Greetings everyone!

A Porsche tracking thread has been missing from this forum. I’ll clarify right at the start that this thread discusses Porsche AG (officially Dr. Ing. h.c. F. Porsche AG), whose ticker is P911. This should not be confused with Porsche SE, which is a publicly listed holding company whose primary holdings are Volkswagen and Porsche AG. How such a cross-ownership entanglement came about dates back over 15 years, when Porsche attempted a hostile takeover of Volkswagen. It involved interesting ownership maneuvers and power struggles between the Piëch and Porsche families, which are probably not necessary to delve into further in this context. Anyone can learn more about them, for example, using Wikipedia. The most important thing is that the ownership structures are at least somewhat sensible at the moment, and they are shown in the diagram below:

Porsche began its stock market journey at the end of September 2022, after Volkswagen listed its shares in an IPO. In my opinion, Volkswagen ultimately made a foolish move from its own perspective, and the timing of the listing was delayed enough that the most extravagant prices for Porsche were missed. Volkswagen hasn’t really done anything sensible with the cash received from the listing, but as a result of everything, this luxury car manufacturer is now an independent publicly traded company. Since last year, its independence has grown as financial relationships with the parent company have been clarified.

Over the years, I have owned both Porsche SE (a terrible chronic value trap) and Volkswagen (always disappointed my expectations). I have been following Porsche’s stock market journey very closely all along. At the time of the IPO, I was unable to buy shares, and after the stock price started a rather vigorous ascent, I concluded that the company didn’t quite fit my strategy. However, the price has come down, and in mid-January of this year, I determined that the stock was at a buying level according to my parameter preferences. The dividend yield is still too small for now, but presumably growing. My buying decision was based on both the company’s strong financials and, in my opinion, favorable future prospects. I also like Porsche’s products, although I have no direct contact with them other than having spent a lot of time tinkering with an engine designed by Porsche.

Strong financials are evident in Porsche’s financial statement published today, the key figures of which are here:

The latest financial figures and investor presentation can be found here: Financial Information | Porsche AG .

Porsche is an extremely profitable automotive company, and its P/E ratio at today’s closing price is 15.9. Its market capitalization is approximately 82 billion euros, which is very much in the same league as another sports car manufacturer, Ferrari, whose market capitalization is 75 billion euros. Ferrari’s valuation is in a completely different class, with a P/E ratio of 56. Compared to Ferrari, Porsche is currently priced very moderately, although compared to other German car manufacturers, Porsche is indeed expensive. The consensus of analysts’ target prices is currently 95 euros, but I would expect them to rise with today’s financial statement. The stock price, at least, was in a lively upward trend, ending up 11.47% in the positive.

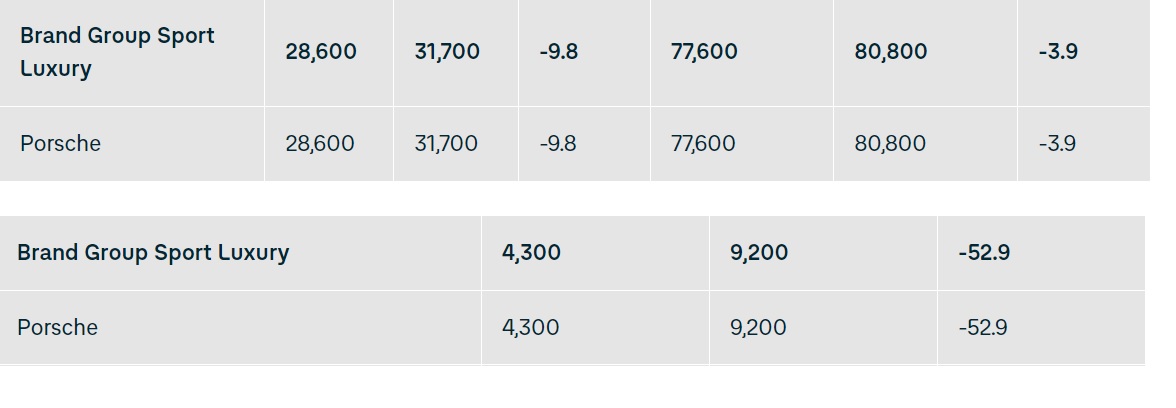

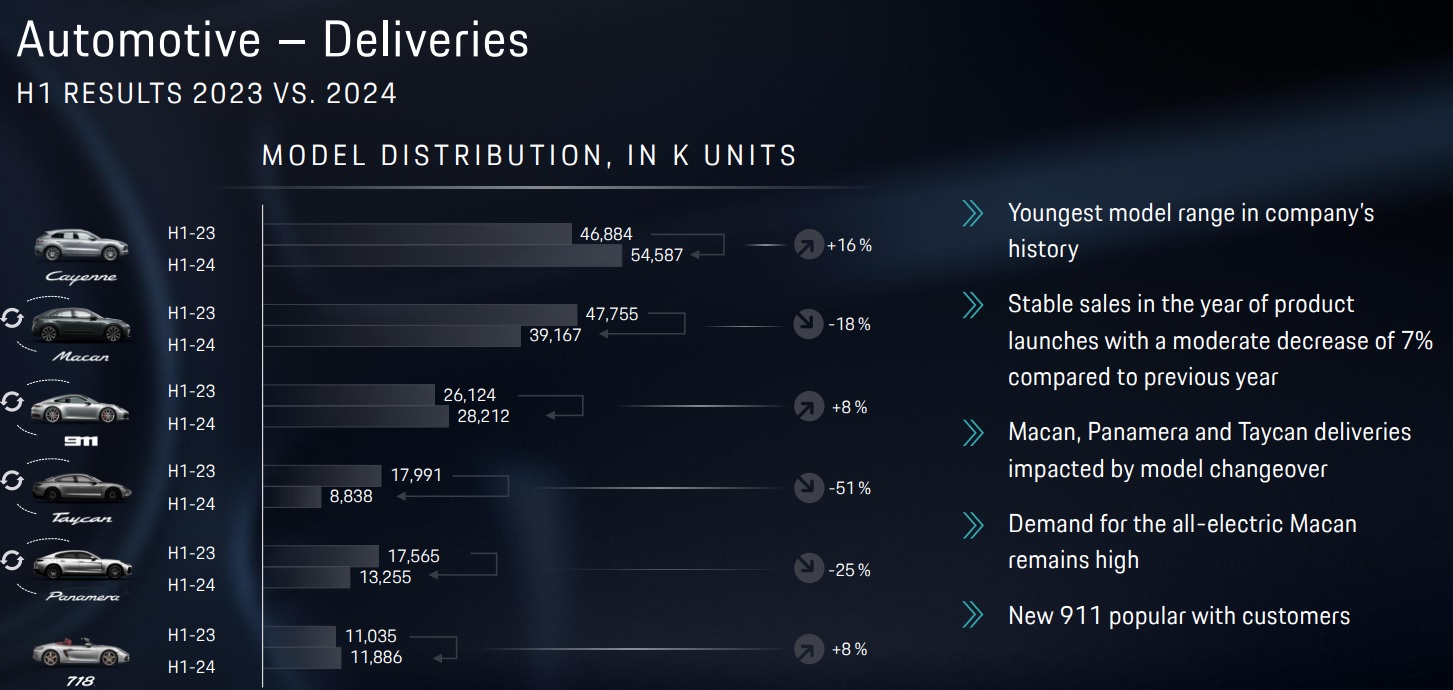

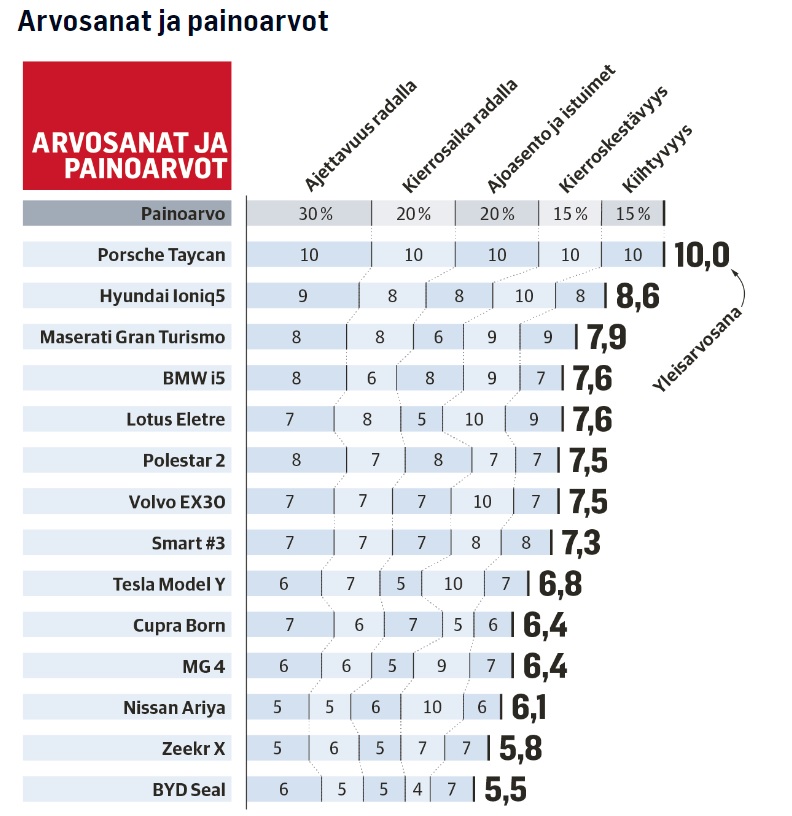

Porsche’s sales have been very good, considering it is a rather expensive product. The development of sales volumes is shown in the following table:

The current year will not be a year of significant growth; instead, the guidance was very flat:

The reason for zero growth is related to the model range renewal. All models have either just been renewed or are soon to be renewed. The Cayenne and Macan are currently in such a limbo, and the new 911, important for its image, will be introduced in the middle of the year. The company’s own assumption is that sales volumes will increase after the launches. I don’t believe they are wrong about that. Porsche’s operating logic is not the same as mass manufacturers, and this manufacturer is not going into car discount sales. Interestingly, among luxury products, Porsche is currently rated as the most valuable brand: Brandirectory