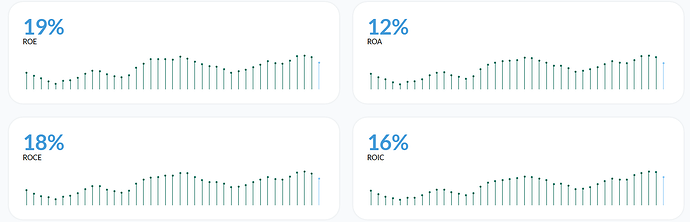

My interest in this company was piqued over in the raw materials thread (discussions about the price increases of rare Ge and Ca elements), and at first glance, it seems like a very interesting company. It is a company generating quite nice cash flow, especially when considering that they have also made significant investments in the business. Furthermore, when looking at the history of return on invested capital, this looks very attractive:

The valuation doesn’t seem stretched at all, either. Of course, the fire at Rönnskär brought a clear drop in the price. But it seems its impact will remain relatively small for this year: Press releases - Boliden SEK 200m Q2 EBIT impact and a SEK 88m write-down on the balance sheet.

Are there any estimates regarding the contribution of different minerals to the company’s results? Have there been any signs yet of a premium in product prices offered by green production?

I need to study the company’s materials in more detail, but based on this quick look, it will likely end up as a watchlist position.