With the Helsinki Stock Exchange having risen about 40% in a year, there aren’t many truly enticing entry points on the watchlist. Especially when the primary goal is to find quality at a low price. And I have no desire to invest more money into rows that are already in the red. In this situation, an impatient stock picker might turn their gaze abroad, which could be either a threat or an opportunity. Hopefully, the latter.

Since no withholding tax is charged on dividends from London-listed companies for an Equity Savings Account (OST), I spent the weekend having a long conversation with Gemini about British companies that might fit my strategy. I haven’t used AI for investment decisions before and was initially skeptical, but through various lines of questioning, one company kept coming up and earned a closer look. I mulled it over for a couple of days, and Domino’s Pizza Group PLC ended up in my portfolio with a five percent weight at a price of 1.8 pounds per share.

Investment Plan: I am building a dividend portfolio at a steady pace toward retirement days looming in the 2050s. I aim to acquire shares mainly from Finland so that as much of the dividends as possible can be received tax-free into the Equity Savings Account. Following Buffett’s teachings, I try to buy “a piece of a business” instead of a stock certificate for the long term, and I generally look at four factors when making buying decisions.

Domestic-like. Naturally, Domino’s is not a “Hesuli” (Helsinki) stock, but like its Finnish cousins, no withholding tax is paid on the dividends. For example, 15% of Altria’s dividends stay in the USA, and there’s no way to get that credited back in an OST. Domino’s Pizza Group PLC dominates the UK and Irish pizza market, and in my opinion, it adds nice defensiveness and dividend flow to my portfolio in addition to geographical diversification. Hopefully for a long time.

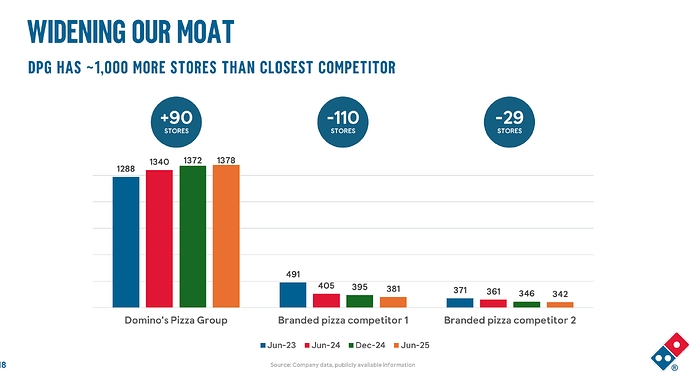

High Quality. Domino’s business model is quite simple and understandable. It leases the property and takes on a franchise entrepreneur as a subtenant. After this, Domino’s sells the raw materials to the entrepreneur and takes a slice (heh) of every pizza sold. That’s about it. Of course, Domino’s also owns a few stores itself where it tests concepts, but the number of these is quite small. Domino’s tried to expand into Germany and Scandinavia, which caused debt to grow, but they have withdrawn from these areas, and the company will focus only on the British Isles moving forward. Free cash flow has been rising over the long term, and ROIC has fluctuated between 15-20%. By the way, Warren Buffett owns the American parent company of DOMI.

Dividend Stock. Domino’s has paid a rising dividend for the last 10 years; only during COVID was there a small shift to the following year. At the current price, the dividend yield is over 6%, and Domino’s pays out a very moderate 40% of its earnings. In addition to the dividend, Domino’s also buys back its own shares quite nicely (shown in blue).

At a Discount. Both P/E and EV/EBIT for next year have sunk to historical lows. While the forward-looking P/E has been between 16-18x over the last ten years, at the beginning of the year, it was already under 10x.

Of course, there are reasons for the low valuation, which Verneri has covered in the company’s thread. I already mentioned the failed international expansions, but there are other reasons too. Growth is no longer very rapid, the economic situation in Britain is starting to turn sour, and the CEO was recently let go after saying that “pizza peak” had been reached in Britain. A new CEO has not yet been named, which has certainly added to the uncertainty.

We’ll see if they start buying any new operations (Domino’s already has an efficient supply chain built), but in my opinion, this is a good spot to take some solid dividend flow and a market leader into the portfolio at a moderate valuation. Let’s be “greedy when others are fearful” and add a slightly larger sparring partner for NoHo Partners into the portfolio for the long haul.

According to the investment plan, I will continue with time diversification, and the next purchase will be in 30 days at the earliest. I’ll be keeping a close eye on Lassila & Tikanoja and Revenio at the very least. Gemini also tried hard to push the tailspinning alcohol giant Diageo PLC into the portfolio, so I’ll need to research that calmly over the coming weeks as well.