There could be some derivatives involved, for example, and these shorts are then used to hedge some of the risk. For instance, if someone wants to bet on the magnitude of the move but not the actual direction, or something like that. Or if they are used to lock in derivative returns/potential losses at a certain level, etc. I don’t know the specifics of these strategies, but I know they exist. Or then someone is just betting that the stock will go down. ![]() So it’s really hard to say directly what’s going on behind the scenes.

So it’s really hard to say directly what’s going on behind the scenes.

Changes in the Executive Team. ![]()

Janne Pynnönen (M.Sc. Eng.) has been appointed Senior Vice President, Business Development at Valmet as of February 1, 2024. In his new role, he will be a member of Valmet’s Executive Team and report to President and CEO Pasi Laine.

Janne Pynnönen started his career at Valmet in 2020 and currently holds the position of Vice President, Research and Development. Before joining Valmet, he worked in various business management and development roles, as well as research and development positions at Stora Enso since 2003.

Janne Pynnönen succeeds Julia Macharey, who will leave Valmet at the end of January, as announced in August 2023.

Rautpohja foundry begins change negotiations. The reason is a decreased order backlog.

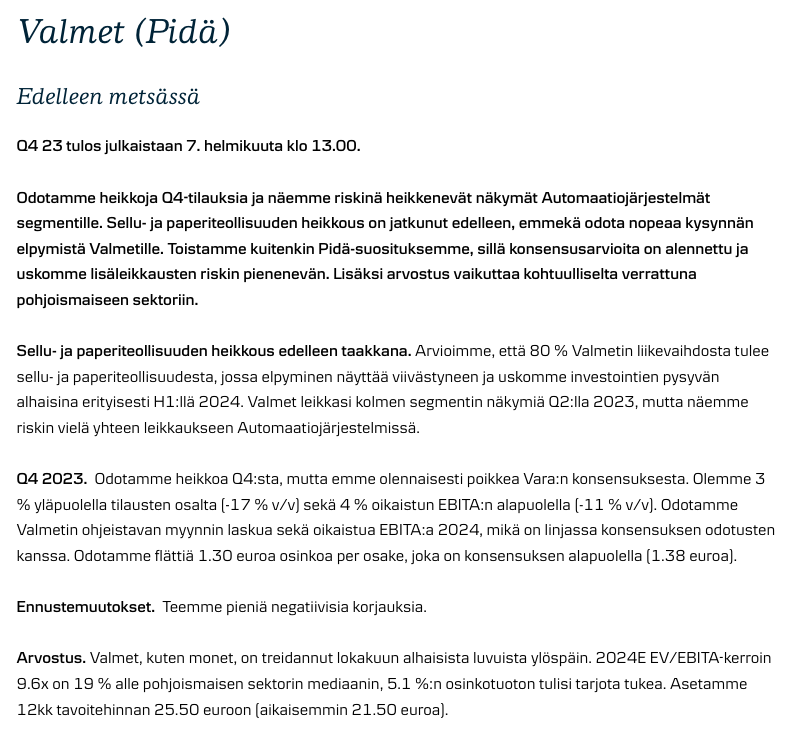

Danske Bank updated its view on Valmet. Recommendation HOLD, target price €25.50 (previous: €21.50). The firm expects Valmet to pay a dividend of €1.30 per share (consensus: €1.38) ![]()

(Screenshot from Danske’s free and publicly available online morning report.)

Valmet launches polymer concentration measurement for municipal and industrial wastewater as well as paper and board production polymer applications

Valmet introduces the new optical polymer concentration measurement, Valmet PCM, which is the first advanced inline polymer measurement for municipal and industrial wastewater treatment as well as paper and board processes. Real-time and continuous polymer concentration measurement data creates new opportunities for process optimization, such as even more accurate polymer dosing, savings in polymer usage, and rapid response to process disturbances.

When actual polymer concentrations are known, plants can significantly reduce polymer consumption through precise treatment and dosing. Stable polymer concentration, in turn, improves flocculation, clarification, dewatering, and other key processes. Improved performance saves energy and reduces sludge volumes in transport and incineration, contributing to the positive environmental and social impacts of efficient wastewater treatment.

In paper and board processes, chemicals—typically polymers—are added to improve the retention of fines and fillers during web formation. Accurate information on polymer concentration helps optimize wet-end retention and improve process efficiency.

Proven optical measurement technology

Valmet PCM measurement utilizes Valmet’s decades of experience in optical measurement expertise in board and paper processes. Valmet PCM’s optical measurement technology brings industrial-level quality and reliability to wastewater treatment.

Despite the compact sensor design, the optics maximize the measurement volume. By using multiple optical channels to collect scattered and reflected light, the sensor processes six times more measurement information compared to traditional solutions to enhance performance.

Integrated cleaning makes maintenance easy

As a solution to sensor fouling commonly encountered in wastewater applications, Valmet developed a new automatic flushing system to keep the Valmet PCM sensor clean and measurements stable. The flushing unit integrated into the measuring sensor has a connection for a manual sampling valve.

Another fire in Rautpohja.

"There is a fire at Valmet’s Rautpohja factory in Jyväskylä. An alarm for a large building fire was issued after 2:00 PM. 15 units have been dispatched to the scene.

Shortly after half past two, the Central Finland Rescue Department’s situation and command center reported that a fire had been detected at the site, and the initial visible flames have been brought under control."

Update 15:30

“The fire started in a shell drilling machine at the factory and has now been extinguished.

According to preliminary information, no injuries have occurred.”

Long article about Valmet in Kauppalehti (unfortunately for subscribers only)

Thanks for sharing the article and mentioning it’s for subscribers only. ![]()

![]()

A small summary is always welcome, though, so one can always be added. Some articles or links automatically include a summary, as is often the case with Inderes’ own links.

In the article, which takes just under ten minutes to read, Kauppalehti visited the Rautpohja factory in Jyväskylä. The article covers things such as:

Valmet is aiming more boldly for the fiber products market, although it naturally continues to diligently serve the paper, pulp, and energy sectors, among others.

The company has cast its net into the fiber product market and is collaborating with companies like Metsä Group and Spinnova. It should be remembered that this is a long process, and the potential “results” will be seen in years to come.

This likely goes to show that Valmet is truly striving to be involved in emerging markets. ![]()

Valmet will deliver a complete tissue production line to Suzano Papel e Celulose in Brazil, including a tissue production line and converting equipment. The order also includes a biomass boiler. This is Valmet’s first order combining both tissue production and converting lines since Valmet completed the acquisition of the tissue converting business at the end of 2023. The tissue order also includes an extensive automation package, flow control valves, and Valmet Industrial Internet solutions.

The orders for the tissue production line and biomass boiler are included in Valmet’s orders received for the fourth quarter of 2023, and the order for the tissue converting equipment in the orders received for the first quarter of 2024. The total value of the order will not be disclosed, but the value of such an order is typically around EUR 100 million.

The tissue production line, converting equipment, and biomass boiler will be installed at the Aracruz mill in Espírito Santo, Brazil. The aim of the investment is to meet the growing demand of Brazilian consumers for high-quality tissue products with low environmental impact. The start-up is scheduled for the first quarter of 2026.

The Paasikivi family’s Oras Invest’s stake in Valmet has risen above 10% (previously 6.6% according to information on the Inderes company page).

Addition: I initially posted this in the wrong Valmet thread. ![]()

Analyst’s pre-comments on Valmet’s Q4 results. ![]()

Valmet is expanding its roll cover offering by launching two new calender roll covers. The new Valmet Calender Roll Cover CL-W and CL-S covers combine extreme wear resistance with the best load and impact resistance. Thanks to improvements in material technology, grinding intervals are long even in the most demanding calendering conditions, such as soft and multi-roll calenders. In addition to graphic papers, they are also suitable for specialty papers and packaging boards.

Significant opportunities for production efficiency and cost savings

Valmet Calender Roll Cover CL-W and CL-S provide cost savings thanks to the longer running times of the calender rolls. This results in fewer roll changes and lower grinding costs. Total costs are also lower because the service life of the cover is longer. The wear-resistant CL-W enables the removal of production bottlenecks related to vibration and shutdown intervals. CL-S can improve the product’s bulk, which reduces fiber costs. These improvements enhance production time and material efficiency.

Valmet receives top A rating in CDP’s climate program list. ![]()

CDP’s assessment is based on data from the company’s previous reporting year regarding its strategy, targets, governance, risks and opportunities, as well as risk management and actions related to climate change mitigation and the development of low-carbon technology and solutions.

“The CDP A rating, alongside other leading sustainable companies, is a positive indication of our climate work and ambitious goals. We have consistently advanced our climate program, which covers the entire value chain, and our goal to enable carbon-neutral production for our customers worldwide. We are pleased with our achievements so far, but at the same time, we recognize the importance of continuous improvement,” says Anu Salonsaari-Posti, Valmet’s Senior Vice President, Marketing, Communications, Sustainability and Corporate Relations.

The implementation of the climate program is a very important priority for Valmet. The program covers the company’s entire value chain: the supply chain, its own operations, and the use phase of technologies and services at customer sites. During 2023, the company achieved its goal of enabling carbon-neutral production for its pulp, paper, and energy customers seven years ahead of schedule. In its own operations, Valmet made significant energy efficiency investments to reduce carbon dioxide emissions at its sites and continued to purchase carbon-free electricity, achieving 100 percent carbon-neutral electricity procurement in Finland and Sweden. In the supply chain, the company has succeeded in engaging more than 90 of its highest-emitting suppliers in climate action.

If anyone is wondering why Valmet started to rally ![]() Valmetin tilinpäätöstiedote 1. tammikuuta – 31. joulukuuta 2023: Saadut tilaukset olivat lähes 5,0 miljardia euroa ja vertailukelpoinen EBITA kasvoi 619 miljoonaan euroon vuonna 2023

Valmetin tilinpäätöstiedote 1. tammikuuta – 31. joulukuuta 2023: Saadut tilaukset olivat lähes 5,0 miljardia euroa ja vertailukelpoinen EBITA kasvoi 619 miljoonaan euroon vuonna 2023

With the forestry sector stalling, it was good to get the share price near the 20 euro mark, thanks to the sellers. The order backlog remains incredibly strong, and it will continue to be so in the future.

I wondered a bit about the reaction even after reading that. Revenue beat, but the result was a bit below. The order backlog is steadily strong, of course, but Q4 wasn’t exactly anything spectacular in that regard either.

However, the 2024 outlook might explain the reaction a bit more. Inderes at least seemed to predict a decline for 2024, if I don’t remember incorrectly.

Valmet estimates that net sales in 2024 will remain at the same level in comparison with 2023 (EUR 5,532 million) and that the result (comparable EBITA) in 2024 will remain at the same level or increase compared to 2023 (EUR 619 million).

The most important part went pretty much in line with forecasts, as far as I understand.

The Board of Directors proposes to the Annual General Meeting scheduled to be held on March 21, 2024, that a dividend of EUR 1.35 per share be paid for 2023. The proposed dividend corresponds to 70 percent of net profit and would be paid in two installments.

I have to say, I’m still not the biggest fan of these reports coming out in the middle of the trading day. Well, Valmet still seems to be doing well, based on a very quick look.

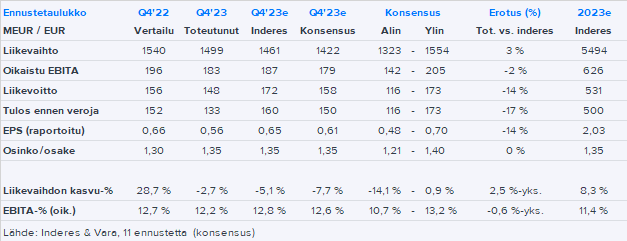

And here is the table. Q4 landed between our and consensus expectations regarding the operating result (the bottom lines fell short due to small one-off costs and higher-than-expected financial costs). By unit, there were no major deviations in the results. Orders met expectations, and within orders, Services exceeded at least our forecast.

Guidance was strong, especially when compared to our forecasts. This is partly explained by an order backlog that is shorter than last year and our estimate (85% of the backlog will convert to revenue in 2024 vs. 75% a year ago). Market outlook remained unchanged, as expected.

Valmet delivered a fairly good result considering the economic cycle—a nice change of pace, as the earnings season has otherwise been a bit of a slog for most of the other companies I own ![]()

It was particularly positive that the year ended with a strong order intake: 1555 MEUR in Q4 / 4955 MEUR for the full year. I expected that the order intake development could have been as much as -25% Q4 2023 vs Q4 2022, but fortunately, Services saved the day. As expected, orders received in Pulp and Paper were significantly down, at -19% and -44%.

Profitability remained at a gratifyingly good level, with an EBIT margin of 9.9% in Q4 and 9.2% for the whole of last year. ROCE also stayed at a good level of 14%.

This is a good position to move forward from. It seems to have been a good idea to load up on more shares last October (as was the case the autumn before last), as the share price expectedly started to head uphill.

OP’s Henri Parkkinen comments on Valmet’s results. ![]()

In the video, senior analyst Henri Parkkinen reviews Valmet’s Q4 results published today. The company’s comparable operating profit in the final quarter of last year met market consensus expectations.

Here is an article about Valmet from Sijoittaja.fi; the rest of the article is behind a paywall.

Valmet reiterates a good/satisfactory short-term market outlook for services (capacity utilization rate good, customer activity satisfactory), a good short-term market outlook for flow control, automation systems, and energy, as well as a satisfactory short-term market outlook for pulp, board and paper, and tissue.

The short-term market outlook refers to the six-month period following the reporting period. It is based on customer activity (50%) and Valmet’s capacity utilization rate (50%). The scale is “weak-satisfactory-good”.