CombinedX Q4 report was released today, the market at least liked it (+12%).

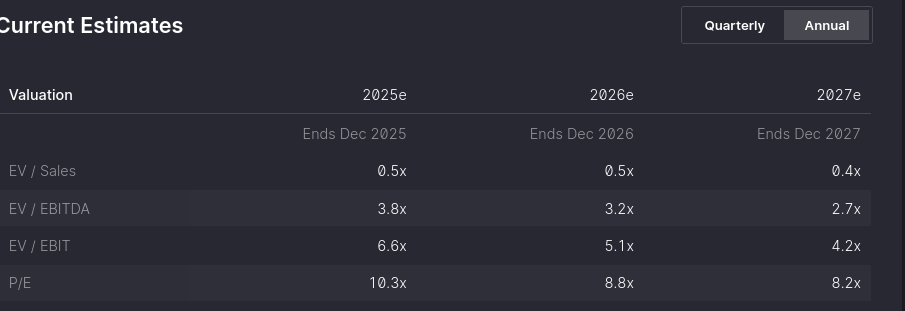

The company still doesn’t report in English, so at least I have to interpret these through a translator. Last year’s downturn seems to be turning around, even though organic growth was still negative. However, the profit (EPS 2.82) and cash flow are again attractive relative to the valuation (36.3 SEK / share).

Press release:

Pdf:

Fourth quarter, Oct 1 – Dec 31

- Net sales were SEK 258.0 (210.5) million.

- Growth was 22.5% (5.1%) of which organic growth was -7.1% (-0.7%)

- EBITA was SEK 25.5 (29.1) million with an EBITA margin of 9.9% (13.8%)

- Adjusted EBITA was SEK 25.5 (29.1) million and adjusted EBITA margin was 9.9% (13.8%)

- EBIT was SEK 21.4 (25.6) million and EBIT margin was 8.3% (12.1%)

- Adjusted EBIT was SEK 21.4 (25.6) million and adjusted EBIT margin was 8.3% (12.1%)

- Profit before tax was SEK 22.5 (26.5) million.

- Cash flow from operating activities was SEK 55.0 (31.9) million.

- Earnings per share before dilution amounted to SEK 1.07 (1.25) and earnings per share after dilution were SEK 1.07 (1.23).

Full year 2024, 1 Jan – 31 Dec

- Net sales were SEK 929.9 (765.7) million.

- Growth was 21.4% (17.7%) of which organic growth was -2.3% (6.4%)

- EBITA was SEK 78.2 (94.3) million with an EBITA margin of 8.4% (12.3%)

- Adjusted EBITA was SEK 81.2 (94.6) million and adjusted EBITA margin was 8.7% (12.3%)

- EBIT was SEK 63.1 (80.0) million and EBIT margin was 6.8% (10.4%)

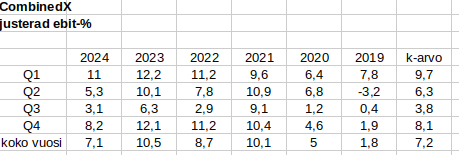

- Adjusted EBIT was SEK 66.0 (80.3) million and adjusted EBIT margin was 7.1% (10.5%)

- Profit before tax was SEK 62.1 (87.3) million.

- Cash flow from operating activities was SEK 124.3 (81.4) million.

- Earnings per share before dilution amounted to SEK 2.82 (4.15) and earnings per share after dilution were SEK 2.82 (4.09).

- The board of directors proposes a dividend of SEK 1.40 (2.00) per share.

CEO JÖRGEN QWIST COMMENTS

One step sideways and several steps forward

In the fourth quarter, we continue to go sideways financially. The operating margin (EBIT) was 8.3% (12.1%) and for the full year 2024 we show an adjusted operating margin of 7.1% (10.5%). Including this year’s acquisitions, growth in Q4 amounts to a strong 22.5% (5.1%), but organic growth was quite negative: -7.1 percent (-0.7%). For the full year 2024 we show a total growth of 21.4% (17.7%), of which organic growth was -2.3% (6.4%).

The main reason for this year’s weak organic growth and deterioration in earnings is, as I have described in previous reports, a weaker market and lower occupancy than in 2023. We hope and believe that the market will turn upward in 2025, what we know for sure is that it is our ability to sell that will determine how the year turns out.

We believe that sales start with a very clear offering. We don’t believe in “We are experts at everything”, because we have never met any such experts. CombinedX is therefore about building companies with strong, clear offers and brands in growing sub-markets. We call them Leading Brands, and as we enter 2025 we are doing so with six companies, each with the ambition to be the very best in their domain.

Our best sign that a company is on the right track – that it has found its “cross” in a unique combination of technology and business knowledge – is that it wins new customers and business. That is the cross that the X in the CombinedX logo stands for. Since the previous quarterly report, we have been able to report that M3CS has taken on new Infor M3 projects at Plockmatic and Nudie Jeans, and that Absfront has been entrusted with digitizing the energy company Kraftringen’s sales and delivery processes using Microsoft’s CRM platform as a base. Three good examples of business we want to win in line with each company’s “cross”.

This January, M3CS and Elvenite will form one of the largest and fastest growing partners of Infor M3 in the Nordics, a true Leading Brand. During 2024, the companies have gotten to know each other and prepared the groundwork for the merger. In addition, Elvenite offers AI and BI expertise to help its customers take full advantage of their business data. Here is a fourth example of good sales: In December, Skellefteå Kraft invited eight suppliers to a hackathon with the task of finding the best solution to assess the bioenergy content of residual waste from forestry. Elvenite’s AI team found a solution where different data sources can be combined with an AI model for a more precise prediction and won the competition. Skellefteå Kraft has now ordered the solution in an initial production run. Sales can be driven in many ways and this is a textbook example of how demonstrated customer benefit drives business.

2024 was thus a challenging year financially, but strategically we have taken many steps forward. I am thinking mainly of the formation of the new Elvenite together with M3CS and the integration of Aspire into Ninetech, but also of new business such as the examples above and the customer relationships we strengthened during the year when we passed an NPS of +50 for the first time. We are strong for 2025!

As shown in this quarterly report, we have adjusted our financial targets so that in future we will measure and comment on our profitability at EBITA level instead of EBIT. This is because it better reflects our underlying profitability and how the capital market analyzes an acquiring group of consulting companies like ours. We are now some way off the new target of 12% EBITA, but with our six well-positioned specialist companies and hard work, I am confident that we will get back there.

//Jörgen Qwist, CEO CombinedX