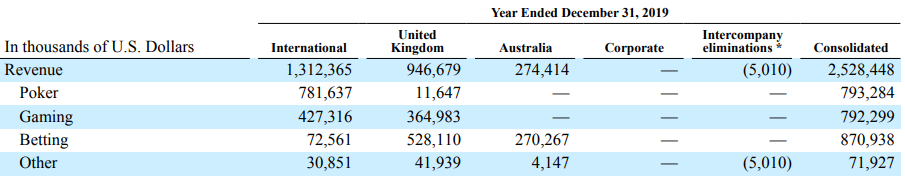

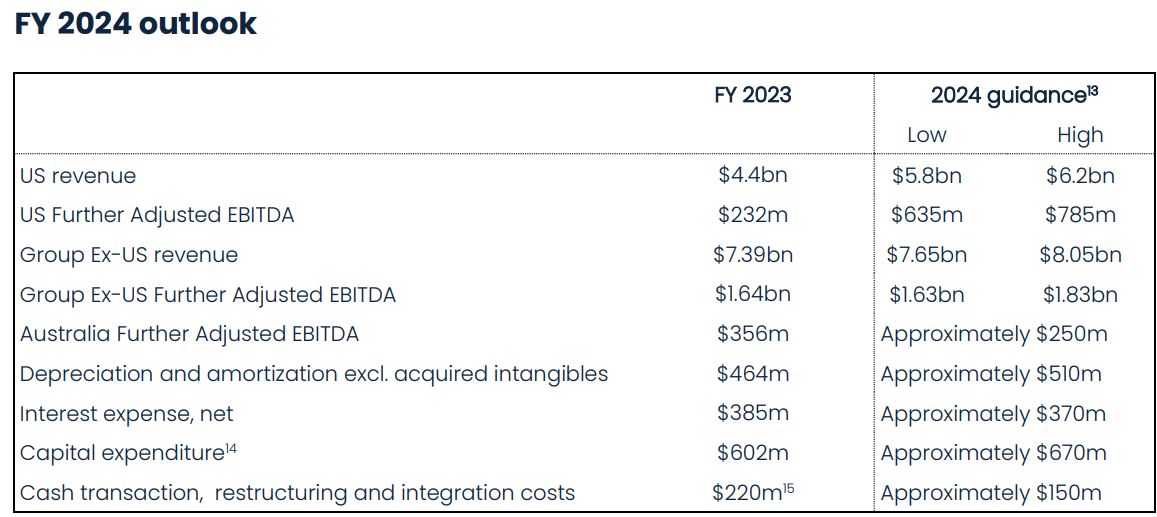

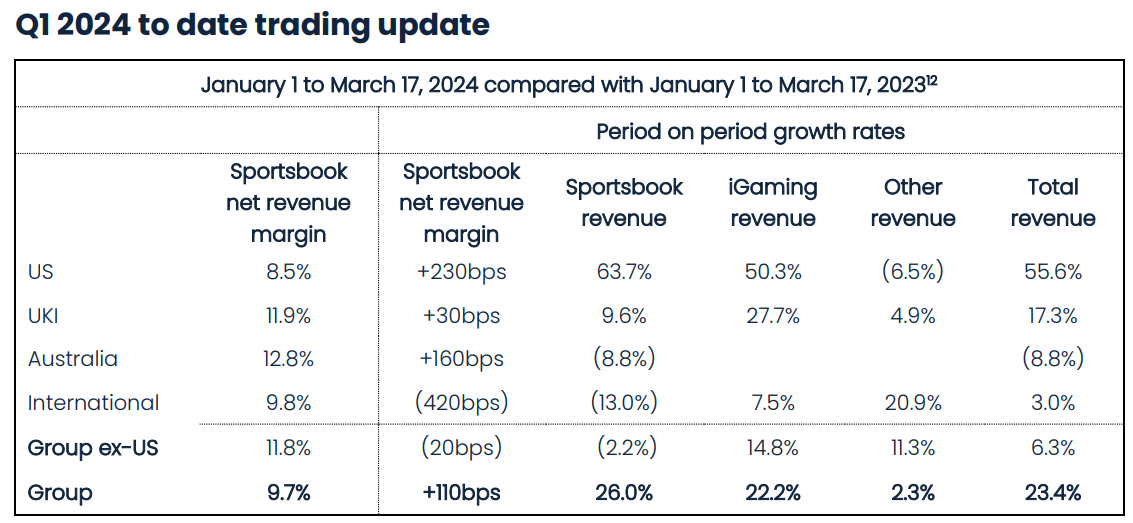

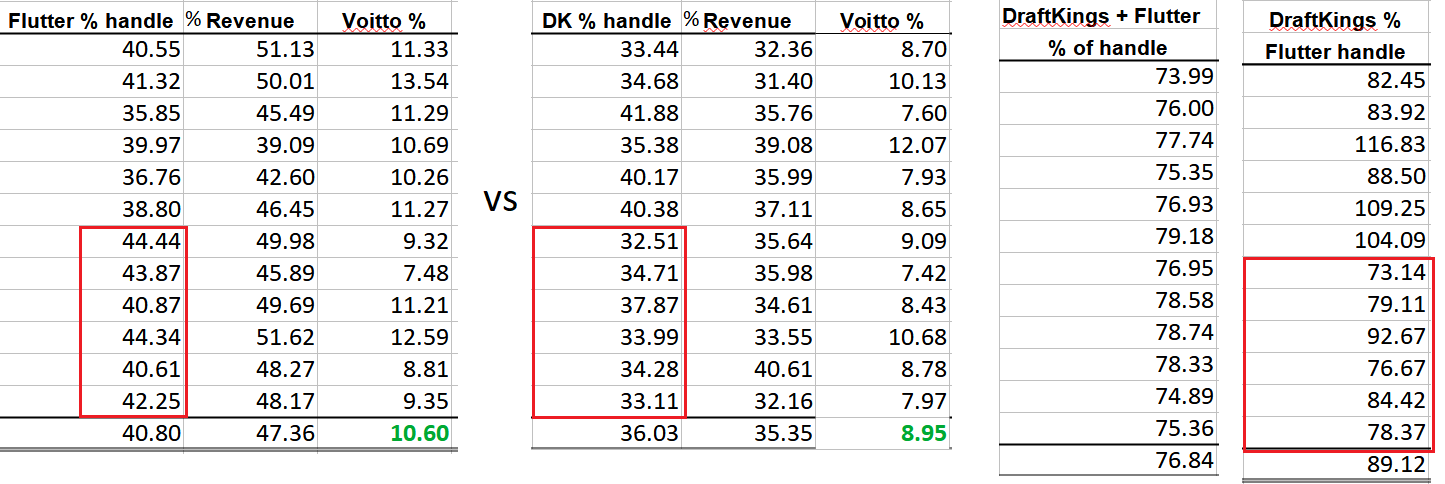

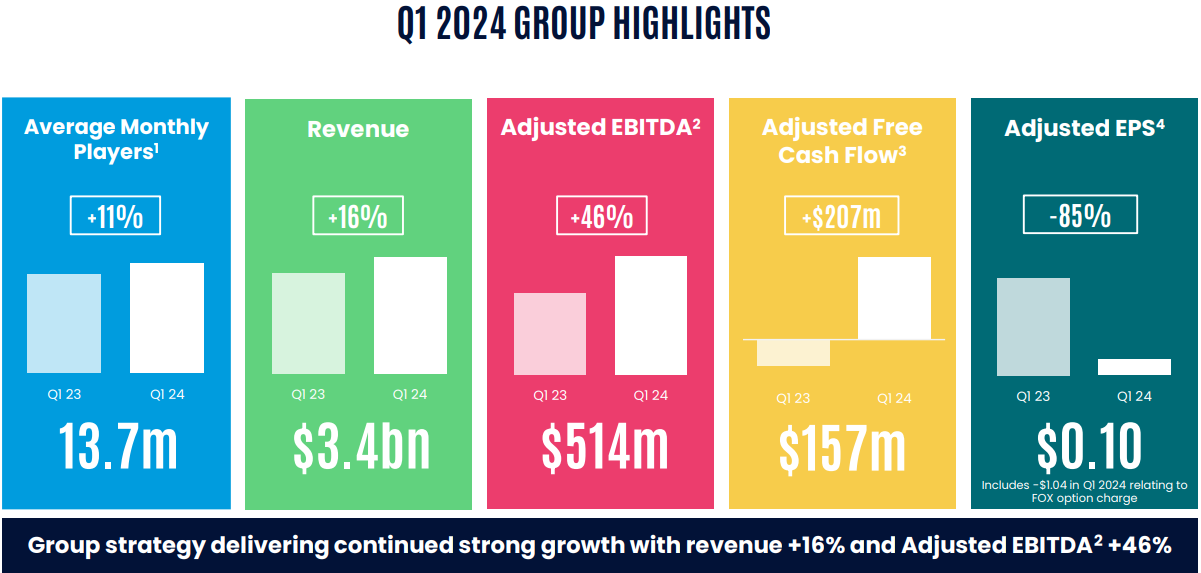

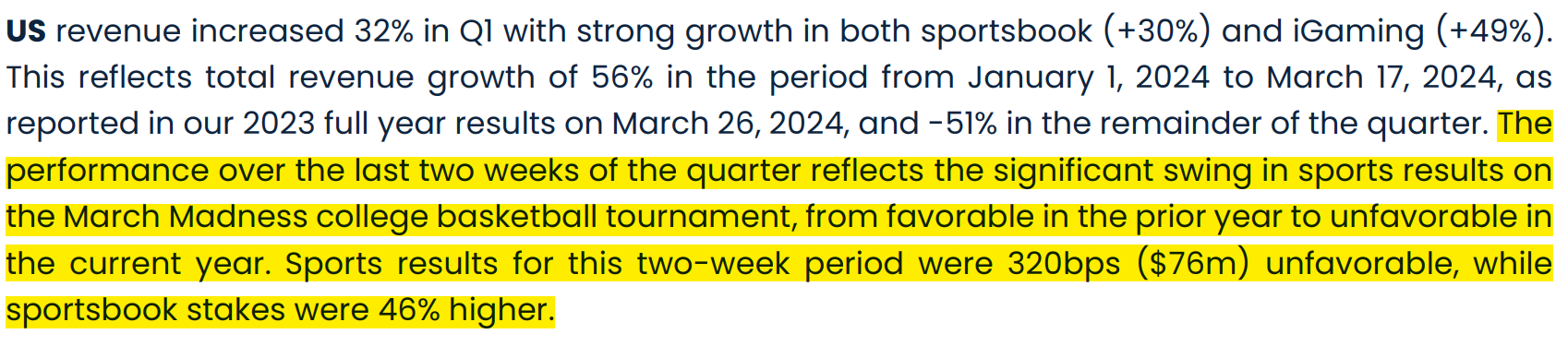

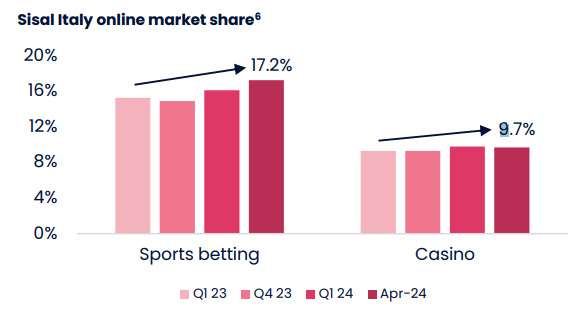

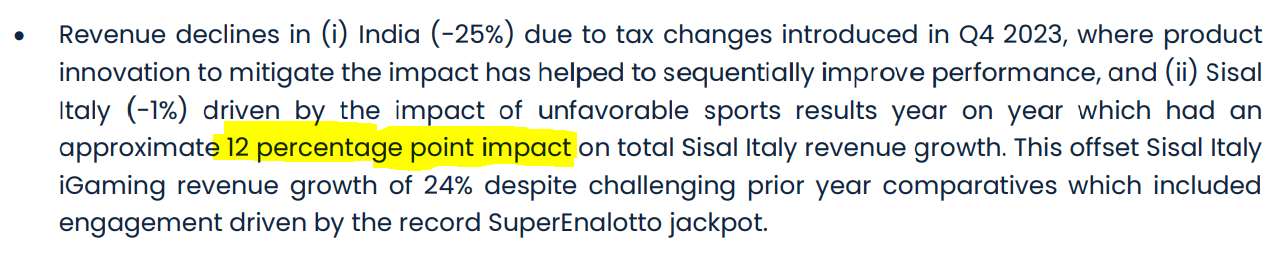

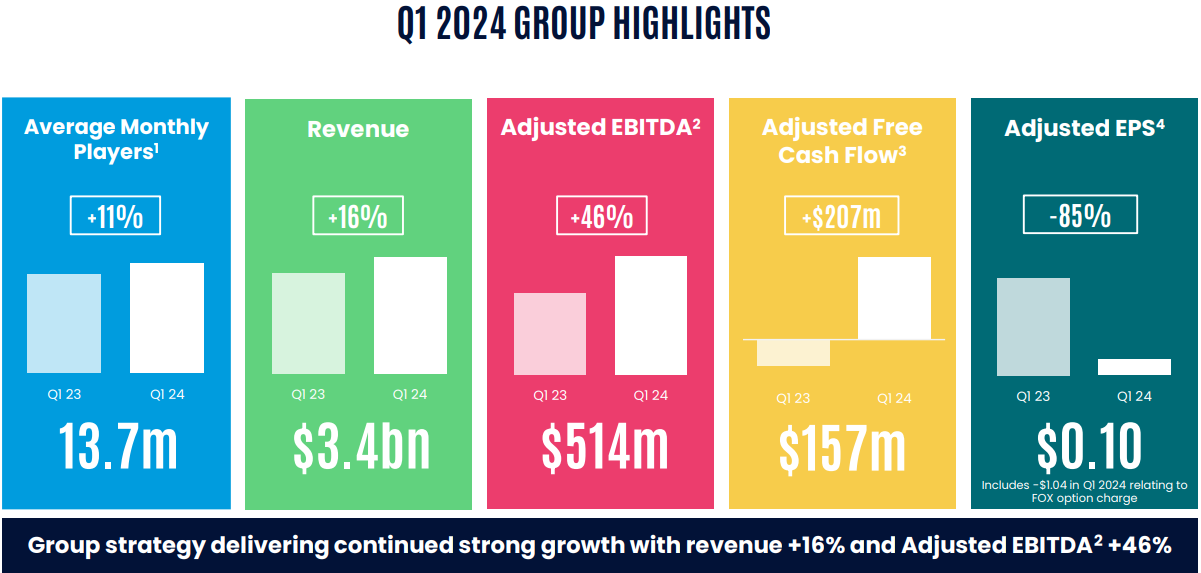

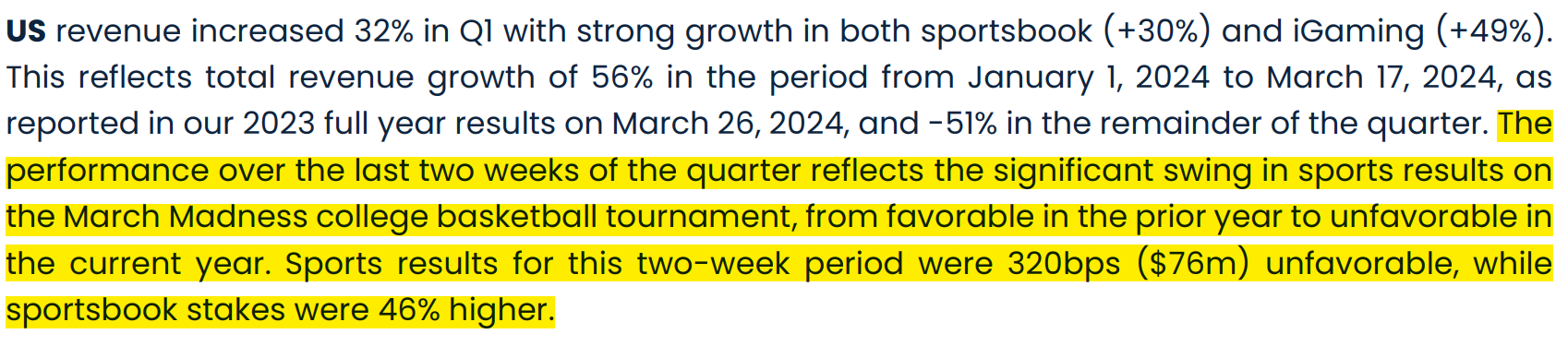

US revenue grew +56% at the start of the year, then a couple of bad weeks in betting resulted in a +32% figure. Similarly, Italy’s Sisal suffered from good player luck. UK & Ireland grew +12% CC, which was an excellent performance when compared to a strong period.

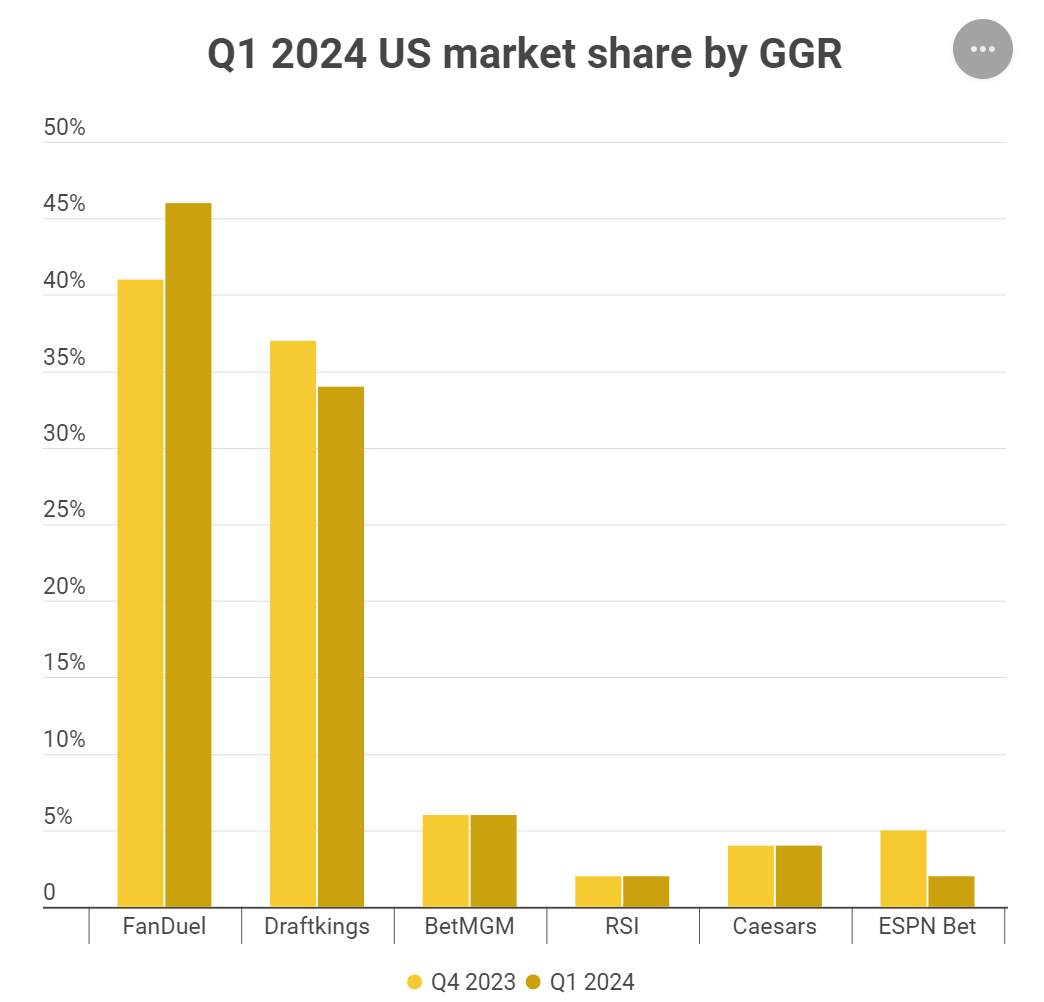

Betting Gross Gaming Revenue market share was 46%, Net Gaming Revenue 52%. I imagine the difference between these relates somehow to “promotional spending,” meaning some states provide tax benefits for marketing.

iGaming market share in the US grew to 27 percent.

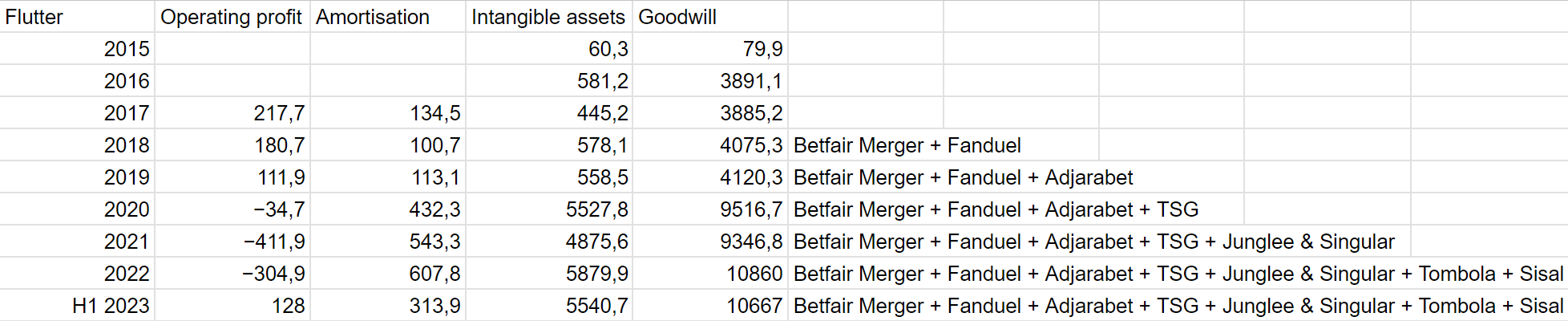

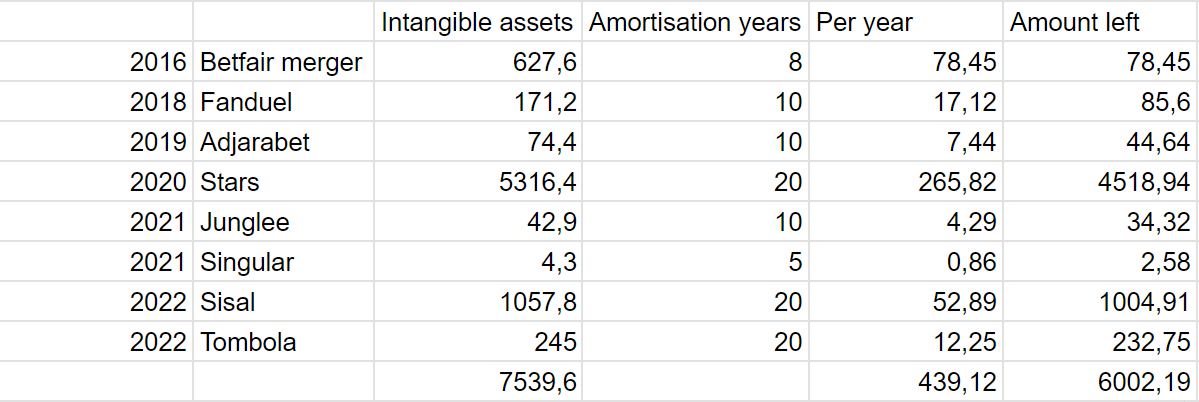

Cash flow was strong and debt was also reduced by a small slice, as I anticipated.

The Fox Option ate into profits again. As I had guessed, as FanDuel grows, the Fox Option—the 18.6% stake available to the Fox Corporation—grows in value. This is then recorded as an increasing liability.

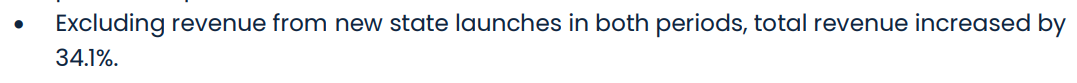

Guidance remained unchanged. DraftKings, on the other hand, raised its guidance.

The North Carolina launch was good.

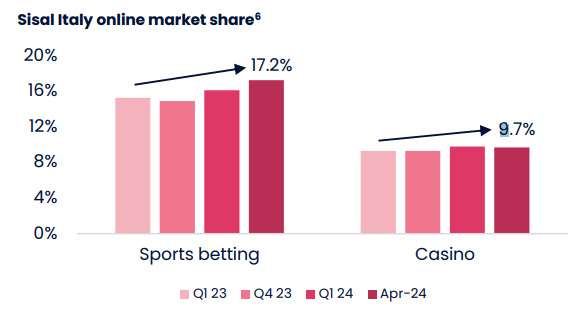

Excellent performance from Sisal, even though player luck ate into revenue. (ping betsson Italy)

I was personally convinced enough after the conference call that I am considering buying an additional lot. Flutter’s operational efficiency is growing so fast that it mitigates risks well.

The company already moved its HQ to New York, and the primary listing will be moved to the NYSE on May 31. It remains to be seen whether this will boost the share price.