At that time, the Metso of the day offloaded its “inferior” part, namely the paper machines and boilers. It was later seen that they fared better as Valmet than the remaining Metso performed.

Analyst’s comments following Valmet’s Q3 results. ![]()

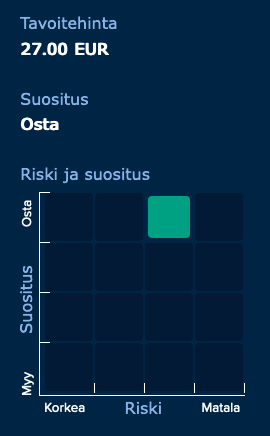

Recommendation upgraded to BUY (previous: ACCUMULATE), target price adjusted to 27.00 euros (previous: 29.00 €).

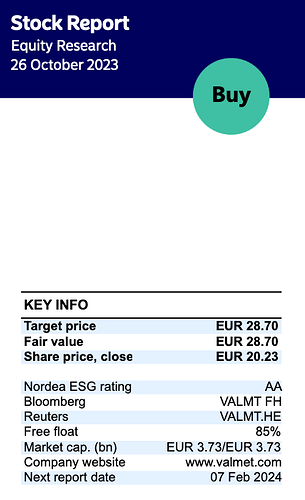

Nordea published its updated Valmet analysis following the Q3 results. The recommendation remains BUY, and the target price is adjusted to EUR 28.70 (previous: €31.40).

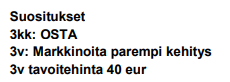

In yesterday’s Handelsbanken morning briefing, they were quite optimistic about Valmet.

The valuation is too modest, and next year orders will recover, driven by the USA and China ![]()

I don’t see Handelsbanken’s target price and recommendation history, but with Valmet, the market has certainly smacked the gel-heads and their recommendations in the face to such an extent that I wouldn’t put much weight on recommendations and target prices in the future, especially not on some 3-month recommendations.

Analysis aims to, or should, look at the value of the business. The purpose of analysis is not to predict a share price based on supply and demand.

Valmet and Metsä Group are developing a joint sustainability model for industrial investment projects. ![]()

Valmet and Metsä Group are collaborating to develop a comprehensive sustainability operating model related to technology and maintenance investments. The operating model includes various sustainability themes, taking into account environmental, social, and corporate governance (ESG) factors. The model is intended to be used to verify the sustainability of process units delivered by Valmet to Metsä Group and their associated supply chains. Valmet and Metsä Group have established a joint working group to develop and implement the sustainability model. The model is planned to be implemented by 2027.

How large a share of Valmet’s earnings comes from China? I’m just wondering, if geopolitical risks were to materialize in the South China Sea and US and EU sanctions were imposed on China, what kind of impact would that have on Valmet’s earnings power? Then, of course, there’s the situation in the Middle East and if Iran decides to close the Strait of Hormuz to support Palestine. This would obviously be a major development and would throw the markets into total chaos.

I have a heavy weighting in Nordic P&C insurance and have so far avoided these companies that are heavily dependent on global trade, because I find the probability of sudden bad news to be too high. Am I thinking about this the wrong way, and are my concerns unfounded?

Valmet’s own website has quite a bit of material on the subject:

If the China vs. EU & US situation escalates significantly, the direct impacts are only part of the truth. The total impact through complex order/supply chains is probably almost impossible to estimate. This also applies to companies that are not ostensibly dependent on China (but their customers or their customers’ customers or subcontractors’ subcontractors, etc., are).

Thank you very much for the quick response and I will review the material, I appreciate it👍

In addition to those potential supply chain challenges, Valmet also has manufacturing operations in China. If drawing parallels to the actions in Russia, all of these would be at risk.

Valmet in China

- 3 research and development centers

- 5 service centers

- 6 production units

- 6 sales offices

- 2,323 employees

Valmet definitely has significant China risks, and the realization of feared scenarios would have massive impacts on Valmet. However, I personally look at it in a way that if those bad China scenarios were to happen, we’d be in deep trouble anyway. The effects on the global economy and world order would be so vast that one wouldn’t have to worry much about the direction of their portfolio’s performance.

If, on the other hand, geopolitical tensions were to decrease and the Chinese economy were to recover in the coming years, this would certainly have a very positive impact on Valmet, among others. I also take a cautious approach to carrying direct (or near-direct) China risk, but I haven’t seen total avoidance as very sensible. If one considered a (proxy or direct) war breaking out between China and the United States likely, then it would certainly be better to allocate capital to coffee and pea soup…

Sijoituskästi’s Teemu and @Heikki_Keskivali also talked about Valmet in the new episode, they brought up some good points about the company. ![]()

Valmet has completed the acquisition of Körber’s Tissue business area. The business area offers innovative process technologies and related services for converting tissue jumbo rolls into finished products. The transaction was completed in accordance with the agreement announced on July 7, 2023.

Tissue Converting business unit to become part of the Paper business line

By combining Valmet’s and the acquired business’s complementary offerings and expertise, Valmet creates the market’s broadest technology, automation, and services offering, covering the entire value chain for the growing tissue industry from fiber to finished products.

The new tissue converting business will be integrated as a business unit into Valmet’s Paper business line. It focuses on delivering and servicing converting lines and packaging equipment for rolled and folded tissue products, as well as providing digital solutions and services. With the acquired business, Valmet is able to serve the tissue industry with even broader expertise, process technologies, and services. These allow the company to offer comprehensive solutions, including automation systems and flow control equipment.

Körber Tissue is a good continuation of acquisitions, and Valmet now has the entire tissue mill chain together, including maintenance and patents.

November 19 is World Toilet Day, because toilets or latrines are still not an everyday reality for many. In the economic transition, there is ethnocentric talk about how Europeans and North Americans buy electric vehicles and charging stations or use AI for Tinder messages.

However, most of the economic growth in the coming decades will come from India and other developing countries. By 2050, the Global South will clearly be the largest part of the global economy, and the largest economies will be China, India, Egypt, etc. Rising consumers in the Global South are not buying a Tesla, but rather toilet paper, Netflix, and a better education for their children. If there is money left over, they buy an Indian electric moped.

Valmet’s machines seem to be highly specialized, so the volumes don’t interest bulk producers. On the other hand, the machines still need to be kept running, which flows as steady income into Valmet’s coffers.

Is there any information about the parties involved?

Valmet to replace the steam turbine automation system at Härnösand Energi & Miljö AB’s plant in Härnösand, Sweden.

The order is included in Valmet’s orders received for the fourth quarter of 2023. The value of the order will not be disclosed. The customer will take delivery of the turbine automation system in November 2024.

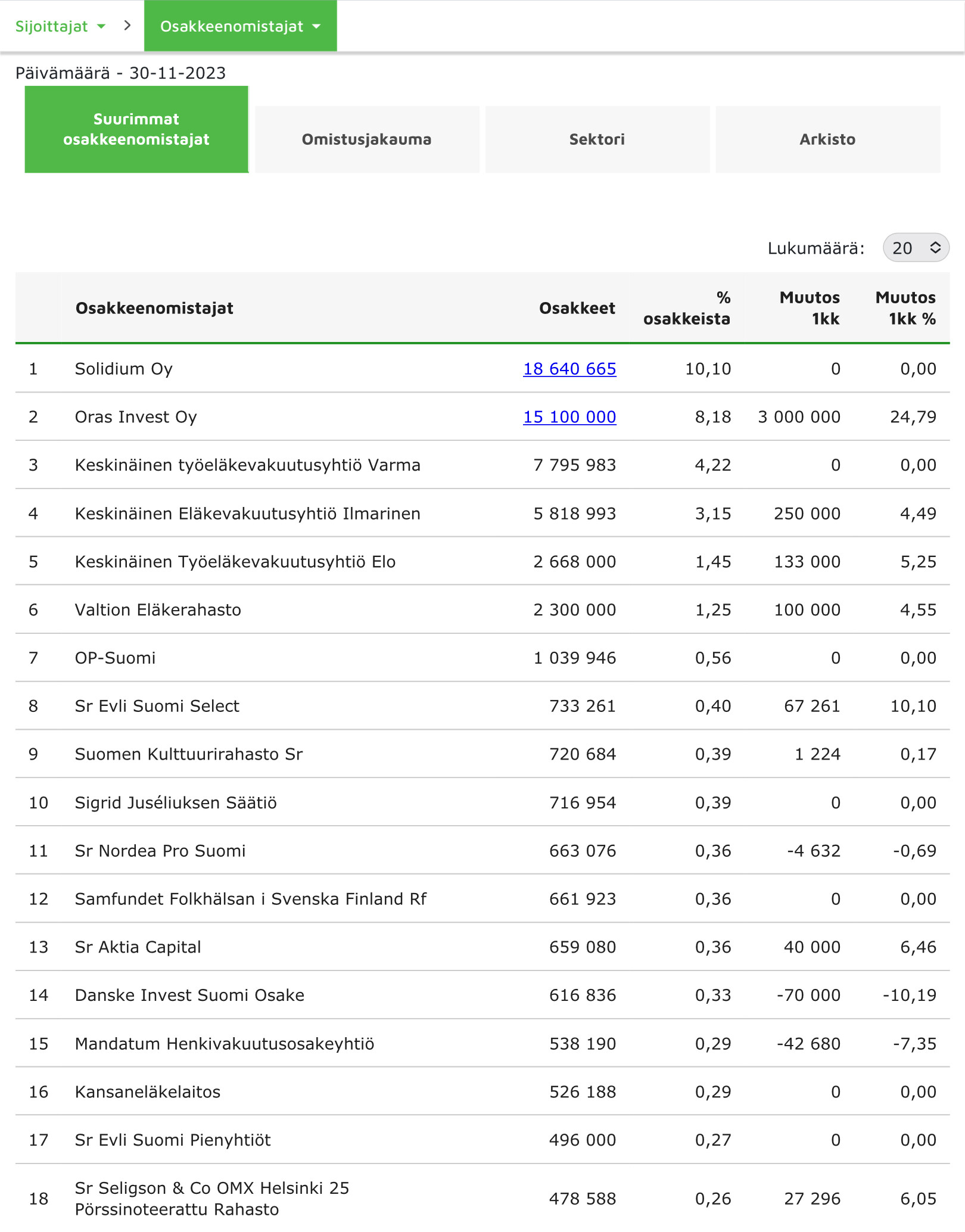

Paasikivis bought 3 million shares last month

Engineering Sector Review: On average strong balance sheets. ![]()

https://classic.inderes.fi/fi/videot/konepajakatsaus-keskimaarin-vahvat-taseet

The Q3 earnings season has been wrapped up and the balance sheets of machinery companies were on average strong at the end of Q3. In this engineering sector review, analyst Erkki Vesola comments on the machinery companies’ Q3 results, balance sheet profiles, market outlook, expectations for Q4 and next year, as well as valuations.

Topics:

00:00 Introduction

00:29 Q3 in a nutshell

01:55 Balance sheet profiles

04:04 Kesla, Robit and Norrhydro

07:10 Market outlook and expectations

09:32 Valuations