https://www.youtube.com/shorts/Nf_bK3vbFPo

Electronic Arts is an American video game company headquartered in California. The company was founded in May 1982 by former Apple employee Trip Hawkins. EA was one of the pioneers of the early home computer game industry. EA released numerous games, but all of these were developed by external individuals or groups until 1987, when Skate or Die! was released. After this, the company moved towards its own internal game studios, often through acquisitions, such as when Distinctive Software became EA Canada studio in 1991.

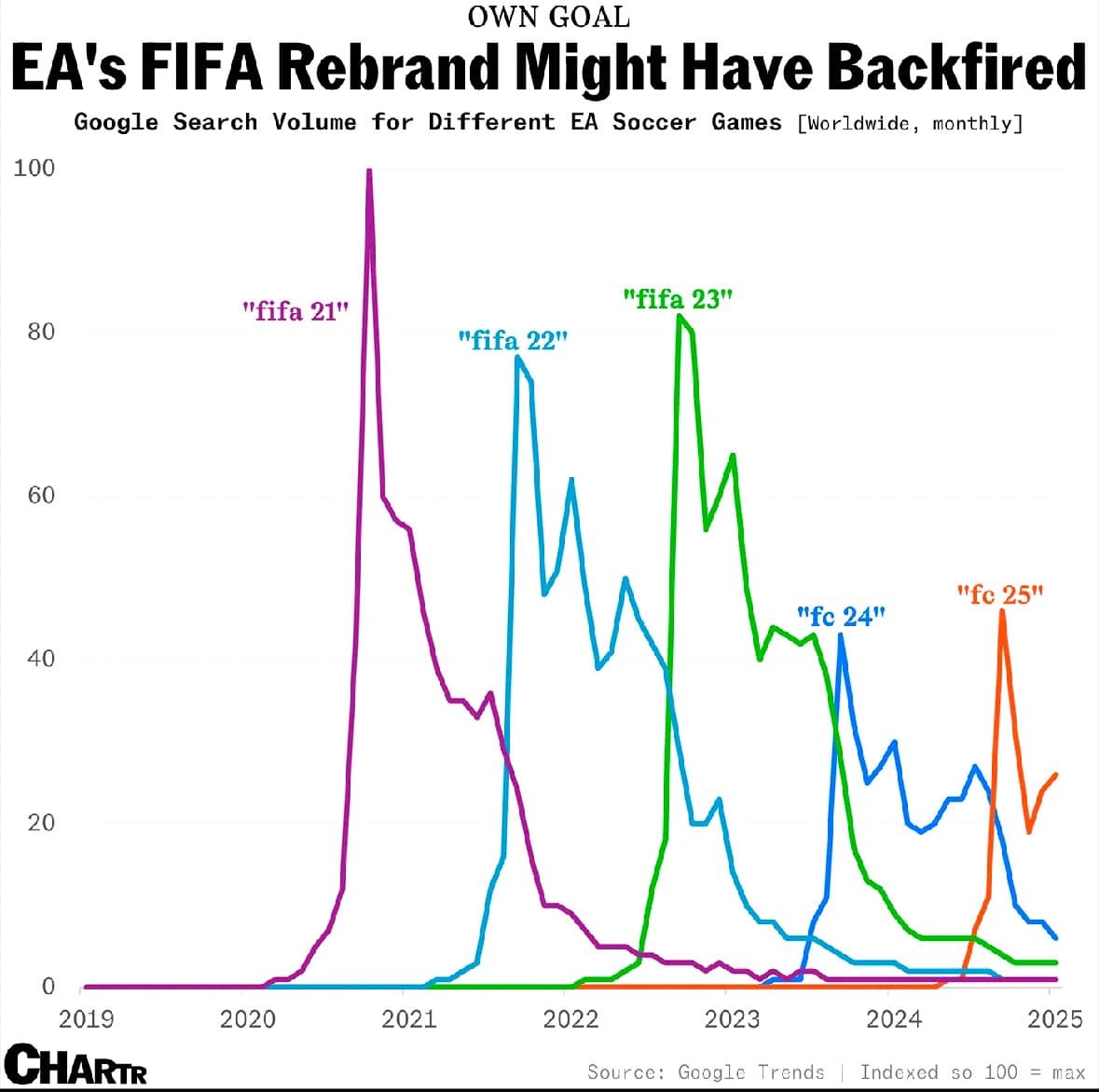

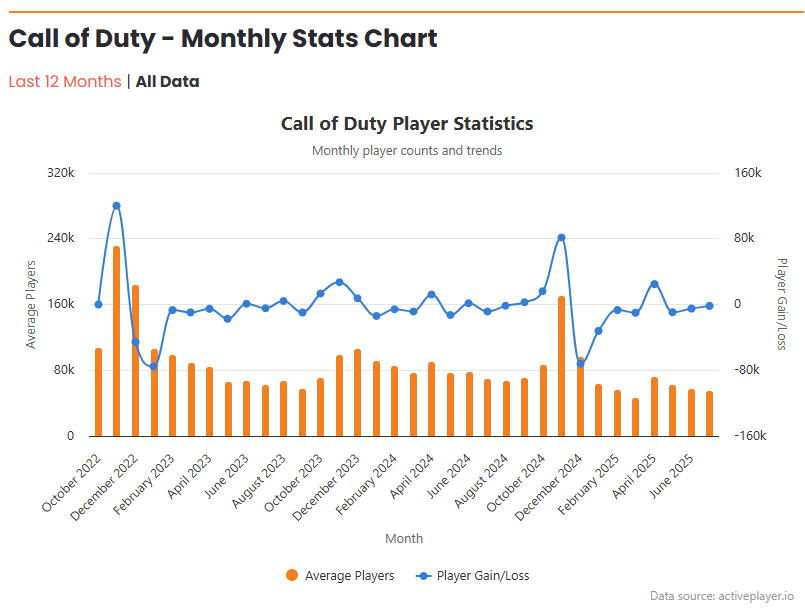

Through EA, games like these have become familiar to gamers: Battlefield, Need for Speed, The Sims, Medal of Honor, Command & Conquer, Dead Space, Mass Effect, Dragon Age, Army of Two, Apex Legends, and Star Wars. And of course, EA is known for its sports games, such as FC, FIFA, Madden NFL, NBA Live, NHL, PGA, and UFC.

Since 2022, the company’s PC games have been available on their own EA App platform. EA also owns and “leads” several significant game studios, such as DICE, Motive Studio, BioWare, and Respawn Entertainment.

The story of Electronic Arts is one of the biggest in the gaming industry, with which many have a love-or/and hate relationship. The company continues its growth and development by bringing new innovations and games to the market. EA’s influence in the video game world is enormous, and it has managed to stay current, even though the gaming world has changed and evolved significantly over the years.

Investor’s thoughts:

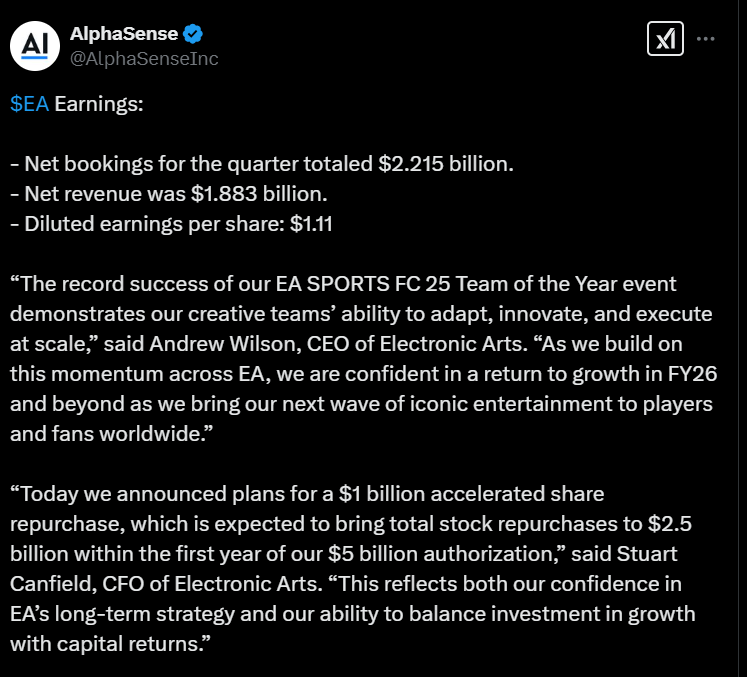

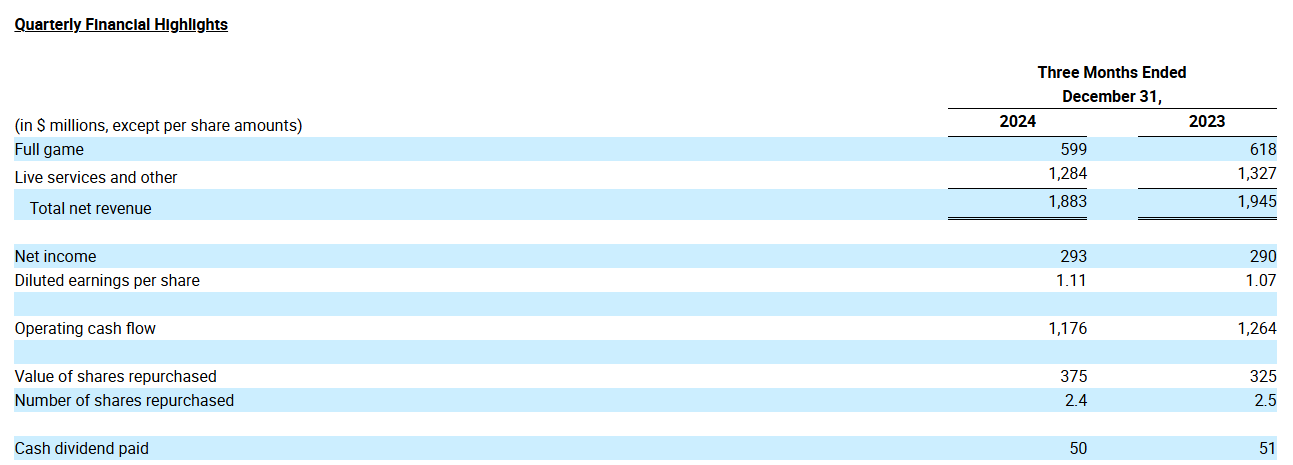

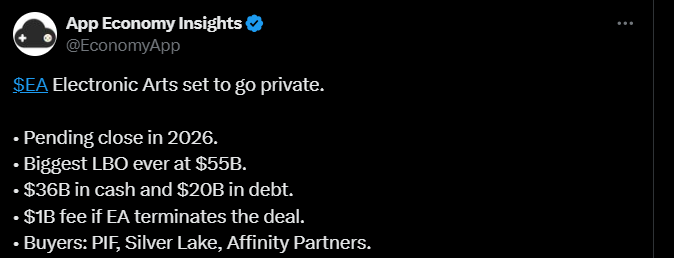

Electronic Arts is not currently considered particularly attractive because revenue fell short of the previous year’s level, and the outlook is not glowing either; for example, console sales have decreased, and sales expectations are somewhat negative even in the longer term. However, the new PS5 Pro is expected to potentially revive console demand and thus also EA game sales. Additionally, the company’s “financial matters” are in order, meaning there is sufficient liquidity.

The valuation cannot be considered cheap, but not particularly expensive either.

P/E ratio: 34.90

P/B ratio: 5.22

P/S ratio: 5.18

The company is expensive for many relative to expectations, but it has resources, and if the company can reverse the trend, then it can be re-evaluated more closely.

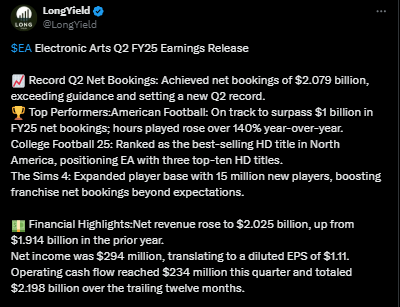

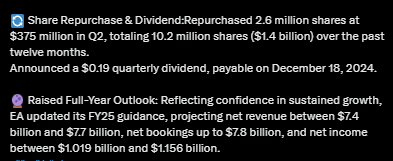

Here’s a brief summary of recent quarterly results:

https://x.com/Quality_stocksA/status/1818391970672189527

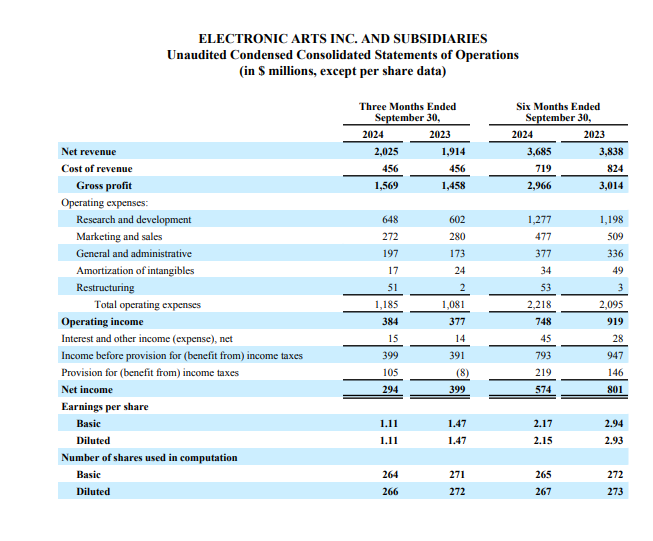

Spotted in EA’s reports:

![]()

Me and @Pohjolan_Eka

My usual Tinder dates: