Domino’s Pizza is a globally recognized American pizza brand. Its image is characterized by speed, affordability, and predictability: it’s not the best pizza, but customers know what they’re getting when they order a pizza from a Domino’s pizzeria. Domino’s Pizza’s operations in the British Isles are run by the publicly listed Domino’s Pizza Group PLC. ![]()

Everyone knows what pizza is, but from an investor’s perspective, pizza has delicious characteristics (in addition to taste). It’s relatively inexpensive to make (low in protein), quick to prepare, and it retains heat well, making it excellent for delivery.

Delivery or pickup from the pizzeria is precisely Domino’s pizzerias’ strength. Delivery times are fast. The restaurants are relatively small, which means smaller investments. The company argues that logistics and technology are its trump cards. Previously, it was quipped that Domino’s is a technology company that happens to make pizzas. Nowadays, there’s a buzz that it’s a logistics company that bakes pizzas.

Domino’s doesn’t operate all restaurants itself; most are run by franchise entrepreneurs. Franchisees bear the entrepreneurial risk, investments, and pay for part of the marketing, while Domino’s focuses on selling them raw materials at a reasonable price. As far as I understand, Domino’s takes approximately a 5.5% slice of sales as commission.

Globally, Domino’s doesn’t even directly operate the franchise operations itself, and this is where we get to Domino’s Pizza Group itself. It is, therefore, a perpetual master franchise company operating the Domino’s brand’s UK operations. The model is practically the same: DOMI runs logistics and marketing in the UK itself, but it pays half of the 5.5% commission to American Domino’s. System-wide sales are around 1.5 billion pounds, but DOMI’s own revenue, which includes raw material sales and fees from franchisees, is just under 700 million pounds.

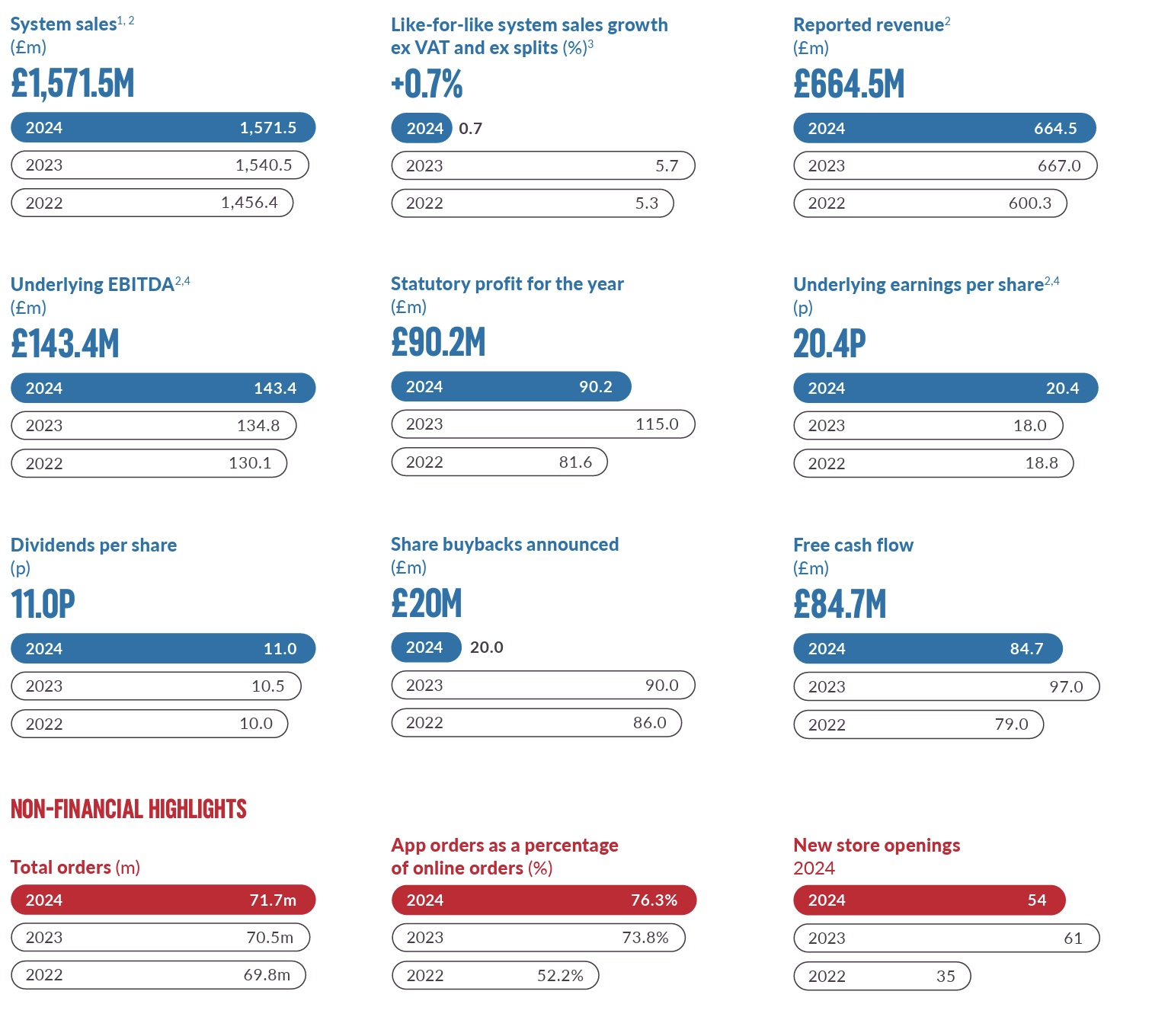

Here are some key figures from the 2024 annual report.

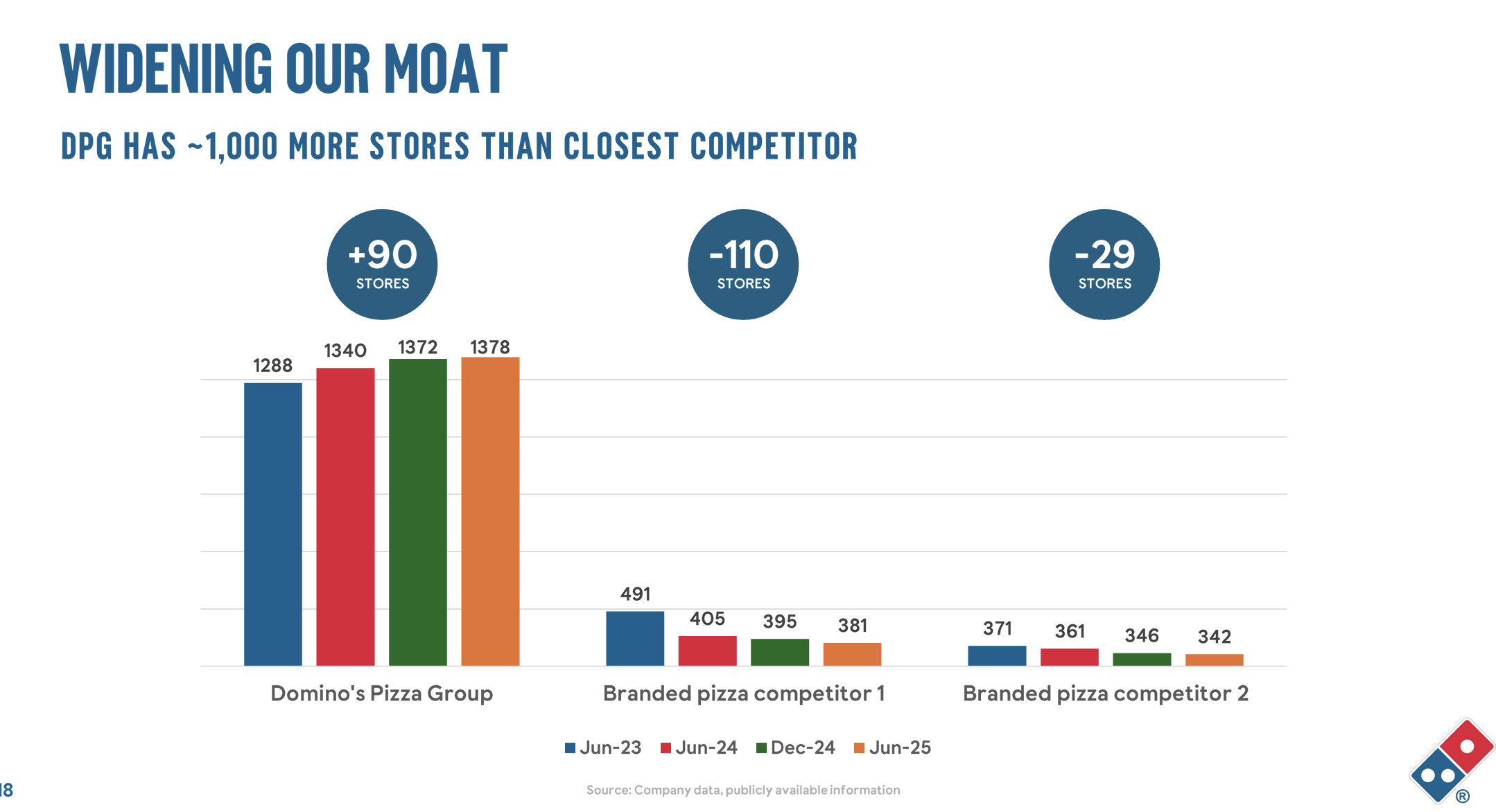

The company has achieved a dominant market position in the UK with over a 50% share. Domino’s talks about ‘fortification,’ strategically placing pizzerias at optimal distances so that there’s no room for another pizzeria to compete. Competitors have been in trouble, and in a difficult economic situation, Domino’s relative position has strengthened.

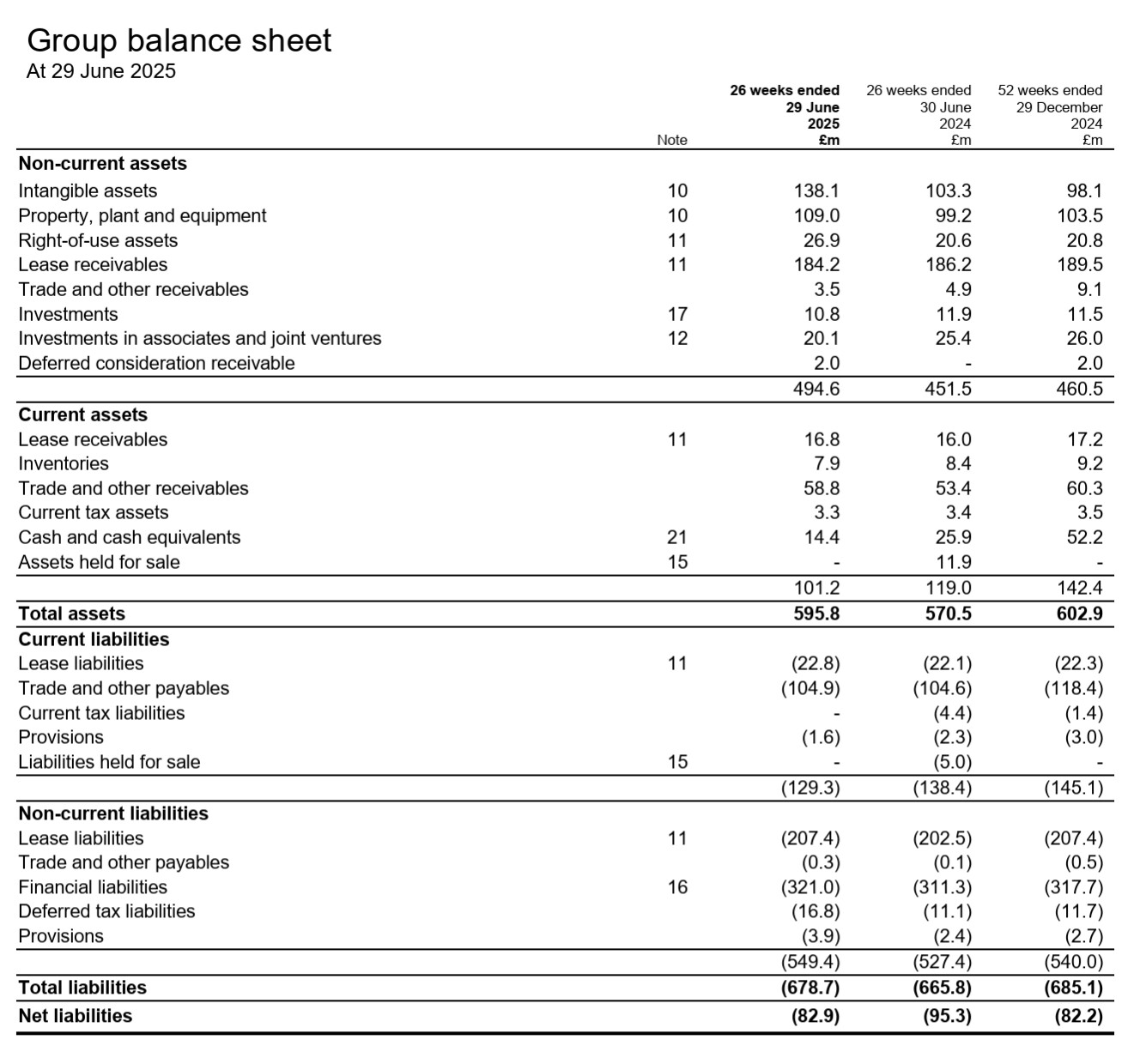

The quality of the company’s operations is demonstrated not only by a fast average delivery time of 24 minutes and 99.99% logistics functionality but also, of course, by a high return on invested capital. The company doesn’t actually tie up much capital. This is well illustrated by the fact that equity is currently negative. The balance sheet is a bit peculiar. There are a couple of hundred million in lease liabilities, but these are practically netted to zero by lease receivables from franchisees.

In practice, invested capital is equity + long-term interest-bearing liabilities, meaning capital committed to the business is -80 + 321 = approx. 240 million pounds. If the profit is around 90 million, the return on capital would be roughly ~40%.

Alright, so we have an excellent business with a strong brand and a solid market position. The stock trades at a forward P/E ~11x. What’s the catch?

It’s easy to dig up reasons why the business might not be interesting to own, such as

-Slow growth in recent years.

-The company talks about plans to expand into another brand where it could utilize its logistics machinery. The market considers this a distraction, the company knows it, and that’s why the CEO has reassured by saying “we won’t do anything silly.” In fact, the company recently launched a 20 million pound share buyback program, which suggests that a suitable brand has not been found.

-The dire economic situation in the British Isles. The economy is flirting with stagnation, inflation is rapid, interest rates are high, and public finances are under immense pressure for tax increases.

-As far as I understand, American Domino’s has some deal where the number of pizza restaurants in the UK must grow at a certain rate per annum. This could be a conflict of interest if DOMI doesn’t benefit from growth and has to pay some compensation to American Domino’s, but the cooperation has reportedly been in good spirits for decades.

-A few franchisees hold a significant share of all pizzerias: the two largest each had almost 20% shares! In past years, the company had some disagreements with franchisees, but agreements were renewed, and there is peace, at least for now.

-If all the best pizza locations have already been opened, why would opening new ones create value? This is a common counter-question in retail and the restaurant business. To that, one can indeed say that few firms have a complete understanding of how well their concept works geographically; instead, it is continuously learned by opening stores and experimenting.

But is a P/E of 11x still too low? As mentioned, the business doesn’t tie up much capital, so the company pays out a dividend of 11 pence per share (approximately 40 million pounds). On top of that, there was another 20 million pound share buyback program, meaning the shareholder yield is 60 / 800 market value = 7.5%.

If one doesn’t believe the business can grow, then naturally, the stock’s pricing should be close to the required rate of return. If it’s 9%, a P/E of 11 is perfectly correct. When debts are considered, the enterprise value of the entire business is currently approximately 1140 million pounds. If operating profit is roughly 15% of revenue, the EV/EBIT would be 11.4x.

But I don’t believe the company’s growth will stop anytime soon. CEO Andrew Rennie, a franchisee entrepreneur himself at one point, ran a pizzeria in an area with only 6,000 residents (the average Domino’s today has an area with over 20,000 customers). He believes that there is still room for a few pizzerias in small towns on the islands, and there is additional potential in Ireland.

Previously, this has traded, like quality restaurant brands, in the P/E 20x range. If the situation eased slightly, one could see a nice multiple correction here. While waiting, one can enjoy dividends and share buybacks.