Dear investor community,

After approximately thirty years of analysis, I have made a significant decision, at least for myself, to leave Inderes and start looking at life and the world from a slightly broader perspective than an analyst’s responsibilities have allowed. I am not changing jobs, nor do I currently have very clear plans for the future. Fortunately, my situation allows me not to be under any particular pressure to find paid employment. I also don’t expect recruitment consultants to throng my doorstep, as I will turn 60 in a couple of months. I will therefore spend the near future paying off the temporal debt I have accumulated towards myself, my family, other loved ones, and my friends. In the longer term – who knows?

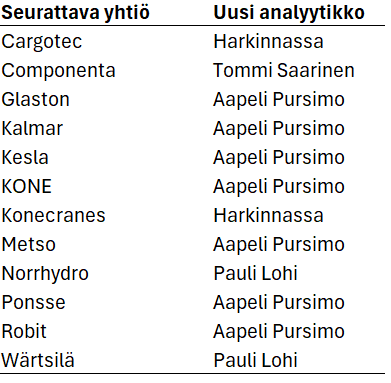

I have been at Inderes for about eight years now, and I can honestly say that it has been my best analyst workplace in terms of the way things are done, the balance of responsibility and freedom, the drive, and above all, my colleagues. The mere fact that I was taken into the group without batting an eyelid even at the age of 51 speaks volumes about the strong positive underlying current in Inderes’ culture. I will certainly miss this company. At the same time, I firmly believe that the analytical responsibility for the companies I follow will transfer to hands at least as capable as my own. For my part, I have strived to ensure that the transfer of responsibility is seamless and that as much key information for analysis as possible is passed on to my successors. The table below lists the transfers we have agreed upon so far:

My last working day at Inderes is Friday, February 14th. I want to thank all members of the community for your interest in my reports and comments, as well as for the good challenges and discussions. And of course, I am not disappearing completely; I will continue to follow Inderes’ activities and publications/videos and remain a member of the community – now, however, without an analyst’s hat. You might also encounter me on the Forum in various contexts in the future. Although the last five years have been unusually murky in the stock markets due to the pandemic, Russia’s war of aggression, and most recently Trump’s election, I still have enough faith at this stage of my life that stocks remain the superior investment vehicle. I sometimes have to remind myself of both the importance of diversification and the beauty of long-term investing: by investing a fixed amount every month, economic cycles or timing have little significance. I wish the community members a future characterized by rising stock prices and growing dividend streams, and I believe Inderes’ products will provide their own support for this. For my part, I say goodbye for now.

Regards, Eki