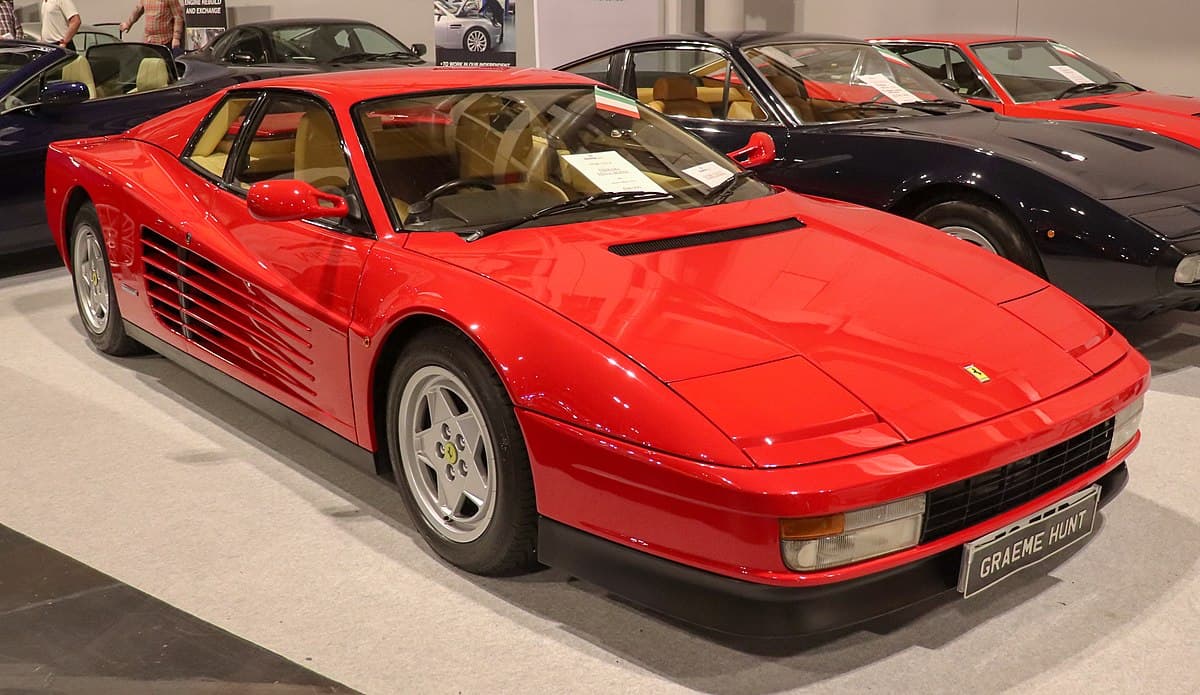

Ferrari is certainly a very familiar car brand to everyone. It has a magnificent history in sports cars and motorsports.

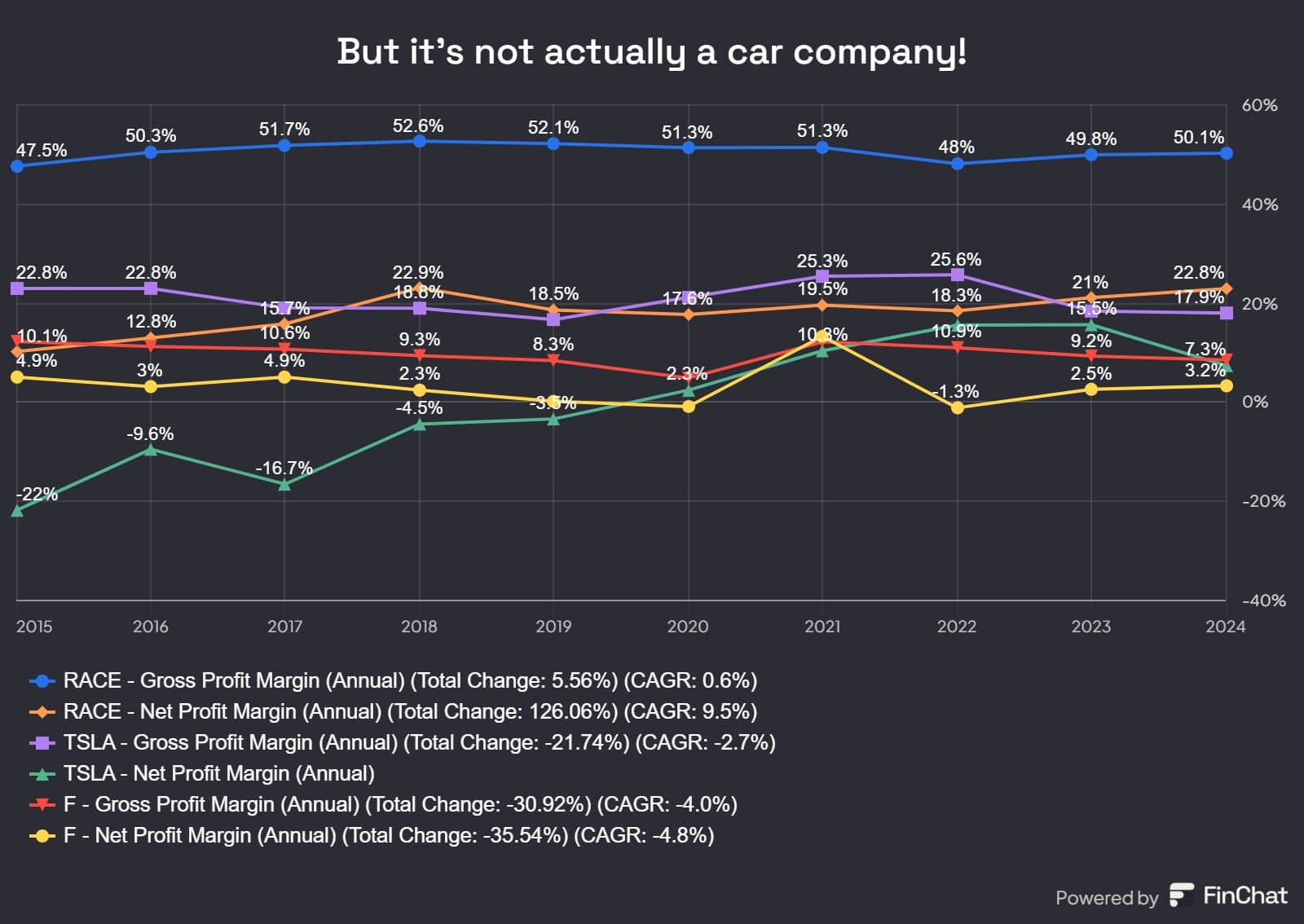

Ferrari is Ferrari. It is far from the shopping list of ordinary people, unlike many premium brands; even Porsche can be distantly considered a sort of sports car for the people, but Ferrari is not. As a car, it represents its magnificent history as well as aesthetics, innovation, and power.

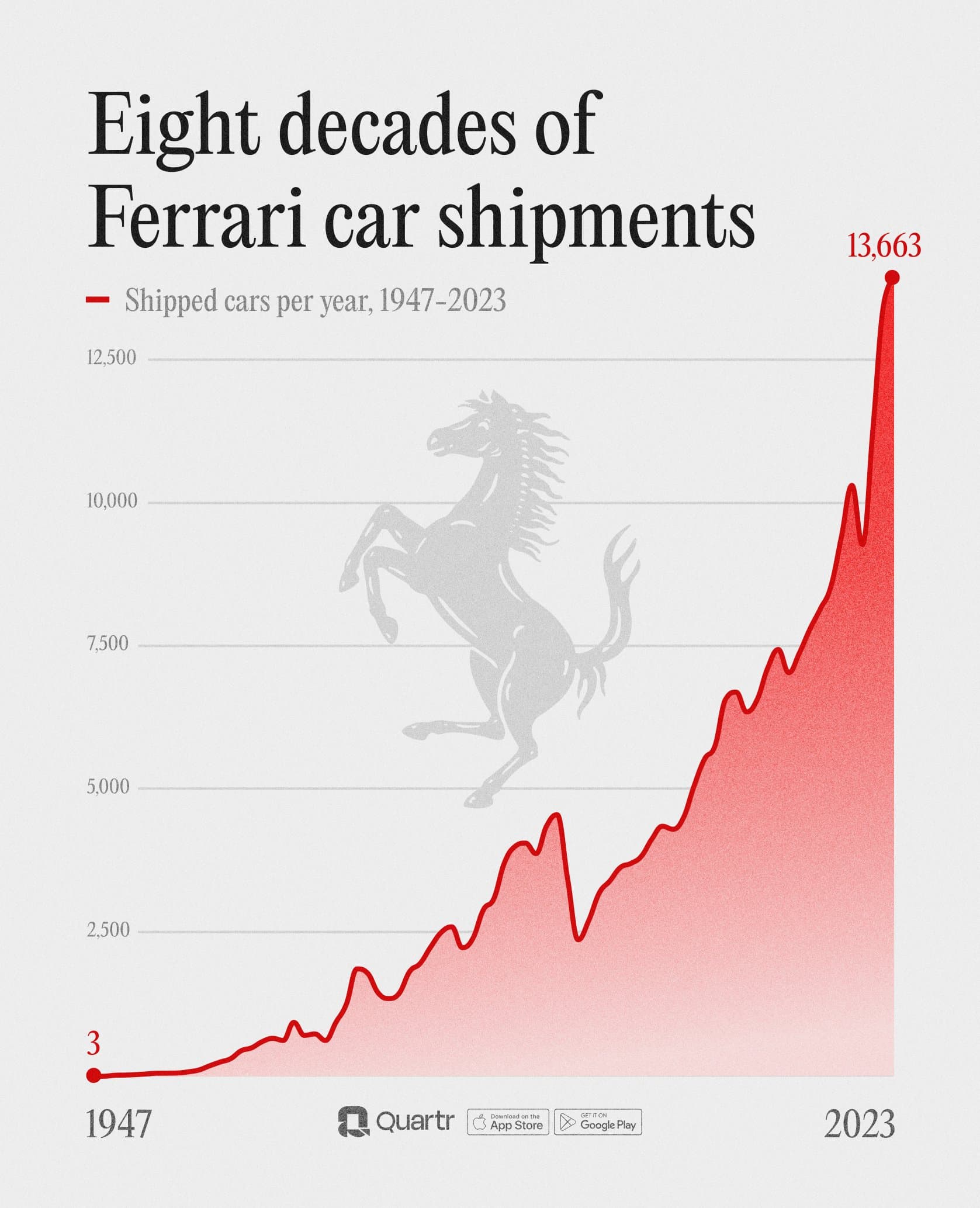

Ferrari was founded in 1939 when Enzo Ferrari left Alfa Romeo’s racing division and founded a company called Auto Avio Costruzioni. In 1940, the company built its first car, and in 1947, the first Ferrari-branded car was introduced.

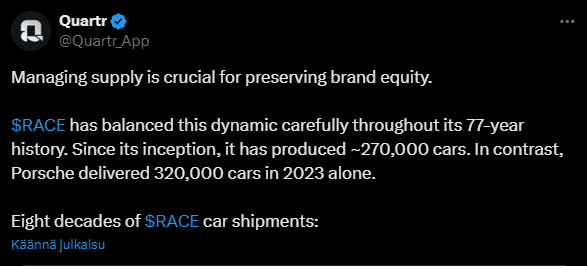

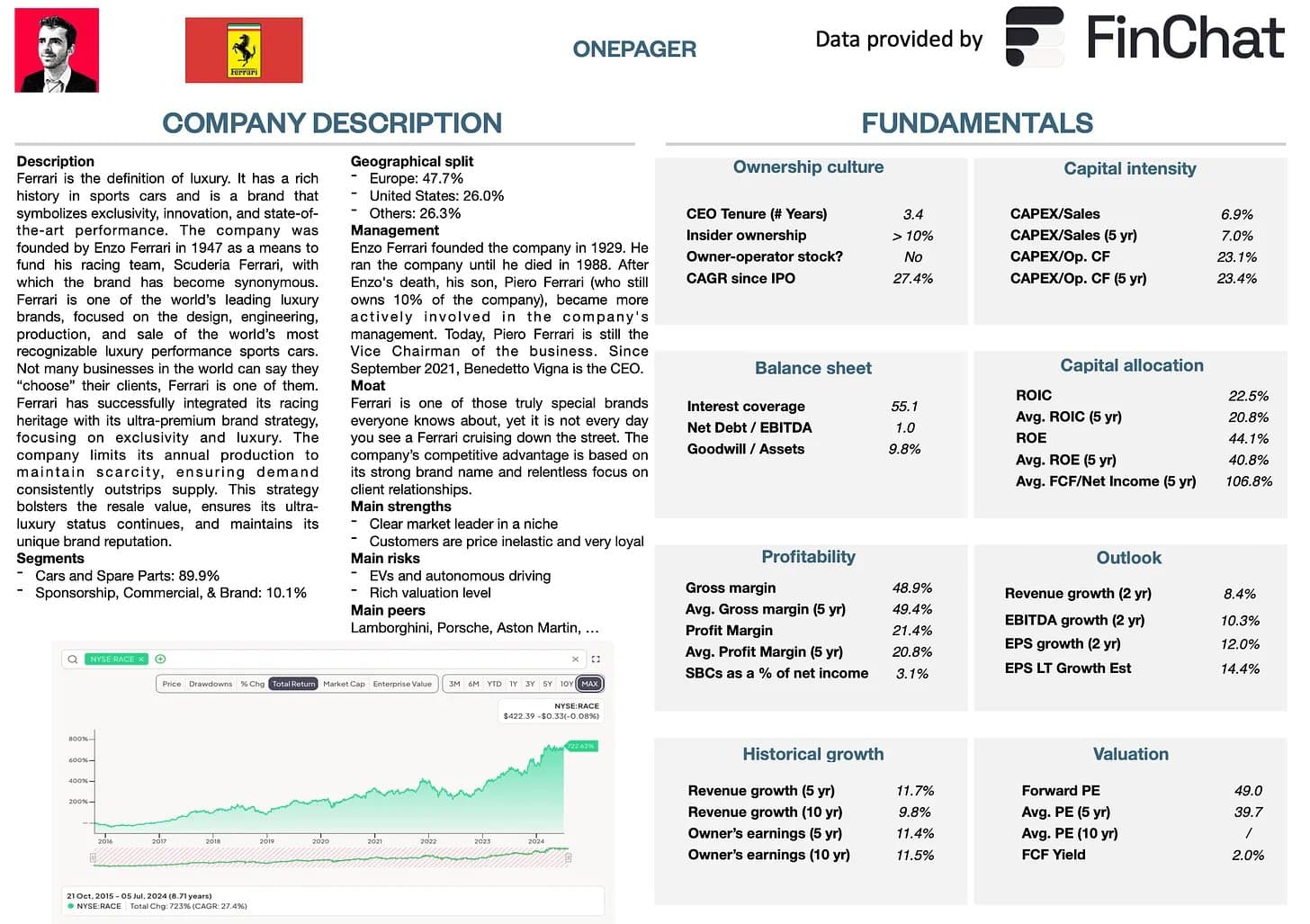

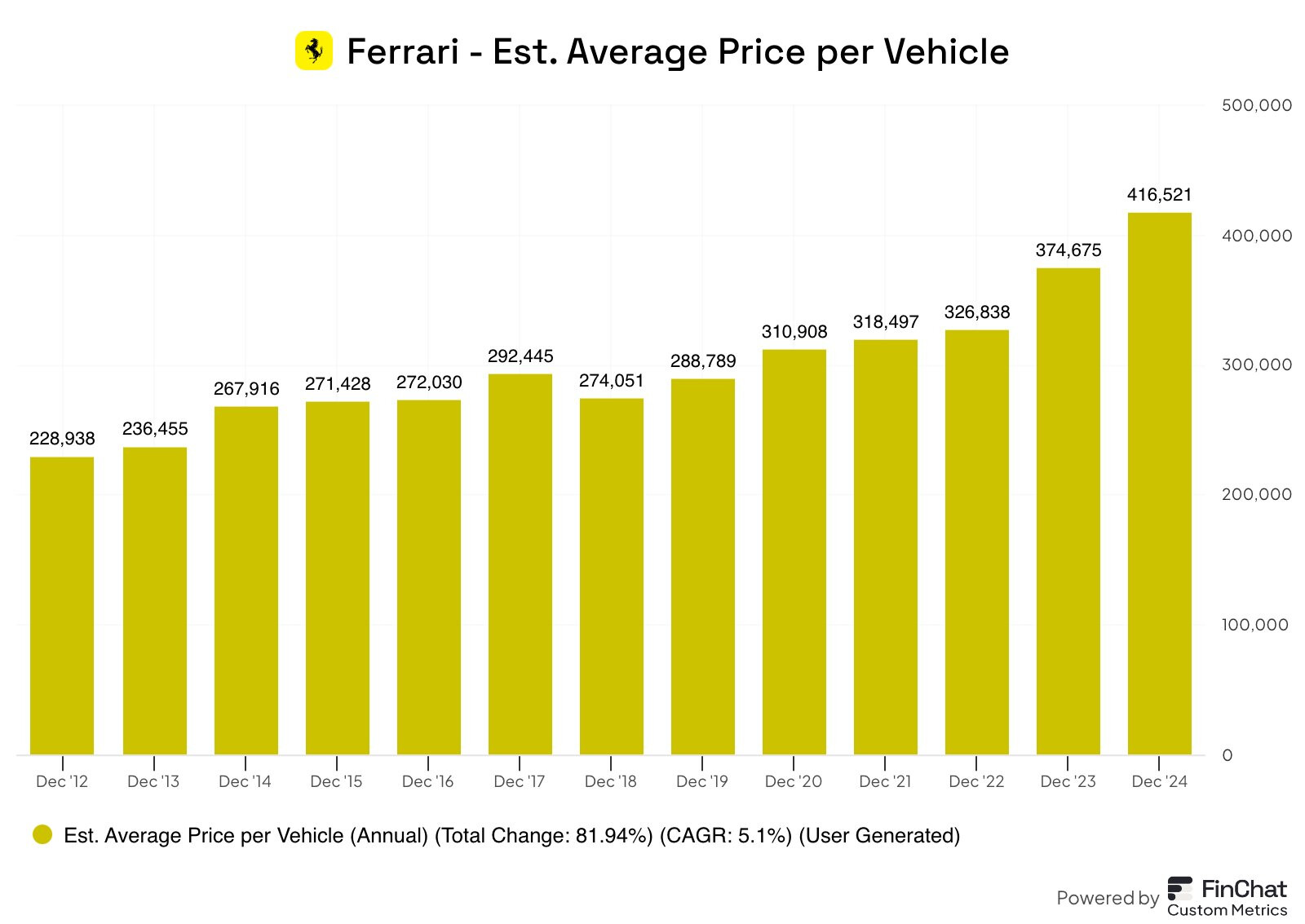

So far, Ferrari has not yet started courting the masses, and to some extent, the company chooses its customers. A stupendous history in both cars and motorsports is strongly associated with Ferrari; after all, there are much faster and more innovative cars, but Ferrari is Ferrari. The company practically intentionally limits its annual production to maintain its glamour, ensuring that demand constantly exceeds supply. This strategy results in Ferraris always having resale value and ensures the continuity of a certain luxury uniqueness, while also maintaining the brand’s reputation.

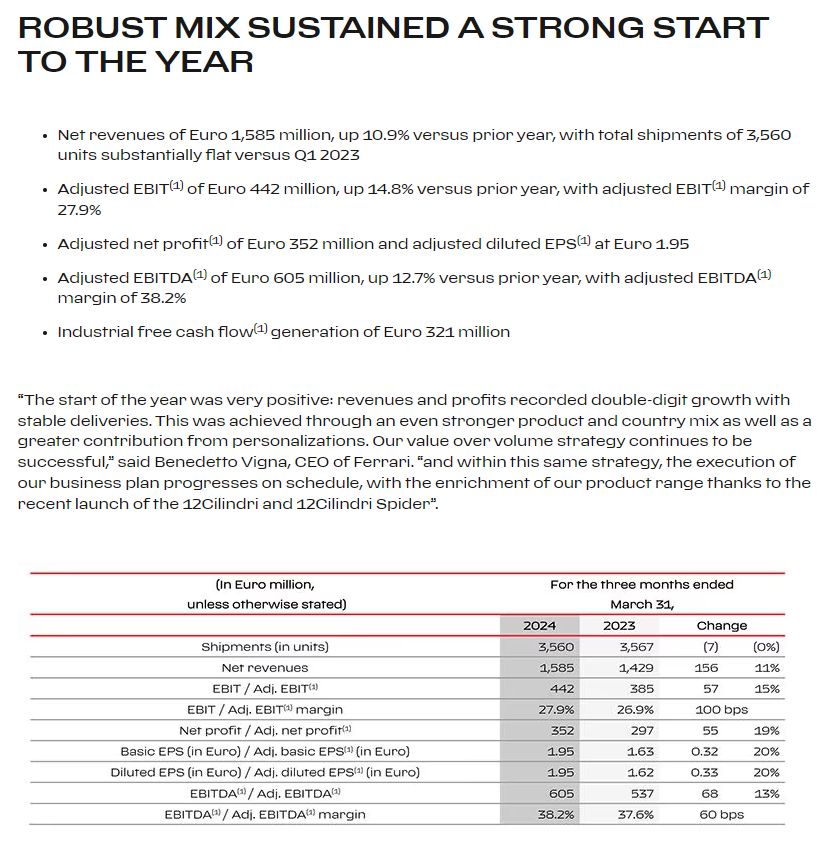

Segments:

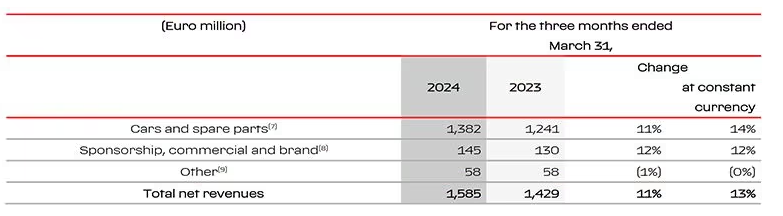

- Cars and spare parts: 89.9%

- Sponsorship, commercial and brand: 10.1%

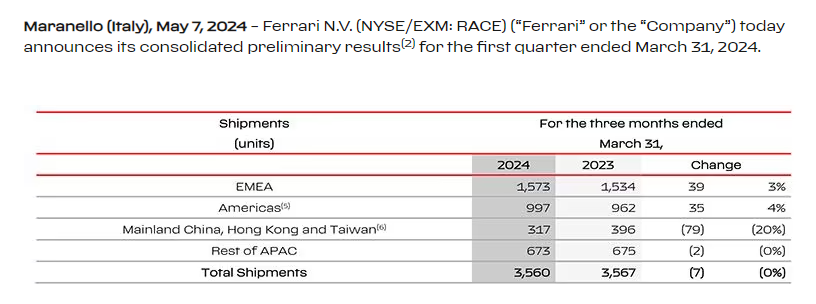

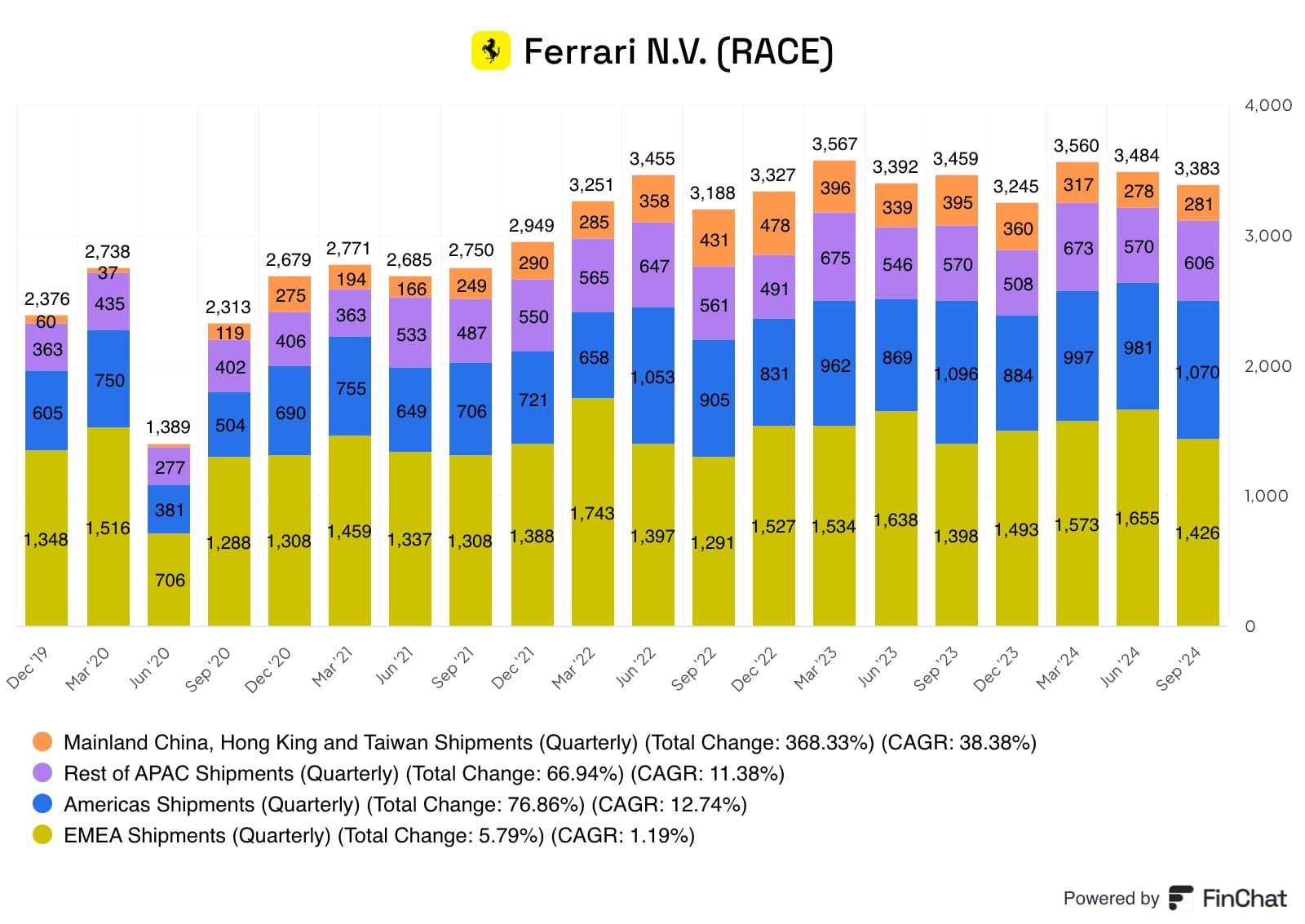

Geographical distribution:

- Europe: 47.7%

- United States: 26.0%

- Others: 26.3%

Pluses

- Strong brand: Ferrari is Ferrari

- Ferrari remains rare and available to few - this has certainly been a major success factor for the company.

- Both customers and ordinary people are very loyal to this brand.

- History in cars and motorsports: This cannot be forgotten

Minuses

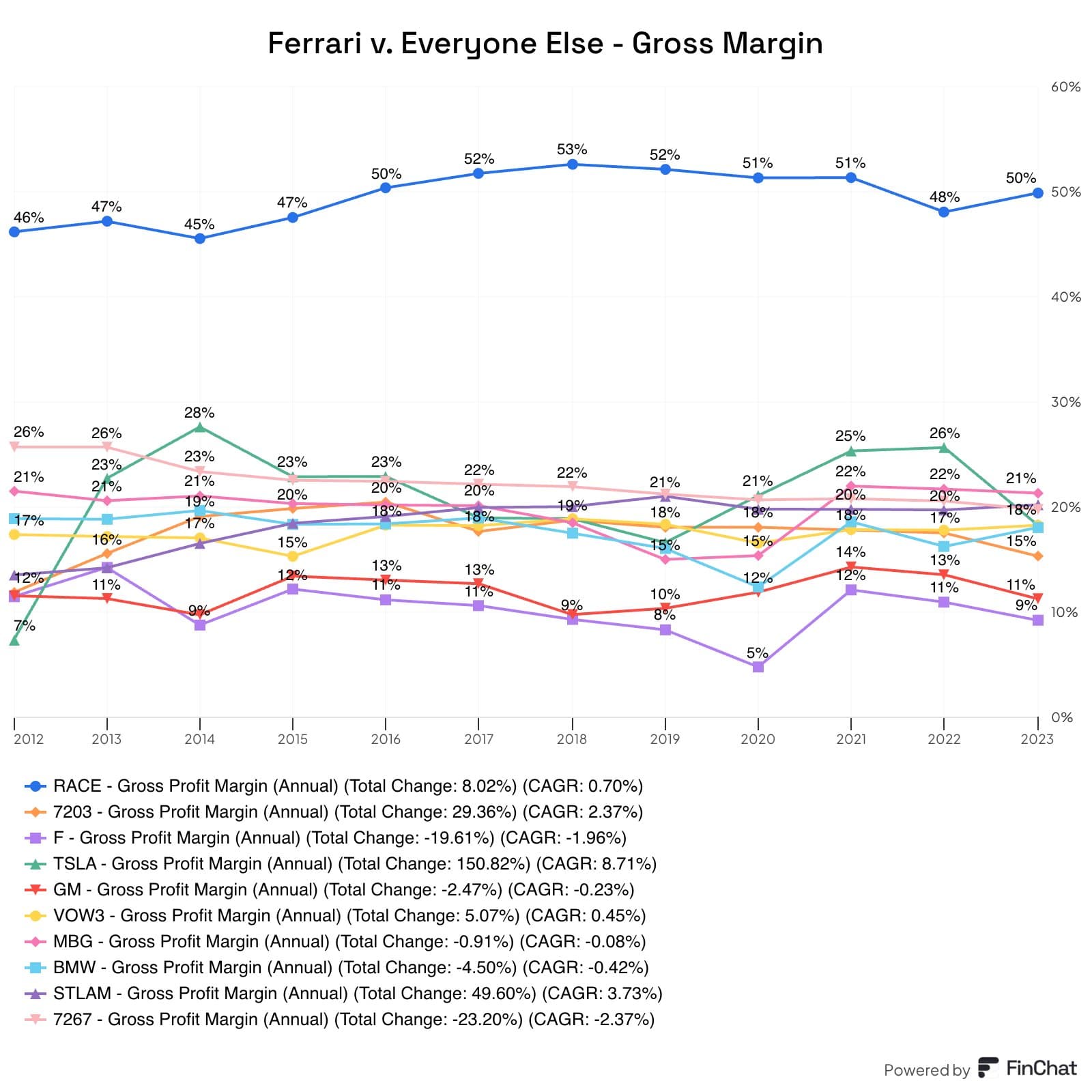

- High valuation multiples, partly justified?

- Limited production is also a challenge. Will Ferrari ever get excited about “more ordinary luxury”? A threat and an opportunity as an investment…

- Some perceive such luxury product markets as safe, but there can be many opinions on this.

- Electric vehicles and other soulless technology, perhaps more of an opportunity for others than for Ferrari?

- Competition is increasing

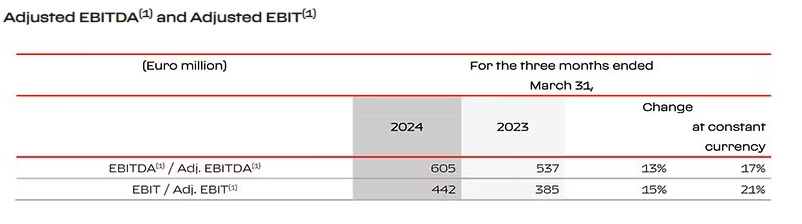

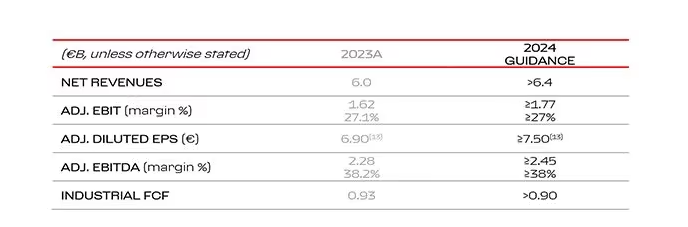

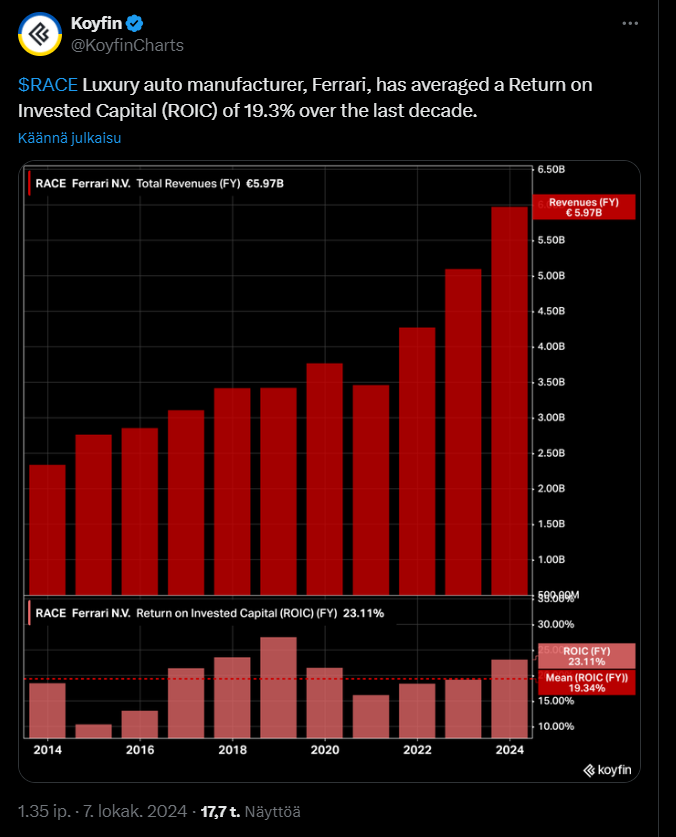

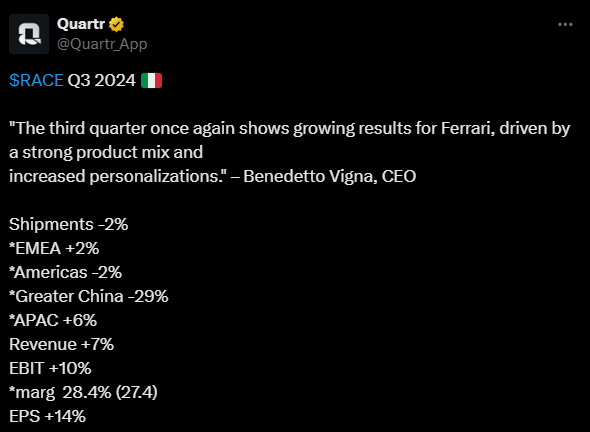

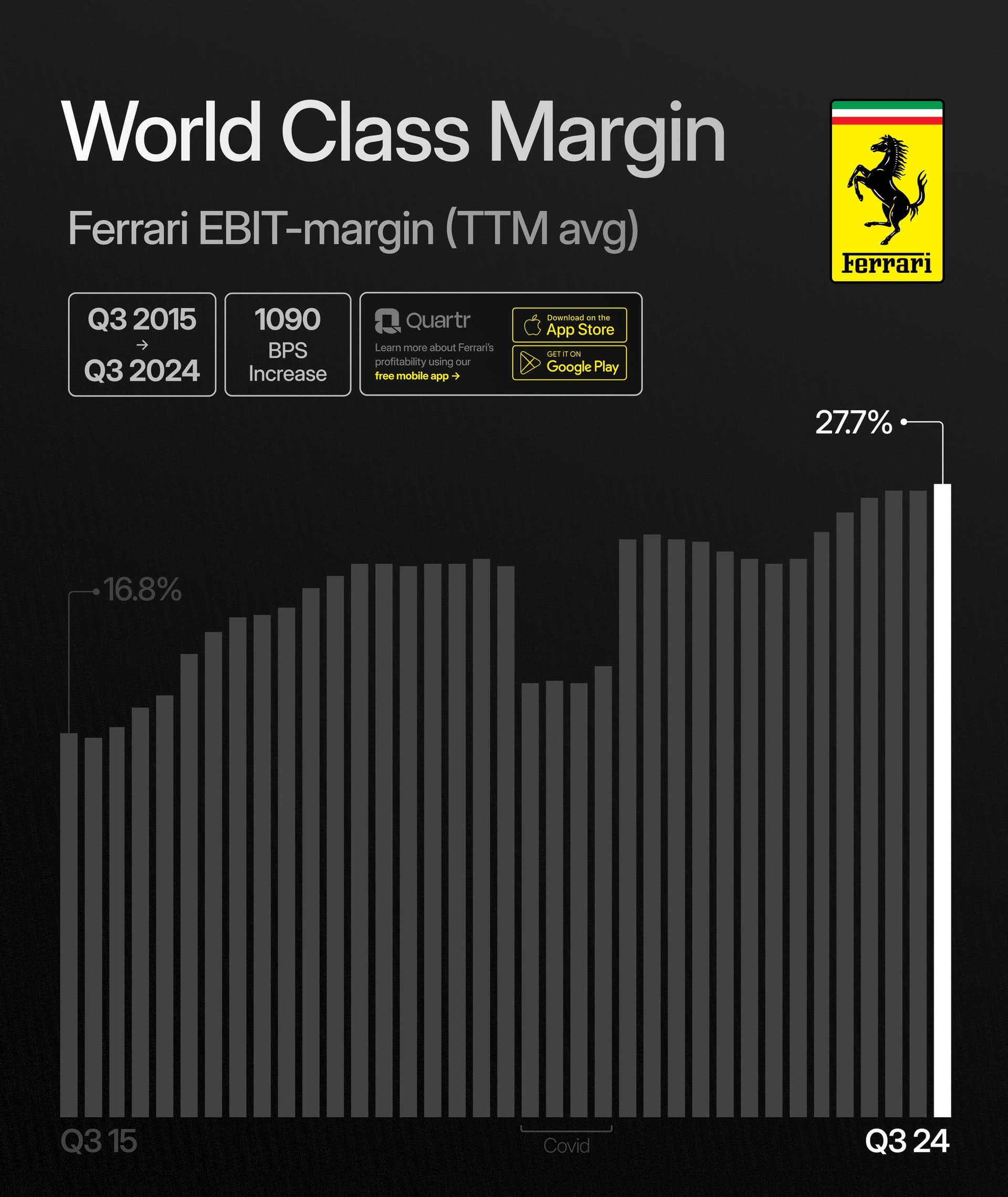

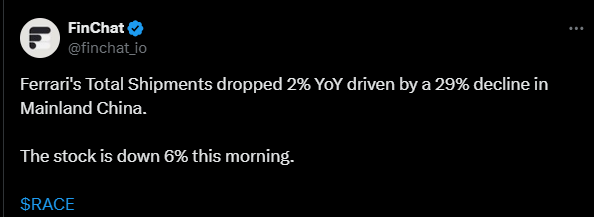

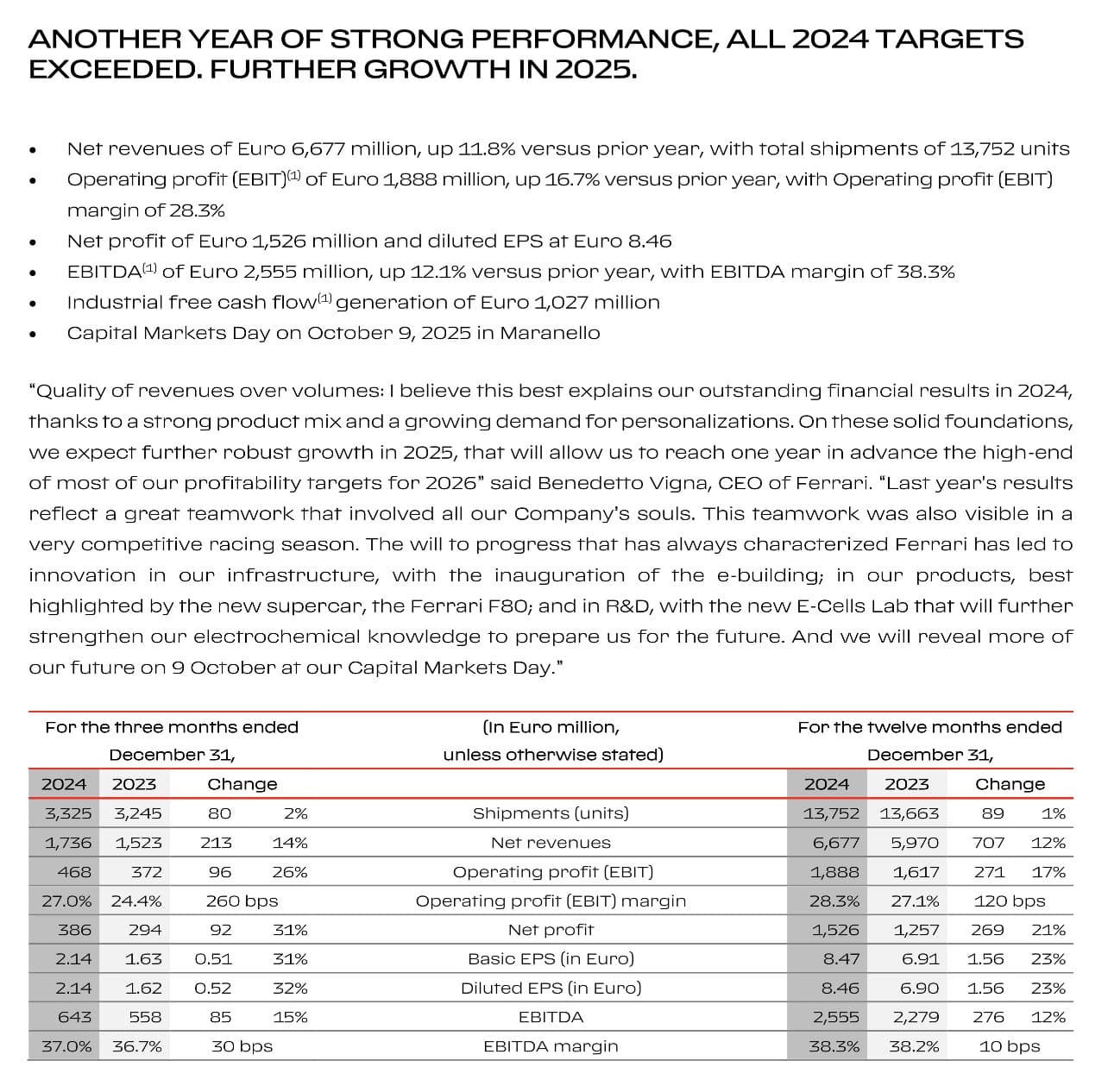

The company’s goal is to remain unique and to succeed in competitive sports, especially in F1. At the same time, through the company’s Lifestyle activities, they aim to increase revenue and otherwise actively strive to innovate with larger investments. Ferrari sees cost inflation continuing, but strong free cash flow generation partially compensates for increased capital expenditures and higher other costs.

19.7.2024:

P/E: 53

P/B: 21

Return on Equity (ROE): 43.1%