BPC Instruments herätti jonkun verran kiinnostusta foorumilla viime kesänä.

Päätin luoda sille nyt oman ketjun Q3 tuloksen myötä.

Yhtiöön voi perehtyä enemmän kesäisen lyncheilyraportin avulla:

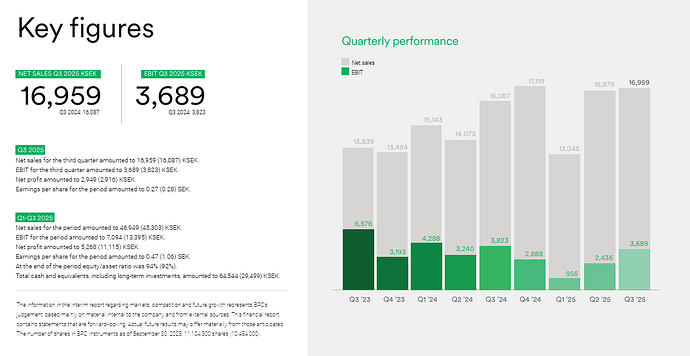

Itse Q3-raportti ei valtavasti hurraahuutoja aiheuttanut liikevaihdon sekä -voiton pysyessä viime vuoden tasoilla. Tosin alku vuoden matala kannattavuus palautui edeltävien vuosien tasolle.

Koko raportti:

Näin ketjun avauksen kunniaksi päätin pyytää toimitusjohtaja Jing Liulta vastauksen muutamaan kiperään kysymykseen, johon hän kovin ystävällisesti vastasi.

Hi Teemu,

Thank you for your message and for the continued interest from the Inderes community. Please find my responses to your questions below. I hope this could help understanding of BPC’s business.

Best regards

Jing

- Revenue growth was flat in Q3, but margins reached a more familiar level after a couple of weaker quarters. Could you walk us through the primary drivers for this, and what is the company’s outlook for a return to growth?

Q3 revenue remained stable, with variations mainly linked to the timing of larger biogas orders. The slight variation mainly reflects the timing of larger orders within the biogas segment, which can shift between quarters. Margins improved due to a more favourable product mix and cost management. The company does not provide forward-looking guidance yet, though underlying demand in the company’s main application areas continues to show stability. Our focus remains on sustainable, profitable growth supported by diversification and close collaboration with our customers.

- The European Commission has ambitious targets for sustainable biomethane, aiming for 35 bcm by 2030, up from the current 7 bcm (as of Q1 2025). From your industry perspective, how realistic is this target? And more specifically, how important is this target to BPC’s future growth strategy?

The EU’s 35 bcm biomethane target by 2030 is certainly ambitious, and there are still barriers that need to be overcome to accelerate progress. Nevertheless, it demonstrates a strong political commitment to developing the biomethane sector as a means of ensuring Europe’s energy security and sustainability.

From an industry perspective, this is a very positive and encouraging direction, providing strong motivation for further biomethane development. It will also drive demand for advanced analytical technologies where BPC can provide great contribution, which are essential for scaling up biomethane production efficiently. BPC’s solutions are increasingly recognised in this context, supporting both R&D activities and operational biomethane facilities across Europe and beyond.

- The company has made a clear effort to diversify by expanding into new sectors. Could you elaborate on the long-term potential this creates for the company’s growth and resilience?

Our diversification into biodegradability testing builds directly on our core expertise in biological process analysis. The market is growing, driven by new regulations and industrial interest in sustainable materials. This expansion allows us to reach a broader customer base, balancing the investment cycles of the biogas market.

- Regarding the new consultation and training service: Is the primary objective to create a new, distinct revenue stream, or is it mainly a strategic initiative to improve customer satisfaction and retention?

The consultation and training service enables us to work even closer to our customers, including clients from biogas plants and laboratories that rely on our instruments daily. By sharing our knowledge, we help them achieve more accurate and consistent data, while also deepening our understanding of real-world challenges. It strengthens customer satisfaction and retention, and over time, may develop into an additional revenue stream.