Are there people on the forum who use excavators, doing REAL work? ![]() Or people familiar with the industry.

Or people familiar with the industry.

For a few years now, I have been following a Swedish, infuriatingly profitable (how do Swedes manage it!) bucket company called engcon. (Follow companies here on Inderes)

The company’s innovation, which is changing the excavation industry, is simply… some gadget (“tiltrotator”) that makes the bucket rotate. ![]()

Look at this picture, where “engcon” is written in small print on the bucket:

I understand that a rotating bucket offers enormous benefits for excavation work. But I don’t understand how this can be so revolutionary. Hasn’t this really been invented before? ![]()

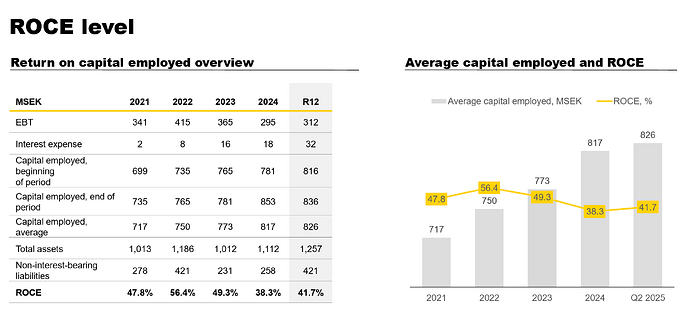

However, this innovation, which seems “modest” to my eyes, has created a business whose invested capital yields over 40%! In other words, every euro invested in the business generates 40 cents per year. ![]() For basic companies, it’s good if they reach 10%.

For basic companies, it’s good if they reach 10%.

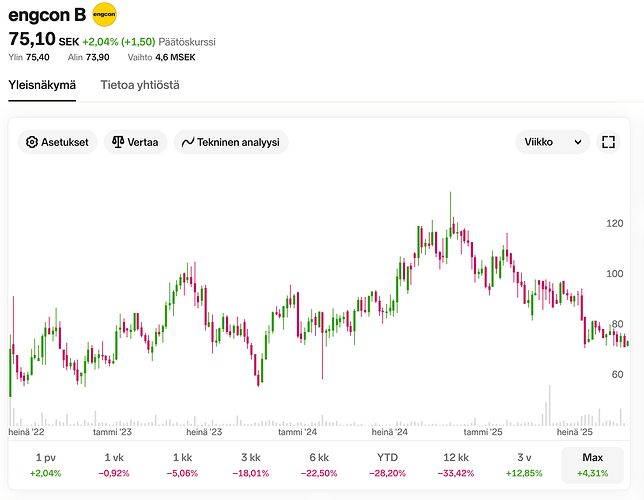

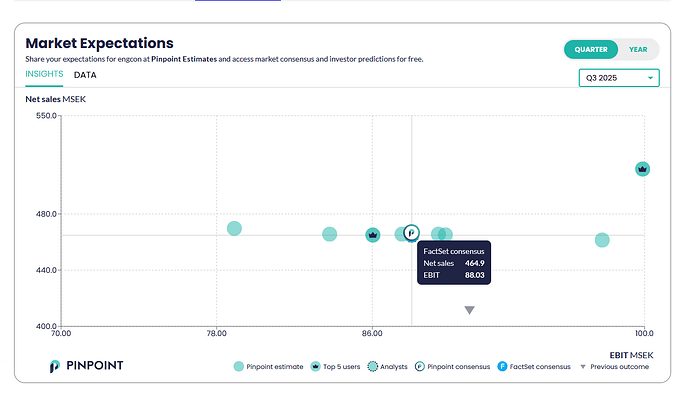

The stock has been languishing in a weak construction cycle, but the ever-optimistic Swedes are currently keeping it afloat on the stock exchange with a market capitalization of over one billion euros, even though the company’s revenue is… approximately 170 MEUR. Thus, revenue multiples are higher than those of an average software company.

When it listed in 2022, the company envisioned strong growth based on market forecasts (as always), but a difficult construction cycle has kept sales growth suppressed: revenue has decreased from a couple of billion in 2022 to 1.7 billion SEK in 2024 (in SEK).

The company’s margins have faced a slight headwind since the peak cycle of 2022, but the company’s estimate of its 45% global market share has remained since its listing. Five players account for almost the entire market. Cheap competition may emerge from Asia, but on the other hand, according to the company, customers prefer reliability and a service network. That argument is easy to buy in the sense that an expensive machine and operation would be halted if the tiltrotator broke down. It is therefore the wrong place to save money.

Here are the competitors and market shares according to the 2022 listing prospectus:

The stock may also have been pressured by weakness in North America, but at the same time, one of the successes of recent years has been Europe’s rise as the largest segment.

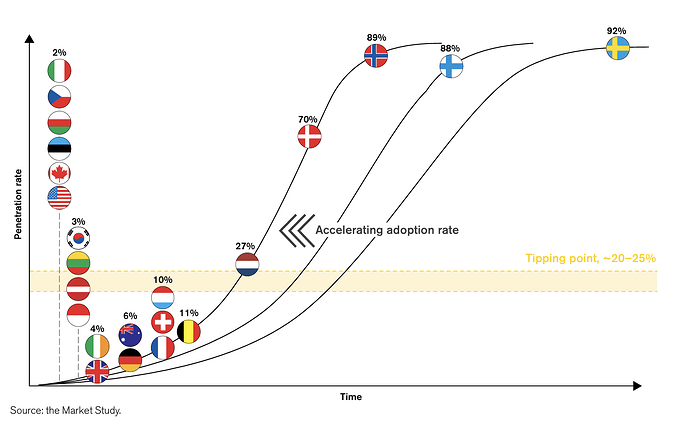

What’s the main point? Well, it’s that the current global market share of tiltrotators, which is a couple of percent, will grow to the level of Sweden’s over 90% share! A tiltrotator significantly increases excavator productivity, which would be important in countries plagued by lower productivity and labor shortages. And more and more countries around the world definitely fit this description, not to mention fuel savings and climate impact.

Questions for experts:

a) Have engcon’s products changed your excavation experience?

b) Do these products face competition, or do you consider them completely unique, something no one else (besides these five players) can manufacture?

These questions are of immense importance for engcon. The company’s current profitability would hardly be possible in a world where competition in bucket rotation systems was tougher. On the other hand, the company needs to spread the good word of tiltrotators everywhere. If the message doesn’t get through, global growth will remain just a dream.

A word on stock valuation.

Indeed, the company’s current market capitalization is 11.5 billion SEK, with revenue of 1.8 billion SEK.

If we assume that the current ~2% penetration rate in new excavators (forgetting the potential of maintenance, spare parts, and retrofits) rises to 40% over the next 20 years and the company maintains its market share, revenue would roughly increase 20-fold.

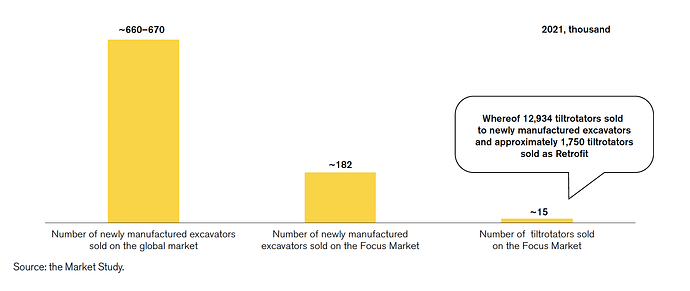

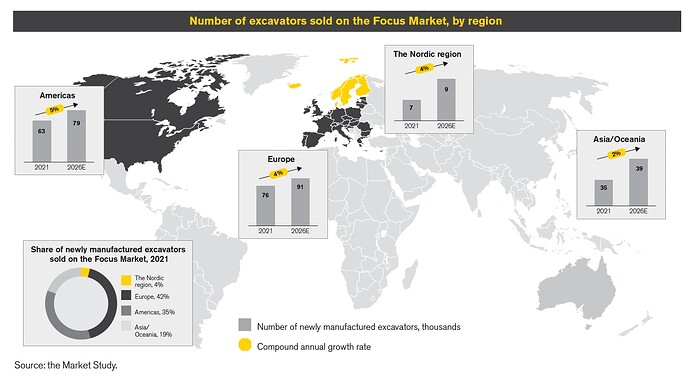

Situation in 2021:

However, since the company’s market share is weaker in, for example, the large American market according to the listing prospectus, and as the market grows, we can assume competition will increase, let’s assume that the company’s global market share still decreases to a juicy 30% from the current 45%. This is a terrible assumption; no one knows where the world will truly be in 20 years. What I do know is that, with high probability, people will be drinking coffee and eating Italian food with forks, all traditions that have lasted for hundreds of years, but what will be the popularity of tiltrotators? Who knows.

Excavator market distribution globally in 2021. Don’t look at the listing prospectus forecasts. ![]() They are what they are. Certainly, those CAGRs are probably acceptable figures in the long run.

They are what they are. Certainly, those CAGRs are probably acceptable figures in the long run.

In any case, these assumptions would therefore lead to an approximately 15-fold increase in revenue.

Revenue would therefore be just under 30 billion SEK in 2045 (3 billion euros at current exchange rates).

Let’s assume that the industry is still experiencing strong growth at that point, as the Swedish vision of tiltrotators conquering the world is proving to be somewhat correct. The industry remains relatively concentrated, and engcon’s operating profit margin is approximately 20%, supported by maintenance and spare parts. AI has not disrupted the industry, and Chinese players have not gained significant popularity globally except in Africa and South America.

Operating profit would therefore be approximately 6 billion SEK.

If the company were to trade at an EV/EBIT of 15x, in the spirit of a high-quality engineering company, the enterprise value (which for a debt-free company is practically the same as market capitalization, assuming there isn’t a huge net cash position) would therefore be 90 billion SEK.

Great, so with these assumptions, we would have a stock that increases 8-fold in 20 years!

But 20 years is a long time. On an annual basis, the return would be approximately 11%, plus a little in dividends (dividend yield currently 1.3%). By no means bad, but not spectacular either.

And there are a lot of assumptions here. Will tiltrotators become as commonplace globally as they are in the Nordic countries? What if the competitive dynamics change? Could engcon’s hitherto well-managed house fall into disrepair along the way? What do the main owners think about the company’s ultimate purpose?

The painted scenario will most likely go awry, but it could also be exceeded if the whole world goes crazy for Swedish buckets. Time will tell.